India Hydropower Equipment Market Size, Share, Trends, and Forecast by Product, Application, and Region, 2025-2033

India Hydropower Equipment Market Size and Share:

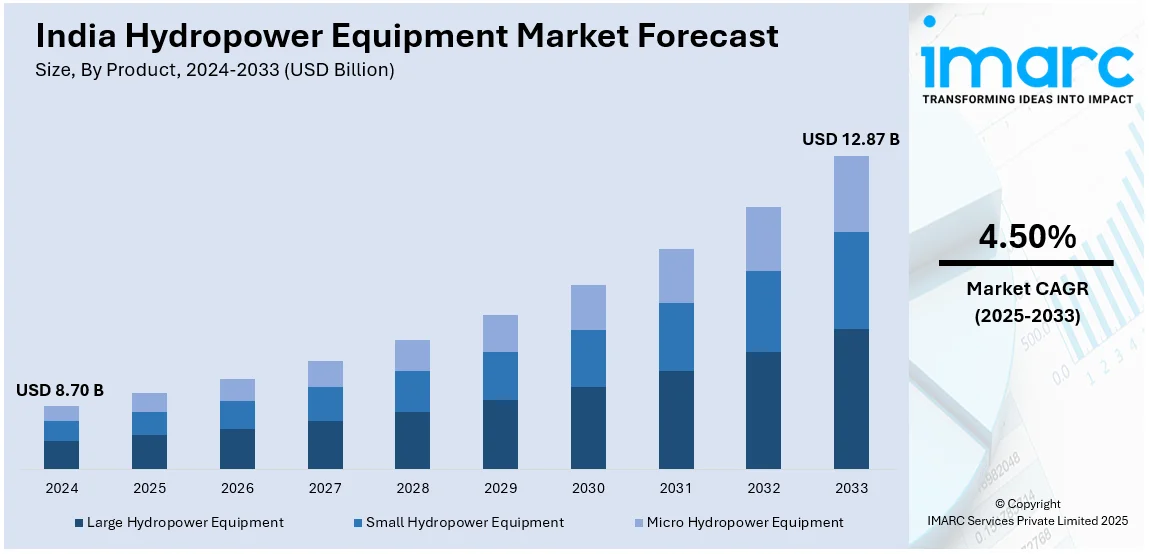

The India hydropower equipment market size reached USD 8.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.87 Billion by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is witnessing significant growth, driven by growing investments in large-scale hydropower projects and modernization and upgradation of aging hydropower infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.70 Billion |

| Market Forecast in 2033 | USD 12.87 Billion |

| Market Growth Rate (2025-2033) | 4.50% |

India Hydropower Equipment Market Trends:

Growing Investments in Large-Scale Hydropower Projects

The India hydropower equipment market is witnessing significant investments in large-scale projects, driven by the government’s focus on increasing renewable energy capacity. The Ministry of Power and public sector enterprises, such as NHPC Limited and SJVN Limited, are actively developing new hydroelectric projects and expanding existing ones to meet the rising electricity demand and grid stability requirements. The Indian government has classified large hydropower projects (above 25 MW) as part of renewable energy, which enhances policy incentives and financial support mechanisms. Additionally, strategic projects in the northeastern states and the Himalayan India are gaining traction due to their abundant hydropower potential. Private sector participation is also increasing through joint ventures and public-private partnerships, further strengthening the market for hydropower equipment. Leading global and domestic manufacturers are supplying advanced turbines, generators, and control systems to improve efficiency and reliability. For instance, as per industry reports, India made significant strides in hydropower between November 2023 and November 2024, expanding capacity and reinforcing its commitment to achieving 500 GW from non-fossil sources by 2030 through sustainable energy advancements. The growing focus on pumped storage hydropower projects, which facilitate grid balancing and renewable energy integration, is further supporting the demand for specialized equipment such as reversible turbines and high-capacity transformers.

To get more information on this market, Request Sample

Modernization and Upgradation of Aging Hydropower Infrastructure

The modernization of aging hydropower plants is a key trend shaping the India hydropower equipment market. Many existing plants, particularly those commissioned before the 1990s, are operating at reduced efficiency due to outdated technology, mechanical wear, and sedimentation-related issues. In order to enhance performance, extend operational life, and align with evolving grid requirements, utilities are investing in refurbishment projects. The Central Electricity Authority (CEA) has identified several aging hydropower plants for renovation and modernization under government-supported initiatives. For instance, in December 2024, the Indian government supported hydropower by recognizing large projects (above 25 MW) as renewable energy, promoting hydro-pumped storage, and implementing initiatives to harness the country's full hydroelectric potential for sustainable energy growth. This trend is driving demand for advanced hydro turbines, digital control systems, and predictive maintenance solutions. Digitalization is playing a crucial role in plant upgrades, with utilities integrating smart sensors, real-time monitoring systems, and automation to optimize operations and minimize downtime. Additionally, the replacement of older Kaplan, Francis, and Pelton turbines with high-efficiency models is improving energy output and reducing water consumption per unit of electricity generated. Companies specializing in hydropower refurbishment services are collaborating with state electricity boards and private players to implement performance enhancement measures. The modernization of India’s hydropower fleet is essential for maintaining grid stability, ensuring energy security, and optimizing the utilization of available water resources, further driving sustained demand for hydropower equipment in the country.

India Hydropower Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Large Hydropower Equipment

- Small Hydropower Equipment

- Micro Hydropower Equipment

The report has provided a detailed breakup and analysis of the market based on the product. This includes large hydropower equipment, small hydropower equipment, and micro hydropower equipment.

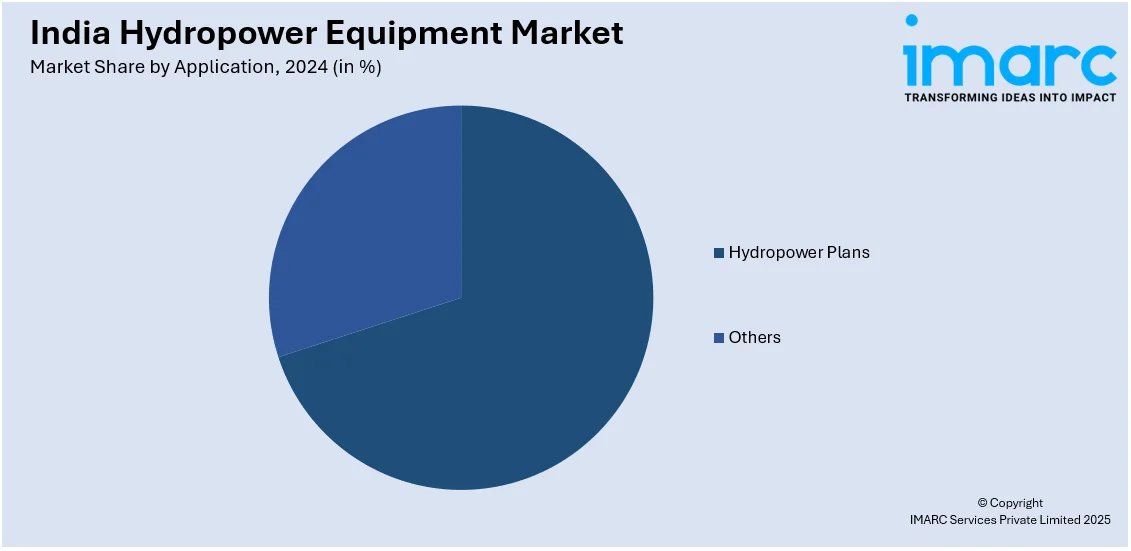

Application Insights:

- Hydropower Plans

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hydropower plans and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydropower Equipment Market News:

- In February 2025, EDF India and Actis announced collaboration to develop an Advanced Metering Infrastructure Service Provider (AMISP) platform, reinforcing their commitment to India’s power sector. Supporting the National Smart Metering Project under RDSS, this initiative aims to improve operational efficiency, reduce losses, and enhance power distribution sustainability.

- In January 2025, India is planning a ₹1.5 lakh crore hydropower dam on the Siang River in Arunachal Pradesh to strengthen energy security and counter China’s infrastructural moves. Designed with a 9.2 billion cubic meter storage capacity, the project aims to enhance power generation while addressing potential water security concerns along the border.

India Hydropower Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Large Hydropower Equipment, Small Hydropower Equipment, Micro Hydropower Equipment |

| Applications Covered | Hydropower Plans, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hydropower equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India hydropower equipment market on the basis of product?

- What is the breakup of the India hydropower equipment market on the basis of application?

- What is the breakup of the India hydropower equipment market on the basis of region?

- What are the various stages in the value chain of the India hydropower equipment market?

- What are the key driving factors and challenges in the India hydropower equipment?

- What is the structure of the India hydropower equipment market and who are the key players?

- What is the degree of competition in the India hydropower equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydropower equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydropower equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydropower equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)