India Ice Maker Market Size, Share, Trends and Forecast by Product Type, End Use Sector, and Region, 2025-2033

India Ice Maker Market Overview:

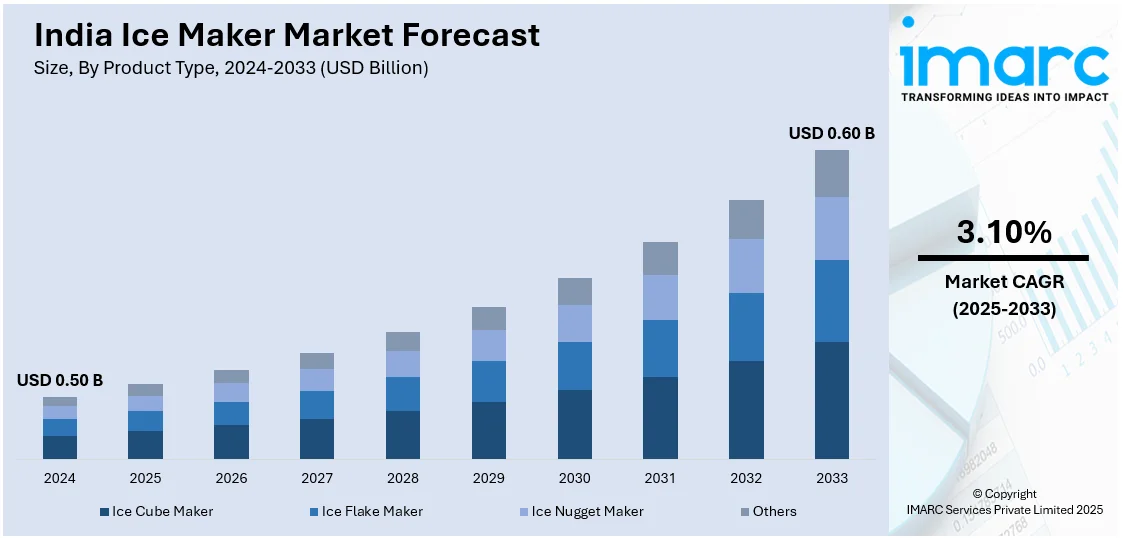

The India ice maker market size reached USD 0.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.60 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The expanding hospitality and foodservice sectors, increasing demand for hygienic ice in healthcare and cold chain logistics, and a growing shift toward energy-efficient, eco-friendly appliances is impelling the market demand. Also, the rising consumer expectations for quality, government sustainability initiatives, and technological advancements further propel market growth across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.50 Billion |

| Market Forecast in 2033 | USD 0.60 Billion |

| Market Growth Rate (2025-2033) | 3.10% |

India Ice Maker Market Trends:

Growing Demand from the Hospitality and Foodservice Sector

One of the major trends influencing the India ice maker market is the increasing demand from the foodservice and hospitality sector. Growth in hotels, quick-service restaurants (QSRs), cafes, and catering companies in metropolitan and tier-II cities is fueling the demand for commercial ice makers. These venues need reliable and clean ice production for use in beverages, food preservation, and presentation. The increasing demand for energy-saving and large-capacity equipment has led the manufacturers to launch technologically improved products. Also, the rising social dining culture, outdoor catering, and events culture have resulted in steady demand for quick and efficient ice-making solutions, compelling companies to invest in new-generation ice-making equipment that guarantees better hygiene and optimal performance.

To get more information on this market, Request Sample

Expansion of Cold Chain and Healthcare Infrastructure

The development of cold chain logistics and healthcare infrastructure is shaping the India ice maker market, with increasing demand from pharmaceuticals, diagnostics labs, and hospitals for vaccine and specimen storage. The COVID-19 pandemic highlighted the urgency of robust cold storage and medical-grade ice systems, prompting greater investment in healthcare refrigeration. This aligns with the National Health Policy 2017, which targets raising public health investment to 2.5% of GDP by 2025. As of March 31, 2023, India had 818,661 beds across PHCs, CHCs, SDHs, DHs, and medical colleges, reflecting ongoing healthcare expansion. Parallel growth in organized retail and food processing is also driving ice solution needs. Government initiatives to improve cold chain access in rural and semi-urban areas are accelerating demand for durable, temperature-optimized ice makers suited for healthcare and industrial use.

Rising Adoption of Energy-Efficient and Eco-Friendly Ice Makers

The industry is seeing a transition towards energy-saving and environmentally friendly ice maker technology. Companies are focusing more on equipment that saves energy and has environmentally friendly refrigerants in order to meet environmental regulations and cut costs. The manufacturers are catering to this demand by introducing models with hydrofluorocarbon-free (HFC-free) or low-global-warming-potential refrigerants. Along with this, digital control systems and automatic defrost functions are being incorporated to make energy consumption optimal. The increasing concern regarding carbon footprints and energy conservation is pushing end-users towards the shift from traditional models to eco-friendly ones. Sustainability drives promoted by governments and certification schemes have also increased the demand for energy-efficient ice makers, shaping purchasing behavior in commercial and industrial segments in India.

India Ice Maker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end use sector.

Product Type Insights:

- Ice Cube Maker

- Ice Flake Maker

- Ice Nugget Maker

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ice cube maker, ice flake maker, ice nugget maker, and others.

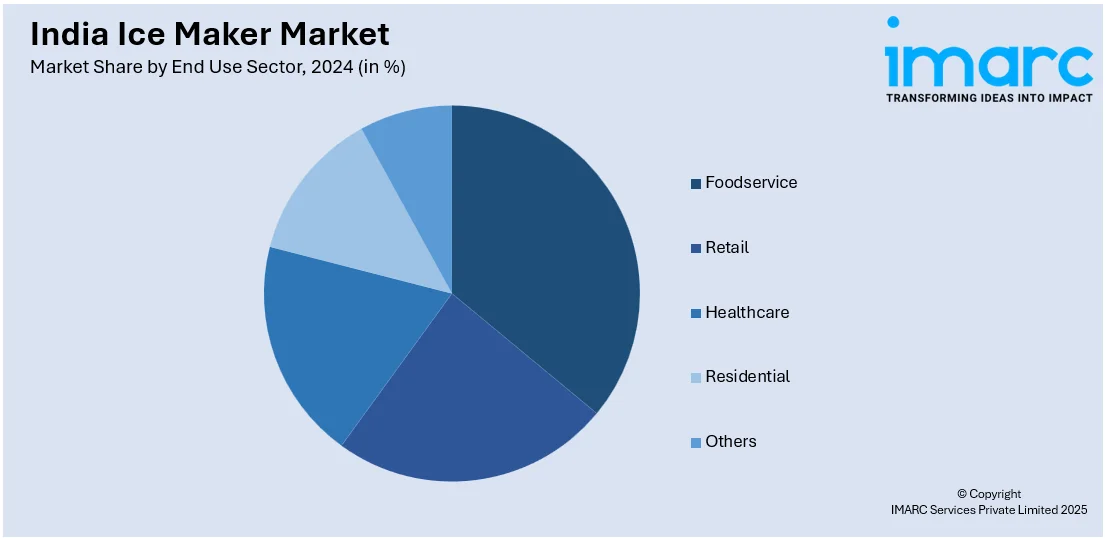

End Use Sector Insights:

- Foodservice

- Retail

- Healthcare

- Residential

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes foodservice, retail, healthcare, residential, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ice Maker Market News:

- In July 2024, TAFE Motors and Tractors Ltd. partnered with Germany-based Deutz AG to jointly manufacture Deutz’s internal combustion engine (ICE) range in India. The collaboration aims to expand TAFE’s ICE business and strengthen domestic production capabilities. This strategic agreement is expected to boost local manufacturing, enhance technology exchange, and cater to growing demand across various sectors. The pact marks a significant step in advancing engine production in the Indian market.

- In June 2024, GE Profile introduced the Opal 2.0 Ultra Nugget Ice Maker, an upgraded countertop device equipped with scale-inhibiting water and air filters, a modern touch display, and a capacity to generate up to 38 pounds of chewable ice daily.

India Ice Maker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ice Cube Maker, Ice Flake Maker, Ice Nugget Maker, Others |

| End Use Sectors Covered | Foodservice, Retail, Healthcare, Residential, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ice maker market performed so far and how will it perform in the coming years?

- What is the breakup of the India ice maker market on the basis of product type?

- What is the breakup of the India ice maker market on the basis of end use sector?

- What is the breakup of the India ice maker market on the basis of region?

- What are the various stages in the value chain of the India ice maker market?

- What are the key driving factors and challenges in the India ice maker?

- What is the structure of the India ice maker market and who are the key players?

- What is the degree of competition in the India ice maker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ice maker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ice maker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ice maker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)