India ICT Market Size, Share, Trends and Forecast by Spending, Technology, and Region, 2026-2034

India ICT Market Summary:

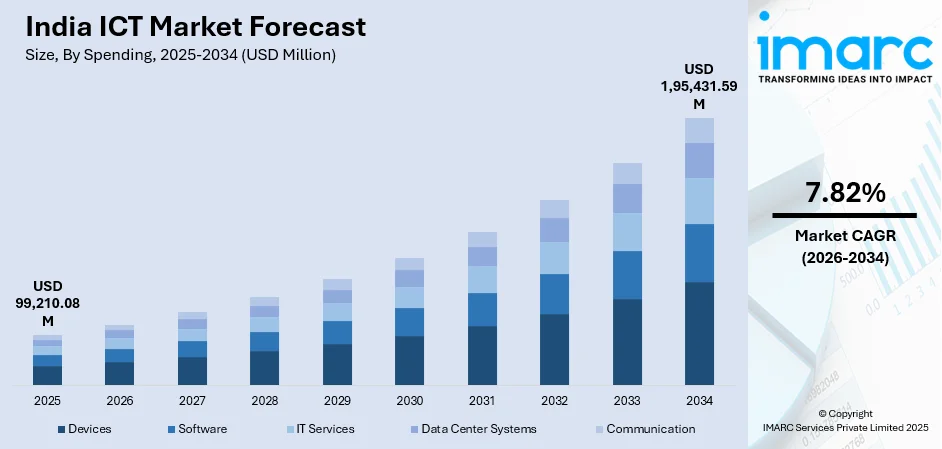

The India ICT market size was valued at USD 99,210.08 Million in 2025 and is projected to reach USD 1,95,431.59 Million by 2034, growing at a compound annual growth rate of 7.82% from 2026-2034.

The India ICT market is experiencing robust expansion, driven by widespread digital transformation initiatives across the government and enterprise sectors. Growing adoption of cloud computing, artificial intelligence (AI), and Internet of Things (IoT) technologies is reshaping business operations nationwide. The deployment of next-generation telecommunications infrastructure is enhancing digital connectivity across urban and rural regions. Rising smartphone penetration and increasing internet accessibility are accelerating the demand for digital services and solutions across the economy.

Key Takeaways and Insights:

-

By Spending: Devices dominate the market with a share of 33% in 2025, owing to the expanding enterprise digitization, rising hybrid work adoption, and government-led manufacturing incentives boosting local production.

-

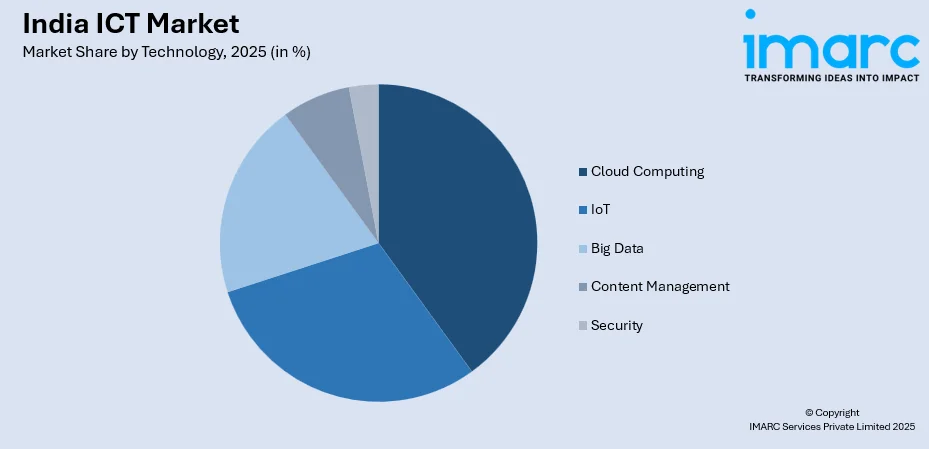

By Technology: Cloud computing leads the market with a share of 31% in 2025. This dominance is driven by accelerated enterprise cloud migration, government digital initiatives supporting cloud-first strategies, and the proliferation of software-as-a-service (SaaS) solutions enabling scalable business operations nationwide.

-

By Region: North India comprises the largest region with 29% share in 2025, propelled by the concentration of government institutions, global capability centers, and emerging data center infrastructure in Delhi-NCR establishing the region as the primary technology hub.

-

Key Players: Key players drive the India ICT market by expanding cloud service portfolios, investing in AI capabilities, and strengthening nationwide digital infrastructure. Their investments in research and development (R&D) activities, strategic alliances, employee skill enhancement drive innovations, expedite business adoption, and guarantee steady technology delivery across various industry verticals.

To get more information on this market Request Sample

The India ICT market is experiencing transformative growth, propelled by multiple converging factors that are fundamentally reshaping the digital landscape. Government-led digitization programs, including flagship connectivity initiatives, are establishing comprehensive broadband infrastructure connecting urban centers and rural communities alike. The proliferation of global capability centers across major metropolitan areas is creating significant demand for enterprise technology solutions and specialized information technology (IT) services. Financial institutions and banking organizations are ramping up investments in digital platforms to meet evolving customer expectations around contactless transactions and mobile banking services. The rapid deployment of fifth-generation telecommunications networks is enabling ultra-low latency applications and supporting industrial automation across manufacturing sectors. As per the Ericsson Mobility Report, wireless broadband remained the leader in 2025 with 954.99 Million users versus 44.82 Million wired connections, bolstered by swift 5G adoption, which reached 394 Million subscriptions by year-end. Small and medium enterprises (SMEs) are increasingly adopting cloud-based solutions to enhance operational efficiency and compete in digitally-driven marketplaces.

India ICT Market Trends:

Accelerated Enterprise Cloud Migration and Hybrid Infrastructure Adoption

With organizations seeking flexibility, scalability, and operational efficiency, enterprises are rapidly transitioning to cloud-native architectures, propelling the India ICT market growth. An IDC study indicated that nearly 40% of Indian organizations were set to implement cloud services in some form by 2024. The shift towards hybrid cloud models enables businesses to balance compliance requirements with performance needs across regulated industries. Public sector digitization mandates are positioning cloud computing as the default deployment option for government systems and citizen services. Service providers are delivering end-to-end cloud transformation offerings, including managed services, hybrid integration capabilities, and enhanced monitoring solutions that support enterprise modernization journeys across the financial services, healthcare, and manufacturing sectors.

AI Integration Across Industry Verticals

The integration of AI and machine learning (ML) capabilities is transforming business operations across Indian enterprises, fueling the market expansion. Almost 89% of startups established in India in 2024 incorporated AI into their offerings. Organizations are leveraging AI-powered analytics platforms to gain actionable insights, automate routine processes, and enhance customer experience delivery. The government's strategic focus on building sovereign AI infrastructure is democratizing access to computing resources for startups, researchers, and enterprises developing indigenous capabilities. Industries, including banking, healthcare, manufacturing, and retail, are deploying AI solutions for fraud detection, predictive diagnostics, quality control, and personalized customer engagement.

Fifth-Generation Network Expansion and Digital Infrastructure Enhancement

The nationwide rollout of fifth-generation telecommunications networks is catalyzing digital transformation by enabling ultra-low latency applications and enhanced connectivity. Service providers are expanding coverage into tier-two and tier-three cities while strengthening network capacity in metropolitan centers. The deployment supports industrial automation, smart city initiatives, and fixed wireless access services that deliver broadband connectivity to underserved areas. Edge computing deployments are gaining momentum, as enterprises require distributed processing capabilities for real-time analytics and latency-sensitive applications.

Market Outlook 2026-2034:

The India ICT market is positioned for sustained expansion, as digital transformation accelerates across government institutions, enterprises, and consumer segments. Strategic investments in cloud infrastructure, AI capabilities, and telecommunications networks are establishing robust foundations for technology-driven economic growth. The market generated a revenue of USD 99,210.08 Million in 2025 and is projected to reach a revenue of USD 1,95,431.59 Million by 2034, growing at a compound annual growth rate of 7.82% from 2026-2034. The proliferation of global capability centers, expanding data center ecosystems, and rising adoption of emerging technologies, including generative AI and edge computing, will continue to drive market momentum throughout the forecast period.

India ICT Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Spending | Devices | 33% |

| Technology | Cloud Computing | 31% |

| Region | North India | 29% |

Spending Insights:

- Devices

- Software

- IT Services

- Data Center Systems

- Communication

Devices dominate with a market share of 33% of the total India ICT market in 2025.

The devices segment leads the India ICT market, driven by expanding enterprise digitization requirements and the widespread adoption of hybrid work policies necessitating substantial investments in computing hardware. Organizations across sectors are implementing remote work practices that fuel demand across laptop, desktop, and mobile device categories. Government schemes have attracted significant investments, with approved manufacturers generating substantial production value and transforming domestic electronics manufacturing capabilities from earlier benchmarks to enhanced output levels exceeding expectations.

Rising cloud adoption and cybersecurity requirements further stimulate device upgrades, as enterprises prioritize performance, security, and compatibility with modern software ecosystems. Education and healthcare sectors also contribute through large-scale procurement of tablets and specialized devices supporting digital classrooms and telemedicine initiatives. Growing affordability, financing options, and faster replacement cycles accelerate refresh demand, while domestic assembly improves supply reliability. Collectively, these trends sustain robust device shipments, reinforce local value addition, and strengthen India’s position within global ICT hardware value chains across enterprises, public institutions, and export-oriented manufacturing clusters nationwide in India.

Technology Insights:

Access the comprehensive market breakdown Request Sample

- IoT

- Big Data

- Cloud Computing

- Content Management

- Security

Cloud computing leads with a share of 31% of the total India ICT market in 2025.

Cloud computing technology commands market leadership, as Indian enterprises accelerate migration to scalable infrastructure platforms that enable digital transformation and operational efficiency. As per IMARC Group, the India cloud computing market size reached USD 37.1 Billion in 2025. The shift towards hybrid cloud models addresses compliance requirements while delivering performance benefits across regulated industries, including banking and healthcare. Government cloud-first mandates are positioning cloud services as the default deployment option for public systems.

Cloud infrastructure investments from hyperscale providers are securing localized capabilities that address data sovereignty requirements and latency performance targets. The SaaS segment represents one of the largest revenue streams, as organizations adopt subscription-based applications for customer relationship management (CRM), enterprise resource planning (ERP), and collaboration platforms. SMEs demonstrate one of the fastest adoption rates as pay-as-you-go pricing models lower barriers to cloud service access while enabling operational scalability without substantial capital expenditure.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India ICT market in 2025.

North India commands regional market leadership, driven by the concentration of government institutions, administrative headquarters, and expanding global capability centers across Delhi-NCR. The region serves as the primary hub for policy-driven digital initiatives and public sector technology deployments that generate substantial demand for ICT solutions and services. Noida has emerged as a significant data center hub within North India, with operational capacity growing as hyperscale and colocation providers establish AI-ready facilities, featuring advanced cooling systems and high-density rack configurations.

The Delhi-NCR region encompasses major economic centers, including Delhi, Noida, and Gurgaon that collectively host global corporations, manufacturing companies, business process outsourcing operations, and technology startups. In March 2025, Sify Technologies announced the expansion of its Noida campus with a new AI-ready data center featuring capacity exceeding 130 MW across three towers with dedicated power infrastructure. The region's established telecommunications infrastructure and fiber connectivity support enterprise requirements for high-bandwidth applications and real-time data processing capabilities.

Market Dynamics:

Growth Drivers:

Why is the India ICT Market Growing?

Government-Led Digital Infrastructure Expansion and Connectivity Initiatives

The Indian government has undertaken ambitious digital infrastructure programs that are fundamentally transforming connectivity across the nation, fueling the ICT market expansion. Strategic initiatives aim to provide high-speed optical fiber connectivity to all administrative units, ensuring that various regional communities gain access to essential digital services in education, healthcare, governance, and economic opportunities. The national broadband mission targets universal access with adequate speeds for every citizen through establishment of advanced digital communication infrastructure including fiber networks and mobile towers. These programs are creating substantial demand for telecommunications equipment, networking hardware, and managed connectivity services while establishing the foundation for technology-enabled service delivery across government departments and public institutions. The systematic approach to bridging the digital divide is generating sustained investment flows into ICT infrastructure across underserved regions while enabling technology vendors to expand service footprints beyond traditional metropolitan markets into emerging growth corridors.

Accelerated Enterprise Digital Transformation and Cloud Adoption

Enterprises across Indian industry verticals are accelerating digital transformation journeys to remain competitive, decrease operational costs, and increase efficiency. Organizations are migrating mission-critical workloads to cloud platforms while adopting AI, ML, and data analytics solutions that require scalable computing infrastructure. The BFSI sector represents a significant contributor to enterprise ICT spending, as institutions invest in digital platforms, contactless payment systems, and customer engagement technologies. Manufacturing organizations are implementing Industry 4.0 technologies, including industrial IoT, automation systems, and predictive maintenance solutions that demand robust connectivity and edge computing capabilities. As per IMARC Group, the India industrial IoT market size reached USD 9.40 Billion in 2024. Retail enterprises are deploying omnichannel commerce platforms and supply chain visibility solutions while healthcare providers implement electronic medical records, telemedicine platforms, and AI-assisted diagnostic systems that collectively drive sustained demand for ICT infrastructure and services.

Hyperscaler Investments and Data Center Ecosystem Expansion

Major global technology companies are committing substantial investments to expand cloud and data center infrastructure across India, recognizing the India ICT market growth potential and strategic importance. In October 2025, Adani Enterprises, in collaboration with its joint venture AdaniConneX and Google, revealed a groundbreaking partnership to build India's biggest AI data center campus and new renewable energy facilities in Visakhapatnam, Andhra Pradesh. These investments are securing localized computing capabilities that address data sovereignty requirements, regulatory compliance mandates, and performance optimization needs for enterprise customers. The data center ecosystem is experiencing rapid expansion with capacity additions planned across major hubs, including Mumbai, Chennai, Hyderabad, Delhi-NCR, and emerging locations. Colocation and hyperscale facilities are deploying AI-ready infrastructure featuring high-density rack configurations, liquid cooling systems, and renewable energy integration. The establishment of cable landing stations and fiber network interconnections is enhancing international connectivity while supporting real-time application requirements.

Market Restraints:

What Challenges the India ICT Market is Facing?

Skilled Workforce Shortage in Emerging Technology Domains

The India ICT market faces significant challenges from persistent talent shortages across AI, cybersecurity, cloud architecture, and specialized technology domains. Demand for qualified professionals substantially outpaces available supply, as digital transformation accelerates across enterprises. Rising wage pressures and attrition rates in niche skill areas inflate project costs and squeeze service provider margins while limiting delivery capacity for complex transformation engagements.

Rural Digital Infrastructure and Last-Mile Connectivity Gaps

Despite substantial investments in broadband infrastructure, significant connectivity gaps persist across rural and remote regions. Last-mile fiber deployments face challenges from high installation costs, right-of-way hurdles in urban areas, and logistical complexities in dispersed rural locations. Limited digital infrastructure constrains technology adoption among small businesses and underserved communities, restricting market expansion potential beyond established metropolitan corridors.

Escalating Cybersecurity Threats and Compliance Complexities

The expanding digital footprint increases vulnerability to sophisticated cyber threats targeting critical infrastructure, financial institutions, and enterprise systems. Organizations must navigate evolving data protection regulations and compliance requirements that add complexity and cost to technology deployments. SMEs often lack resources for comprehensive security implementations, creating risk exposure that potentially slows broader digital adoption across price-sensitive market segments.

Competitive Landscape:

The India ICT market exhibits a dynamic competitive environment, characterized by the presence of established global technology providers, domestic IT services leaders, and emerging specialized vendors. Market participants compete across hardware manufacturing, software development, cloud services, telecommunications, and managed IT services segments. Companies differentiate through technology innovations, service delivery capabilities, industry expertise, and geographic coverage. Strategic partnerships between domestic players and international technology providers enable comprehensive solution portfolios. Vendors are expanding investments in AI capabilities, cloud infrastructure, and cybersecurity offerings to address evolving enterprise requirements. The market structure encourages competitive pricing while demanding continuous innovations and service quality improvements to maintain customer relationships across enterprise, government, and consumer segments.

India ICT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Spendings Covered | Devices, Software, IT Services, Data Center Systems, Communication |

| Technologies Covered | IOT, Big Data, Cloud Computing, Content Management, Security |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India ICT market size was valued at USD 99,210.08 Million in 2025.

The India ICT market is expected to grow at a compound annual growth rate of 7.82% from 2026-2034 to reach USD 1,95,431.59 Million by 2034.

Devices dominated the market with a share of 33%, driven by expanding enterprise digitization, hybrid work adoption, and government manufacturing incentives boosting production capacity across the country.

Key factors driving the India ICT market include government-led digital infrastructure expansion, accelerated enterprise cloud adoption, hyperscaler investments in data centers, and rising integration of AI and ML technologies.

Major challenges include skilled workforce shortages in emerging technology domains, rural digital infrastructure gaps limiting last-mile connectivity, escalating cybersecurity threats, complex regulatory compliance requirements, and high implementation costs for advanced solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)