India Image Sensor Market Size, Share, Trends and Forecast by Technology, Spectrum, Array Type, Processing Type, Vertical, and Region, 2025-2033

India Image Sensor Market Overview:

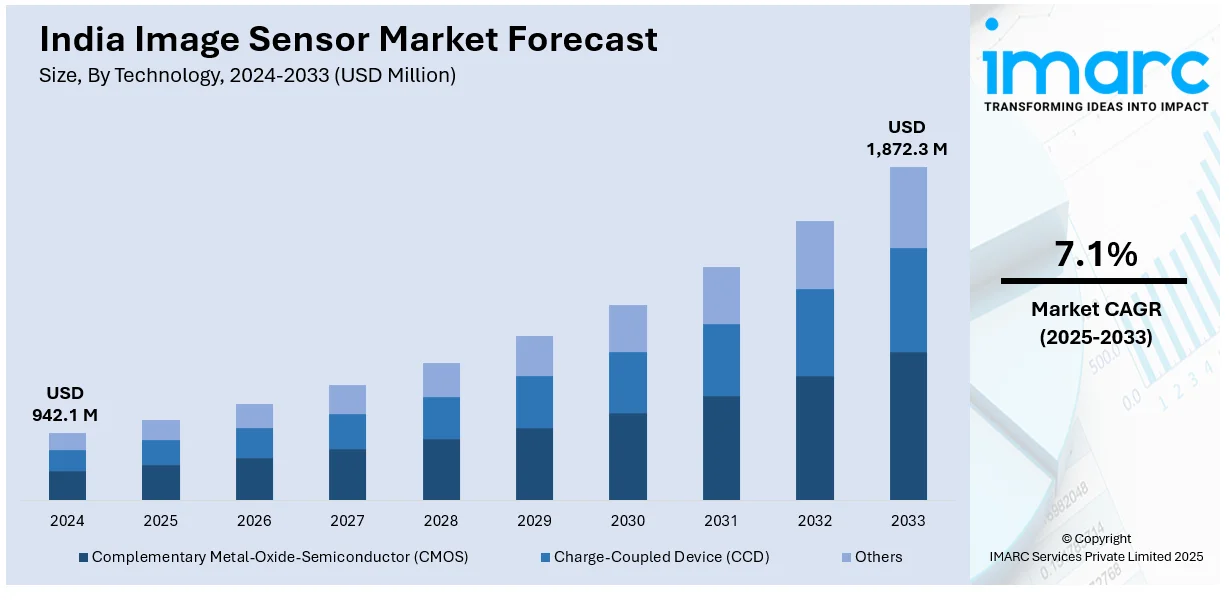

The India image sensor market size reached USD 942.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,872.3 Million by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033. The market is growing due to rising demand in consumer electronics, surveillance, healthcare, and automation, driven by advancements in CMOS technology, increasing smartphone penetration, expanding security and industrial applications, and supportive government policies and digitalization trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 942.1 Million |

| Market Forecast in 2033 | USD 1,872.3 Million |

| Market Growth Rate 2025-2033 | 7.1% |

India Image Sensor Market Trends:

Increasing Demand for Advanced Driver Assistance Systems (ADAS)

The implementation of Advanced Driver Assistance Systems (ADAS) in India is fueling strong growth in the image sensor market. As there is a heightening emphasis on road safety and government campaigns supporting vehicle safety features, automakers are incorporating high-performance image sensors in vehicles. ADAS depends on image sensors for lane departure warning, automatic emergency braking, adaptive cruise control, and night vision systems. Rising volume of EVs and high-end vehicles accelerate demand for state-of-the-art image solutions further. Advances in the resolution of sensors, performance at low lighting, and the utilization of AI-processing for images will improve ADAS feature precision and dependability. Regulatory pressures also, through enforcement of standards compelling passenger vehicle manufacturers to bundle and commercial vehicles as well to bundle safety technology packages, drive business adoption further. The growing availability of affordable CMOS image sensors and advancing processing speed and energy efficiency is making ADAS integration increasingly feasible across various vehicle segments in India.

To get more information on this market, Request Sample

Growth in Industrial Automation and Smart Manufacturing

The speed of industrialization in India and the drive to intelligent manufacturing are creating demand for high-performance image sensors in automation industries. Industries like automotive, pharma, and electronics production are incorporating vision systems based on high-end image sensors to enhance efficiency in manufacturing, quality checks, and automation with robots. The move towards Industry 4.0, coupled with the government's "Make in India" vision, is fueling the integration of AI-based imaging solutions into automated assembly lines and precision manufacturing. High-definition image sensors with improved speed, accuracy, and reliability are employed for defect inspection, process monitoring, and real-time decision-making. For instance, in July 2023, Chennai startup GalaxEye is set to introduce the first world's multi-sensor satellite, combining SAR and optical sensors for better Earth imaging, enhancing defense, agriculture, and disaster management with better data accuracy. Moreover, the increasing demand for automated logistics and warehouses continues to drive the market growth as image sensors are also essential for barcode reading, stock tracking, and automatic guided vehicles. As Indian industries continue to become more modernized, 3D imaging, and hyperspectral sensor advances are likely to further increase industrial applications.

Expanding Use in Consumer Electronics and IoT Devices

The increasing penetration of smartphones, wearables, and IoT devices in India is driving growth in advanced image sensors. Customers are highly looking for high-pixel-density cameras with better low-light imaging, HDR photography, and AI-assisted computational photography in smartphones. The spread of dual and multi-camera configurations is driving compact, low-power image sensors innovations. For example, in February 2024, Sony India unvieled the Alpha 9 III with the world's first full-frame global shutter image sensor, with 120 fps high-speed shooting, distortion-free photos, and full-speed flash synchronization. Additionally, outside smartphones, uses in smart home devices, AR/VR headsets, and surveillance security systems are increasing. Facial recognition, biometric authentication, and gesture control technologies are increasingly becoming part of many consumer devices, necessitating highly accurate and responsive image sensors. IoT-based smart cameras for home security and industrial monitoring further fuel the demand. Wearable devices like fitness trackers and medical monitoring devices are also integrating miniature image sensors for uses such as, health tracking and remote diagnostics. Eternal innovations in sensor technology, including reduced pixel size and greater quantum efficiency, are fueling innovation in the consumer electronics space.

India Image Sensor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, spectrum, array type, processing type, vertical.

Technology Insights:

- Complementary Metal-Oxide-Semiconductor (CMOS)

- Charge-Coupled Device (CCD)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes complementary metal-oxide-semiconductor (CMOS), charge-coupled device (CCD), and others.

Spectrum Insights:

- Visible Spectrum

- Non-Visible Spectrum

A detailed breakup and analysis of the market based on the spectrum have also been provided in the report. This includes visible spectrum and non-visible spectrum.

Array Type Insights:

- Area Image Sensor

- Linear Image Sensor Bread

The report has provided a detailed breakup and analysis of the market based on the array type. This includes area image sensor and linear image sensor.

Processing Type Insights:

- 2D Image Sensor

- 3D Image Sensor

A detailed breakup and analysis of the market based on the processing type have also been provided in the report. This includes 2D image sensor and 3D image sensor.

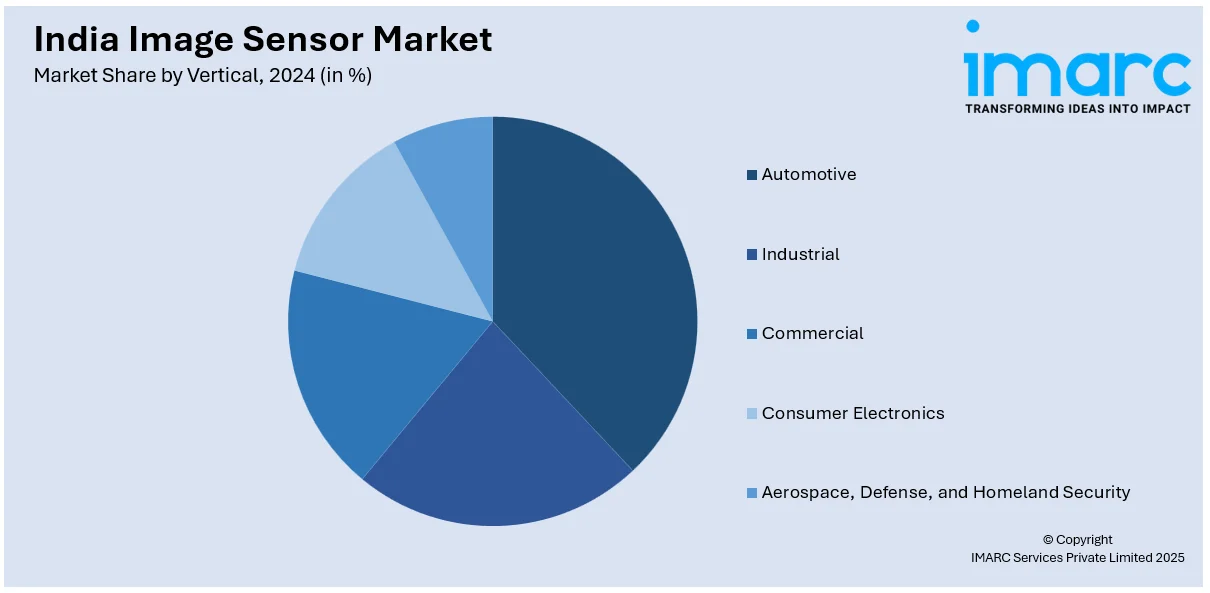

Vertical Insights:

- Automotive

- Industrial

- Commercial

- Consumer Electronics

- Aerospace, Defense, and Homeland Security

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes automotive, industrial, commercial, consumer electronics, and aerospace, defense, and homeland security.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Image Sensor Market News:

- January 2025, Indian space-tech firm Pixxel has successfully launched three hyperspectral imaging satellites on a SpaceX rocket from California. With cutting-edge image sensors, these satellites are capable of recording highly detailed data over hundreds of bands of light, to assist industries such as agriculture, mining, and defence.

- In June 2024, Samsung Electronics introduced the ISOCELL HP9, the industry's first 200MP telephoto sensor for smartphones. This sensor offers high-resolution imaging with advanced zoom capabilities and improved low-light performance, setting new standards in mobile photography.

India Image Sensor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Complementary Metal-Oxide-Semiconductor (CMOS), Charge-Coupled Device (CCD), Others |

| Spectrums Covered | Visible Spectrum, Non-Visible Spectrum |

| Array Types Covered | Area Image Sensor, Linear Image Sensor |

| Processing Types Covered | 2D Image Sensor, 3D Image Sensor |

| Verticals Covered | Automotive, Industrial, Commercial, Consumer Electronics, Aerospace, Defense, and Homeland Security |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India image sensor market performed so far and how will it perform in the coming years?

- What is the breakup of the India image sensor market on the basis of technology?

- What is the breakup of the India image sensor market on the basis of spectrum?

- What is the breakup of the India image sensor market on the basis of array type?

- What is the breakup of the India image sensor market on the basis of processing type?

- What is the breakup of the India image sensor market on the basis of vertical?

- What is the breakup of the India image sensor market on the basis of region?

- What are the various stages in the value chain of the India image sensor market?

- What are the key driving factors and challenges in the India image sensor?

- What is the structure of the India image sensor market and who are the key players?

- What is the degree of competition in the India image sensor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India image sensor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India image sensor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India image sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)