India Immunology Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, End User, and Region, 2025-2033

India Immunology Drugs Market Overview:

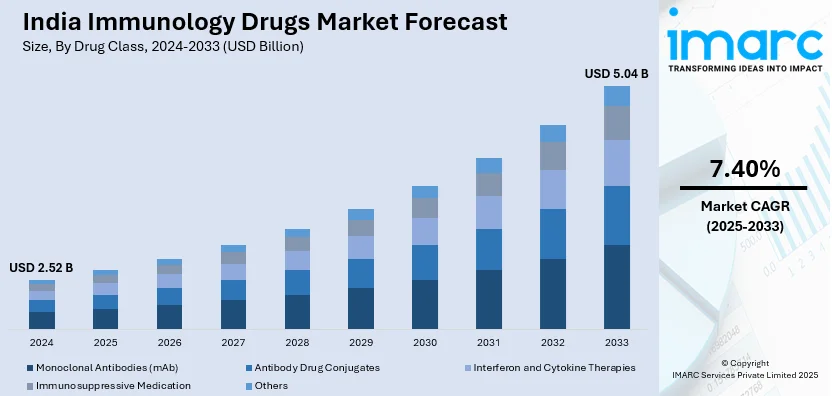

The India immunology drugs market size reached USD 2.52 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.04 Billion by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is expanding at a rapid pace because of rising autoimmune conditions and growing awareness of treatment possibilities. Moreover, increased healthcare access, innovative drug development, and government subsidies are inducing market growth. Also, biological treatments and advanced diagnostics are driving the trend.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.52 Billion |

| Market Forecast in 2033 | USD 5.04 Billion |

| Market Growth Rate 2025-2033 | 7.40% |

India Immunology Drugs Market Trends:

Expansion of Diagnostics and Personalized Medicine

Diagnostic technologies and personalized medicine are transforming the market of immunology drugs in India. Also, there has been a heightened demand for accurate diagnostics that allow for customized treatment protocols due to an increasing incidence of autoimmune diseases. In line with this personalized medicine, Crohn's Mind genetic profiles, biomarkers, and unique health status facilitate better and targeted treatments. This strategy enhances patient outcomes and minimizes the risk of drug-related adverse reactions. Advances in diagnostic technologies, including advanced imaging and biomarker-based assays, are assisting doctors in determining the best immunotherapy treatments for patients. Similarly, the precision medicine trend is underpinned by growing investments in healthcare infrastructure and biotechnology advances. Furthermore, the market for immunology drugs is ready for further growth with advancing diagnostic services and the availability of personalized treatment solutions. Growing awareness among both healthcare professionals and patients regarding the need for personalized treatment is behind this movement, thereby making immunology drugs more available and efficient in treating a range of autoimmune diseases.

To get more information on this market, Request Sample

Growing Demand for Biologic Immunology Drugs

The Indian market has witnessed rising demand for biologic drugs, particularly monoclonal antibodies and immune checkpoint inhibitors. Moreover, these emerging therapies have significant advantages in autoimmune disease treatment, such as rheumatoid arthritis, multiple sclerosis, and Crohn's disease, due to their specificity and effectiveness in controlling the immune system. Patients are increasingly opting for such therapies because they are most effective, relatively free from side effects, and increasingly available targeted therapies. With providers of healthcare increasingly advocating biologic therapies over traditional drugs, the market has been seeing a quick shift to this sector. Further, innovation in biotechnology and investments in research have helped bring the cost of manufacturing biologics down, making them affordable to the general public. In September 2024, Indian Immunologicals Limited launched a pediatric dose of its Indigenous Hepatitis A vaccine, Havisure (0.5 ml), which bolstered the immunology drugs market by increasing vaccine accessibility, particularly for children. This move reinforced IIL’s role in India’s self-sufficiency in immunology products and helped expand the immunology drug landscape. Government policies supporting innovative drug approvals and manufacturing also play a crucial role in promoting biological treatments in the country.

India Immunology Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drug class, indication, and end user.

Drug Class Insights:

- Monoclonal Antibodies (mAb)

- Antibody Drug Conjugates

- Interferon and Cytokine Therapies

- Immunosuppressive Medication

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes monoclonal antibodies (mAb), antibody drug conjugates, interferon and cytokine therapies, immunosuppressive medication, and others.

Indication Insights:

- Arthritis

- Plaque Psoriasis

- Spondylitis

- Inflammatory Bowel Disease

- Transplant Rejection

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes arthritis, plaque psoriasis, spondylitis, inflammatory bowel disease, transplant rejection, and others.

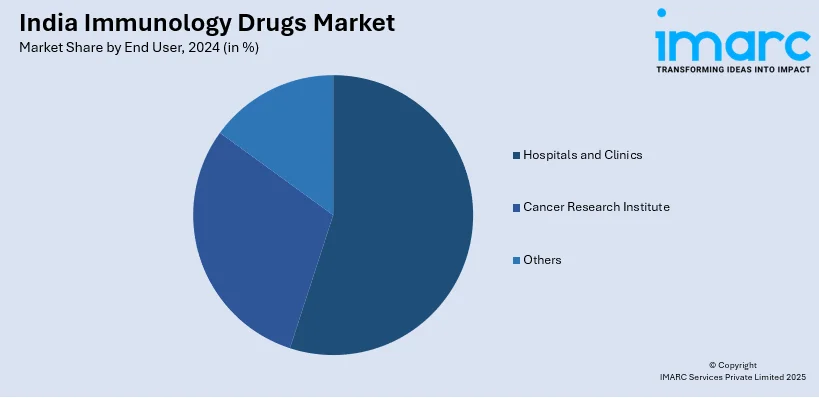

End User Insights:

- Hospitals and Clinics

- Cancer Research Institute

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, cancer research institute, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Immunology Drugs Market News:

- February 2025: Sanofi’s Rezurock (Belumosudil Tablets) received marketing approval in India for treating chronic graft-versus-host disease (cGVHD). This breakthrough therapy offers a new treatment option for patients with limited options, enhancing India’s immunology drugs segment by addressing critical unmet needs in transplant care.

- January 2025: Emcure Pharmaceuticals launched its Emcure Research Centre in Ahmedabad, Gujarat, focusing on complex drug delivery systems, including advanced immunology drug formulations like sustained-release therapies and liposomal injections. This development is expected to accelerate innovations in immunology drugs.

India Immunology Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Monoclonal Antibodies (mAb), Antibody Drug Conjugates, Interferon and Cytokine Therapies, Immunosuppressive Medication, Others |

| Indications Covered | Arthritis, Plaque Psoriasis, Spondylitis, Inflammatory Bowel Disease, Transplant Rejection, Others |

| End Users Covered | Hospitals, Clinics, Cancer Research Institute, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India immunology drugs market performed so far and how will it perform in the coming years?

- what is the breakup of the India immunology drugs market on the basis of drug class?

- what is the breakup of the India immunology drugs market on the basis of indication?

- what is the breakup of the India immunology drugs market on the basis of end user?

- What are the various stages in the value chain of the India immunology drugs market?

- What are the key driving factors and challenges in the India immunology drugs market?

- What is the structure of the India immunology drugs market and who are the key players?

- What is the degree of competition in the India immunology drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India immunology drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India immunology drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India immunology drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)