India Implantable Medical Devices Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2025-2033

India Implantable Medical Devices Market:

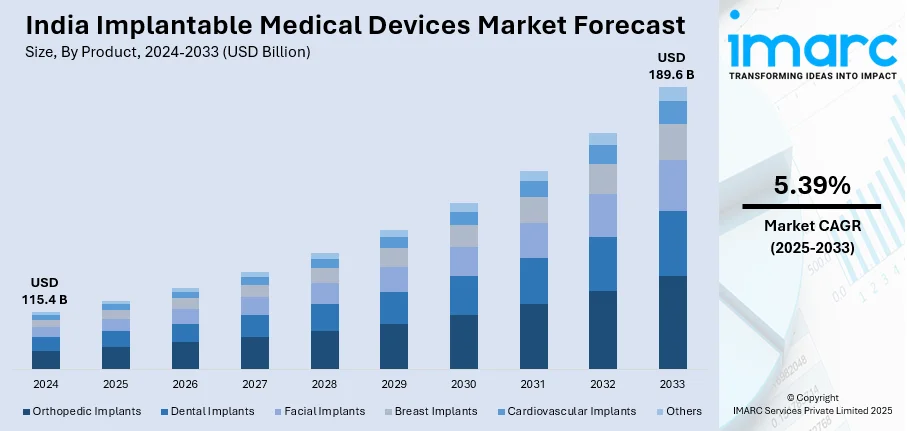

The India implantable medical devices market size reached USD 115.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 189.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.39% during 2025-2033. Rising prevalence of chronic diseases, aging population, technological advancements, surging disposable incomes, and government initiatives are some of the major factors driving the India implantable devices market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 115.4 Billion |

| Market Forecast in 2033 | USD 189.6 Billion |

| Market Growth Rate (2025-2033) | 5.39% |

India Implantable Medical Devices Market Analysis:

- Major Market Drivers: Increasing disposable incomes, improving healthcare infrastructure, rising geriatric population, surging awareness about cosmetic surgeries, etc., are propelling the market growth. Moreover, as India's economy grows, there's a corresponding increase in healthcare expenditures. This leads to a greater investment in advanced medical technologies, including implants.

- Key Market Trends: Rising minimally invasive procedures, continuous technological advancements, growing trend towards personalized medicines, and expanding medical tourism are expected to stimulate the India implantable medical devices market demand. Moreover, with an aging population and increasing incidence of musculoskeletal disorders, the demand for orthopedic implants such as hip and knee replacements, spinal implants, and trauma fixation devices is on the rise, thereby contributing to the India implantable medical devices market demand.

- Geographical Trends: North India has seen significant investments in healthcare infrastructure, including the establishment of hospitals, specialty clinics, and medical centers. The expansion of healthcare facilities in the region increases access to advanced medical treatments, including surgical procedures requiring implants. Moreover, with improving economic conditions and increasing per capita income in North India, there's a corresponding rise in healthcare expenditure. As people become more willing and able to spend on healthcare services, there's a growing demand for advanced medical interventions, including implants.

- Challenges and Opportunities: Regulatory hurdles, infrastructure limitations, price sensitivity, and limited insurance coverage are some of the challenges that the market is facing. However, with increasing disposable incomes and growing awareness of healthcare, Indians are willing to spend more on medical treatments, including surgical procedures involving implantable devices. This presents implantable medical devices market opportunities in India for manufacturers to tap into a growing market for premium medical devices.

To get more information on this market, Request Sample

India Implantable Medical Devices Market Trends:

Rising Geriatric Population

India's population is aging, with a growing number of elderly individuals. For instance, according to the article published by UNFPA in December 2023, the population aged 60 and above is expected to reach 347 million by 2050 as compared to 153 million in 2023. Aging is a significant risk factor for chronic diseases such as cardiovascular diseases, diabetes, and musculoskeletal disorders, which often require medical interventions including implantable devices like pacemakers, stents, and joint replacements. According to the article published by the National Library of Medicine, with an increase in age, the prevalence of musculoskeletal symptoms goes on rising, i.e. 12 out of 24 responders in the age group 31–40 years, 6 out of 8 in 41–50 years, and 5 out of 6 (83%) in >50 years age group had neck disorders. Moreover, rising cases of breast cancer is also driving the adoption of medically implanted devices. For instance, breast cancer is the most frequent cancer in India, accounting for 28.2% of all female cancers and is expected to cause 216,108 cases by 2022. From 1990 to 2016, the age-standardized incidence rate of female breast cancer grew by 39.1%, and this trend has been observed in all states of India over the last 26 years. Furthermore, breast cancer treatment often involves surgical procedures such as lumpectomy or mastectomy, followed by breast reconstruction surgery. Implantable devices such as breast implants or tissue expanders are commonly used in breast reconstruction procedures, driving the demand for these implants. For instance, in January 2024, MGM Cancer Institute opened Clinic B, a unique clinic that offers innovative and complete treatment for all breast health issues, from cysts and benign lumps to tumors and reconstruction. These factors are bolstering the India implantable medical devices market revenue.

High Prevalence of Cardiovascular Diseases

Cardiovascular diseases, including coronary artery disease, heart failure, and arrhythmias, are major contributors to morbidity and mortality in India. The prevalence of these conditions is on the rise due to factors such as sedentary lifestyles, unhealthy dietary habits, and tobacco use. For instance, according to an article published by the National Library of Medicine, cardiovascular diseases (CVDs), including ischemic heart disease and cerebrovascular accidents (stroke), are the primary cause of 17.7 million deaths worldwide. The World Health Organization estimates that India is responsible for one-fifth of all global deaths, particularly among younger people. According to the Global Burden of Disease report, India has an age-standardized CVD death rate of 272 per 100,000 people, which is significantly higher than the 235 global averages. As the burden of CVDs grows, there's a corresponding increase in the demand for implantable medical devices to manage and treat these conditions. Moreover, advances in medical technology have led to the development of a wide range of implantable cardiac devices for the management of various cardiovascular conditions. These devices include implantable cardioverter-defibrillators (ICDs), pacemakers, cardiac resynchronization therapy (CRT) devices, and implantable loop recorders (ILRs). For instance, in January 2024, India Medtronic Private Limited collaborated with Cardiac Design Labs in order to introduce, develop, and broaden the use of CDL's innovative diagnostic technology, Padma Rhythms, an external loop recorder (ELR) patch intended for thorough, long-term cardiac monitoring and diagnosis. These factors are further creating lucrative opportunities for India implantable medical device companies.

Technological Advancements

Technological advancements have led to the development of implantable medical devices with improved performance and functionality. For example, pacemakers and implantable cardioverter-defibrillators (ICDs) now incorporate advanced algorithms and sensors for more accurate detection and treatment of cardiac arrhythmias, improving patient outcomes and reducing the risk of complications. For instance, in April 2024, the JN Medical College, Aligarh Muslim University's Department of Cardiology hosted a free Pacemaker Interrogation Camp where representatives from Medtronic, USA, St. Jude, and Biotronics checked and programmed all types of pacemakers, including single chamber, double chamber, ICDs, and CRTS, as well as performed the necessary parameter setting. This is further positively influencing the India implantable medical devices market’s recent price. Moreover, advances in microelectronics and materials science have facilitated the miniaturization and integration of implantable medical devices, allowing for smaller, more discreet implants with enhanced functionality. This trend is particularly evident in devices such as cochlear implants, neurostimulators, and drug-delivery implants, where smaller form factors and increased integration improve patient comfort and device longevity. For instance, in November 2023, the Sawai Man Singh (SMS) Hospital, Jaipur, utilized electronic-free cochlear implants in patients with hearing loss. The technology claims to have less chance of failure. These factors are further contributing to the India implantable medical devices market share.

India Implantable Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India implantable medical devices market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on product, material, and end user.

Breakup by Product:

- Orthopedic Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Cardiovascular Implants

- Others

Orthopedic implants represent the most popular model type

The report has provided a detailed breakup and analysis of the market based on the product. This includes orthopedic implants, dental implants, facial implants, breast implants, cardiovascular implants and others. According to the report, orthopedic implants accounted for the largest market share.

According to the India implantable medical devices market outlook, orthopedic conditions such as osteoarthritis, fractures, and degenerative bone diseases are prevalent in India, driven by factors such as an aging population, sedentary lifestyles, and road traffic accidents. As the incidence of these conditions rises, there's a corresponding increase in the demand for orthopedic implants for joint replacement surgeries, fracture fixation, and spinal fusion procedures. Joint replacement surgeries, including total hip replacement (THR), total knee replacement (TKR), and total shoulder replacement (TSR), are among the most common orthopedic procedures performed in India. These surgeries involve the implantation of artificial joints made of metal, plastic, or ceramic materials to replace damaged or diseased joint surfaces. The growing demand for joint replacement surgeries is driving the market for orthopedic implants in India. For instance, in January 2024, Coimbatore-based Ganga Hospital performed an all-ceramic total knee replacement, without any metals.

Breakup by Material:

- Polymers

- Metals

- Ceramics

- Biologics

Metals hold the largest share in the market

The report has provided a detailed breakup and analysis of the market based on the material. This includes polymers, metals, ceramics, and biologics. According to the report, metals accounted for the largest market share.

As per the India implantable medical devices market overview, metals such as titanium, stainless steel, and cobalt-chromium alloys are commonly used in orthopedic implants due to their excellent mechanical properties, biocompatibility, and corrosion resistance. These metals are utilized in implants for joint replacement surgeries (e.g., hip, knee, shoulder), fracture fixation devices (e.g., plates, screws, nails), and spinal implants (e.g., pedicle screws, rods). Moreover, in cardiovascular interventions, metal alloys such as stainless steel, cobalt-chromium, and nitinol are widely used in the fabrication of implantable devices such as stents, pacemakers, and defibrillators. These metals offer high strength, flexibility, and durability, making them suitable for applications requiring long-term implantation within the cardiovascular system.

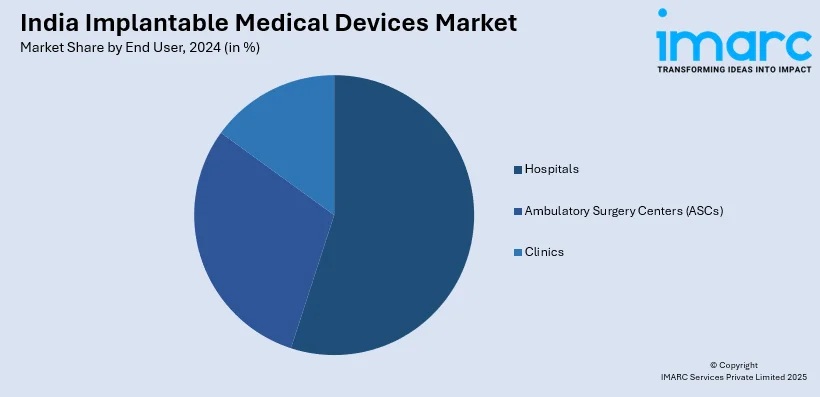

Breakup by End User:

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Clinics

Hospitals presently accounts for the largest market share

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes hospitals, ambulatory surgery centers (ASCs), and clinics. According to the India implantable medical devices market report, the hospitals accounted for the largest market share.

Chronic diseases such as cardiovascular diseases, orthopedic disorders, and diabetes are prevalent in India. These conditions often require surgical interventions that involve implanted medical devices like stents, joint replacements, and pacemakers. As the burden of chronic diseases increases, so does the demand for implantable medical devices in hospitals. Moreover, there has been significant growth in healthcare infrastructure in India, particularly in urban areas. Many hospitals are equipped with state-of-the-art facilities and specialized departments for orthopedics, cardiology, neurology, and oncology, where implanted medical devices are frequently used in surgical procedures.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India. According to the report, North India accounted for the largest market share.

As per the India implantable medical devices market statistics, North India, including states like Delhi, Uttar Pradesh, Punjab, Haryana, and Rajasthan, has seen substantial investments in healthcare infrastructure. The region is home to several prominent hospitals, medical centers, and specialty clinics equipped with advanced medical facilities and specialized departments for various medical specialties, driving the demand for implanted medical devices. Moreover, North India has a dense population, and urbanization is rapidly increasing. With a large population base, there's a higher prevalence of chronic diseases such as cardiovascular diseases, orthopedic disorders, and diabetes, which often require surgical interventions involving implanted medical devices. The growing disease burden contributes to the demand for these devices in the region. For instance, in January 2024, DJ College of Dental Sciences and Research, Modinagar, Delhi NCR, launched DJ Clinico Excellencia Academy to offer various courses including implantology.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

India Implantable Medical Devices Market News:

- May 2024: Abbott, a global healthcare company launched XIENCE Sierra, an everolimus-eluting coronary stent system in India.

- March 2024: GMC became the first hospital in India to use a gold-coated implant for a knee replacement procedure.

- February 2024: Asian Orthopedic Institute at SIMS Hospital introduced a new ceramic knee replacement system.

India Implantable Medical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Orthopedic Implants, Dental Implants, Facial Implants, Breast Implants, Cardiovascular Implants, Others |

| Materials Covered | Polymers, Metals, Ceramics, Biologics |

| End Users Covered | Hospitals, Ambulatory Surgery Centers (ASCs), Clinics |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Implantable medical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Implantable medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Implantable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India implantable medical devices market was valued at USD 115.4 Billion in 2024.

We expect the India implantable medical devices market to exhibit a CAGR of 5.39% during 2025-2033.

The high prevalence of various chronic diseases, along with the growing application of implantable medical devices to aid in replacing damaged body organs as well as in monitoring the functions of different organs and tissues, is primarily driving the India implantable medical devices market.

The sudden outbreak of the COVID-19 pandemic had led to postponement of numerous elective surgeries across the nation to reduce the risk of the coronavirus infection upon hospital visits and interaction with medical equipment, thereby limiting the demand for implantable medical devices.

Based on the product, the India implantable medical devices market can be segmented into orthopedic implants, dental implants, facial implants, breast implants, cardiovascular implants, and others. Currently, orthopedic implants hold the majority of the total market share.

Based on the material, the India implantable medical devices market has been divided into polymers, metals, ceramics, and biologics. Among these, metals currently exhibit a clear dominance in the market.

Based on the end user, the India implantable medical devices market can be categorized into hospitals, Ambulatory Surgery Centers (ASCs), and clinics. Currently, hospitals account for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India implantable medical devices market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)