India In-app Advertising Market Size, Share, Trends, and Forecast by Type, Platform, Application, and Region, 2025-2033

India In-app advertising Market Overview:

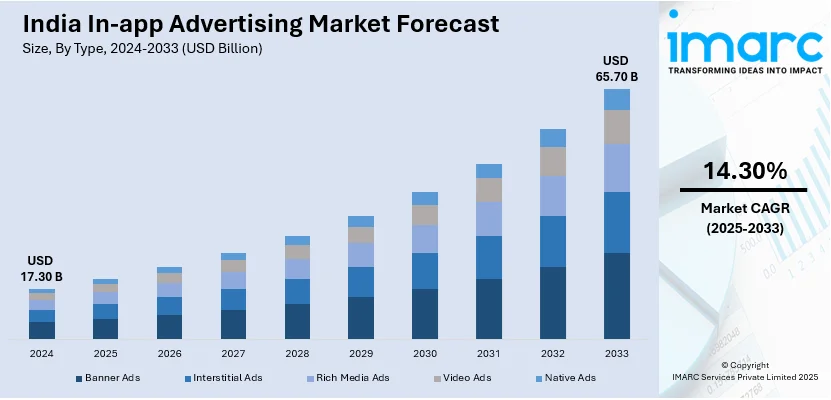

The India in-app advertising market size reached USD 17.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.70 Billion by 2033, exhibiting a growth rate (CAGR) of 14.30% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of programmatic advertising and growth of video and interactive ad formats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.30 Billion |

| Market Forecast in 2033 | USD 65.70 Billion |

| Market Growth Rate (2025-2033) | 14.30% |

India In-app advertising Market Trends:

Rising Adoption of Programmatic Advertising

India's in-app advertising space is currently experiencing growing programmatic advertising adoption to make ad placements increasingly efficient and precise. With the programmatic advertising technologies using artificial intelligence (AI) and real-time bidding (RTB), brands can base their interaction with users according to their behavior, preferences, or demographic characteristics. This data-oriented approach improves the relevance of most advertisements and hence attracts more engagement with higher returns on investment (ROI) for the advertisers. Particularly, as the digital economy grows and mobile internet penetration continues to expand, more Indian advertisers are migrating to programmatic platforms, from the traditional ad-buying methods. Therefore, with more than 800 million smartphone users in India and growing mobile consumption, advertisers today are increasingly looking at in-app programmatic services to reach these high-involvement audiences. For instance, as per industry reports, in 2024, India, with 900 million internet users, recorded 24.3 billion app downloads, reflecting the country's growing digital adoption and increasing demand for mobile applications across various sectors. Moreover, advancements in AI-driven demand-side platforms (DSPs) and supply-side platforms (SSPs) are enabling more automated, scalable, and cost-effective advertising strategies. Regulatory developments, such as India’s evolving data protection framework, are also shaping programmatic advertising trends, pushing companies to focus on privacy-compliant targeting mechanisms. Major advertisers are investing in contextual targeting and first-party data strategies to mitigate the impact of restrictions on third-party cookies and device identifiers. As India’s digital advertising landscape matures, programmatic in-app advertising is expected to become a dominant mode of ad delivery, optimizing audience engagement and ad spend efficiency.

To get more information on this market, Request Sample

Growth of Video and Interactive Ad Formats

The increasing consumption of video content on mobile apps is driving the demand for video and interactive ad formats in India’s in-app advertising market. Video ads, including short-form, rewarded, and in-stream ads, are gaining traction due to their higher engagement rates and ability to deliver immersive brand messaging. With the rise of platforms such as YouTube Shorts, Instagram Reels, and OTT streaming services, advertisers are investing in mobile-first video strategies to capture user attention. Interactive ad formats, such as playable ads, gamified content, and augmented reality (AR)-enabled ads, are also seeing increased adoption. These frameworks stimulate user engagement through participation rather than passive viewing. The gaming sector, which accounts for a significant share of in-app advertising revenue, is a key driver of interactive ad adoption. Rewarded video ads, which offer incentives like in-game currency or premium content in exchange for ad engagement, have proven effective in boosting user retention and monetization for app developers. As smartphone penetration and internet speeds improve, advertisers are leveraging AI and machine learning to personalize video and interactive ad experiences. For instance, in February 2025, GroupM's TYNY report projected that Indian advertising to grow 7%, reaching ₹1,64,137 crore, with an incremental ₹10,730 crore, reflecting continued expansion in digital and media investments. The shift toward immersive advertising aligns with evolving consumer preferences, making these formats integral to the future of India’s in-app advertising ecosystem.

India In-app advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, platform, and application.

Type Insights:

- Banner Ads

- Interstitial Ads

- Rich Media Ads

- Video Ads

- Native Ads

The report has provided a detailed breakup and analysis of the market based on the type. This includes banner ads, interstitial ads, rich media ads, video ads, and native ads.

Platform Insights:

- Android

- iOS

- Others

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes android, iOS, and others.

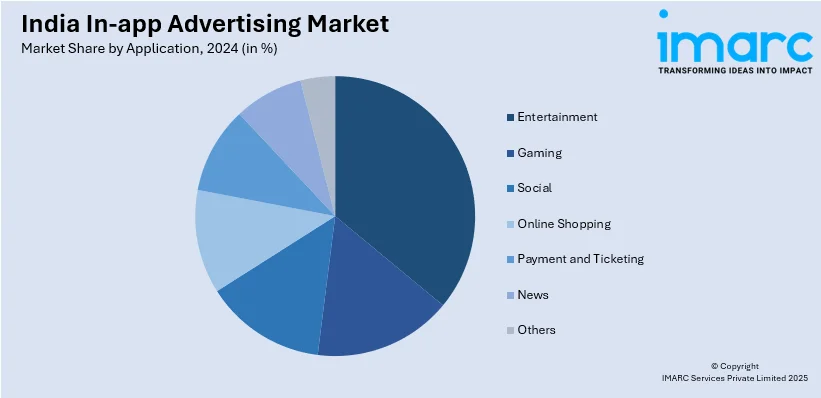

Application Insights:

- Entertainment

- Gaming

- Social

- Online Shopping

- Payment and Ticketing

- News

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes entertainment, gaming, social, online shopping, payment and ticketing, news, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India In-app advertising Market News:

- In February 2024, PhonePe announced the launch of Indus Appstore, a localized app marketplace in India, creating new opportunities for in-app advertising. With India's booming mobile app market, this platform enables targeted ad placements, developer monetization, and enhanced user engagement, attracting startup founders and tech leaders to its growing digital ecosystem.

India In-app advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Banner Ads, Interstitial Ads, Rich Media Ads, Video Ads, Native Ads |

| Platforms Covered | Android, iOS, Others |

| Applications Covered | Entertainment, Gaming, Social, Online Shopping, Payment and Ticketing, News, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India in-app advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India in-app advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India in-app advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India in-app advertising market was valued at USD 17.30 Billion in 2024.

The India in-app advertising market is projected to exhibit a CAGR of 14.30% during 2025-2033, reaching a value of USD 65.70 Billion by 2033.

The India in-app advertising market is driven by rising smartphone penetration, affordable internet access, and increased mobile app usage. Growth in digital payments, mobile gaming, and regional language content also boosts engagement. Advertisers benefit from precise targeting, while businesses leverage app-based platforms to reach diverse consumer segments across urban and rural areas further contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)