India In Vitro Diagnostics Market Size, Share, Trends and Forecast by Test Type, Product, Usability, Application, End User, and Region, 2025-2033

India In Vitro Diagnostics Market Size and Share:

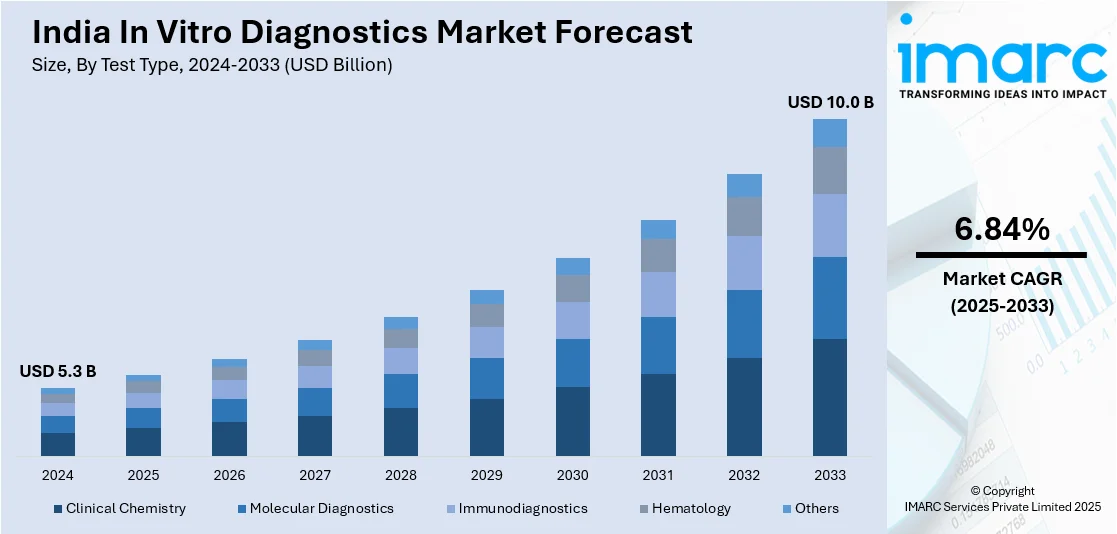

The Indian in vitro diagnostics market size reached USD 5.3 Billion in 2024. The market is expected to reach USD 10.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. The market growth is attributed to the rising incidence of chronic diseases such as diabetes, cardiovascular diseases, and cancer, which has fueled the demand for diagnostic tests for early diagnosis, treatment planning, as well as monitoring.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of test type, the market has been divided into clinical chemistry, molecular diagnostics, immunodiagnostics, hematology, and others.

- On the basis of product, the market has been divided into reagents and kits, and instruments.

- On the basis of usability, the market has been divided into disposable IVD devices and reusable IVD devices.

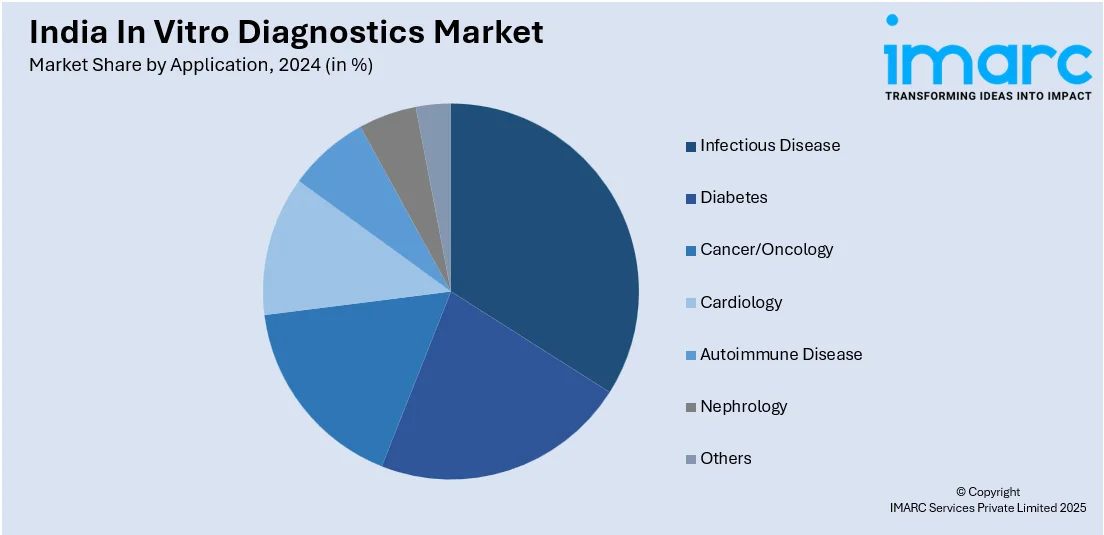

- On the basis of application, the market has been divided into infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and others.

- On the basis of end user, the market has been divided into hospitals laboratories, clinical laboratories, point-of-care testing centers, academic institutes, patients, and others.

Market Size and Forecast:

- Market Size in 2024: USD 5.3 Billion

- Market Forecast in 2033: USD 10.0 Billion

- Market Growth Rate (2025-2033): 6.84%

In vitro diagnostics (IVD) refers to a category of medical tests conducted outside the living organism, typically in a laboratory setting. These tests analyze biological specimens such as blood, urine, or tissue to detect diseases, infections, or other health conditions. IVD plays a crucial role in disease diagnosis, monitoring, and treatment by providing accurate and timely information to healthcare professionals. Common IVD techniques include immunoassays, molecular diagnostics, clinical chemistry, and microbiology. The results obtained from these tests aid in making informed decisions about patient care, enabling early detection of diseases and facilitating personalized treatment plans. In vitro diagnostics contribute significantly to the advancement of precision medicine, preventive healthcare, and the overall improvement of patient outcomes. The field continues to evolve with advancements in technology, offering innovative solutions for diagnosing and managing various medical conditions.

To get more information on this market, Request Sample

The in vitro diagnostics market in India is experiencing robust growth, driven by several key factors. Firstly, the increasing prevalence of chronic diseases has necessitated the demand for advanced diagnostic tools and techniques, propelling the IVD market forward. Additionally, the aging population contributes significantly to the market's expansion, as older individuals are more susceptible to various health conditions that require precise diagnostic solutions. Furthermore, technological advancements in the field of diagnostics, such as the integration of molecular diagnostics and personalized medicine, have spurred innovation and adoption. Moreover, the rising awareness among patients and healthcare professionals regarding the benefits of early disease detection has fueled the demand for sophisticated in vitro diagnostic methods. Furthermore, the increasing emphasis on preventive healthcare measures and the growing trend of point-of-care testing contribute substantially to the market's momentum. Collectively, these interconnected factors create a conducive environment for the continuous evolution and expansion of the in vitro diagnostics market. As technology, demographics, and healthcare priorities intersect, the IVD market is poised to play a pivotal role in shaping the future of medical diagnostics.

India In Vitro Diagnostics Market Trends:

Advancements in Molecular Diagnostics

The molecular diagnostics segment is experiencing unprecedented growth within the India in vitro diagnostics market share, driven by revolutionary technologies such as PCR amplification, next-generation sequencing, and CRISPR-based diagnostic platforms that offer superior sensitivity and specificity for pathogen detection and genetic analysis. These advanced molecular techniques are enabling precise identification of infectious agents, genetic mutations, and biomarkers at the DNA and RNA levels, facilitating personalized treatment approaches and targeted therapy selection. The integration of artificial intelligence and machine learning algorithms with molecular diagnostic platforms is enhancing interpretation accuracy and reducing turnaround times for complex genetic analyses. Point-of-care molecular diagnostic devices are gaining significant traction, allowing healthcare providers to conduct sophisticated tests directly at patient bedsides or in remote healthcare facilities, dramatically improving diagnostic accessibility and fueling India in vitro diagnostics market growth. The COVID-19 pandemic accelerated the adoption of molecular diagnostics, establishing robust infrastructure and expertise that continues to benefit broader infectious disease testing and cancer genomics applications. Emerging technologies such as digital PCR, isothermal amplification, and microfluidic devices are making molecular diagnostics more affordable and user-friendly, expanding their applicability across various healthcare settings. Government initiatives supporting genomic research and precision medicine are creating favorable conditions for molecular diagnostic companies to invest in advanced manufacturing capabilities and research development activities.

Focus on Chronic and Infectious Disease Testing

The escalating burden of chronic diseases including diabetes, cardiovascular disorders, and cancer is driving substantial demand for sophisticated diagnostic solutions that enable early detection, disease monitoring, and treatment optimization across India's healthcare system. Advanced biomarker testing, including cardiac troponins, HbA1c monitoring systems, and tumor markers, is becoming integral to chronic disease management protocols in both urban and rural healthcare facilities. Infectious disease diagnostics have gained renewed importance following the pandemic experience, with enhanced focus on rapid pathogen identification, antimicrobial resistance testing, and outbreak surveillance capabilities. The increasing prevalence of lifestyle-related diseases among India's growing urban population is creating sustained demand for comprehensive metabolic panels, lipid profiles, and inflammatory marker testing services, as per the India in vitro diagnostics market analysis. Point-of-care testing solutions for both chronic and infectious diseases are expanding healthcare access in remote areas, enabling timely diagnosis and treatment initiation without requiring patients to travel to centralized laboratory facilities. Integrated diagnostic platforms that can simultaneously test for multiple chronic disease markers and common infections are gaining popularity among healthcare providers seeking cost-effective and efficient testing solutions. Government healthcare programs focusing on non-communicable disease prevention and infectious disease control are driving standardization of diagnostic protocols and increasing adoption of quality-assured testing methodologies across public healthcare networks.

Growth, Opportunities, and Challenges in the Indian In Vitro Diagnostics Market:

- Government Schemes Supporting Market Growth: The Production Linked Incentive (PLI) Scheme for Promoting Domestic Manufacturing of Medical Devices is significantly boosting the In Vitro Diagnostics Market Size in India by providing financial incentives to encourage local manufacturing of critical medical devices and diagnostics equipment. Import substitution policies and preferential procurement norms for domestically manufactured medical devices are creating protected market opportunities for Indian IVD companies, which in turn is augmenting the in vitro diagnostics market size in India.

- Market Opportunities in the Indian In Vitro Diagnostics Market: The untapped potential in tier-2 and tier-3 cities presents significant growth opportunities as healthcare infrastructure development and medical tourism expansion create demand for quality diagnostic services. The increasing focus on home healthcare and point-of-care testing creates opportunities for portable and user-friendly diagnostic devices that can be used outside traditional laboratory settings. The government's push for indigenous manufacturing through initiatives like Make in India and Atmanirbhar Bharat offers substantial opportunities for local IVD companies to develop cost-effective diagnostic solutions.

- Market Challenges in the Indian In Vitro Diagnostics Market: The highly fragmented nature of India's diagnostic market with numerous small players creates pricing pressure and quality standardization challenges that limit market consolidation and growth potential. Limited healthcare reimbursement coverage for diagnostic tests restricts patient access to advanced testing solutions and constrains market expansion in price-sensitive segments. The shortage of skilled laboratory technicians and regulatory compliance complexities create operational challenges for diagnostic companies seeking to scale their operations across diverse regional markets.

India In Vitro Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on test type, product, application, usability, and end user.

Test Type Insights:

- Clinical Chemistry

- Molecular Diagnostics

- Immunodiagnostics

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes clinical chemistry, molecular diagnostics, immunodiagnostics, hematology, and others.

Product Insights:

- Reagents and Kits

- Instruments

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes reagents and kits and instruments.

Usability Insights:

- Disposable IVD Devices

- Reusable IVD Devices

The report has provided a detailed breakup and analysis of the market based on the usability. This includes disposable IVD devices and reusable IVD devices.

Application Insights:

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and others.

End User Insights:

- Hospitals Laboratories

- Clinical Laboratories

- Point-of-care Testing Centers

- Academic Institutes

- Patients

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals laboratories, clinical laboratories, point-of-care testing centers, academic institutes, patients, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2025, India launched the In-Vitro Diagnostics (IVD) validation portal at the National Virus Research & Diagnostic Laboratory (VRDL) Conclave, a key initiative aimed at improving the efficiency and transparency of IVD validation processes. This portal, alongside new validation protocols developed by ICMR and CDSCO, is designed to strengthen India’s diagnostic capabilities and enhance global competitiveness in the IVD market.

- In August 2025, the Central Drugs Standard Control Organization (CDSCO) and the Indian Council of Medical Research (ICMR) issued a draft of standard evaluation protocols for In-Vitro Diagnostics (IVDs) devices, aimed at assessing their quality and performance. The 180-page document, which includes protocols for 15 IVD types like Dengue, Malaria, and SARS-CoV-2, invites feedback from stakeholders until August 25, 2025, and will serve as a foundation for issuing IVD licenses in India.

- In September 2024, Fapon showcased its innovative IVD solutions at Medical Fair India 2024, held in Mumbai, aiming to support the growth of the Indian IVD industry. The company introduced new biomarkers, reagents, and open-instrument platforms, offering comprehensive one-stop solutions designed to help local manufacturers enhance diagnostic capabilities and improve patient care in India.

India In Vitro Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others |

| Products Covered | Reagents and Kits, Instruments |

| Usabilities Covered | Disposable IVD Devices, Reusable IVD Devices |

| Applications Covered | Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others |

| End Users Covered | Hospitals Laboratories, Clinical Laboratories, Point-of-Care Testing Centers, Academic Institutes, Patients, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India in vitro diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India in vitro diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India in vitro diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in vitro diagnostics market in India was valued at USD 5.3 Billion in 2024.

The India in vitro diagnostics market is projected to exhibit a CAGR of 6.84% during 2025-2033, reaching a value of USD 10.0 Billion by 2033.

The India in vitro diagnostics (IVD) market is fueled by increasing chronic disease prevalence, rising demand for early and accurate testing, and growing health awareness. Government healthcare initiatives, expansion of diagnostic labs in rural areas, and implementation of cutting-edge technologies, such as molecular diagnostics and point-of-care testing, are further accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)