India Inductor Market Size, Share, Trends and Forecast by Inductance, Core Type, Shield Type, Mounting Technique, Application, End User, and Region, 2025-2033

India Inductor Market Overview:

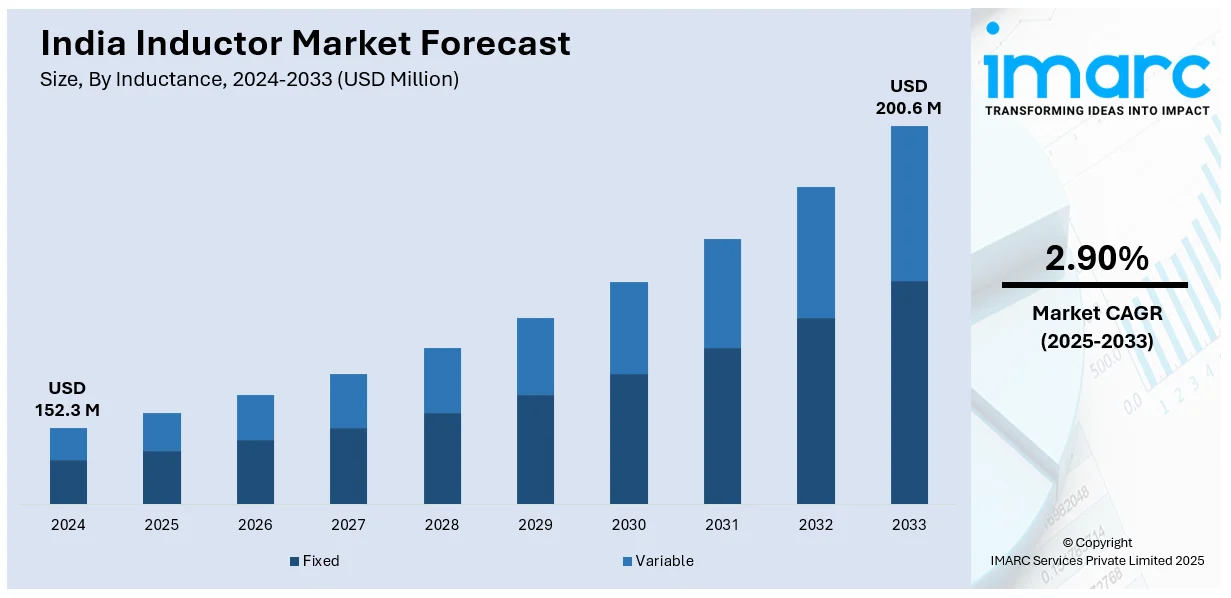

The India inductor market size reached USD 152.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 200.6 Million by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The rising demand from consumer electronics, rapid adoption of electric vehicles, and expansion in renewable energy infrastructure. Government initiatives like Make in India and FAME-II further support domestic manufacturing, while technological advancements in miniaturization and energy efficiency enhance the appeal of inductors across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 152.3 Million |

| Market Forecast in 2033 | USD 200.6 Million |

| Market Growth Rate (2025-2033) | 2.90% |

India Inductor Market Trends:

Rising Demand from Consumer Electronics Sector

The growth of India's consumer electronics industry is heavily driving the demand for inductors. With rising adoption of smartphone, smart TV, laptop, and wearables, the demand for miniaturized, high-performance inductors has picked up. These products play a vital role in power management circuits and signal processing. Companies are designing small and low-power-consuming inductors to address changing consumer tastes. Additionally, the government schemes of production-linked incentive (PLI) and "Make in India" are promoting domestic manufacturing of electronic components such as inductors. Indigenous assembly lines are being ramped up, lessening dependence on imports and building a strong supply chain. Growth in this industry is directly impacting innovations in inductor design, particularly surface mount and multilayer designs for high-frequency and miniature applications.

To get more information on this market, Request Sample

Growing Adoption of Electric Vehicles (EVs)

The accelerating shift toward electric mobility in India is driving a surge in inductor demand, essential for EV battery management, onboard chargers, motor drives, and power converters. In the first half of 2024, EV registrations in India increased by 16%, reaching 842,396 units from 723,492 in 2023. National policies like FAME-II and growing investments in EV manufacturing infrastructure are fostering localization in the supply chain. Inductors used in EVs must handle high currents and extreme temperatures, prompting manufacturers to develop advanced high-power inductors. The expanding presence of global and domestic EV makers is further pushing component suppliers to produce toroidal and custom-wound inductors for next-generation automotive electronics, creating new opportunities in high-efficiency power solutions. This shift is reinforcing India’s role as a key player in EV component manufacturing.

Expansion of Renewable Energy Systems

India's expanding renewable energy infrastructure, particularly in solar and wind power, is driving a strong market for inductors. These components are essential in power conditioning, inverters, and grid interface technologies. As of October 2024, India's renewable energy capacity reached 203.18 GW, making up over 46% of the total installed electricity generation. The country targets 500 GW of non-fossil fuel capacity by 2030, thus bolstering demand for inductors with low core loss, high efficiency, and thermal stability. Manufacturers are developing advanced inductors for variable load renewable systems, hybrid energy setups, and smart grid solutions. This innovation push is supporting India’s decarbonization goals and strengthening its clean energy transition by enhancing the efficiency and reliability of power conversion and grid integration technologies.

India Inductor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on inductance, core type, shield type, mounting technique, application, end user.

Inductance Insights:

- Fixed

- Variable

The report has provided a detailed breakup and analysis of the market based on the inductance. This includes fixed and variable.

Core Type Insights:

- Air

- Ferrite

- Iron

A detailed breakup and analysis of the market based on the core type have also been provided in the report. This includes air, ferrite, and iron.

Shield Type Insights:

- Shielded

- Unshielded

The report has provided a detailed breakup and analysis of the market based on the shield type. This includes shielded, and unshielded.

Mounting Technique Insights:

- Surface Mount

- Through Hole

A detailed breakup and analysis of the market based on the mounting technique have also been provided in the report. This includes surface mount, and through hole.

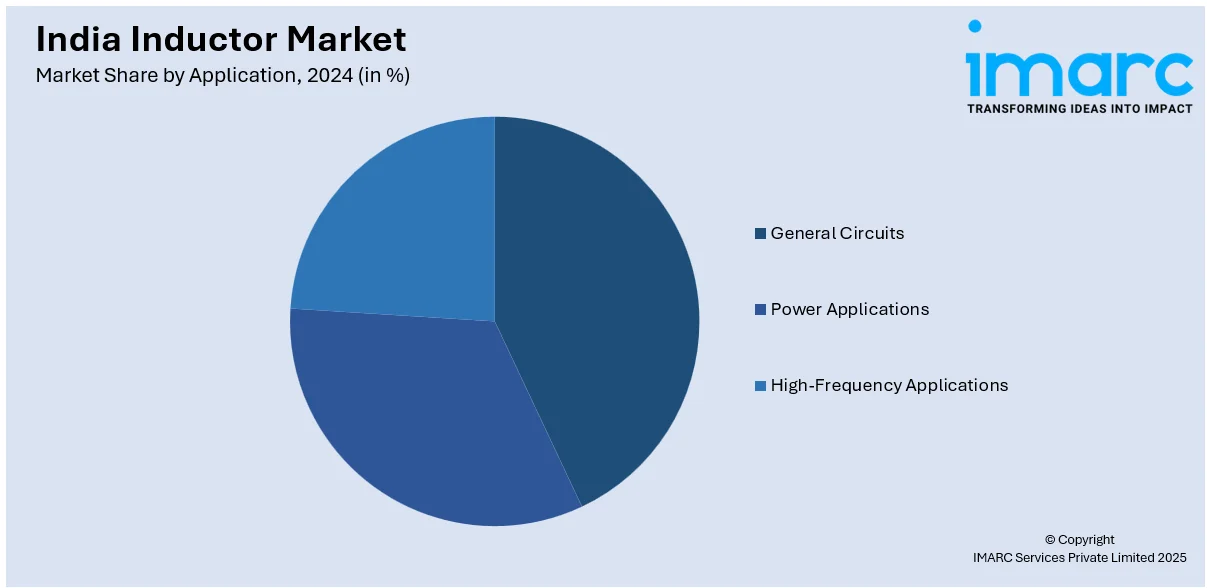

Application Insights:

- General Circuits

- Power Applications

- High-Frequency Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes general circuits, power applications, and high-frequency applications.

End User Insights:

- Automotive

- Industrial

- Telecom

- Military and Defense

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, industrial, telecom, military and defense, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Inductor Market News:

- In February 2025, India is poised to launch its first made-in-India semiconductor chip by September-October 2025, announced IT Minister Ashwini Vaishnaw. Developed by Tata Electronics and Powerchip Semiconductor in Gujarat, this marks a milestone in India's semiconductor journey. The government’s focus on gallium nitride R&D, production-linked incentives, and upcoming GPU initiatives under IndiaAI are driving momentum. With recent investments of Rs 13,162 crore and access to advanced chip design tools, the electronics sector is witnessing rapid growth.

- In July 2024, TAIYO YUDEN unveiled the world’s first multilayer metal power inductor capable of withstanding temperatures up to 165°C. The MCOIL™ LACNF2012KKTR24MAB, part of the LACN Series, meets AEC-Q200 standards and supports high-density mounting in extreme automotive environments. Designed for DC-DC converters in ECUs, BMS, ADAS, and more, this innovation enhances miniaturization and performance of power circuits, marking a significant advancement in automotive-grade passive components.

India Inductor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Inductances Covered | Fixed, Variable |

| Core types Covered | Air, Ferrite, Iron |

| Shield Types Covered | Shielded, Unshielded |

| Mounting Techniques Covered | Surface Mount, Through Hole |

| Applications Covered | General Circuits, Power Applications, High-Frequency Applications |

| End Users Covered | Automotive, Industrial, Telecom, Military and Defense, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India inductor market performed so far and how will it perform in the coming years?

- What is the breakup of the India inductor market on the basis of inductance?

- What is the breakup of the India inductor market on the basis of core type?

- What is the breakup of the India inductor market on the basis of shield type?

- What is the breakup of the India inductor market on the basis of mounting techniques?

- What is the breakup of the India inductor market on the basis of application?

- What is the breakup of the India inductor market on the basis of end user?

- What is the breakup of the India inductor market on the basis of region?

- What are the various stages in the value chain of the India inductor market?

- What are the key driving factors and challenges in the India inductor market?

- What is the structure of the India inductor market and who are the key players?

- What is the degree of competition in the India inductor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India inductor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India inductor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India inductor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)