India Industrial Automation Sensors Market Size, Share, Trends and Forecast by Sensor Type, Type, Mode of Automation, End User, and Region, 2025-2033

India Industrial Automation Sensors Market Size and Share:

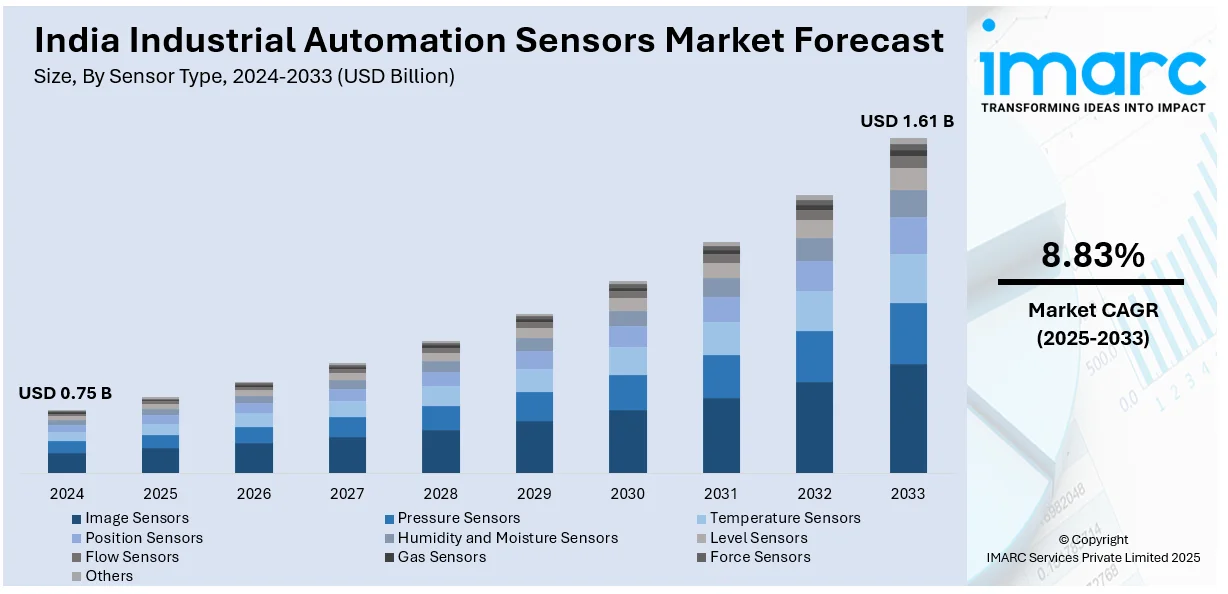

The India industrial automation sensors market size reached USD 0.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.61 Billion by 2033, exhibiting a growth rate (CAGR) of 8.83% during 2025-2033. The rising demand for real-time data, integration of AI-driven predictive maintenance, rapid expansion of smart factories, government incentives for automation, and increasing reliance on high-precision, energy-efficient sensors in industries like automotive, electronics, and pharmaceuticals are positively impacting the India industrial automation sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.75 Billion |

| Market Forecast in 2033 | USD 1.61 Billion |

| Market Growth Rate (2025-2033) | 8.83% |

India Industrial Automation Sensors Market Trends:

Expansion of Smart Manufacturing and Industry 4.0 Adoption

The adoption of Industry 4.0 in India is driving India industrial automation sensors market growth. These sensors are capable of seamless machine-to-machine communication, remote monitoring, and advanced analytics. According to an industry report, by 2025, almost two-thirds of Indian manufacturers will have adopted digital transformation, helping to achieve the target of 25% manufacturing GDP in India. As Indian manufacturers transition from conventional automation to smart manufacturing, they require sensors with enhanced connectivity, interoperability, and self-diagnostic capabilities. Industries such as automotive, food processing, and heavy machinery are increasingly deploying smart sensors to improve production efficiency and ensure compliance with quality standards. Government initiatives encourage automation investments, further propelling the demand for smart sensors. Companies are deploying wireless and cloud-connected sensors to optimize supply chains, track real-time production parameters, and enhance predictive analytics. As factories become more digitized, the role of industrial automation sensors in facilitating real-time control, asset tracking, and energy optimization is expanding significantly.

To get more information on this market, Request Sample

Expansion of Automotive and Electronics Manufacturing in India

The rapid growth of India's automotive and electronics manufacturing sector is positively influencing the India industrial automation sensors market outlook. Government initiatives such as the Production Linked Incentive (PLI) scheme are inducing foreign manufacturers to set up production facilities in India with increasing reliance on automation technology. The automotive sector, driven by the likes of Tata Motors, Mahindra, and foreign OEMs, is embracing industrial sensors for process automation, robot production lines, and quality inspection. Industry reports suggest that India's electronics production could be worth USD 278 Billion in FY 30, of which USD 253 Billion would be from finished goods and USD 25 Billion from component manufacturing are included in this estimate. The development of India's electronics manufacturing ecosystem, with investments by firms such as Foxconn and Jabil, is propelling the use of sensors in high-precision automation systems. Demand for vision sensors, proximity sensors, and force sensors is rising as factories automate production lines and quality inspection. The push towards electric vehicle (EV) production is also propelling the use of sensors in battery manufacturing and powertrain automation.

India Industrial Automation Sensors Market Segmentation:

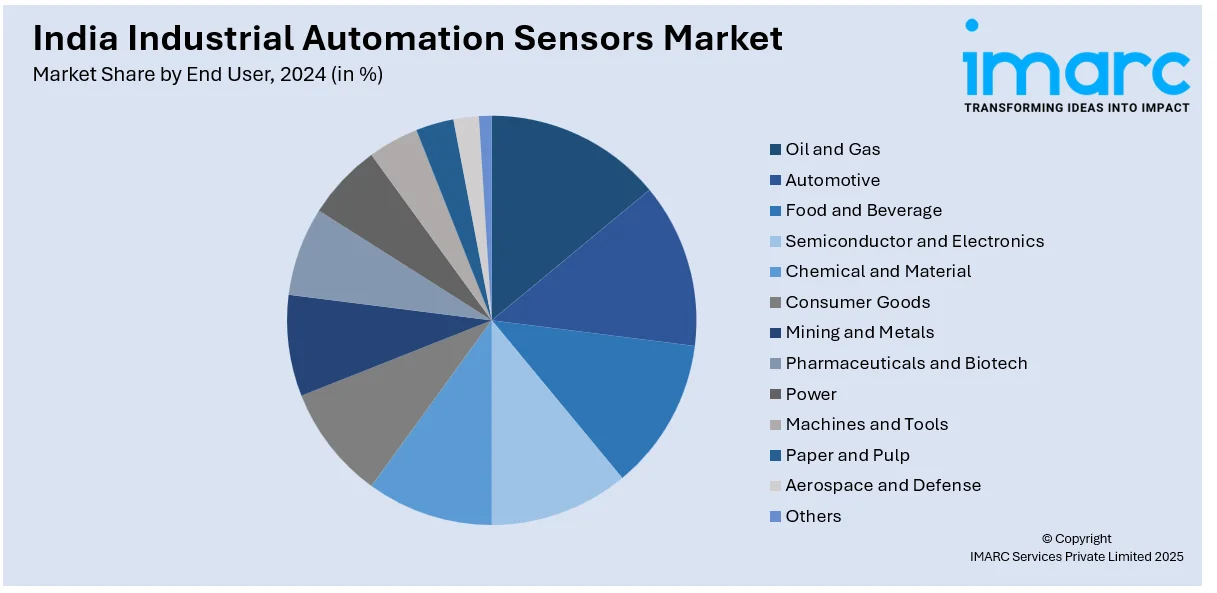

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on sensor type, type, mode of automation, and end user.

Sensor Type Insights:

- Image Sensors

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Humidity and Moisture Sensors

- Level Sensors

- Flow Sensors

- Gas Sensors

- Force Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the sensor type. This includes image sensors, pressure sensors, temperature sensors, position sensors, humidity and moisture sensors, level sensors, flow sensors, gas sensors, force sensors, and others.

Type Insights:

- Contact Sensors

- Non-Contact Sensors

- Photonic Sensors

- Hall Effect Sensors

- Capacitive Sensors

- Ultrasonic Sensors

- Inductive Sensors

- Laser Displacement Sensor

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes contact sensors and non-contact sensors (photonic sensors, hall effect sensors, capacitive sensors, ultrasonic sensors, inductive sensors, and laser displacement sensors)

Mode of Automation Insights:

- Semi-Automatic Systems

- Fully Automatic Systems

The report has provided a detailed breakup and analysis of the market based on the mode of automation. This includes semi-automatic systems and fully automatic systems.

End User Insights:

- Oil and Gas

- Automotive

- Food and Beverage

- Semiconductor and Electronics

- Chemical and Material

- Consumer Goods

- Mining and Metals

- Pharmaceuticals and Biotech

- Power

- Machines and Tools

- Paper and Pulp

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, automotive, food and beverage, semiconductor and electronics, chemical and material, consumer goods, mining and metals, pharmaceutical and biotech, power, machines and tools, paper and pulp, aerospace and defence, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Automation Sensors Market News:

- On August 21, 2024, Panasonic Life Solutions India's Industrial Devices Division unveiled an advanced factory automation suite at Automation Expo 2024 in Mumbai. This suite includes the HL-G2 Series laser sensor, GM1 motion controller, and MINAS A7 servo systems, which is AI powered. These are collectively designed to enhance operational efficiency and precision for Indian OEMs. These solutions aim to improve equipment control, reduce errors, and boost productivity across various industries.

- On January 23, 2025, Schaeffler India announced its participation in IMTEX 2025, hosted in Bengaluru at the Bangalore International Exhibition Centre (BIEC) from January 23 to 29. The company showcased advanced motion technology solutions for machine tools, robotics, and industrial automation, emphasizing precision, efficiency, and high-performance technologies. Highlights included high-performance spindle bearings, linear guidance systems, robotics motion systems, and sensor-integrated condition monitoring products.

India Industrial Automation Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sensor Types Covered | Image Sensors, Pressure Sensors, Temperature Sensors, Position Sensors, Humidity and Moisture Sensors, Level Sensors, Flow Sensors, Gas Sensors, Force Sensors, Others |

| Types Covered |

|

| Mode of Automations Covered | Semi-Automatic Systems, Fully- Automatic Systems |

| End Users Covered | Oil and Gas, Automotive, Food and Beverage, Semiconductor and Electronics, Chemical and Material, Consumer Goods, Mining and Metals, Pharmaceuticals and Biotech, Power, Machines and Tools, Paper and Pulp, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial automation sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial automation sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial automation sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial automation sensors market in India was valued at USD 0.75 Billion in 2024.

The India industrial automation sensors market is projected to exhibit a CAGR of 8.83% during 2025-2033, reaching a value of USD 1.61 Billion by 2033.

The market is driven by increasing focus on operational efficiency, the need for real-time data, and rising use of automated systems in manufacturing. Industries are adopting sensors to enhance accuracy, reduce downtime, and support quality control. Rising industrial activity, along with a shift towards smart production environments, continues to accelerate the demand for automation sensors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)