India Industrial Burner Market Size, Share, Trends and Forecast by Burner Type, Fuel Type, Automation, Operating Temperature, Application, End Use Industry, and Region, 2025-2033

India Industrial Burner Market Overview:

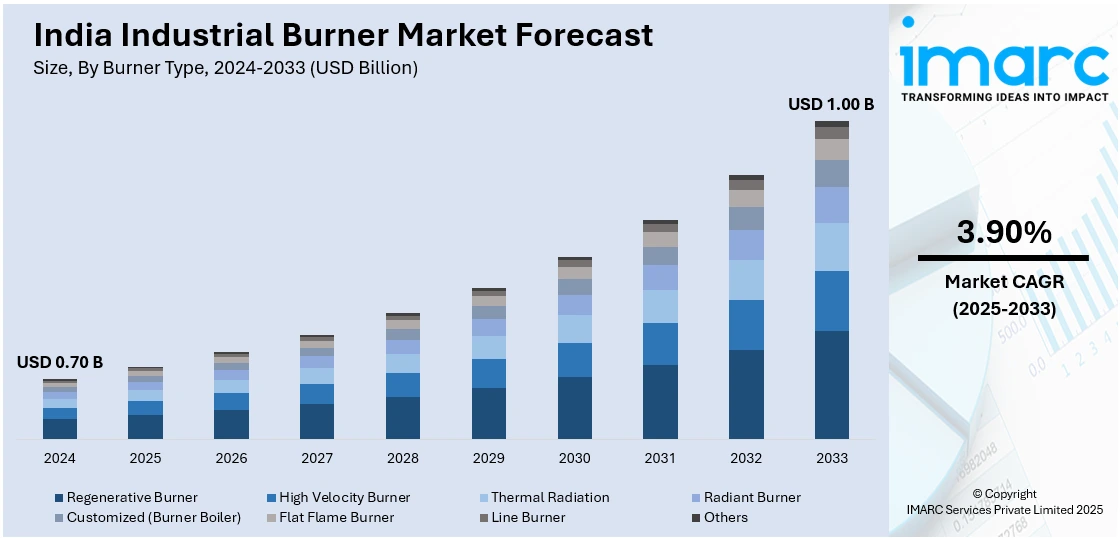

The India industrial burner market size reached USD 0.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.00 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The India industrial burner market is driven by expanding manufacturing activities, rising demand for energy-efficient heating solutions, government initiatives like the Production Linked Incentive (PLI) scheme, technological advancements in burner automation, and rapid adoption in industries such as metal processing, chemicals, food production, and power generation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.70 Billion |

| Market Forecast in 2033 | USD 1.00 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

India Industrial Burner Market Trends:

Expansion of the Manufacturing Sector

India's manufacturing industry has gone through significant progress, driving the escalated need for industrial burners. The Gross Value Added (GVA) in the manufacturing industry rose by 26.6% compared to the previous year, as indicated in the Annual Survey of Industries (ASI) for 2021-22, showing robust industrial activity. Such a rise in manufacturing processes demands effective thermal solutions, making industrial burners key elements in numerous industries. This sustained industrial development is a reflection of the elevating demand for equipment such as industrial burners, which are critical to processes like heating, melting, and drying. As metal processing, chemicals, food processing, and textile industries broaden their scope of operations, the need for efficient and high-performance industrial burners has gained greater importance. Businesses with heat-based processes are constantly modernizing their equipment, adopting sophisticated burner technologies to improve efficiency while maximizing energy usage. Moreover, programs from the government, such as the Production Linked Incentive (PLI) scheme, have triggered manufacturers to expand their production volume, further amplifying the requirement for industrial burners. As automation and smart manufacturing become popular, burners with digital controls and fuel optimization capabilities are being used across industries, enabling accurate thermal utilization with energy conservation.

To get more information on this market, Request Sample

Emphasis on Energy Efficiency and Sustainability

India's focus on energy efficiency and sustainability has also been instrumental in molding the industrial burner market. The National Energy Data: Survey and Analysis report draws attention to the pattern of consumption of different energy products in the industrial sector, focusing on the necessity to use energy in efficient ways. Industries are moving toward cutting-edge industrial burners aimed at maximizing fuel efficiency and reducing emissions, as a step toward national energy conservation. The emphasis of the government on curbing carbon footprints and ensuring sustainable industrial operations has resulted in the adoption of energy-efficient technology. This transformation not only sustains environmental goals but also boosts operational efficiency, and contemporary industrial burners become an essential tool in the quest to attain such goals. In summary, the powerful development of India's industrial sector, complemented by strong focus on energy efficiency and sustainability, has greatly driven the need for industrial burners. These considerations indicate that industrial burners continue to be an imperative in facilitating the nation's industrial base and environmental priorities.

India Industrial Burner Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on burner type, fuel type, automation, operating temperature, application, and end use industry.

Burner Type Insights:

- Regenerative Burner

- High Velocity Burner

- Thermal Radiation

- Radiant Burner

- Customized (Burner Boiler)

- Flat Flame Burner

- Line Burner

- Others

The report has provided a detailed breakup and analysis of the market based on the burner type. This includes regenerative burner, high velocity burner, thermal radiation, radiant burner, customized (burner boiler), flat flame burner, line burner, and others.

Fuel Type Insights:

- Oil-Based

- Gas-Based

- Dual Fuel

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes oil-based, gas-based, and dual fuel.

Automation Insights:

- Monoblock

- Duoblock

A detailed breakup and analysis of the market based on the automation have also been provided in the report. This includes monoblock and duoblock.

Operating Temperature Insights:

- High Temperature (>1,400 °F)

- Low Temperature (<1,400°F)

A detailed breakup and analysis of the market based on the operating temperature have also been provided in the report. This includes high temperature (>1,400 °F) and low temperature (<1,400°F)

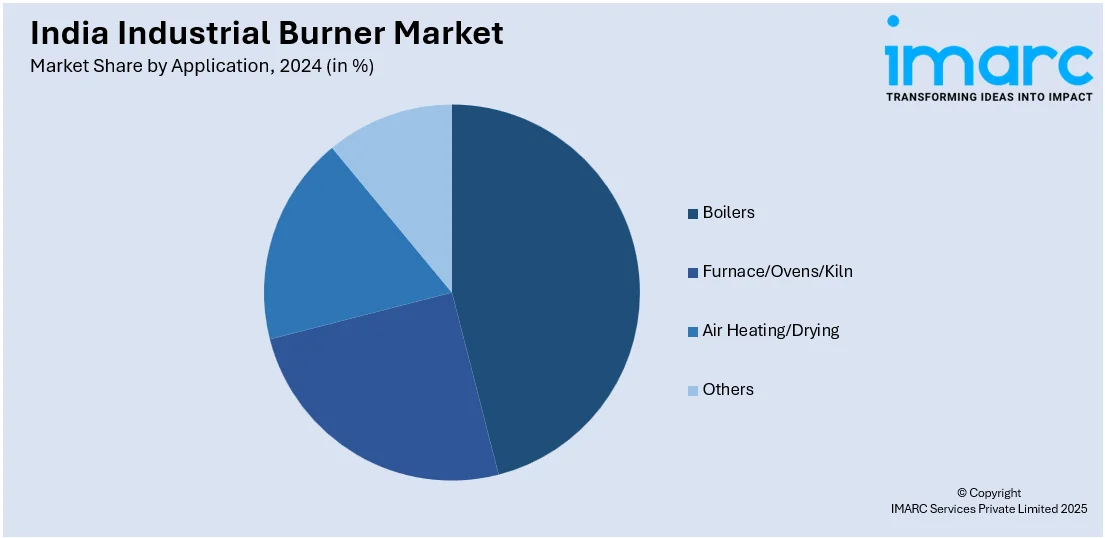

Application Insights:

- Boilers

- Furnace/Ovens/Kiln

- Air Heating/Drying

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes boilers, furnace/ovens/kiln, air heating/drying, and others.

End Use Industry Insights:

- Food and Beverages

- Power Generation

- Chemicals

- Petrochemicals

- Metals and Mining

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food and beverages, power generation, chemicals, petrochemicals, metals and mining, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Burner Market News:

- November 2024: Stove Kraft ordered a new cast iron foundry at its Harohalli plant, with an initial capacity of 2.2 million pieces per year, expandable to 4.4 million pieces. This boosting of the production of cast iron cookware escalates the need for industrial burners necessary in foundry processes. Therefore, the industrial burner market in India gains from such manufacturing capacity boosts.

- August 2024: Bühler India launched SmartLine solutions for the biscuit and cracker industry, which include the DirectBake Smart oven having a recipe-controlled burner system. This raises efficiency in food processing through optimum control of heat and fuel. The need for high-tech burner systems in industrial baking drives the elevation of India's industrial burner market, as industries increasingly embrace accurate and energy-efficient thermal solutions.

India Industrial Burner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Burner Types Covered | Regenerative Burner, High Velocity Burner, Thermal Radiation, Radiant Burner, Customized (Burner Boiler), Flat Flame Burner, Line Burner, Others |

| Fuel Types Covered | Oil-Based, Gas-Based, Dual Fuel |

| Automations Covered | Monoblock, Duoblock |

| Operating Temperatures Covered | High Temperature (>1,400°F), Low Temperature (<1,400°F) |

| Applications Covered | Boilers, Furnace/Ovens/Kiln, Air Heating/Drying, Others |

| End Use Industries Covered | Food and Beverages, Power Generation, Chemicals, Petrochemicals, Metals and Mining, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial burner market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial burner market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial burner industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial burner market in India was valued at USD 0.70 Billion in 2024.

The India industrial burner market is projected to exhibit a (CAGR) of 3.90% during 2025-2033, reaching a value of USD 1.00 Billion by 2033.

The market is fueled by swift industrialization, growing demand from manufacturing and power generation industries, and a growing interest in low-emission, energy-efficient technologies. Government initiatives encouraging the use of cleaner fuels and investments in modernizing industrial infrastructure also boost market growth, inspiring use of advanced burner systems to enhance fuel efficiency and lower operating expenses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)