India Industrial Chains Market Size, Share, Trends, and Forecast by Application, Type, and Region, 2025-2033

India Industrial Chains Market Overview:

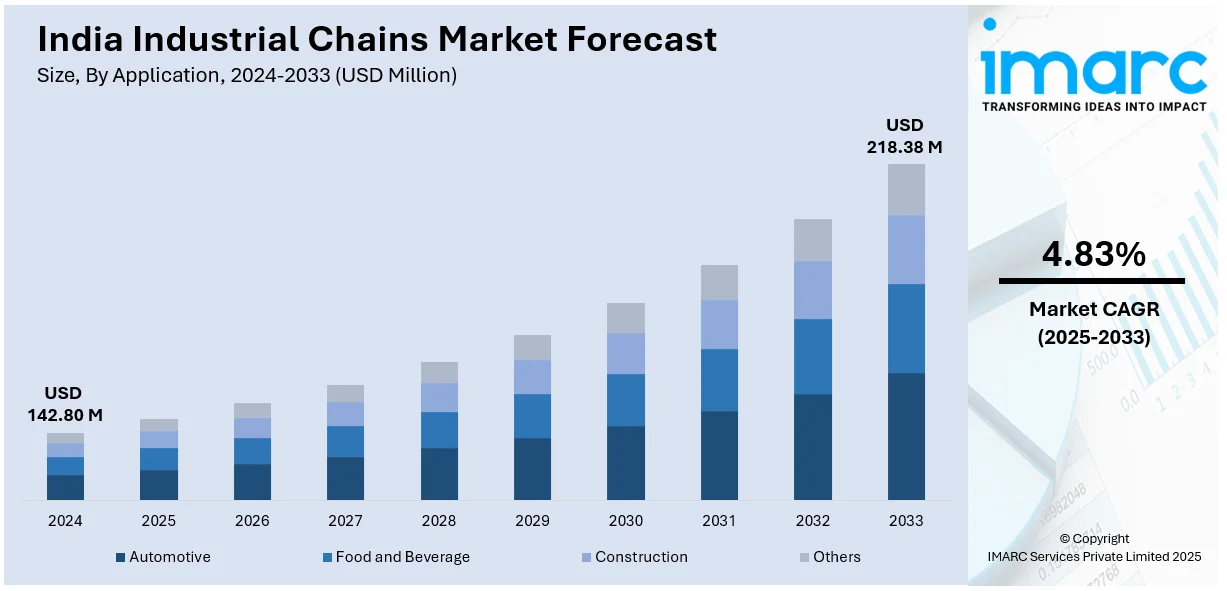

The India industrial chains market size reached USD 142.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 218.38 Million by 2033, exhibiting a growth rate (CAGR) of 4.83% during 2025-2033. The market is growing with the increasing demand from manufacturing, automotive, mining, and construction industries. Moreover, improvements in high-strength, corrosion-resistant, and automated chain systems are propelling adoption. Growing infrastructure projects and industrial automation are also driving market growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 142.80 Million |

| Market Forecast in 2033 | USD 218.38 Million |

| Market Growth Rate 2025-2033 | 4.83% |

India Industrial Chains Market Trends:

Rising Demand for High-Performance and Durable Chains

The Indian industrial chains market is experiencing growth driven by the rising demand for high-performance, wear-resistant, and long-lasting chains. This is associated with rapid industrialization and growth in industries such as automotive, manufacturing, mining, and construction. For instance, in January 2025, as per industry reports, India's infrastructure production saw a 4.6% annual growth, reflecting an upward trend in industrial expansion and development activities. As industries focusing on productivity and efficiency, there is an increased demand for precision-engineered chains that provide higher load-carrying capacity, less wear and tear, and greater resistance to harsh operating conditions. Additionally, chains used in heavy industries, including cement, steel, and mining, need to tolerate high temperatures, heavy loads, and around-the-clock operation, which increases demand for high-quality materials such as stainless steel, alloy steel, and polymer-coated chains. Moreover, producers are bringing forth self-lubricating and corrosion-resistant chains that help minimize downtime for maintenance and extend service life. Roller chains and conveyor chains with enhanced resistance against fatigue and high-speed operation is also being implemented by the automotive and logistics industries. Furthermore, as businesses demand cost-efficient and long-lasting alternatives, the production of high-level chain technologies is driving the industry, with suppliers making investments in precision machining, automation, and improved material makeups to respond to changing industry demands.

To get more information on this market, Request Sample

Expansion of Infrastructure and Heavy Industry Sectors

India’s expanding infrastructure sector is a major driver for the industrial chains market, with rising investments in construction, mining, power generation, and heavy machinery fueling the demand for durable and high-strength chains. With the government’s continued focus on mega infrastructure projects, highways, railways, and smart cities, industries are increasing their reliance on heavy-duty chains for lifting, material handling, and conveyor applications. For instance, in August 2024, the Union Cabinet announced the approval for the establishment of the Palakkad Industrial Smart City in Kerala. This project is designed to strengthen industries such as medical, chemical, and high-tech sectors, positioning Palakkad as a key industrial hub in the region. Additionally, the growing adoption of renewable energy projects, particularly in wind and solar power plants, is leading to increased demand for industrial chains used in tracking systems, maintenance, and structural components. Mining and steel industries, which are integral to India’s infrastructure development, are also driving demand for drag chains, forged link chains, and conveyor chains capable of withstanding extreme conditions. As India’s industrial and infrastructure growth accelerates, the need for specialized, high-load, and impact-resistant chains is expected to rise, prompting manufacturers to expand production capacity and introduce customized solutions for heavy industrial applications.

India Industrial Chains Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and type.

Application Insights:

- Automotive

- Food and Beverage

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, food and beverage, construction, and others.

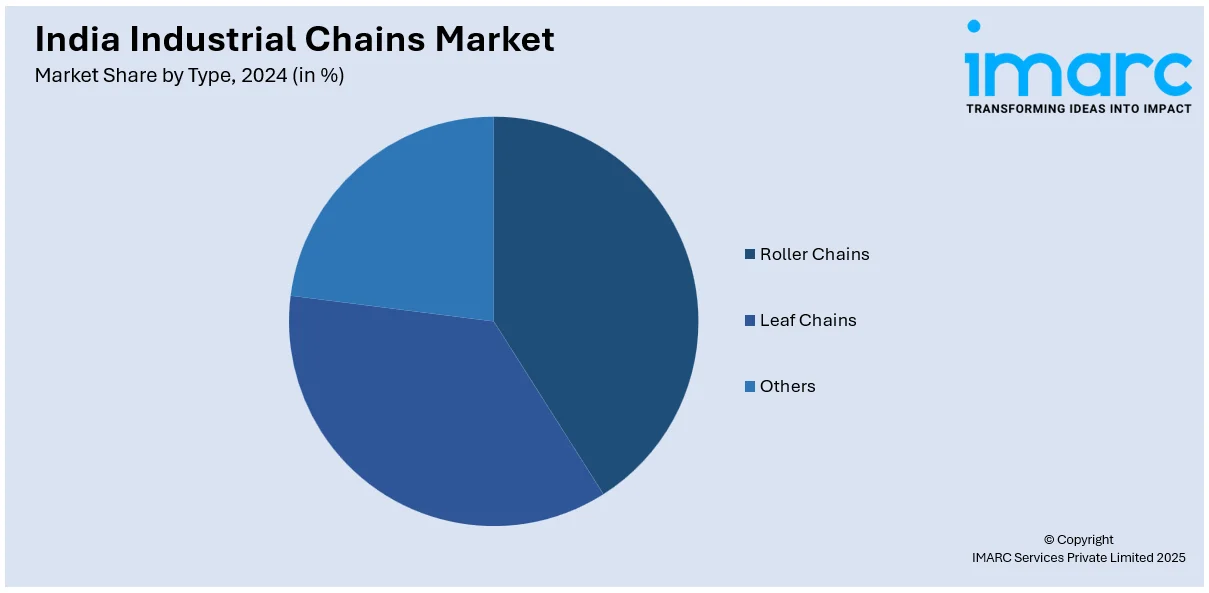

Type Insights:

- Roller Chains

- Leaf Chains

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes roller chains, leaf chains, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Chains Market News:

- In September 2023, the Ministry of Commerce and Industry announced the standards for "Precision Roller and Bush Chains, Attachments, and Associated Chain Sprockets (Quality Control) Order, 2023", which aims to ensure the quality and standardization of these products. It mandates compliance with IS 2403:2014 or ISO 606:2004 standards, requiring products to display the Bureau of Indian Standards’ Standard Mark.

India Industrial Chains Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive, Food and Beverage, Construction, Others |

| Types Covered | Roller Chains, Leaf Chains, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial chains market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial chains market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial chains industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial chains market was valued at USD 142.80 Million in 2024.

The India industrial chains market is projected to exhibit a CAGR of 4.83% during 2025-2033, reaching a value of USD 218.38 Million by 2033.

The India industrial chains market is fueled by expanding manufacturing in automotive, mining, and logistics sectors requiring durable, high-performance transmission systems. Infrastructure development, including railways and material handling equipment, increases demand. Additionally, modernization drives and automation adoption push the need for precision-engineered chains, boosting replacement and aftermarket growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)