India Industrial Couplings Market Size, Share, Trends and Forecast by Type, End User Industry, and Region, 2025-2033

India Industrial Couplings Market Overview:

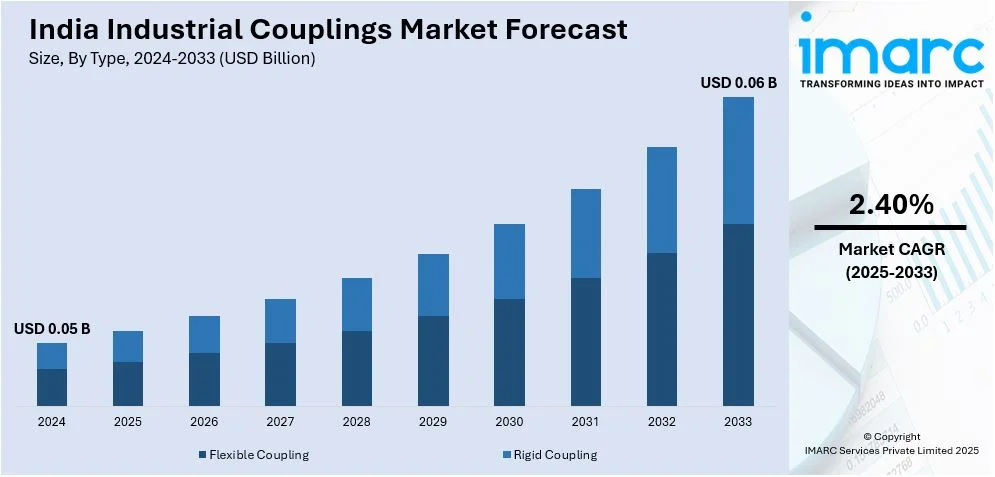

The India industrial couplings market size reached USD 0.05 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.06 Billion by 2033, exhibiting a growth rate (CAGR) of 2.40% during2025-2033. The India industrial couplings market is driven by rapid industrialization, increasing automation, and expanding infrastructure projects across sectors like power, steel, and manufacturing. Growing demand for high-performance, maintenance-free couplings, the integration of IoT-enabled predictive maintenance solutions, and a rising focus on energy-efficient machinery further accelerate market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.05 Billion |

| Market Forecast in 2033 | USD 0.06 Billion |

| Market Growth Rate 2025-2033 | 2.40% |

India Industrial Couplings Market Trends:

Rising Demand for High-Performance Couplings in Heavy Industries

The Production Linked Incentive (PLI) Scheme of the Indian government, with a budgetary outlay of ₹25,938 crores, aims to increase domestic production in the automobile and auto component industry. This is in line with the growing demand for high-performance industrial couplings, especially in heavy industries like steel, cement, and power. Increased infrastructure development projects and swift industrialization are propelling the demand for high-torque-capable couplings, misalignment, and harsh conditions. The use of materials such as carbon fiber and high-strength alloys is on the rise because they are strong and lightweight. Manufacturers are focusing on precision engineering to improve reliability and efficiency, while the use of maintenance-free, self-lubricating couplings is minimizing downtime and maximizing productivity. With industries focusing on cost-effectiveness and performance, technologically advanced couplings are becoming more critical in major industrial sectors.

To get more information on this market, Request Sample

Integration of Smart and IoT-Enabled Couplings

The adoption of intelligent technology in industrial couplings is revolutionizing the Indian market due to the development of Industry 4.0 and predictive maintenance approaches. Internet of Things (IoT) couplings with sensors are capable of detecting torque, vibration, misalignment, and wear in real-time, enabling industries to maximize equipment efficiency and avoid unplanned breakdowns. The trend is most suited for manufacturing, oil & gas, and automotive industries, where equipment uptime is essential. Sophisticated data analysis and cloud integration are increasingly strengthening predictive maintenance functions, lowering overall operating expenses. With industries adopting automation and digitalization, the need for smart couplings providing remote diagnostics and performance optimization is gathering pace in India's industrial sector.

Growing Adoption of Elastomeric and Disc Couplings for Energy Efficiency

Energy efficiency is now a major priority in India's industrial sector, pushing the rising use of elastomeric and disc couplings. These types of couplings have better damping qualities, cutting vibrations and conserving energy in rotating machinery. The move towards renewable energy sources, such as wind and hydroelectricity, has also fueled the demand for more efficient and reliable couplings. Also, industries are giving high importance to couplings with low maintenance levels in order to enhance long-term cost-effectiveness. Backlash-free and non-lubricated couplings are increasingly becoming the preference because they also ensure enhanced operating efficiency. As industries are placing increasing focus on sustainability and energy usage at an optimal cost, the market for efficient couplings will witness huge growth.

India Industrial Couplings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user industry.

Type Insights:

- Flexible Coupling

- Rigid Coupling

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible coupling, and rigid coupling.

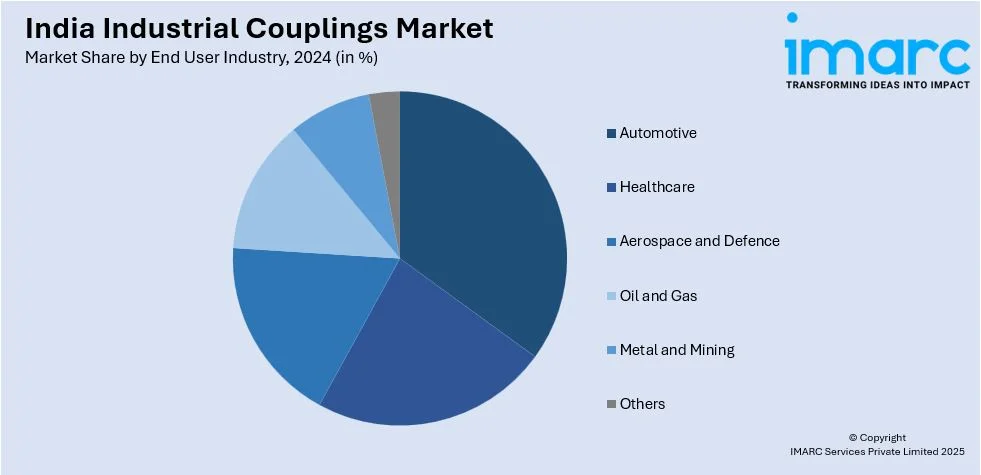

End User Industry Insights:

- Automotive

- Healthcare

- Aerospace and Defence

- Oil and Gas

- Metal and Mining

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes automotive, healthcare, aerospace and defence, oil and gas, metal and mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Couplings Market News:

- In January 2025, Mayr Power Transmission has expanded its global footprint by opening a production plant in Halol, Gujarat, India. After decades of serving the Indian market through a sales partnership, the company will now manufacture safety brakes and clutches locally. This marks a key milestone in its 125-year history, strengthening its presence in India's growing high-tech sector while ensuring safety and reliability in industrial machinery and systems.

- In April 2024, RENK Group AG, a global leader in mission-critical drive solutions, is expanding in India with a new 7,000 sqm production facility in Tamil Nadu’s Defense Industrial Corridor. Partnering with Horizon Industrial Parks, the site will manufacture gearboxes, transmissions, and couplings for military and civil applications by 2025. The project enhances RENK’s Indo-Pacific presence and strengthens global supply chains. The groundbreaking ceremony was led by RENK and Blackstone executives.

India Industrial Couplings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Coupling, and Rigid Coupling |

| End User Industries Covered | Automotive, Healthcare, Aerospace and Defence, Oil and Gas, Metal and Mining, and Others. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial couplings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial couplings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial couplings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial couplings market was valued at USD 0.05 Billion in 2024.

The India industrial couplings market is projected to exhibit a CAGR of 2.40% during 2025-2033, reaching a value of USD 0.06 Billion by 2033.

The India industrial couplings market is driven by rapid growth in manufacturing sectors like automotive, steel, and cement, alongside government-backed infrastructure and “Make in India” initiatives. Demand for reliable power transmission, precision, and reduced maintenance fosters adoption. Rising renewable energy projects and modernized machinery replace older components, enhancing market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)