India Industrial Dehumidifiers Market Size, Share, Trends and Forecast by Type, Installation, End User, and Region, 2025-2033

India Industrial Dehumidifiers Market Size and Share:

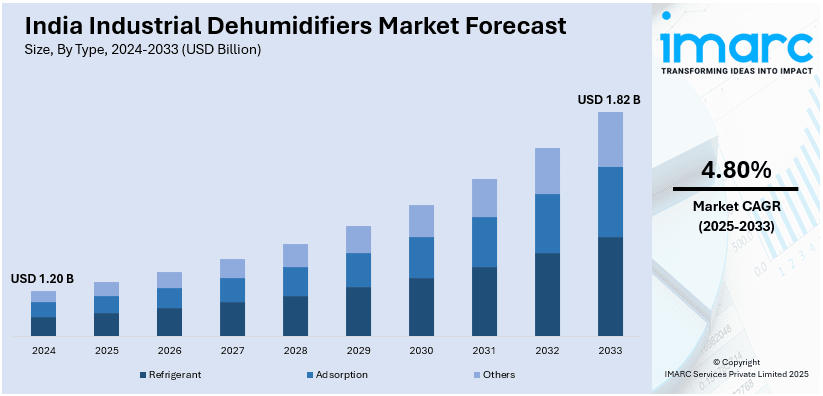

The India industrial dehumidifiers market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.82 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by the expansion of manufacturing, warehousing, and pharmaceutical sectors, alongside stringent humidity control requirements. Rising demand for energy-efficient solutions, government sustainability initiatives, and the need to protect goods from moisture damage further propel India industrial dehumidifiers market growth. Technological advancements, such as IoT-enabled devices, also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 1.82 Billion |

| Market Growth Rate (2025-2033) | 4.80% |

India Industrial Dehumidifiers Market Trends:

Growing Demand for Energy-Efficient Dehumidifiers

India industrial dehumidifiers market is experiencing a strong transition towards energy-saving solutions due to higher energy prices and environmental considerations. Industrial segments like the pharma industry, food processing industries, and electronics manufacturing industries are giving importance to dehumidifiers with newer technologies like variable speed compressors and heat exchangers, which help save energy. Government programs supporting eco-friendly approaches like the Energy Conservation Act and tax credits for green technologies are also supporting this shift. A market report by IMARC group states that the size of India's green technology and sustainability market was worth USD 837.2 Million as of 2024. It is estimated to grow to USD 9,761.1 Million by 2033, with a compound annual growth rate (CAGR) of 27.36% between 2025 and 2033. Additionally, the adoption of IoT-enabled dehumidifiers, which optimize performance and energy usage through real-time monitoring, is gaining traction. As industries aim to lower operational costs and meet regulatory standards, the demand for energy-efficient dehumidifiers is growing steadily, creating a positive India industrial dehumidifiers market outlook.

To get more information on this market, Request Sample

Expansion of Manufacturing and Warehousing Sectors

The rapid growth of India's manufacturing and warehousing sectors is pushing the demand for industrial dehumidifiers. Various initiatives, including Make in India, are strengthening local manufacturing for sectors such as automotive, textiles, and chemicals, all of which require effective and accurate humidity control to ensure product quality and operational efficiency. Moreover, moisture-related damage to products has increased the demand for dehumidifiers with the growing e-commerce and cold storage facilities. In India, the number of e-commerce users is projected to reach 501.6 million by the year 2029, with user penetration's more stable approach from 22.1% in 2024 to 34.0%. The average revenue per user (ARPU) is predicted to be INR 14,121. The Government e-Marketplace (GeM) recorded its highest-ever gross merchandise value (GMV) of USD 201.1 Billion in the last fiscal year, 2022-23. The pharmaceutical sector, in particular, is driving demand due to stringent humidity control requirements for drug manufacturing and storage. Furthermore, manufacturers are focusing on customized solutions to meet diverse industry needs which is supporting the India industrial dehumidifiers market share.

India Industrial Dehumidifiers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, installation, and end user.

Type Insights:

- Refrigerant

- Adsorption

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerant, adsorption, and others.

Installation Insights:

- Floor

- Ceiling

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes floor and ceiling.

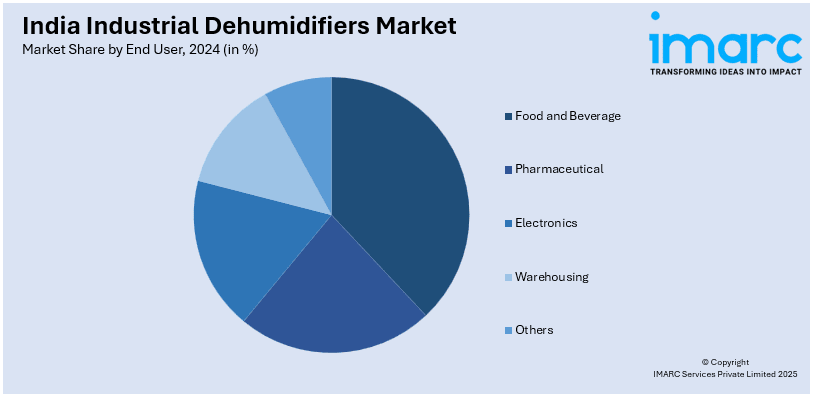

End User Insights:

- Food and Beverage

- Pharmaceutical

- Electronics

- Warehousing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food and beverage, pharmaceutical, electronics, warehousing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Dehumidifiers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerant, Adsorption, Others |

| Installations Covered | Floor, Ceiling |

| End Users Covered | Food and Beverage, Pharmaceutical, Electronics, Warehousing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial dehumidifiers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial dehumidifiers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial dehumidifiers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial dehumidifiers market in india was valued at USD 1.20 Billion in 2024.

The India industrial dehumidifiers market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 1.82 Billion by 2033.

The India industrial dehumidifiers market is driven by the expansion of manufacturing, warehousing, and pharmaceutical sectors, strict humidity control needs, rising demand for energy-efficient and IoT-enabled solutions, and government sustainability policies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)