India Industrial Drying Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, Mode of Operation, Technology, and Region, 2025-2033

India Industrial Drying Equipment Market Overview:

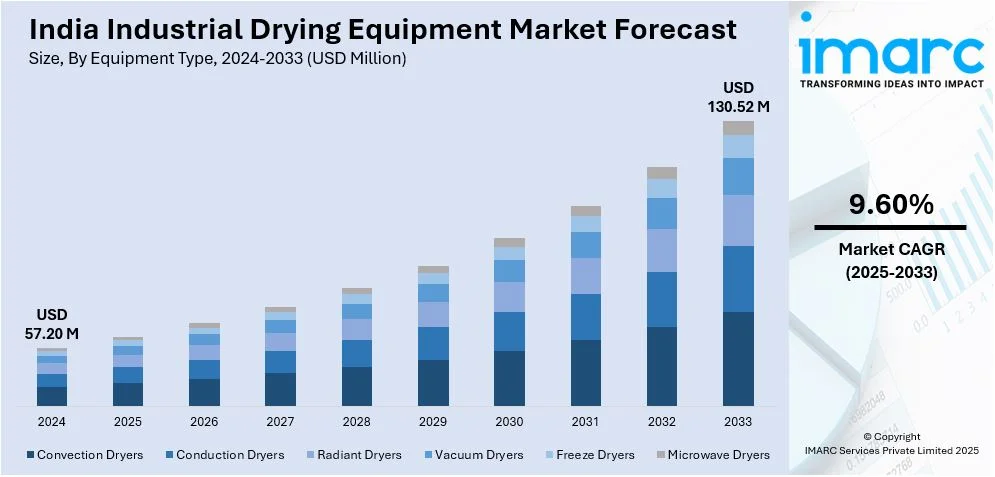

The India industrial drying equipment market size reached USD 57.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 130.52 Million by 2033, exhibiting a growth rate (CAGR) of 9.60% during 2025-2033. The market is driven by rising demand for energy-efficient solutions, spurred by high operational costs and sustainability mandates. Growth in food processing and pharmaceuticals fuels adoption of advanced drying technologies. Additionally, automation and stricter quality standards accelerate the need for high-performance drying systems across industries. Government initiatives, such as the PAT scheme and PLI incentives, are further expanding the India industrial drying equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.20 Million |

| Market Forecast in 2033 | USD 130.52 Million |

| Market Growth Rate 2025-2033 | 9.60% |

India Industrial Drying Equipment Market Trends:

Rising Demand for Energy-Efficient Drying Equipment

The market is witnessing a growing demand for energy-efficient solutions due to environmental regulations and increasing energy costs. During the fiscal year 2023–24, India's Total Primary Energy Supply increased by 7.8% to 903,158 KToE, while per capita energy consumption reached 18,410 MJ, reflecting increased industrial demand and rising energy prices. Industrial energy consumption jumped to 311,822 KToE to become the growth pace-setting end-use industry. This trend fuels the need for energy-efficient industrial drying equipment as manufacturers seek low-cost alternatives in the face of rising energy costs. Industries such as food processing, pharmaceuticals, and chemicals are adopting advanced drying technologies, including heat pump dryers, vacuum dryers, and hybrid systems, to reduce energy consumption. These systems offer lower operational costs and comply with sustainability goals, making them attractive for manufacturers. The implementation of government initiatives, such as the Perform, Achieve, and Trade (PAT) scheme, further encourage industries to adopt energy-efficient equipment by providing incentives. Additionally, the shift toward renewable energy integration in drying processes is gaining traction, with solar-assisted dryers emerging as a viable option. As industries prioritize cost savings and environmental responsibility, the demand for innovative, energy-efficient drying solutions is expected to rise significantly in the coming years.

To get more information of this market, Request Sample

Growth in Food Processing and Pharmaceutical Sectors

The expansion of India's food processing and pharmaceutical industries is propelling the India industrial drying equipment market growth. With increasing demand for processed foods, spices, and dairy products, manufacturers require advanced drying technologies to ensure product quality and shelf life. Similarly, the pharmaceutical sector relies on precise drying solutions for granulation, lyophilization, and moisture control in drug manufacturing. Spray dryers, freeze dryers, and fluidized bed dryers are gaining popularity due to their efficiency and compliance with stringent industry standards. Government support through schemes such as the Production Linked Incentive (PLI) for food processing and the promotion of 'Make in India' for pharmaceuticals further favors market growth. India's pharmaceutical industry is set to grow to USD 130 Billion by 2030 and USD 450 Billion by 2047 with the help of more than 10,500 production units and USD 23 Billion of foreign direct investment since 2000. Initiatives by the government, such as the Rs. 15,000 Crores (approximately USD 1.77 Billion) Production-Linked Incentive scheme and allocation of Rs. 5,268.72 crores (approximately USD 6.23 Billion) in the budget, are helping in increasing local production and export strength. This expansion is generating a serious need for advanced industrial drying apparatus, which is crucial for growth in energy-saving and GMP-compliant pharmaceutical production. As these sectors continue to expand, the need for high-performance, hygienic, and automated drying equipment will rise, creating significant opportunities for market players.

India Industrial Drying Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, application, mode of operation, and technology.

Equipment Type Insights:

- Convection Dryers

- Conduction Dryers

- Radiant Dryers

- Vacuum Dryers

- Freeze Dryers

- Microwave Dryers

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes convection dryers, conduction dryers, radiant dryers, vacuum dryers, freeze dryers, and microwave dryers.

Application Insights:

.webp)

- Food Processing

- Chemical Manufacturing

- Pharmaceuticals

- Pulp and Paper

- Textile Industry

- Biotechnology

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food processing, chemical manufacturing, pharmaceuticals, pulp and paper, textile industry, and biotechnology.

Mode of Operation Insights:

- Continuous Drying

- Batch Drying

- Intermittent Drying

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes continuous drying, batch drying, and intermittent drying.

Technology Insights:

- Direct Heating Technology

- Indirect Heating Technology

- Hybrid Drying Technology

- Vacuum Drying Technology

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes direct heating technology, indirect heating technology, hybrid drying technology, and vacuum drying technology.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Drying Equipment Market News:

- March 18, 2025: Atlas Copco officially commissioned a 270,000-square-foot Talegaon plant in Pune that specializes in producing air and gas compressors, air dryers, and gas generators, further enhancing support to the growing Indian industrial base. Supported by 80% of its energy being derived from a 1.3 MW solar installation, this plant promotes sustainable manufacturing principles while possessing the ISO 50001 certification. This advance is a major leap ahead in India's industrial dryer equipment industry, meeting the growing demand for energy-saving technology.

- December 16, 2024: Simpher Group launched its advanced Infrared Dryer in India, offering fast, energy-saving, and uniform drying solutions to key industries, including food, textiles, printing, and pharmaceuticals. With precise temperature control and compact design, this system cuts energy costs. It improves production capacity substantially, responding to the growing needs of India's USD 130 Billion pharma and growing food processing sectors. This breakthrough makes Simpher a strong player in India's fast-growing industrial drying equipment industry.

India Industrial Drying Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Convection Dryers, Conduction Dryers, Radiant Dryers, Vacuum Dryers, Freeze Dryers, Microwave Dryers |

| Applications Covered | Food Processing, Chemical Manufacturing, Pharmaceuticals, Pulp and Paper, Textile Industry, Biotechnology |

| Mode of Operations Covered | Continuous Drying, Batch Drying, Intermittent Drying |

| Technologies Covered | Direct Heating Technology, Indirect Heating Technology, Hybrid Drying Technology, Vacuum Drying Technology |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial drying equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial drying equipment market on the basis of equipment type?

- What is the breakup of the India industrial drying equipment market on the basis of application?

- What is the breakup of the India industrial drying equipment market on the basis of mode of operation?

- What is the breakup of the India industrial drying equipment market on the basis of technology?

- What is the breakup of the India industrial drying equipment market on the basis of region?

- What are the various stages in the value chain of the India industrial drying equipment market?

- What are the key driving factors and challenges in the India industrial drying equipment market?

- What is the structure of the India industrial drying equipment market and who are the key players?

- What is the degree of competition in the India industrial drying equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial drying equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial drying equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial drying equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)