India Industrial Filtration Market Size, Share, Trends and Forecast by Type, Product, Filter Media, Application, and Region, 2025-2033

Market Overview:

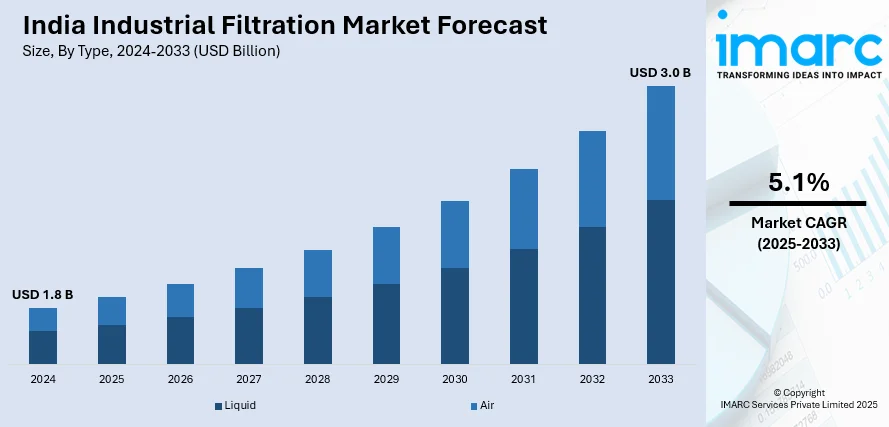

India industrial filtration market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033. The ongoing advancements in filtration technologies, such as membrane filtration, nanotechnology, and IoT integration, which escalate the adoption of more efficient and innovative filtration solutions, making processes more effective and cost-efficient, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate (2025-2033) | 5.1% |

Industrial filtration is a crucial process employed in various industries to remove impurities and contaminants from liquids and gases. This method ensures the quality and purity of the final product, safeguards equipment, and complies with environmental regulations. Employed in sectors such as manufacturing, pharmaceuticals, chemicals, and food and beverage, industrial filtration utilizes diverse technologies like mechanical, chemical, and biological filtration. Common filtration mediums include filter media, membranes, and porous materials. The process involves passing the substance through these mediums, trapping particles and pollutants, resulting in a clarified and purified end product. Efficient industrial filtration enhances production efficiency, extends the lifespan of equipment, and promotes a healthier and safer working environment by minimizing harmful emissions and waste.

To get more information of this market, Request Sample

India Industrial Filtration Market Trends:

The industrial filtration market is experiencing robust growth due to several key drivers. Firstly, heightened awareness regarding environmental sustainability has prompted industries to adopt advanced filtration technologies, driving market expansion. Additionally, stringent government regulations mandating the reduction of emissions and adherence to clean air and water standards have propelled the demand for efficient filtration solutions. Furthermore, the escalating focus on worker health and safety in industrial settings has led to an increased adoption of filtration systems to mitigate exposure to harmful particulates and contaminants. Moreover, the rapid industrialization and urbanization globally have surged the demand for clean water and air, fostering the deployment of filtration solutions in various industrial sectors. Notably, advancements in filtration technologies, such as the development of high-performance filter media and innovative filtration systems, have augmented market growth by offering enhanced efficiency and cost-effectiveness. Furthermore, the rising prevalence of chronic respiratory diseases has accentuated the need for improved air quality, thereby driving the demand for industrial filtration systems in diverse applications. In summary, the industrial filtration market is thriving due to a confluence of factors, including environmental concerns, regulatory imperatives, advancements in technology, and a growing emphasis on health and safety standards in industrial operations.

India Industrial Filtration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, filter media, and application.

Type Insights:

- Liquid

- Air

The report has provided a detailed breakup and analysis of the market based on the type. This Includes liquid and air.

Product Insights:

- Bag Filter

- Cartridge Filter

- Depth Filter

- Filter Press

- Drum Filter

- Electrostatic Precipitator

- ULPA (Ultra-Low Penetration Air)

- HEPA (High Efficiency Particulate Air)

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes bag filter, cartridge filter, depth filter, filter press, drum filter, electrostatic precipitator, ULPA (ultra-low penetration air), HEPA (high efficiency particulate air), and others.

Filter Media Insights:

- Filter Paper

- Metal

- Activated Carbon/Charcoal

- Fiberglass

- Non-Woven Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the filter media. This includes filter paper, metal, activated carbon/charcoal, fiberglass, non-woven fabric, and others.

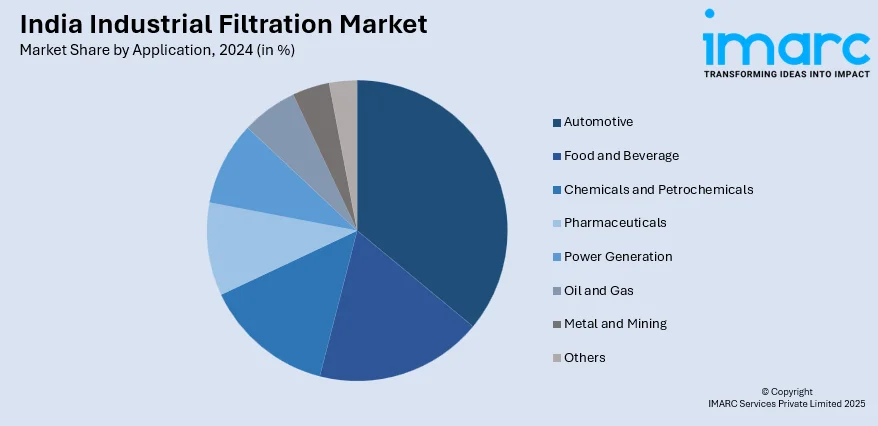

Application Insights:

- Automotive

- Food and Beverage

- Chemicals and Petrochemicals

- Pharmaceuticals

- Power Generation

- Oil and Gas

- Metal and Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, food and beverage, chemicals and petrochemicals, pharmaceuticals, power generation, oil and gas, metal and mining, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid, Air |

| Products Covered | Bag Filter, Cartridge Filter, Depth Filter, Filter Press, Drum Filter, Electrostatic Precipitator, ULPA (Ultra-Low Penetration Air), HEPA (High Efficiency Particulate Air), Others |

| Filter Medias Covered | Filter Paper, Metal, Activated Carbon/Charcoal, Fiberglass, Non-Woven Fabric, Others |

| Applications Covered | Automotive, Food and Beverage, Chemicals and Petrochemicals, Pharmaceuticals, Power Generation, Oil and Gas, Metal and Mining, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial filtration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial filtration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial filtration market size reached USD 1.8 Billion in 2024.

The India industrial filtration market is expected to grow at a CAGR of 5.1%, reaching USD 3.0 Billion by 2033.

The India industrial filtration market growth is driven by advancements in filtration technologies (membrane filtration, nanotech, IoT integration), rising environmental regulations, increased industrialization, and a focus on worker health and safety.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)