India Industrial Gas Cylinders Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033

India Industrial Gas Cylinders Market Size and Share:

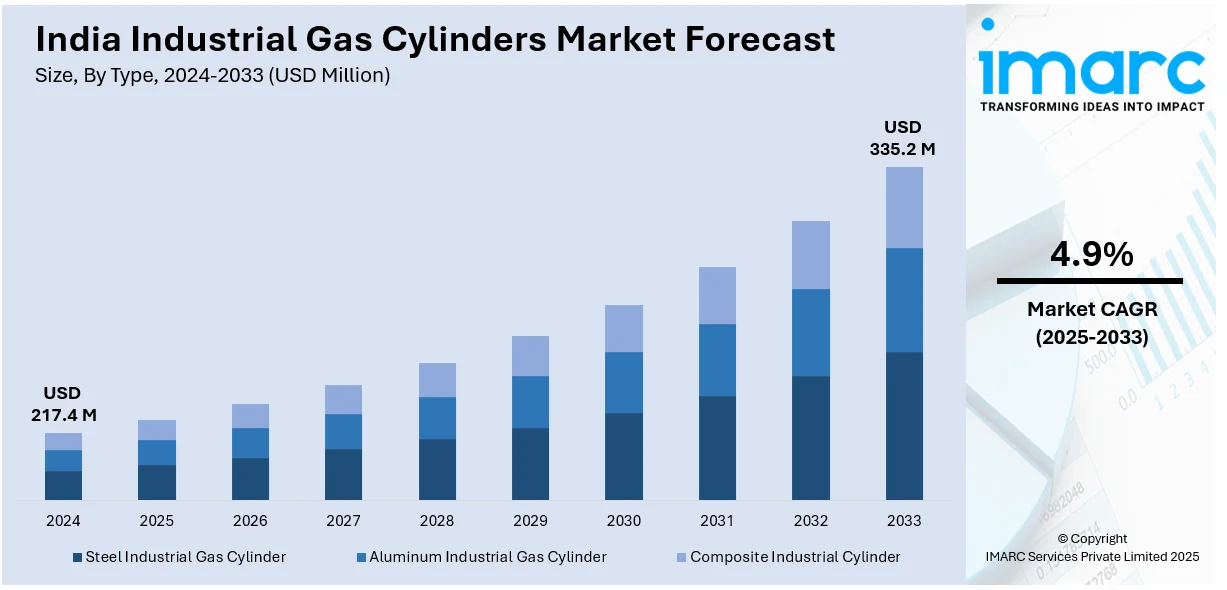

The India industrial gas cylinders market size reached USD 217.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 335.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The market is growing due to the rising demand from sectors, such as healthcare, manufacturing, chemicals, and energy. Additionally, increasing industrialization, government initiatives promoting clean energy, and stricter safety regulations are driving the product adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.4 Million |

| Market Forecast in 2033 | USD 335.2 Million |

| Market Growth Rate (2025-2033) | 4.9% |

India Industrial Gas Cylinders Market Trends:

Expanding Industrial and Manufacturing Applications

An increased output of India's manufacturing industry is directly driving industrial gas cylinder demand, as these gases are all critical to use in welding, cutting, and heat treatment procedures. The steel mill, automotive, metal fabrication, and shipbuilding industries are among those that utilize industrial gas cylinders for accurate manufacturing and assembly processes. Moreover, the petrochemical and chemical industries depend on high-pressure gas cylinders for the safe storage and processing of reactive and inert gases. As India places emphasis on industrial growth under schemes such as 'Make in India' and growing foreign direct investments in manufacturing, demand for effective gas transport and storage solutions is increasing. For instance, as of August 2024, foreign direct investment (FDI) in India's manufacturing sector increased by 69%, reaching US$165.1 billion between 2014 and 2024, compared to the previous decade. Moreover, to cater to these needs, manufacturers are producing durable, high-capacity cylinders that meet industry standards for safety and reliability. The shift toward automation and advanced manufacturing processes is also driving the adoption of smart gas cylinders with digital monitoring capabilities for pressure and gas levels. Furthermore, as industries continue to scale up, the need for efficient and compliant gas cylinder solutions is expected to witness substantial growth.

To get more information of this market, Request Sample

Advancements in Lightweight and Sustainable Cylinder Technology

The Indian industrial gas cylinders market is witnessing a shift toward lightweight and sustainable cylinder technologies, driven by the need for improved safety, efficiency, and environmental responsibility. Traditional steel cylinders, while durable, are being gradually replaced by composite and aluminum cylinders, which offer the same strength while significantly reducing weight. This transition is particularly beneficial in sectors like healthcare, logistics, and energy, where portability and ease of handling are essential. Additionally, industries are adopting advanced cylinder coatings and anti-corrosion materials to enhance longevity and reduce maintenance costs. Sustainability is also becoming a key focus, with manufacturers developing cylinders compatible with eco-friendly gases such as hydrogen and biofuels. The increasing adoption of hydrogen as an alternative energy source is pushing demand for high-pressure cylinders designed for hydrogen storage and transport. With stricter environmental regulations and a push toward green energy solutions, the market for lightweight and sustainable industrial gas cylinders is poised for significant expansion, aligning with India’s long-term energy and industrial growth objectives. For instance, in March 2024, the Department for Promotion of Industry and Internal Trade (DPIIT) announced amendments to the Gas Cylinder Rules to support the green hydrogen ecosystem. These draft rules aim to establish guidelines for hydrogen storage and transportation, reinforcing India's commitment to clean energy.

India Industrial Gas Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Steel Industrial Gas Cylinder

- Aluminum Industrial Gas Cylinder

- Composite Industrial Cylinder

The report has provided a detailed breakup and analysis of the market based on the type. This includes steel industrial gas cylinder, aluminum industrial gas cylinder, and composite industrial cylinder.

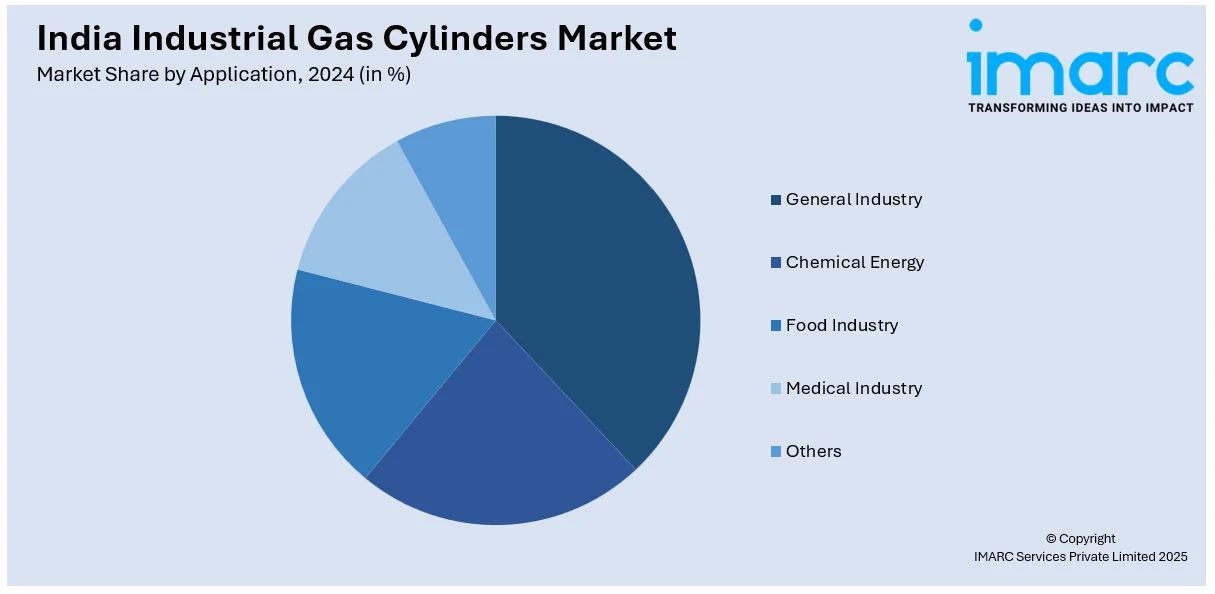

Application Insights:

- General Industry

- Chemical Energy

- Food Industry

- Medical Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general industry, chemical energy, food industry, medical industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Gas Cylinders Market News:

- In February 2024, Confidence Petroleum India Limited announced its arrival into the green hydrogen sector by producing Type-4 hydrogen cylinders through its subsidiary, Silversky Exim Pvt. Ltd. These lightweight, corrosion-resistant cylinders can transport three times the gas of traditional metal cylinders.

India Industrial Gas Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steel Industrial Gas Cylinder, Aluminum Industrial Gas Cylinder, Composite Industrial Cylinder |

| Applications Covered | General Industry, Chemical Energy, Food Industry, Medical Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial gas cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial gas cylinders market on the basis of type?

- What is the breakup of the India industrial gas cylinders market on the basis of application?

- What is the breakup of the India industrial gas cylinders market on the basis of region?

- What are the various stages in the value chain of the India industrial gas cylinders market?

- What are the key driving factors and challenges in the India industrial gas cylinders market?

- What is the structure of the India industrial gas cylinders market and who are the key players?

- What is the degree of competition in the India industrial gas cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial gas cylinders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial gas cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial gas cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)