India Industrial Gases Market Size, Share, Trends and Forecast by Type, Application, Supply Mode, and Region, 2026-2034

India Industrial Gases Market Summary:

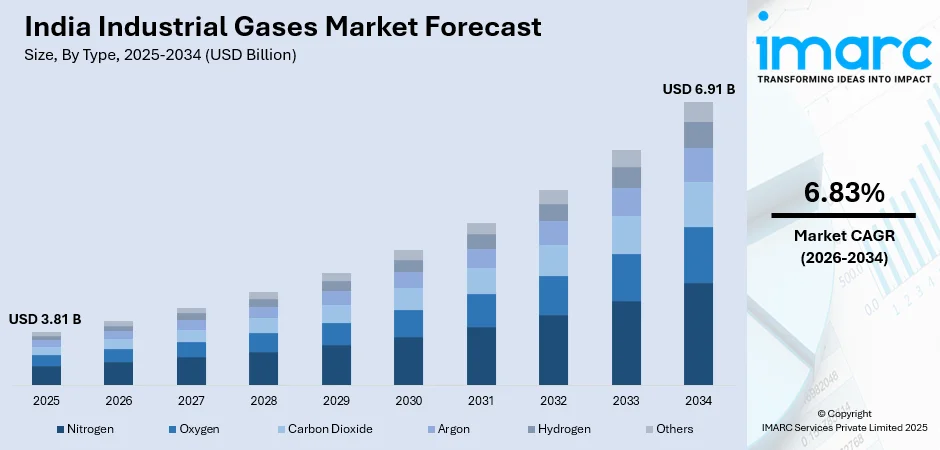

The India industrial gases market size was valued at USD 3.81 Billion in 2025 and is projected to reach USD 6.91 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034.

The market is driven by rapid industrialization across steel, refining, and chemical sectors, alongside increasing infrastructure development and government initiatives promoting local manufacturing. Growing demand for clean energy solutions and decarbonization technologies further stimulates consumption of gases such as oxygen, nitrogen, and hydrogen across diverse applications. With modernization of industries and emphasis on production localization, high-performance gas solutions remain in greater demand, driving the overall India industrial gases market share.

Key Takeaways and Insights:

-

By Type: Nitrogen dominates the market with a share of 28.24% in 2025, driven by applications in chemicals, pharmaceuticals, food processing, and electronics, where its inert properties enable controlled atmospheres, prevention, and blanketing and purging operations.

-

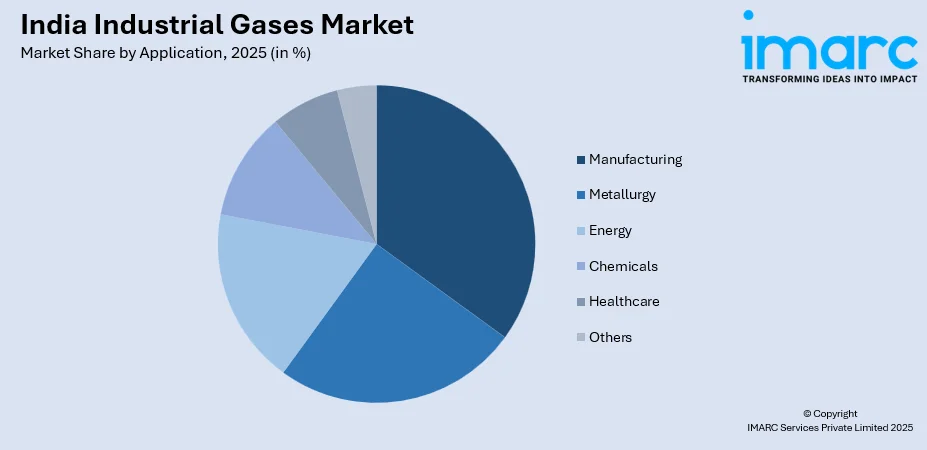

By Application: Manufacturing leads the market with a share of 27.05% in 2025, owing to extensive use in metal cutting, welding, and steelmaking, alongside rising demand from automotive, textiles, and food processing industries nationwide segments.

-

By Supply Mode: Packaged represents the largest segment with a market share of 34% in 2025, driven by small and medium enterprises for convenience, transport ease, and flexibility, serving decentralized operations needing moderate volumes without costly on-site infrastructure investments.

-

By Region: North India leads the market with a share of 32% in 2025, owing to major industrial hubs, steel plants, chemical units in Uttar Pradesh, Delhi NCR, and Haryana, alongside infrastructure expansion and government-backed industrial corridors.

-

Key Players: The India industrial gases market is moderately competitive, with multinationals and regional players competing across price segments, emphasizing partnerships, capacity expansion, and technological innovation to meet evolving industrial demand nationwide.

To get more information on this market Request Sample

India industrial gases market is experiencing robust growth driven by large-scale manufacturing expansion across steel, chemicals, refining, and energy transition sectors. The country's accelerated steel capacity additions and ongoing plant upgrades continue to be significant contributors to rising gas demand, particularly for oxygen and argon. The expanding pharmaceutical and healthcare sectors continuously push demand for medical and specialty gases, with surgical operations, intensive care units, and pharmaceutical manufacturing processes requiring medical oxygen, nitrous oxide, and nitrogen. The nationwide upgradation of healthcare centers has led to increased adoption of on-site oxygen production plants and cryogenic storage facilities. Additionally, India's shift toward clean energy and decarbonization is propelling industrial gas demand, with increased investments in green hydrogen infrastructure, renewable energy, and sustainable manufacturing practices supporting long-term market growth. According to sources, India approved the National Green Hydrogen Mission with ₹19,744 Crore outlay, targeting 5 MMT annual green hydrogen capacity, 125 GW renewables, and large-scale industrial decarbonisation.

India Industrial Gases Market Trends:

Green Hydrogen Infrastructure Development

India is witnessing significant investments in green hydrogen production infrastructure as part of its decarbonization strategy. The development of green hydrogen facilities across refineries and industrial clusters signals a strategic shift toward substituting fossil-derived gases with cleaner alternatives. According to sources, Indian Oil Corporation confirmed it dropped plans for a Mathura green hydrogen unit, instead setting up a 7 KTA green hydrogen plant at Panipat refinery. Moreover, these initiatives are supported by government policies promoting sustainable energy solutions and net-zero emission targets. Industrial gas companies are actively taking steps to form a hydrogen supply chain, electrolysis capacity, and distribution network for the regions because of the demand for a cleaner-burning fuel source from energy-intensive sectors.

Expansion of On-Site Gas Generation Systems

Industries across India are increasingly adopting on-site gas generation systems to ensure supply reliability and reduce transportation expenses. The development of advanced air separation technologies, pressure swing adsorption systems, and cryogenic storage solutions is enabling companies to produce gases locally with enhanced efficiency. In January 2025, INOX Air Products commissioned its largest-ever air separation unit at SAIL’s Bokaro plant, producing 2,150 tonnes per day (TPD) oxygen, 1,200 TPD nitrogen, and 100 TPD argon. Further, this trend is particularly prominent in steel manufacturing, chemical processing, and pharmaceutical sectors where continuous gas supply is critical. The integration of digital technologies in gas monitoring and control systems is improving operational efficiency and safety, with smart sensors and automation playing key roles in optimizing production processes.

Healthcare Infrastructure Modernization

The expansion of healthcare infrastructure across India is driving increased demand for medical gases, particularly oxygen and nitrous oxide. Government healthcare initiatives are amplifying coverage of medical services, sustaining continuous oxygen demand across tertiary hospitals, district hospitals, and emergency care units. As per sources, in March 2025, the Union Health Ministry launched the National Capacity Building Programme on Oxygen Management at AIIMS Delhi, training 200 master trainers to strengthen medical oxygen infrastructure nationwide. Moreover, the pharmaceutical industry depends significantly on high-purity gases for synthesis, chromatography, lyophilization, and packaging applications. Biotechnology laboratories, vaccine production units, and diagnostic centers require constant gas flow for cell culture preservation and analytical work, contributing to sustained market growth.

Market Outlook 2026-2034:

The India industrial gases market is expected to record notable revenue growth during the forecast period, driven by rising demand from manufacturing, healthcare, and electronics sectors. Technological advancements such as improved cryogenic systems and pressure swing adsorption are enhancing production efficiency and supply reliability. Market diversification through tailored solutions for large industries and specialized pharmaceutical and electronics applications is increasing adoption. Growing emphasis on sustainability, energy efficiency, and environmentally responsible gas technologies is anticipated to further support long-term market expansion. The market generated a revenue of USD 3.81 Billion in 2025 and is projected to reach a revenue of USD 6.91 Billion by 2034, growing at a compound annual growth rate of 6.83% from 2026-2034.

India Industrial Gases Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Nitrogen | 28.24% |

| Application | Manufacturing | 27.05% |

| Supply Mode | Packaged | 34% |

| Region | North India | 32% |

Type Insights:

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Others

Nitrogen dominates with a market share of 28.24% of the total India industrial gases market in 2025.

Nitrogen maintains a leading position in the India industrial gases market, attributed to its multifaceted applications across diverse industrial sectors. The inert properties of nitrogen make it indispensable for creating controlled atmospheres, preventing oxidation, and supporting blanketing and purging operations in chemical and pharmaceutical manufacturing. The food and beverage industry extensively utilizes nitrogen for product preservation, packaging, and extending shelf life of perishable goods. Electronics manufacturers rely on high-purity nitrogen for semiconductor fabrication and component assembly processes. According to sources, in November 2025, INOX Air Products partnered with Grew Energy to supply ultra-high-purity nitrogen via a dedicated pipeline for its 3 GW solar PV cell facility in Narmadapuram, Madhya Pradesh.

The steel industry employs nitrogen for laser cutting operations and metal protection against corrosion during manufacturing processes. Pharmaceutical companies require nitrogen for manufacturing sterile products due to its inertness, particularly for drugs highly sensitive to oxygen. The petrochemical sector utilizes nitrogen extensively for purging equipment, pipelines, and storage tanks to maintain inert environments and prevent hazardous situations. Growing investments in on-site nitrogen generation systems across industrial facilities further strengthen this segment's market position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Metallurgy

- Energy

- Chemicals

- Healthcare

- Others

Manufacturing leads with a share of 27.05% of the total India industrial gases market in 2025.

The manufacturing represents the dominant application segment in the India industrial gases market, driven by extensive usage across metal production, automotive, and industrial fabrication processes. Oxygen, nitrogen, and hydrogen are crucial for cutting, welding, and steelmaking operations that form the backbone of manufacturing activities. The expansion of integrated steel facilities and the gradual shift toward electric arc furnace-based production require stable, high-volume oxygen and argon flows for optimal process efficiency.

India's 'Make in India' initiative has accelerated local manufacturing growth, increasing demand for industrial gases across production facilities nationwide. The automotive sector utilizes nitrogen for brazing components and argon for welding applications to protect molten metal from atmospheric contamination. Specialty gases contribute to product innovation, enhancing safety features and manufacturing precision in modern production environments. The growing emphasis on infrastructure development, urbanization, and energy projects continues to drive gas usage across manufacturing industries.

Supply Mode Insights:

- Packaged

- Bulk

- On-Site

Packaged exhibits a clear dominance with a 34% share of the total India industrial gases market in 2025.

The packaged dominates the supply mode category in the India industrial gases market due to its convenience, flexibility, and strong suitability for small and medium enterprises operating across decentralized locations. Packaged gases enable industries to access required volumes without incurring high capital expenditure associated with on-site gas generation systems. This segment is supported by well-established distribution networks, standardized cylinders, and efficient logistics, allowing reliable supply even to remote industrial clusters and emerging manufacturing hubs across the country. In September 2025, Linde India commenced commercial production at its new Unnao, Lucknow facility, enhancing regional storage, handling, and distribution of industrial and medical gases across North India.

Industries with intermittent or variable gas requirements strongly prefer packaged delivery modes because of their cost efficiency and operational adaptability. The segment serves a wide range of end users, including workshops, laboratories, healthcare facilities, and small manufacturing units that require precise gas quantities. Continuous improvements in cylinder design, safety mechanisms, and distribution efficiency further enhance reliability, reinforcing the packaged segment’s strong market presence across industrial and commercial applications in India.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 32% of the total India industrial gases market in 2025.

North India leads the regional market landscape due to the strong concentration of major industrial hubs, steel manufacturing facilities, and chemical processing units across Uttar Pradesh, Delhi NCR, Haryana, and Punjab. The region benefits from sustained government investments in industrial corridors, large-scale infrastructure projects, and special economic zones that stimulate industrial expansion. Initiatives, such as the Delhi–Mumbai Industrial Corridor continue to attract domestic and foreign manufacturing investments, strengthening demand for industrial gases across multiple sectors.

The expanding healthcare infrastructure in the metropolitan centers and tier-two cities are significantly driving demand for medical gases, while pharmaceutical manufacturing clusters rely on high-purity gases for critical production processes. Additionally, North India’s well-established automotive, engineering, and fabrication industries contribute substantially to gas consumption for welding, cutting, and heat treatment applications. Rapid urbanization, rising construction activity, and ongoing industrial development collectively support steady market growth across the northern industrial belt.

Market Dynamics:

Growth Drivers:

Why is the India Industrial Gases Market Growing?

Expanding Steel and Heavy Manufacturing Industries

India's accelerated steel capacity additions and ongoing plant upgrades represent significant contributors to rising industrial gas demand. The expansion of integrated steel facilities and the gradual shift toward electric arc furnace-based production require stable, high-volume oxygen and argon flows for optimal metallurgical processes. As per sources, in October 2025, Air Water India acquired a large-scale gas plant at Tata Steel’s Jamshedpur facility and signed a 20-year operation contract to supply oxygen, nitrogen, and argon. Moreover, steel mills utilize oxygen and argon for cutting, refining, and achieving desired material properties during production. The heavy manufacturing sector, including automotive, cement, and machinery production, relies extensively on industrial gases for welding, heat treatment, and fabrication processes. Government initiatives promoting local manufacturing and infrastructure development continue to stimulate demand across these core industrial sectors.

Growing Healthcare and Pharmaceutical Sector

India's developing pharmaceutical and healthcare sectors continuously push demand for medical and industrial gases. Surgical operations, intensive care units, sterilization processes, and pharmaceutical manufacturing require medical oxygen, nitrous oxide, and nitrogen in substantial quantities. The nationwide upgradation of healthcare centers across rural and semi-urban areas has led to increased adoption of on-site oxygen production plants and cryogenic storage facilities. The pharmaceutical industry depends significantly on high-purity gases for synthesis, chromatography, lyophilization, and packaging where precision and contamination control are paramount. Biotechnology laboratories, vaccine production units, and diagnostic centers require constant gas flow for cell culture preservation and analytical applications, sustaining market growth.

Clean Energy Transition and Decarbonization Initiatives

India's commitment to clean energy and decarbonization is propelling industrial gas demand, with increased investments in green hydrogen infrastructure, renewable energy installations, and sustainable manufacturing practices. As per sources, in November 2025, JSW Energy commissioned India’s largest green hydrogen plant at Vijayanagar, Karnataka, supplying green hydrogen and oxygen under the SIGHT program to support low-carbon steel production. Furthermore. the development of green hydrogen facilities across refineries and industrial clusters signals a strategic shift toward cleaner fuel alternatives. Industrial gas producers are actively establishing hydrogen supply chains and electrolysis capabilities to meet anticipated demand from energy-intensive industries. Stricter environmental regulations encourage industries to transition from conventional fuel systems to gas-based alternatives, positioning industrial gases as key enablers of India's long-term energy and climate policies. Investments in carbon capture technologies and sustainable production methods further support market expansion.

Market Restraints:

What Challenges the India Industrial Gases Market is Facing?

High Capital Investment Requirements

The industrial gases sector requires substantial capital investment for establishing air separation units, cryogenic storage facilities, and distribution infrastructure. High upfront costs associated with advanced production technologies and specialized equipment create barriers for new market entrants and expansion projects. The capital-intensive nature of gas production facilities, combined with extended payback periods, challenges industry participants seeking to expand production capacities.

Raw Material Price Volatility

Fluctuations in energy costs and raw material prices significantly affect profitability in the industrial gases sector. The production of industrial gases, particularly through energy-intensive processes like cryogenic distillation, is susceptible to electricity price variations. Rising operational costs impact production economics and pricing strategies, creating challenges for market participants in maintaining competitive positioning while ensuring sustainable margins.

Distribution and Logistics Challenges

India's vast geographical expanse and varying infrastructure quality across regions present distribution challenges for industrial gas suppliers. Transporting compressed and liquefied gases to remote industrial locations requires specialized logistics capabilities and safety compliance. Inadequate road infrastructure in certain regions increases transportation costs and delivery times, affecting supply reliability for customers located away from major production centers.

Competitive Landscape:

The India industrial gases market exhibits a moderately consolidated competitive structure characterized by the presence of both multinational corporations and regional manufacturers competing across price segments and application areas. Market participants focus on strategic partnerships, long-term supply agreements, and capacity expansions to strengthen their positioning. The development of on-site gas generation facilities at customer locations represents a key competitive strategy, ensuring supply reliability and building long-term customer relationships. Players are investing in research and development to create new gas mixtures, enhance production efficiency, and develop sustainable solutions aligned with evolving environmental requirements. The integration of digital technologies in gas monitoring and control systems differentiates market participants through improved operational efficiency and customer service capabilities.

Recent Developments:

-

In May 2025, Pune Gas inaugurated Kerala’s first LPG & Natural Gas Experience Centre in Kochi, its sixth facility in India. The centre aims to support commercial and industrial users, improve gas flow, reduce waste, and promote cleaner, more efficient energy solutions across Kerala’s hospitality, food service, and industrial sectors.

-

In October 2024, Linde India commissioned a new 250 metric tonnes per day air separation unit (ASU) in Ludhiana, Punjab, marking its second merchant plant in northern India. The facility boosts supply of oxygen, nitrogen, and argon to healthcare, manufacturing, metals, and industrial sectors, supporting regional self-reliance and growth across multiple industries.

India Industrial Gases Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen, Oxygen, Carbon Dioxide, Argon, Hydrogen, Others |

| Applications Covered | Manufacturing, Metallurgy, Energy, Chemicals, Healthcare, Others |

| Supply Modes Covered | Packaged, Bulk, On-Site |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India industrial gases market size was valued at USD 3.81 Billion in 2025.

The India industrial gases market is expected to grow at a compound annual growth rate of 6.83% from 2026-2034 to reach USD 6.91 Billion by 2034.

Nitrogen held the largest share in the India industrial gases market, driven by its extensive use across chemicals, pharmaceuticals, food processing, electronics, and metal fabrication industries, supported by its inert properties and cost-effective, versatile industrial applications.

Nitrogen held the largest share in the India industrial gases market, driven by its extensive use across chemicals, pharmaceuticals, food processing, electronics, and metal fabrication industries, supported by its inert properties and cost-effective, versatile industrial applications.

Major challenges include high capital investment requirements for production infrastructure, raw material and energy price volatility, distribution logistics complexities across diverse geographies, stringent safety regulations, and competition from alternative technologies and supply modes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)