India Industrial Heaters Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

India Industrial Heaters Market Overview:

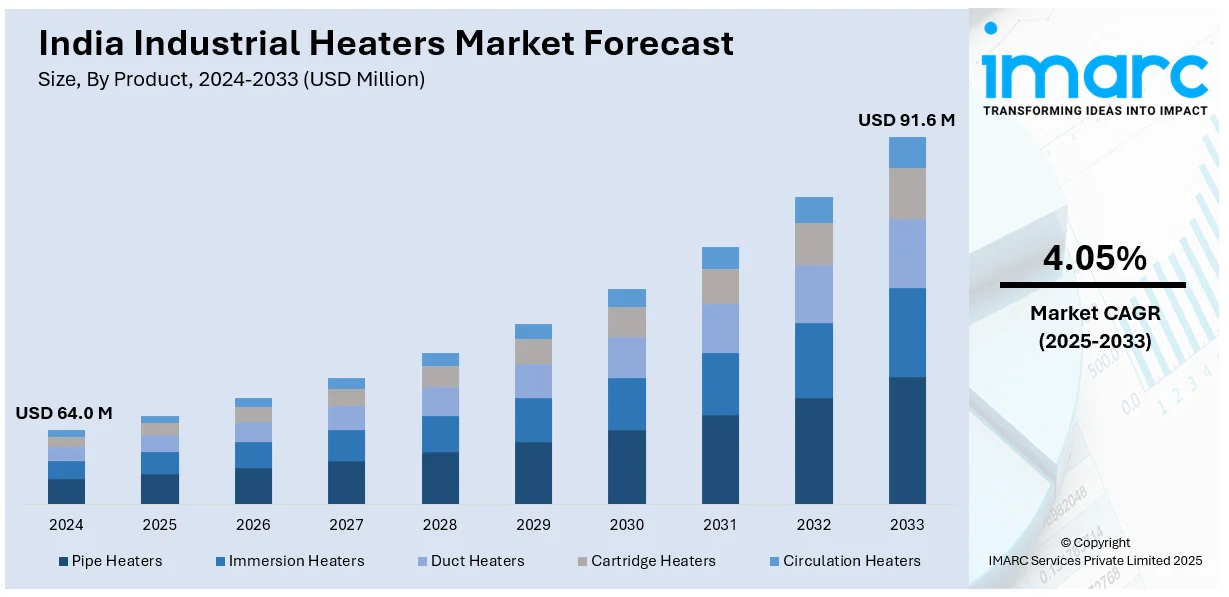

The India industrial heaters market size reached USD 64.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 91.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.05% during 2025-2033. The India industrial heaters market is driven by expanding manufacturing sectors, increasing demand for process heating in industries like chemicals and food processing, and advancements in energy-efficient heating technologies. Government initiatives supporting industrial growth and rising investments in infrastructure further boost demand for industrial heaters across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.0 Million |

| Market Forecast in 2033 | USD 91.6 Million |

| Market Growth Rate 2025-2033 | 4.05% |

India Industrial Heaters Market Trends:

Growing Demand for Energy-Efficient Industrial Heaters

The increasing emphasis on energy conservation and sustainability is driving the adoption of energy-efficient industrial heaters in India. Industries such as chemicals, food processing, and pharmaceuticals are incorporating advanced heating technologies like infrared and induction heaters to reduce energy consumption. Government initiatives promoting energy efficiency have resulted in annual monetary savings of approximately ₹191,810 crores and a reduction of around 306.02 million tonnes of CO₂ emissions. Strict regulations on industrial emissions and energy efficiency standards further encourage businesses to transition to eco-friendly heating solutions. Additionally, rising electricity and fuel costs have led industries to invest in energy-saving heaters to cut operational expenses. Manufacturers are developing smart heating systems with digital controls and automation, reinforcing efficiency-driven trends in India's industrial sector.

To get more information of this market, Request Sample

Expansion of Manufacturing and Process Industries

The expansion of India’s manufacturing and process industries is driving growth in the industrial heaters market. Government initiatives like “Make in India” and the Production Linked Incentive (PLI) scheme, with an allocation of ₹1.97 lakh crore (over US$26 billion) across 14 sectors, are spurring manufacturing investments and boosting demand for industrial heating solutions. Industries such as automotive, metallurgy, and petrochemicals depend on industrial heaters for drying, curing, and material processing. Infrastructure development and the expansion of industrial zones are further increasing the need for efficient heating equipment. As companies scale production, the demand for high-performance heaters capable of supporting continuous operations is rising, reinforcing this trend in India's industrial heater market.

Rising Adoption of Automation and Smart Heating Technologies

Automation is revolutionizing India’s industrial heaters market as manufacturers integrate IoT-enabled and AI-driven heating solutions. Smart industrial heaters with sensors, remote monitoring, and predictive maintenance are gaining traction, allowing industries to optimize performance and minimize downtime. These advanced systems provide real-time data on temperature control and energy consumption, enabling precise adjustments for improved efficiency. Sectors like oil and gas, food processing, and chemicals are adopting automated heating to enhance productivity. With AI projected to contribute USD 450-500 billion to India’s GDP by 2025, accounting for 10% of the country’s USD 5 trillion target, AI-driven heating solutions are playing a crucial role in industrial digitalization and innovation.

India Industrial Heaters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, technology and end user.

Product Insights:

- Pipe Heaters

- Immersion Heaters

- Duct Heaters

- Cartridge Heaters

- Circulation Heaters

The report has provided a detailed breakup and analysis of the market based on the product. This includes pipe heaters, immersion heaters, duct heater, cartridge heaters, and circulation heaters.

Technology Insights:

- Electric Based

- Steam-Based

- Hybrid Based

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electric based, steam-based, and hybrid based.

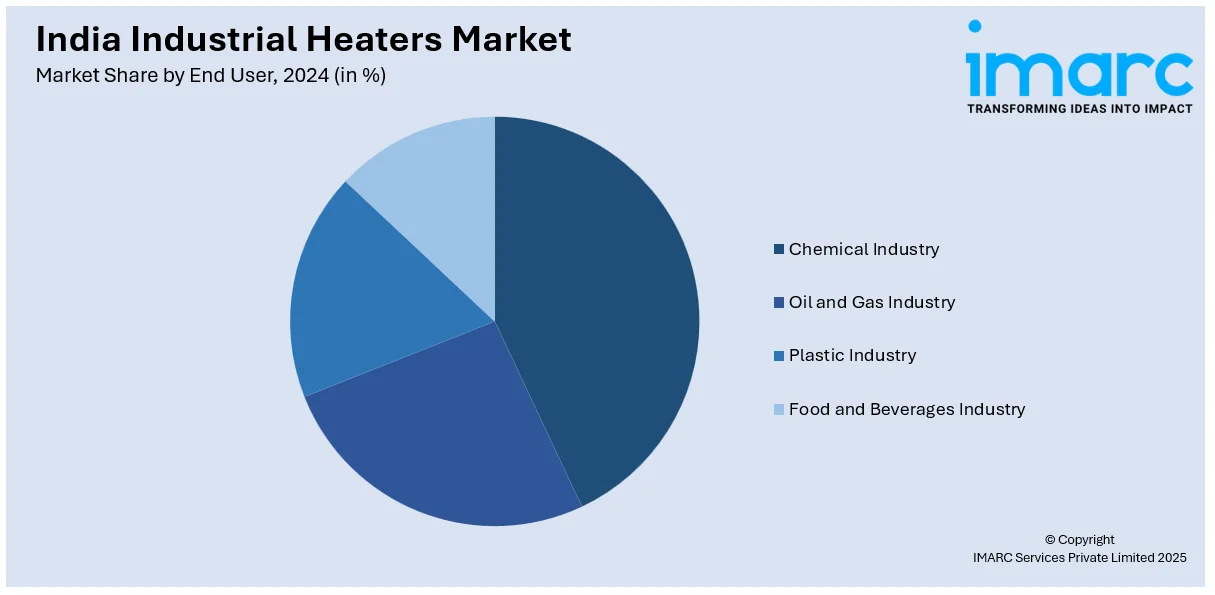

End User Insights:

- Chemical Industry

- Oil and Gas Industry

- Plastic Industry

- Food and Beverages Industry

The report has provided a detailed breakup and analysis of the market based on the end user. This includes chemical industry, oil and gas industry, plastic industry, and food and beverages industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Heaters Market News:

- In November 2024, Crompton Greaves Consumer Electricals Ltd introduced a new TVC for its latest range of 5-star rated water heaters. Titled *"Crompton Geyser On, Energy Savings Full On!"*, the campaign highlights the brand’s energy-efficient heating solutions that ensure convenience while lowering utility costs. Set to air during the India vs South Africa T20 series, the ad showcases Crompton’s commitment to innovation and sustainability in home water heating.

- In September 2024, Thermax unveiled innovative clean energy, air, and water solutions at Boiler India 2024, introducing the Greenpac biograte boiler, Greenbloc thermic fluid heater, and Thermeon 2.0. With advanced biogas and carbon capture technologies, Thermax aims to enhance energy transition efforts. The company also highlighted its service and digital offerings, reinforcing its commitment to sustainable industrial heating solutions at the CIDCO Exhibition Centre, Navi Mumbai.

India Industrial Heaters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Pipe Heaters, Immersion Heaters, Duct Heater, Cartridge Heaters, Circulation Heaters |

| Technologies Covered | Electric Based, Steam-Based, Hybrid Based |

| End Users Covered | Chemical Industry, Oil and Gas Industry, Plastic Industry, Food and Beverages Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial heaters market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial heaters market on the basis of product?

- What is the breakup of the India industrial heaters market on the basis of technology?

- What is the breakup of the India industrial heaters market on the basis of end user?

- What is the breakup of the India industrial heaters market on the basis of region?

- What are the various stages in the value chain of the India industrial heaters market?

- What are the key driving factors and challenges in the India industrial heaters market?

- What is the structure of the India industrial heaters market and who are the key players?

- What is the degree of competition in the India industrial heaters market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial heaters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial heaters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial heaters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)