India Industrial Hoses Market Size, Share, Trends, and Forecast by Material Type, Application, and Region, 2025-2033

India Industrial Hoses Market Overview:

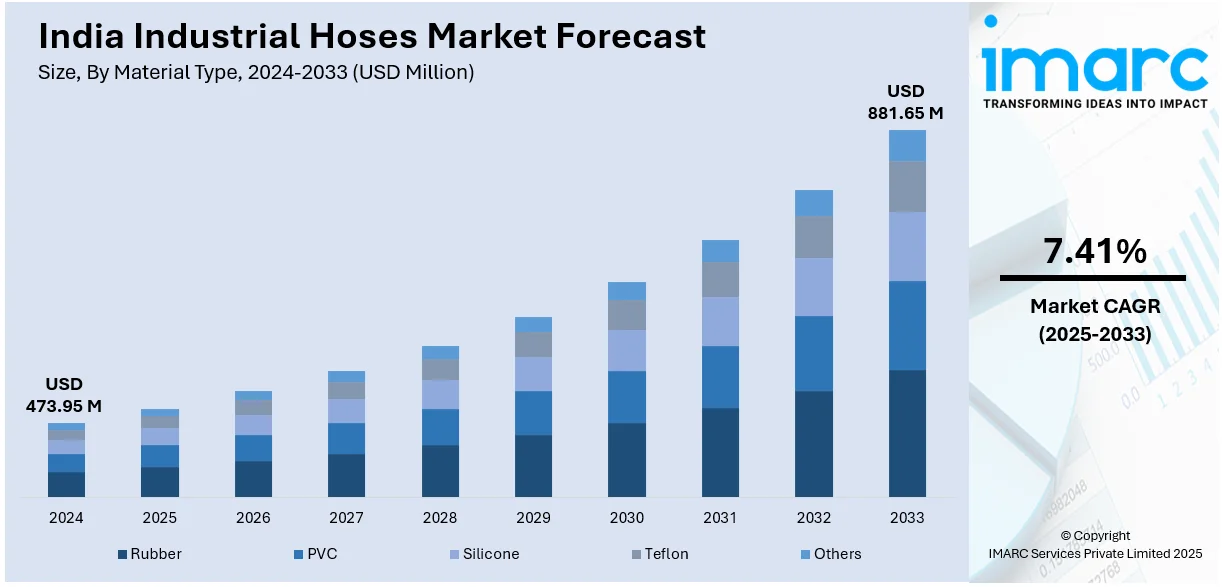

The India industrial hoses market size reached USD 473.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 881.65 Million by 2033, exhibiting a growth rate (CAGR) of 7.41% during 2025-2033. The market is expanding due to an increasing demand from industries such as oil and gas, chemicals, construction, and agriculture. Additionally, rising number of infrastructure projects, advancements in material technology, and the adoption of durable, high-performance hoses are driving market growth, alongside stricter safety and environmental regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 473.95 Million |

| Market Forecast in 2033 | USD 881.65 Million |

| Market Growth Rate 2025-2033 | 7.41% |

India Industrial Hoses Market Trends:

Expansion of Infrastructure and Construction Sectors Driving Growth

India's increasing infrastructure growth is significantly contributing to the demand for industrial hoses, especially in development of roads and construction and urban planning projects. Government initiatives, including Smart Cities Mission and Bharatmala Pariyojana, are driving scale-intensive construction efforts that need sophisticated hoses for the pumping of concrete, material management, and the transfer of water. For instance, as per industry reports, as of October 2024, a total of 26,425 km of projects were granted under the Bharatmala Pariyojana, with 18,714 km already completed. Additionally, industrial hoses play a crucial role in ensuring seamless operations at construction sites, where durability and efficiency are essential. The growing use of mechanized equipment and automation in the construction industry is further driving the adoption of technologically advanced hoses that can withstand heavy-duty usage. Moreover, the expansion of India's power and energy sector, including renewable energy projects like solar and wind farms, is increasing the demand for hoses designed for fluid and gas transfer in power plants. With new industrial parks, manufacturing hubs, and transportation networks under development, the industrial hoses market is poised for substantial growth. Furthermore, companies that offer reinforced, weather-resistant, and high-pressure hoses tailored for construction and energy applications are well-positioned to benefit from this infrastructure-driven demand.

To get more information of this market, Request Sample

Growing Focus on Safety, Compliance, and Sustainable Materials

The Indian industrial hoses market is increasingly shaped by stringent safety regulations, quality compliance, and the shift toward eco-friendly materials. As regulatory bodies impose stricter quality requirements, manufacturers are focusing on developing hoses that comply with safety, hygiene, and durability standards. In addition, environmental concerns are driving the adoption of sustainable, non-toxic materials, reducing the reliance on synthetic rubber and plastics that contribute to industrial waste. There is also a growing demand for flame-resistant, anti-static, and chemical-resistant hoses that enhance workplace safety, especially in hazardous industries like oil and gas, mining, and manufacturing. Moreover, companies are integrating advanced testing protocols and quality control measures to ensure product reliability, which is helping them build stronger customer trust and brand value. For instance, in February 2024, Madras Hydraulic Hose announced the successful attainment of UL 207 and CSA C22.2 certifications, which set the industry standard for tubing and refrigerant components, reinforcing our commitment to quality and compliance. With industries prioritizing safety and sustainability, the market for high-quality, regulation-compliant hoses is set to expand, reinforcing India's commitment to industrial growth and environmental responsibility.

India Industrial Hoses Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material type and application.

Material Type Insights:

- Rubber

- PVC

- Silicone

- Teflon

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes rubber, PVC, silicone, teflon, and others.

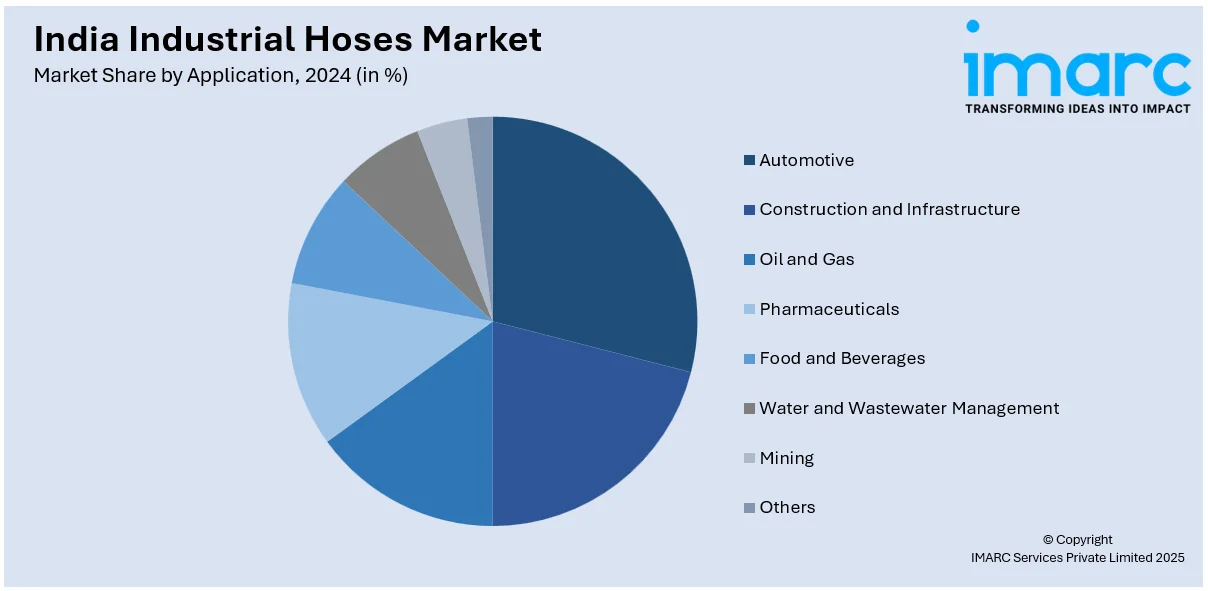

Application Insights:

- Automotive

- Construction and Infrastructure

- Oil and Gas

- Pharmaceuticals

- Food and Beverages

- Water and Wastewater Management

- Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, construction and infrastructure, oil and gas, pharmaceuticals, food and beverages, water and wastewater management, mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Hoses Market News:

- In November 2024, HANSA-FLEX exhibited its hydraulic solutions for the oil and gas sector. It features high-performance hoses, fuel hoses, metal tubes, and pipe fittings enhance durability and efficiency, strengthening the company's position in the industry. This innovation is expected to positively impact India’s industrial sectors by providing reliable, high-quality hose solutions for oil, gas, and infrastructure projects.

India Industrial Hoses Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Rubber, PVC, Silicone, Teflon, Others |

| Applications Covered | Automotive, Construction and Infrastructure, Oil and Gas, Pharmaceuticals, Food and Beverages, Water and Wastewater Management, Mining, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial hoses market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial hoses market on the basis of material type?

- What is the breakup of the India industrial hoses market on the basis of application?

- What is the breakup of the India industrial hoses market on the basis of region?

- What are the various stages in the value chain of the India industrial hoses market?

- What are the key driving factors and challenges in the India industrial hoses market?

- What is the structure of the India industrial hoses market and who are the key players?

- What is the degree of competition in the India industrial hoses market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial hoses market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial hoses market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial hoses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)