India Industrial IoT Market Size, Share, Trends and Forecast by Component, End-User, and Region, 2025-2033

India Industrial IoT Market Overview:

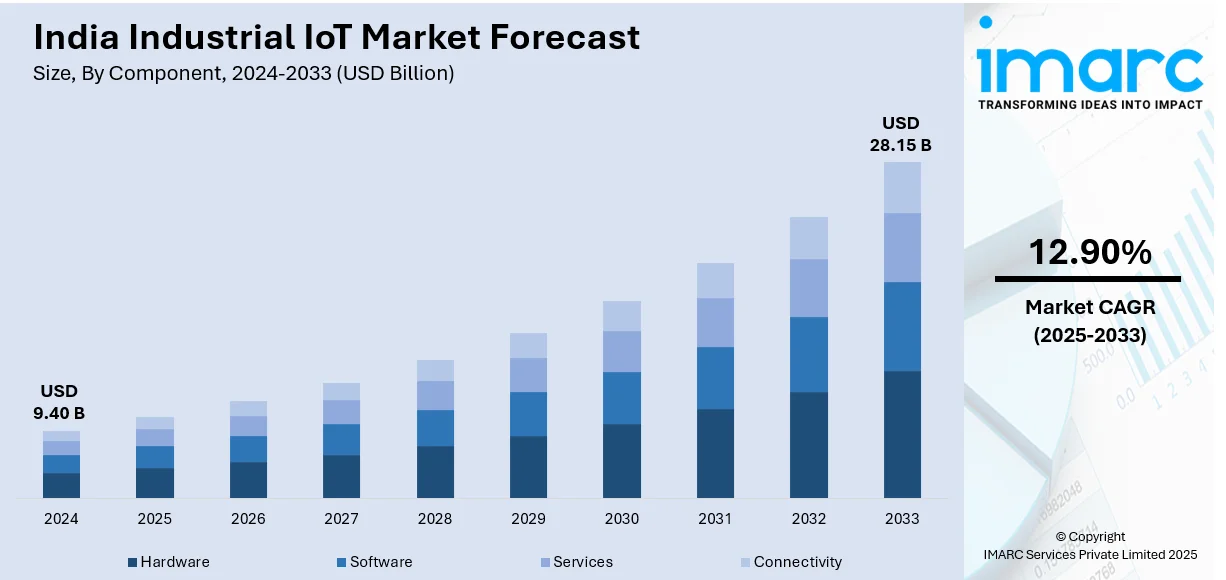

The India industrial IoT market size reached USD 9.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.15 Billion by 2033, exhibiting a growth rate (CAGR) of 12.90% during 2025-2033. The India industrial IoT market share is expanding, driven by the increasing usage of cloud computing, enabling manufacturers to track machine performance and detect faults, along with rising investments in digital twins, robotics, and blockchain technology to streamline operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.40 Billion |

| Market Forecast in 2033 | USD 28.15 Billion |

| Market Growth Rate (2025-2033) | 12.90% |

India Industrial IoT Market Trends:

Increasing adoption of cloud computing

The rising adoption of cloud computing is offering a favorable India Industrial IoT market outlook. According to industry reports, by 2026, cloud technology is set to represent 8% of India’s GDP. It can increase the nation’s GDP by USD 310-380 Billion by 2026 and create 14 Million jobs. Cloud platforms provide scalable storage and computing power, allowing businesses to process real-time data from connected industrial devices without heavy on-premises infrastructure. This reduces operational costs and enhances flexibility, making industrial IoT solutions more accessible to industries of all sizes. Cloud computing also improves remote monitoring, enabling manufacturers to track machine performance, detect faults, and optimize production from anywhere. Additionally, secure cloud infrastructure with advanced encryption and access controls enhances data security, addressing concerns about cyber threats. The expansion of 5G networks strengthens cloud-IoT integration by enabling faster data transmission and seamless device connectivity. As industries shift towards smart factories, cloud computing is becoming essential for managing interconnected devices, improving efficiency, and supporting innovations in India’s industrial sector.

To get more information of this market, Request Sample

Advancements in technology

Advancements in technology are impelling the India Industrial IoT market growth. With the rise of technologies, such as machine learning (ML) and artificial intelligence (AI), industries can connect tools, analyze data in real time, and optimize performance. These innovations allow manufacturers to implement predictive maintenance, reducing downtime and operational costs. The introduction of advanced sensors further enhances industrial automation by enabling faster decision-making at the machine level. Government initiatives like Make in India and Digital India encourage industries and researchers to modernize with smart manufacturing, further bolstering the market growth. In May 2024, the faculty, students, and researchers at the Indian Institute of Technology (IIT) commemorated the successful creation, production, and activation of India's inaugural commercial ‘Reduced Instruction Set Computer (RISC)’ V-based secure IoT system on chip by the startup, Mindgrove, during an event organized on campus to foster a culture of innovations and entrepreneurship among students. As factories, logistics, and energy sectors integrate IoT-based automation, reliability improves and waste is minimized, contributing to sustainable industrial practices. Companies also invest in digital twins, robotics, and blockchain technology to streamline operations and improve supply chain transparency. As India is evolving digitally, these technological advancements are making industrial IoT more accessible, promoting widespread adoption across manufacturing, healthcare, agriculture, and infrastructure, ultimately transforming industrial productivity.

India Industrial IoT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component and end-user.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the components. This includes hardware, software, services, and connectivity.

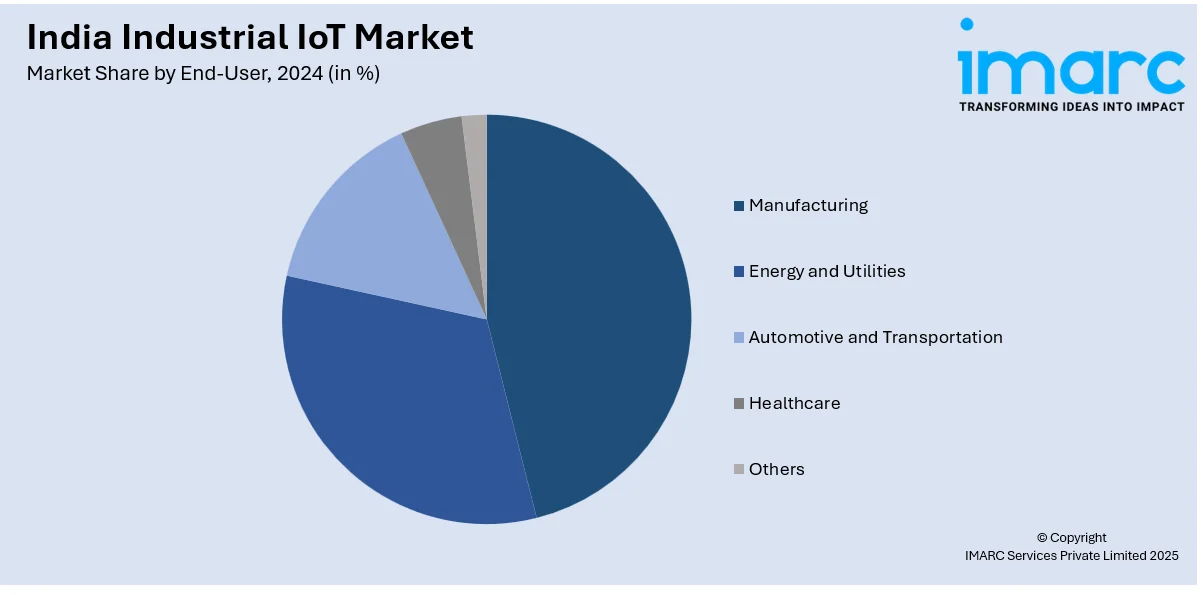

End-User Insights:

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-users have also been provided in the report. This includes manufacturing, energy and utilities, automotive and transportation, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial IoT Market News:

- In March 2025, Ennoconn, a subsidiary of Foxconn, was set to commence operations in its newly established industrial automation facility in Tamil Nadu, intending to introduce its products to the Indian market. The firm aimed to provide top-tier industrial IoT and embedded technology, design, and manufacturing solutions, as well as IT and system integration services in the country.

- In September 2024, Zoho, the prominent tech firm based in Chennai, entered the ONDC network with Vikra, a seller app operating in India, and Zoho IoT solutions, the well-known platform that allowed businesses to create and implement custom IoT applications. The firm unveiled Zoho IoT, a platform aimed at assisting businesses in real-time management of industrial IoT device data, facilitating process automation and decisions based on data.

India Industrial IoT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End-Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial IoT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial IoT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial IoT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial IoT market in India was valued at USD 9.40 Billion in 2024.

The India industrial IoT market is projected to exhibit a CAGR of 12.90% during 2025-2033, reaching a value of USD 28.15 Billion by 2033.

The growing demand for reliable supply chain management is supporting the use of industrial IoT across sectors like manufacturing, energy, logistics, and agriculture. The rise in affordable sensors, improved internet connectivity, and expansion of 5G networks are making IoT deployment more feasible and scalable. Additionally, businesses are recognizing the value of data-oriented decision-making, attracting investments in connected devices and platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)