India Industrial Material Handling Robotics Market Size, Share, Trends and Forecast by Type of Robot, Payload Capacity, Operational Environment, Application, End Use Industry, and Region, 2025-2033

India Industrial Material Handling Robotics Market Overview:

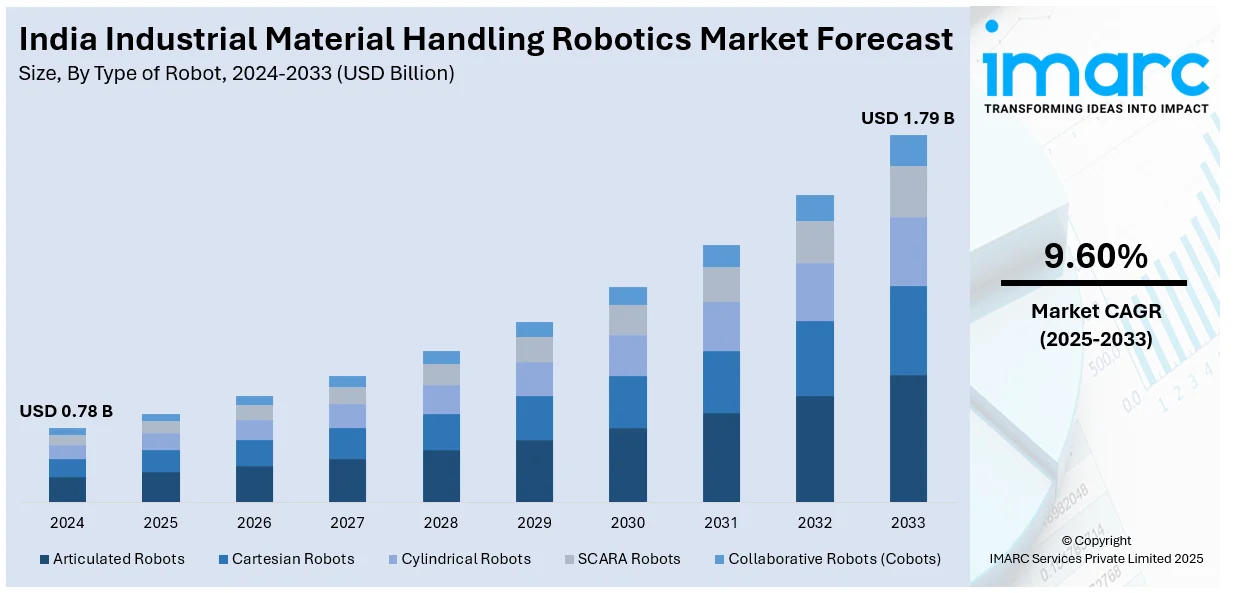

The India industrial material handling robotics market size reached USD 0.78 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.79 Billion by 2033, exhibiting a growth rate (CAGR) of 9.60% during 2025-2033. The market is driven by the increasing demand for automation in manufacturing, which improves efficiency and reduces labor costs. In addition to this, the growth of e-commerce, the need to enhance operational flexibility, continual advancements in artificial intelligence (AI) and robotics technology, and the requirement for safety in hazardous environments are some of the major factors augmenting India industrial material handling robotics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.78 Billion |

| Market Forecast in 2033 | USD 1.79 Billion |

| Market Growth Rate 2025-2033 | 9.60% |

India Industrial Material Handling Robotics Market Trends:

Increased Adoption of Automation in Manufacturing Industries

The increasing trend of automation in India's manufacturing sector is creating a positive impact on market expansion. According to industry reports, the manufacturing sector is a major contributor to the Indian economy, providing jobs to around 27.3 million people and contributing 17% of the GDP of the country. The government of India hopes to achieve 25% of its GDP from manufacturing by 2025. Therefore, in automotive, electronics, and consumer goods industries are making greater investments in robotic technology to increase productivity, eliminate human error, and make processes more efficient. This ambitious vision is prompting the government to initiate several programs like the "Make in India" campaign aimed at enhancing production capacity and revolutionizing manufacturing processes. Automation technologies such as robotics are central to the attainment of this objective through enhanced productivity, lowered operational expenses, and competitiveness. Robots are leveraged in applications such as material handling, assembly, packaging, and quality inspection, reducing human interaction and process accuracy. Additionally, the demand for speed, accuracy, and less production downtime is compelling manufacturers to implement robotic solutions, particularly in assembly lines and supply chain management. Aside from this, an increasing focus on Industry 4.0 technologies and smart factories, where robots contribute to diminishing labor dependence while enhancing real-time data analysis and improved process monitoring, promoting efficiency across all stages of manufacturing.

To get more information of this market, Request Sample

Growth of E-Commerce and Demand for Efficient Warehousing Solutions

The swift growth of India's e-commerce industry is another major trend driving the India industrial material handling robotics market growth. As per industry reports, in FY21, India represented 150 million of the global online consumers, and by FY26, this figure is expected to grow to 350 million. With the mounting number of online orders, especially during holiday periods, there is huge pressure on logistics and warehouse operations to cope with customer requests for quicker delivery. Robotics within warehouses are utilized for operations like order picking, sorting, packaging, and stock management. Such automated applications are increasing operational speed. It also increases precision, minimizes manual labor, and provides for better resource usage. Additionally, while companies work to achieve delivery timelines and expand operations, the incorporation of robot systems lowers the prospect of errors and maximizes space in warehouses. Similarly, major e-commerce market players are increasingly utilizing robotics to enhance the efficiency of supply chains, streamline repetitive motions, and reduce labor expenses. This growing demand for automation in e-commerce fulfillment centers is expected to continue driving market growth in India, with robotic solutions becoming integral to meeting the surge in demand.

India Industrial Material Handling Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of robot, payload capacity, operational environment, application, and end use industry.

Type of Robot Insights:

- Articulated Robots

- Cartesian Robots

- Cylindrical Robots

- SCARA Robots

- Collaborative Robots (Cobots)

The report has provided a detailed breakup and analysis of the market based on the type of robot. This includes articulated robots, cartesian robots, cylindrical robots, SCARA robots, and collaborative robots (Cobots).

Payload Capacity Insights:

- Low Payload (Up to 50 kg)

- Medium Payload (51 kg to 300 kg)

- High Payload (Above 300 kg)

A detailed breakup and analysis of the market based on the payload capacity have also been provided in the report. This includes low payload (up to 50 kg), medium payload (51 kg to 300 kg), and high payload (above 300 kg).

Operational Environment Insights:

- Indoor

- Outdoor

- Controlled Environment (Clean Rooms)

The report has provided a detailed breakup and analysis of the market based on the operational environment. This includes indoor, outdoor, and controlled environment (clean rooms).

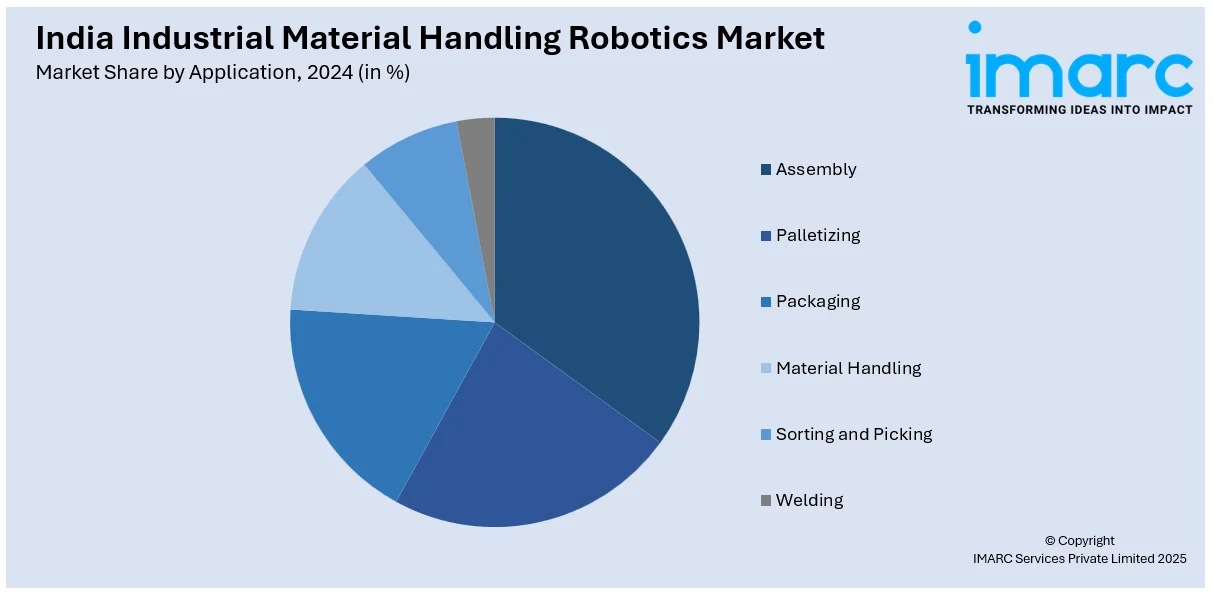

Application Insights:

- Assembly

- Palletizing

- Packaging

- Material Handling

- Sorting and Picking

- Welding

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes assembly, palletizing, packaging, material handling, sorting and picking, and welding.

End Use Industry Insights:

- Automotive

- Food and Beverage

- Electronics

- Aerospace

- Pharmaceuticals

- Logistics and Warehousing

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, food and beverage, electronics, aerospace, pharmaceuticals, and logistics and warehousing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Material Handling Robotics Market News:

- On January 31, 2025, Addverb Technologies unveiled India's first humanoid robot, marking a significant milestone in the nation's technological advancements. The robot is equipped with AI-driven cognitive abilities. It is designed to process visual, auditory, and tactile data, enabling it to operate across various sectors such as fashion, retail, and energy. This innovation aims to facilitate seamless human-machine collaboration, enhancing operational efficiency and productivity across industries.

- On 23 February 2025, Delta unveiled its new D-Bot series of Collaborative Robots (Cobots) in India, announcing its involvement in ELECRAMA 2025, which is about Smart Manufacturing. These 6-axis cobots are made to enable companies with more intelligent and efficient manufacturing processes, including electronics assembly, packaging, materials handling, and even welding. They can carry up to 30 kg of payload and reach speeds of up to 200 degrees per second.

India Industrial Material Handling Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Robots Covered | Articulated Robots, Cartesian Robots, Cylindrical Robots, SCARA Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Low Payload (Up to 50 kg), Medium Payload (51 kg to 300 kg), High Payload (Above 300 kg) |

| Operational Environments Covered | Indoor, Outdoor, Controlled Environment (Clean Rooms) |

| Applications Covered | Assembly, Palletizing, Packaging, Material Handling, Sorting and Picking, Welding |

| End Use Industries Covered | Automotive, Food and Beverage, Electronics, Aerospace, Pharmaceuticals, Logistics and Warehousing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial material handling robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial material handling robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial material handling robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial material handling robotics market in India was valued at USD 0.78 Billion in 2024.

The India industrial material handling robotics market is projected to exhibit a CAGR of 9.60% during 2025-2033, reaching a value of USD 1.79 Billion by 2033.

The India industrial material handling robotics market is driven by rising automation adoption in manufacturing, demand for higher efficiency, and the need to reduce labor dependency. Growth in e-commerce, warehousing, and logistics operations, alongside technological advancements in robotics, further accelerates market expansion and operational productivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)