India Industrial Mixers and Agitators Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2026-2034

India Industrial Mixers and Agitators Market Overview:

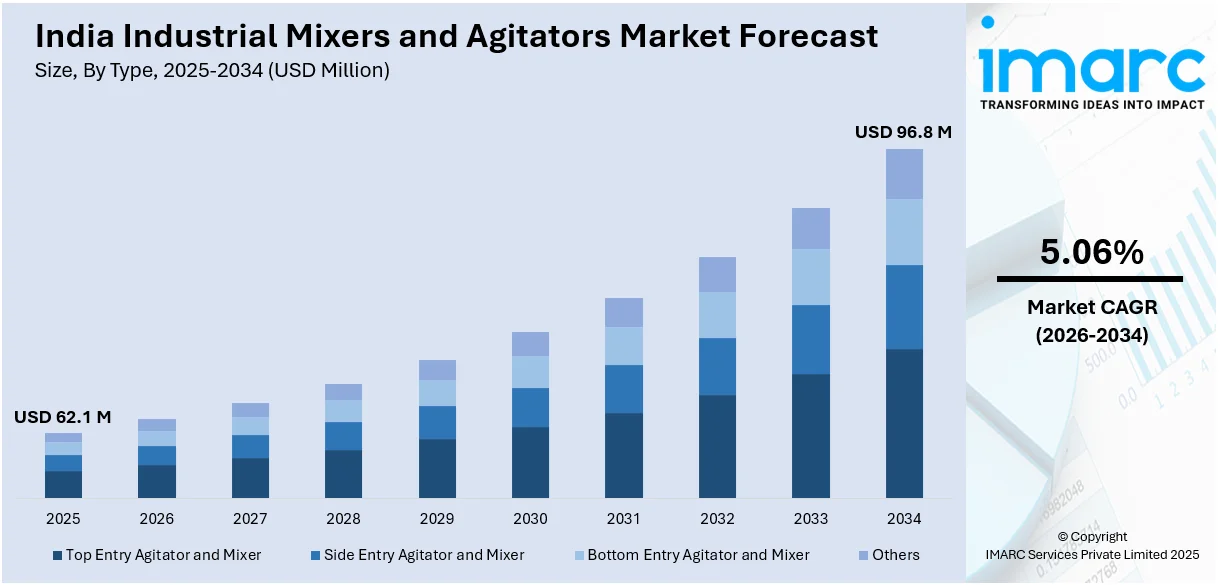

The India industrial mixers and agitators market size reached USD 62.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 96.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.06% during 2026-2034. The market is witnessing an expansion due to heightened demand from pharmaceuticals, chemicals, and food processing industries. Additionally, energy-efficient designs, technological improvements, and automation are improving efficiency. Government programs, infrastructure spending, and environmental policies are also propelling adoption in manufacturing and wastewater treatment applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 62.1 Million |

| Market Forecast in 2034 | USD 96.8 Million |

| Market Growth Rate 2026-2034 | 5.06% |

India Industrial Mixers and Agitators Market Trends:

Technological Advancements and Customization

The Indian industrial mixers and agitators market is witnessing significant growth with the development of technology and an increasing demand for tailor-made solutions. The manufacturers are putting more emphasis on incorporating cutting-edge technologies, including automation and digitalization, to improve operational efficiency and accuracy in mixing operations. This is prompted by the requirement to cater to varied industry needs, especially in industries like pharmaceuticals, chemicals, and food processing, where accurate mixing is essential. For instance, as per industry reports, Renders India Pvt. Ltd. holds prominence in the industrial mixers market with its SmartMix series, which is equipped with advanced features such as speed control, pressure and temperature monitoring, HMI control panels, and process automation components like limit switches and auto control valves. Customized agitators tailored to specific applications are gaining traction, enabling industries to achieve optimal mixing results and maintain product quality. Additionally, the adoption of energy-efficient mixers is on the rise, aligning with global sustainability trends and reducing operational costs for businesses. Furthermore, these technological innovations and the emphasis on customization are propelling the market forward, offering competitive advantages to early adopters.

To get more information on this market Request Sample

Increasing Investments in Infrastructure Development

India's focus on infrastructure development is positively impacting the industrial mixers and agitators market. Government initiatives aimed at boosting manufacturing capabilities and improving industrial infrastructure are creating a conducive environment for market growth. Investments in sectors like construction, oil and gas, and energy are leading to increased demand for mixing equipment used in processes such as concrete mixing, drilling fluid preparation, and biofuel production. For instance, as per industry reports, the Government of India (GOI) announced an investment of ₹10 lakh crore in 2023-24 for India’s infrastructure development. This influx of investment is expected to drive the demand for industrial mixers and agitators, as new manufacturing units and processing plants are established. Additionally, the push towards renewable energy sources and sustainable practices is leading to the adoption of mixers in emerging applications, further diversifying the market landscape.

India Industrial Mixers and Agitators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Top Entry Agitator and Mixer

- Side Entry Agitator and Mixer

- Bottom Entry Agitator and Mixer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes top entry agitator and mixer, side entry agitator and mixer, bottom entry agitator and mixer, and others.

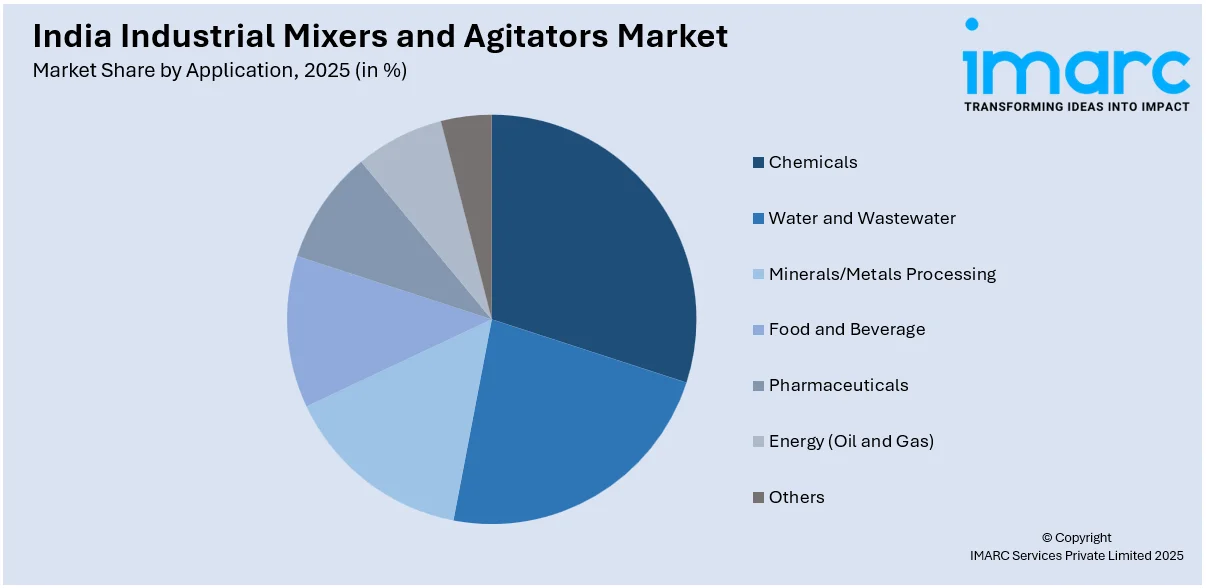

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Chemicals

- Water and Wastewater

- Minerals/Metals Processing

- Food and Beverage

- Pharmaceuticals

- Energy (Oil and Gas)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chemicals, water and wastewater, minerals/metals processing, food and beverage, pharmaceuticals, energy (oil and gas), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Mixers and Agitators Market News:

- In October 2023, Milton Roy, an INGERSOLL RAND brand, announced that it has secured a major contract with NALCO to supply 24 critical agitators for its alumina refinery expansion in Damanjodi, Odisha.

India Industrial Mixers and Agitators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Top Entry Agitator and Mixer, Side Entry Agitator and Mixer, Bottom Entry Agitator and Mixer, Others |

| Applications Covered | Chemicals, Water and Wastewater, Minerals/Metals Processing, Food and Beverage, Pharmaceuticals, Energy (Oil and Gas), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial mixers and agitators market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial mixers and agitators market on the basis of type?

- What is the breakup of the India industrial mixers and agitators market on the basis of application?

- What is the breakup of the India industrial mixers and agitators market on the basis of region?

- What are the various stages in the value chain of the India industrial mixers and agitators market?

- What are the key driving factors and challenges in the India industrial mixers and agitators market?

- What is the structure of the India industrial mixers and agitators market and who are the key players?

- What is the degree of competition in the India industrial mixers and agitators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial mixers and agitators market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial mixers and agitators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial mixers and agitators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)