India Industrial PC Market Size, Share, Trends and Forecast by Type, Display Type, Sales Channel, End Use Industry and Region, 2025-2033

India Industrial PC Market Overview:

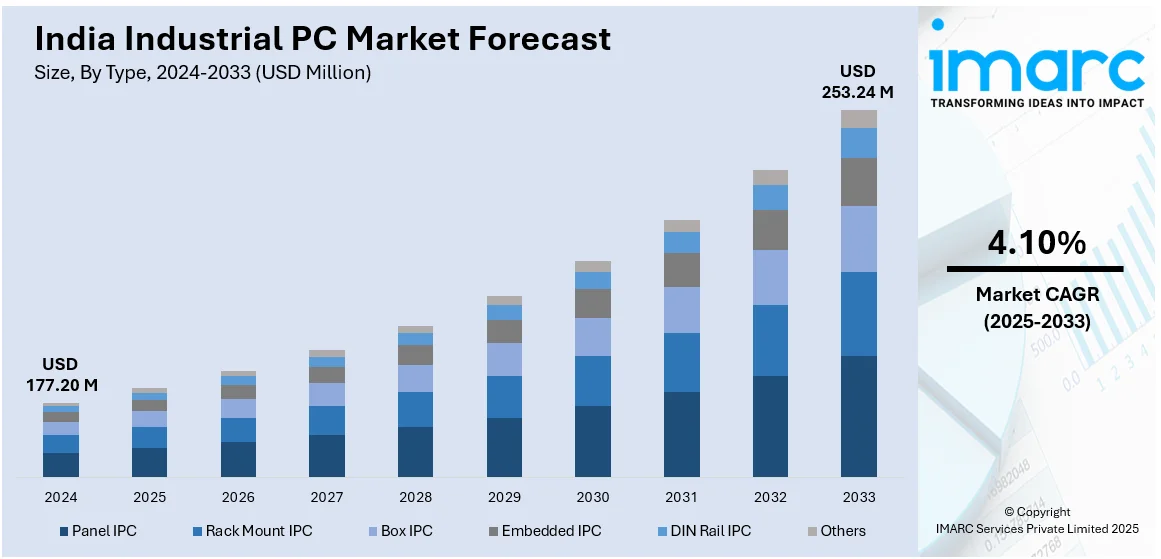

The India industrial PC market size reached USD 177.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 253.24 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. Growing adoption of Industry 4.0, increasing automation in manufacturing, rising demand for real-time data processing, expansion of smart factories, government initiatives like "Make in India," need for rugged computing in harsh environments, advancements in IoT and AI, and rising cybersecurity concerns are expanding the India Industrial PC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 177.20 Million |

| Market Forecast in 2033 | USD 253.24 Million |

| Market Growth Rate 2025-2033 | 4.10% |

India Industrial PC Market Trends:

Rising Adoption of Industrial PCs (IPCs) in Smart Manufacturing

India's industrial sector is rapidly embracing automation and smart manufacturing, driving the India Industrial PC market growth. With the expansion of Industry 4.0, IPCs are increasingly used for real-time data processing, predictive maintenance, and seamless integration with IoT devices. For instance, as of June 24, 2024, the integration of machine learning (ML) and artificial intelligence (AI) in India's industrial sector is bringing about a huge revolution, ushering in the era of smart factories. A recent analysis on Industry 4.0 adoption predicts that by 2025, digital technology would make up 40% of manufacturing spending, up from 20% in 2021. IPCs are being utilized more and more for predictive maintenance, real-time data processing, and smooth IoT device integration as Industry 4.0 grows. To increase productivity and decrease downtime, industries like electronics, pharmaceuticals, and the automotive sector are investing in IPCs. The Indian government's efforts to digitize manufacturing through programs like "Make in India" are also speeding up market expansion. The growing need for real-time automation solutions, ruggedized hardware, and high-performance computing is also contributing to the market demand. Furthermore, manufacturing processes are changing to become more resilient and adaptable due to the emergence of cloud-based industrial solutions, cybersecurity developments, and remote monitoring capabilities. As a result, IPCs are becoming crucial for guaranteeing accuracy, dependability, and improved operational control as businesses transition to intelligent production systems. The importance of IPCs in India's manufacturing landscape is anticipated to increase dramatically over the next several years due to ongoing developments in edge computing and semiconductor technologies.

To get more information of this market, Request Sample

Growing Demand for Rugged and Embedded IPCs

India's demand for resistant and embedded IPCs is being driven by the growing requirement for high-performance computing in harsh environments. Strong computer solutions that can tolerate extremes in temperature, dust, and vibration are necessary for sectors including oil and gas, defense, and power generation. For real-time vehicle administration and surveillance, embedded IPCs are also becoming more popular in the logistics and transportation industries.

The growing focus on cybersecurity and data integrity is further boosting the adoption of IPCs with advanced security features. As industries continue to modernize, this is positively impacting the India industrial PC market outlook. For instance, on January 15, 2025, the Cyber Security Grand Challenge (CSGC 2.0) launched their second edition by the Ministry of Electronics & Information Technology (MeitY) offers a total prize fund of INR 6.85 Crore, a substantial increase from the previous INR 3.2 Crore.

India Industrial PC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, display type, sales channel, and end use industry.

Type Insights:

- Panel IPC

- Rack Mount IPC

- Box IPC

- Embedded IPC

- DIN Rail IPC

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes panel IPC, rack mount IPC, box IPC, embedded IPC, DIN rail IPC, and others.

Display Type Insights:

- Resistive

- Capacitive

- Others

A detailed breakup and analysis of the market based on the display type have also been provided in the report. This includes resistive, capacitive, and others.

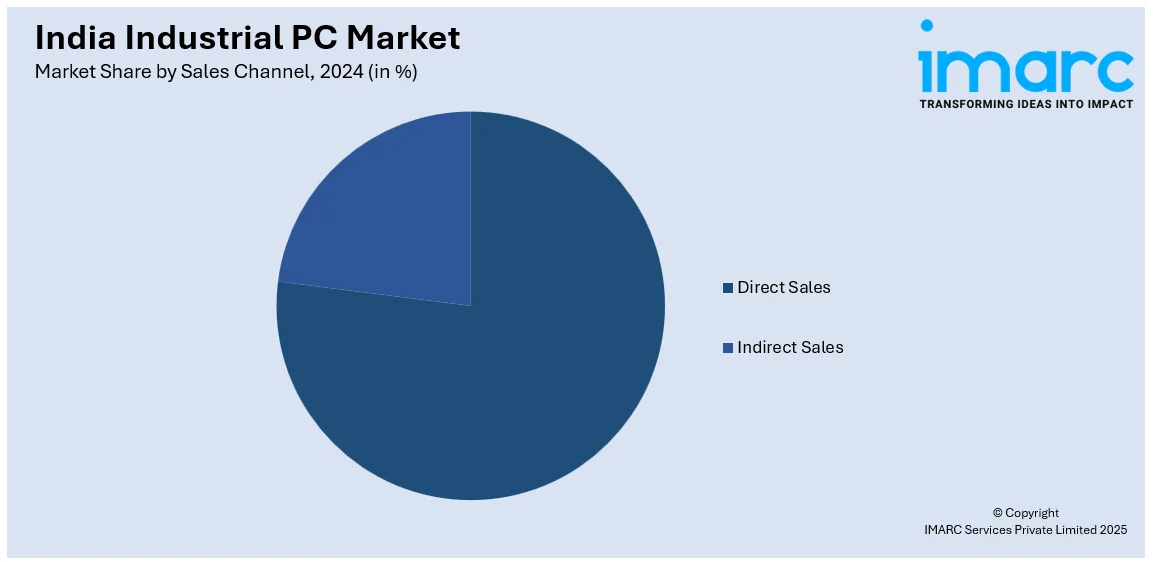

Sales Channel Insights:

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales and indirect sales.

End Use Industry Insights:

- Automotive

- Healthcare

- Chemical

- Aerospace and Defense

- Semiconductor and Electronics

- Energy and Power

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, healthcare, chemical, aerospace and defense, semiconductor and electronics, energy and power, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial PC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Panel IPC, Rack Mount IPC, Box IPC, Embedded IPC, DIN Rail IPC, Others |

| Display Types Covered | Resistive, Capacitive, Others |

| Sales Channels Covered | Direct Sales, Indirect Sales |

| End Use Industries Covered | Automotive, Healthcare, Chemical, Aerospace and Defense, Semiconductor and Electronics, Energy and Power, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial PC market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial PC market on the basis of type?

- What is the breakup of the India industrial PC market on the basis of display type?

- What is the breakup of the India industrial PC market on the basis of sales channel?

- What is the breakup of the India industrial PC market on the basis of end use industry?

- What is the breakup of the India industrial PC market on the basis of region?

- What are the various stages in the value chain of the India industrial PC market?

- What are the key driving factors and challenges in the India industrial PC market?

- What is the structure of the India industrial PC market and who are the key players?

- What is the degree of competition in the India industrial PC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial PC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial PC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial PC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)