India Industrial Pumps and Valves Market Size, Share, Trends and Forecast by Product Type, Position, Driving Force, End Use, and Region, 2025-2033

India Industrial Pumps and Valves Market Overview:

The India industrial pumps and valves market size reached USD 2,163.42 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,531.80 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market is driven by rapid industrialization, expanding water and wastewater treatment infrastructure, growth in oil & gas exploration, increasing chemical processing demand, rising power generation needs, ongoing advancements in smart pump technologies, and supportive government initiatives for manufacturing and infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,163.42 Million |

| Market Forecast in 2033 | USD 3,531.80 Million |

| Market Growth Rate 2025-2033 | 5.60% |

India Industrial Pumps and Valves Market Trends:

Growing Demand for Energy-Efficient and Smart Pumps

The India industrial pumps and valves market is experiencing a powerful shift toward energy-efficient and smart pumping solutions. Industries that include water treatment alongside oil & gas and chemical operations are using pumps equipped with sophisticated monitoring systems and control features because of rising energy prices and the government's sustainability push. Moreover, smart pumps integrating the Internet of Things (IoT) and automation capabilities help improve performance and decrease operational downtime and operational costs simultaneously. For instance, in September 2024, Pump Academy introduced iPUMPNET, an AI- and IoT-enabled solution for water pumping stations, enhancing efficiency, reducing energy use, and extending equipment lifespan, supporting sustainability and cost savings in water management. Besides this, predictive maintenance solutions and variable frequency drives (VFDs) create better reliability and efficiency. Businesses also need to replace outdated pumps with high-efficiency solutions because environmental regulations with energy-efficiency standards are currently in effect. Furthermore, the manufacturing industry dedicated its efforts to creating pumps that offer better hydraulics along with digital connectivity features to address market requirements. The industrial landscape is transforming as intelligent and energy-efficient pumping solutions are more prevalent because they provide operational sustainability with cost-effectiveness. As a result, this is boosting the India industrial pumps and valves market share.

.webp)

To get more information of this market, Request Sample

Expansion of Water and Wastewater Treatment Infrastructure

The expansion of water and wastewater treatment facilities is leading to an increased need for industrial pumps and valves, which is enhancing the India industrial pumps and valves market outlook. For example, in May 2024, Schneider Electric collaborated with SUEZ and Delhi Jal Board to automate a 564 million liters per day sewage treatment plant in Delhi, enhancing water quality and reducing river pollution. In line with this, the combination of fast-paced urban development and rising population numbers, along with industrial growth, requires efficient wastewater treatment solutions because these factors have caused increasing water usage and waste output. Concurrently, the Indian government's Jal Jeevan Mission, together with the Namami Gange Program, motivates massive water management investments, due to which the demand for pumps and valves is surging. In confluence with this, the power generation sector, and pharmaceuticals and chemicals industries, pursue wastewater recycling and zero liquid discharge (ZLD) systems that demand resistant pump and valve technologies. Furthermore, advanced pump technologies continue to find new opportunities because of the rising implementation of desalination plants and sewage treatment facilities. Apart from this, high-performance pumps, along with durable valves, are experiencing an increasing demand from industries and municipalities, which is significantly driving the India industrial pumps and valves market growth.

India Industrial Pumps and Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, position, driving force, and end use.

Product Type Insights:

- Centrifugal

- Positive Displacement

- Reciprocating

- Rotary

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal, positive displacement, reciprocating, rotary, and others.

Position Insights:

- Submersible

- Non-Submersible

A detailed breakup and analysis of the market based on the position have also been provided in the report. This includes submersible and non-submersible.

Driving Force Insights:

- Engine Driven

- Electrical Driven

The report has provided a detailed breakup and analysis of the market based on the driving force. This includes engine driven and electrical driven.

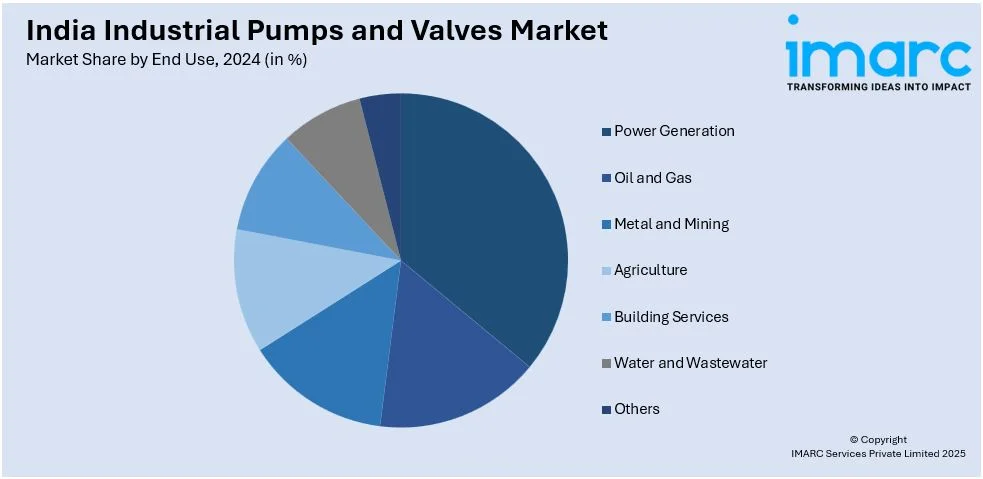

End Use Insights:

- Power Generation

- Oil and Gas

- Metal and Mining

- Agriculture

- Building Services

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes power generation, oil and gas, metal and mining, agriculture, building services, water and wastewater, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Pumps and Valves Market News:

- In October 2024, Burkert Fluid Control Systems officially opened a new 50,000-square-foot production facility in Pune, India. This site includes production, assembly, and testing centers, aiming to enhance local manufacturing capabilities and better serve Indian customers with products and solutions "Made in India."

- In August 2024, Gilbarco Veeder-Root, a Vontier company, secured two tenders worth a combined $59 million from Hindustan Petroleum Corporation Ltd. (HPCL) for dispensers, submersible pumps, and services. This partnership supports India's infrastructure modernization and decarbonization goals.

India Industrial Pumps and Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Centrifugal, Positive Displacement, Reciprocating, Rotary, Others |

| Positions Covered | Submersible, Non-Submersible |

| Driving Forces Covered | Engine Driven, Electrical Driven |

| End Uses Covered | Power Generation, Oil and Gas, Metal and Mining, Agriculture, Building Services, Water and Wastewater, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India industrial pumps and valves market performed so far and how will it perform in the coming years?

- What is the breakup of the India industrial pumps and valves market on the basis of product type?

- What is the breakup of the India industrial pumps and valves market on the basis of position?

- What is the breakup of the India industrial pumps and valves market on the basis of driving force?

- What is the breakup of the India industrial pumps and valves market on the basis of end use?

- What is the breakup of the India industrial pumps and valves market on the basis of region?

- What are the various stages in the value chain of the India industrial pumps and valves market?

- What are the key driving factors and challenges in the India industrial pumps and valves?

- What is the structure of the India industrial pumps and valves market and who are the key players?

- What is the degree of competition in the India industrial pumps and valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial pumps and valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial pumps and valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial pumps and valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)