India Industrial Robotics Software Market Size, Share, Trends and Forecast by Type of Software, Deployment Model, Functionality, Application, End-User Industry, and Region, 2025-2033

India Industrial Robotics Software Market Overview:

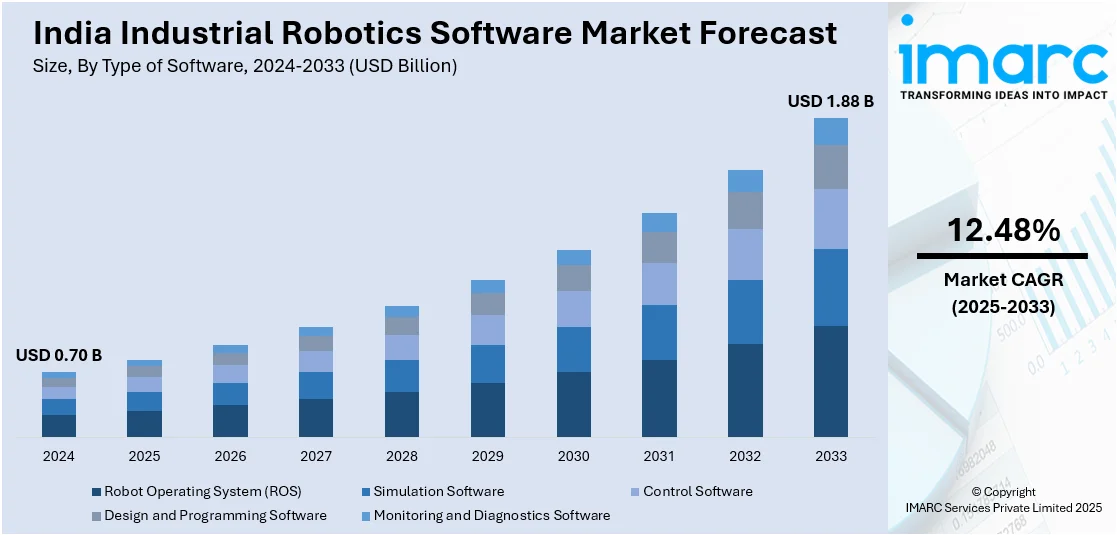

The India industrial robotics software market size reached USD 0.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.88 Billion by 2033, exhibiting a growth rate (CAGR) of 12.48% during 2025-2033. The market is driven by increasing automation in manufacturing, government initiatives like "Make in India," labor cost optimization, and the rise in smart factories. Additionally, advancements in AI and IoT integration, demand for precision and safety, and the need for operational efficiency significantly fuel India industrial robotics software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.70 Billion |

| Market Forecast in 2033 | USD 1.88 Billion |

| Market Growth Rate 2025-2033 | 12.48% |

India Industrial Robotics Software Market Trends:

Integration with Industrial IoT and Smart Factory Ecosystems

One of the most important trends transforming the software landscape of industrial robotics in India is its compatibility with Industrial Internet of Things (IIoT) and intelligent factory ecosystems. With manufacturers needing to upgrade and transform their facilities, they increasingly use software which integrates robots, sensors, devices, and cloud platforms to deliver real-time insights and analytics to improve productivity while minimizing downtime through predictive maintenance, energy management, and adaptive controls. Industrial robotics software today exists as part of a larger digital infrastructure, as per Industry 4.0 goals. This is a shift from isolated automation solutions to holistic, smart systems that offer actionable intelligence and maximize decision-making. As such, software developers are emphasizing interoperability and data compatibility to facilitate easy communication across varied industrial assets and platforms. For instance, as per industry reports, Indian robotics companies like Addverb, Ottonomy, and Ati Motors are leveraging NVIDIA’s AI and robotics technologies, including Isaac and Omniverse platforms, to drive global innovation in sectors such as automation, delivery, and industrial vehicles. These companies are utilizing advanced AI tools to enhance automation processes, optimize operations, and test robots through digital twins. As India’s robotics ecosystem expands, these technologies help scale solutions for industries ranging from healthcare to smart cities, positioning India as a key player in the global robotics market.

To get more information of this market, Request Sample

Rise in Customizable and Scalable Robotics Software Solutions

Another emerging trend in India industrial robotics software market growth is the flourishing demand for customizable and scalable solutions tailored to diverse manufacturing needs. Indian industries, especially SMEs, seek cost-effective software that can adapt to different robot types and operational scales. Vendors are responding by developing modular platforms with user-friendly interfaces and plug-and-play capabilities, allowing easy updates and feature integration. This approach empowers companies to start small and expand as production demands increase. Furthermore, cloud-based deployment models are gaining traction, enabling remote programming and monitoring while minimizing infrastructure costs. The flexibility and scalability of these solutions support rapid digital transformation in sectors like automotive, electronics, and pharmaceuticals, where dynamic market conditions require agile and responsive automation strategies. For instance, in January 2025, Ati Motors, an Indian autonomous mobile robot (AMR) startup, raised USD 20 Million to support its global expansion. With increasing demand for robotics in the U.S., India, and Southeast Asia, driven by a shift from Chinese dependency, Ati Motors focuses on in-house developed robots with advanced spatial awareness. The company has deployed hundreds of Sherpa robots, mainly in the automotive sector. Offering customizable robots through a Robots-as-a-Service (RaaS) model, Ati Motors provides scalable and adaptable automation solutions to meet growing industry needs.

India Industrial Robotics Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type of software, deployment model, functionality, application, and end-user industry.

Type of Software Insights:

- Robot Operating System (ROS)

- Simulation Software

- Control Software

- Design and Programming Software

- Monitoring and Diagnostics Software

The report has provided a detailed breakup and analysis of the market based on the type of software. This includes robot operating system (ROS), simulation software, control software, design and programming software, and monitoring and diagnostics software.

Deployment Model Insights:

- On-Premises Solutions

- Cloud-Based Solutions

- Hybrid Solutions

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes on-premises solutions, cloud-based solutions, and hybrid solutions.

Functionality Insights:

- Robot Programming and Development

- Path Planning and Navigation

- Collaborative Robots (Cobots) Software

- Machine Leaing and AI Integration

- Safety and Compliance Features

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes robot programming and development, path planning and navigation, collaborative robots (cobots) software, machine learning and AI integration, and safety and compliance features.

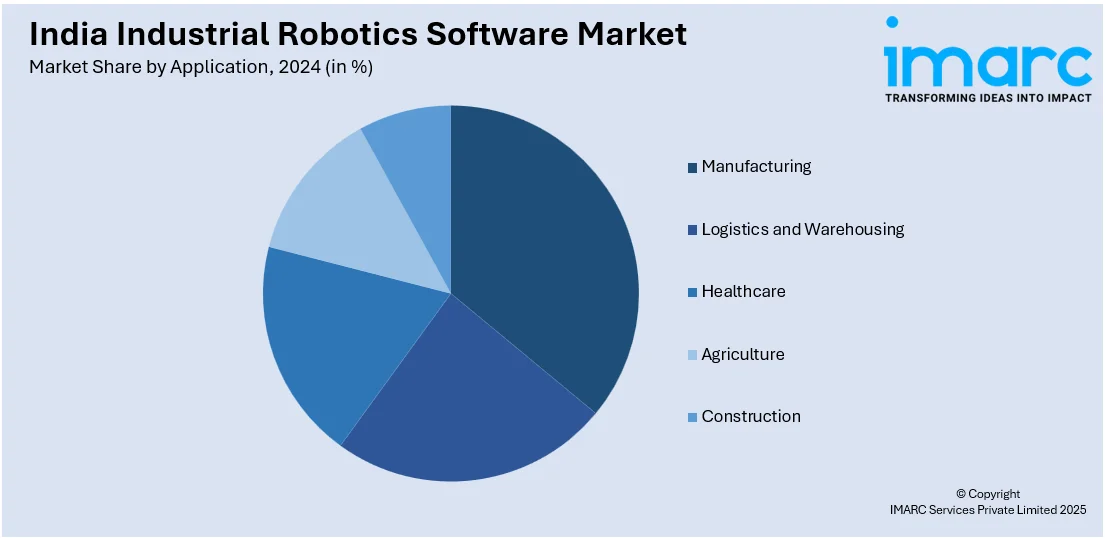

Application Insights:

- Manufacturing

- Logistics and Warehousing

- Healthcare

- Agriculture

- Construction

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes manufacturing, logistics and warehousing, healthcare, agriculture, and construction.

End-User Industry Insights:

- Aerospace and Defense

- Automotive

- Electronics

- Food and Beverage

- Pharmaceuticals

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes aerospace and defense, automotive, electronics, food and beverage, and pharmaceuticals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Robotics Software Market News:

- In March 2025, Twara Robotics, an Indian robotics startup, is revolutionizing manufacturing by developing indigenous automation solutions for the Indian industry. Incubated at ARTPARK, Twara focuses on creating high-quality actuators and robotic systems to reduce India’s dependency on imported technology. With a vision to support MSMEs, the company aims to bridge the automation gap through cost-effective, high-performance robots. Supported by the Indian government, Twara Robotics is advancing the “Make in India” initiative, contributing to the nation’s manufacturing growth by offering world-class, locally produced robotic solutions.

- In February 2025, Delta Electronics launched its D-Bot series Collaborative Robots (Cobots) at ELECRAMA 2025 in India, designed to enhance smart manufacturing with payloads up to 30 kg and speeds of 200 degrees per second. The cobots support diverse tasks like electronics assembly, welding, and materials handling. Delta also introduced a 240kW DC Fast EV Charger and an Industrial Power-protect Transformer-based UPS. Committed to sustainability, Delta's innovations aim to drive energy conservation, smart manufacturing, and contribute to India’s industrial transformation.

- In January 2025, Robot System Products (RSP), a Swedish company specializing in industrial robot accessories, inaugurated its first manufacturing facility in Chennai, India. This strategic move aims to capitalize on India's rapidly growing robotics market, enhance cost competitiveness through localized production, and establish India as a manufacturing hub for South Asia. RSP plans to expand its product range by leveraging the robust manufacturing network within the region as collaborations with local suppliers develop.

- In December 2024, CynLr, an Indian robotics startup, raised USD 10 Million in Series A funding to revolutionize industrial automation. The company aims to enhance its workforce, expand globally, and improve R&D for its modular, vision-enabled CyRo robot. CynLr’s technology addresses key challenges in object manipulation and customization, making automation more flexible and cost-effective.

India Industrial Robotics Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Software Covered | Robot Operating System (ROS), Simulation Software, Control Software, Design and Programming Software, Monitoring and Diagnostics Software |

| Deployment Models Covered | On-Premises Solutions, Cloud-Based Solutions, Hybrid Solutions |

| Functionalities Covered | Robot Programming and Development, Path Planning and Navigation, Collaborative Robots (Cobots) Software, Machine Learning and AI Integration, Safety and Compliance Features |

| Applications Covered | Manufacturing, Logistics and Warehousing, Healthcare, Agriculture, Construction |

| End-User Industries Covered | Aerospace and Defense, Automotive, Electronics, Food and Beverage, Pharmaceuticals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial robotics software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial robotics software market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial robotics software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India industrial robotics software market was valued at USD 0.70 Billion in 2024.

The India industrial robotics software market is projected to exhibit a CAGR of 12.48% during 2025-2033, reaching a value of USD 1.88 Billion by 2033.

The increasing need for automation in the electronics, automotive, and manufacturing sectors is driving the industrial robotics software market in India. Businesses are moving toward robotics-enabled efficiency due to digital transformation projects, Industry 4.0 adoption, and growing labor expenses, which is also fueling the market growth. Government policies supporting smart manufacturing and skilled workforce development further stimulate software innovation and deployment in robotics solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)