India Industrial Sand Market Size, Share, Trends and Forecast by Application, Product Type, Grade, End Use, and Region, 2025-2033

India Industrial Sand Market Overview:

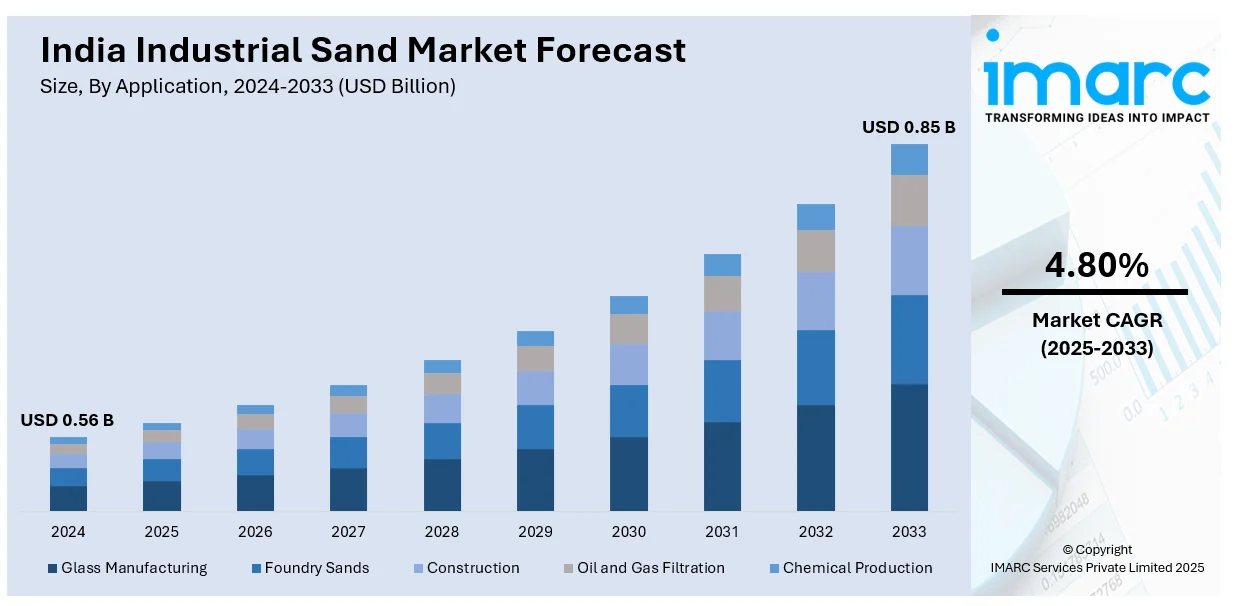

The India industrial sand market size reached USD 0.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.85 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. Developing construction and infrastructure activities, expanding glass and ceramics demand, growth in the automobile sector, expansion of oil and gas applications, innovations in sand processing technology, and sustainability initiatives that encourage sustainable sand extraction are stimulating the India industrial sand market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.56 Billion |

| Market Forecast in 2033 | USD 0.85 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

India Industrial Sand Market Trends:

Growing Demand from the Construction and Infrastructure Sector

The India industrial sand market share is expanding significantly due to the increasing demand from the construction and infrastructure sector. With rapid urbanization, government-led infrastructure projects, and rising real estate developments, the need for high-quality industrial sand in cement, concrete, and asphalt production is increasing. For instance, according to a research paper published on February 11, 2025, 600 million people would live in cities in India by 2036. Given that this urban growth is predicted to account for 75% of the country's GDP, sustainable urban planning is essential. Additionally, smart city initiatives and modern transportation projects, including highways and metro rail networks, are further boosting the market. The use of industrial sand in specialty applications, such as precast concrete and high-strength glass, is also gaining momentum. These factors collectively contribute to the expanding market share of industrial sand in India.

To get more information of this market, Request Sample

Rising Adoption in the Glass and Foundry Industries

The growing demand for industrial sand in the glass and foundry industries is driving the India industrial sand market. With the rising production of flat glass, fiberglass, and container glass, fueled by the automotive and packaging sectors, the need for high-purity silica sand is increasing. Additionally, foundries rely on industrial sand for metal casting applications, supporting the growth of the automotive and heavy machinery industries. The expansion of renewable energy projects, particularly in solar panel manufacturing, further strengthens the demand for industrial sand. For instance, in line with the country's sustainability goals, the Ministry of New & Renewable Energy (MNRE) announced major developments in India's renewable energy sector on December 31, 2024. India increased its installed capacity to over 214 GW in 2024 by adding 27 GW of renewable energy capacity, with wind energy accounting for 47.96 GW and solar energy for 94.17 GW. Furthermore, within ten months, the PM Surya Ghar: Muft Bijli Yojana installed 7 lakh rooftop solar systems, with an average of 70,000 installations per month. This represents a ten-fold increase over prior averages. As industries seek high-quality raw materials, there is an increase in demand of industrial sand which in turn is positively impacting India industrial sand market outlook.

India Industrial Sand Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application, product type, grade, and end use.

Application Insights:

- Glass Manufacturing

- Foundry Sands

- Construction

- Oil and Gas Filtration

- Chemical Production

The report has provided a detailed breakup and analysis of the market based on application. This includes glass manufacturing, foundry sands, construction, oil and gas filtration, and chemical production.

Product Type Insights:

- Round Grain

- Angular Grain

- Coarse Sand

- Fine Sand

The report has provided a detailed breakup and analysis of the market based on the product type. This includes round grain, angular grain, coarse sand, and fine sand.

Grade Insights:

- Industrial Grade

- Specialty Grade

- High Purity Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes industrial grade, specialty grade, and high purity grade.

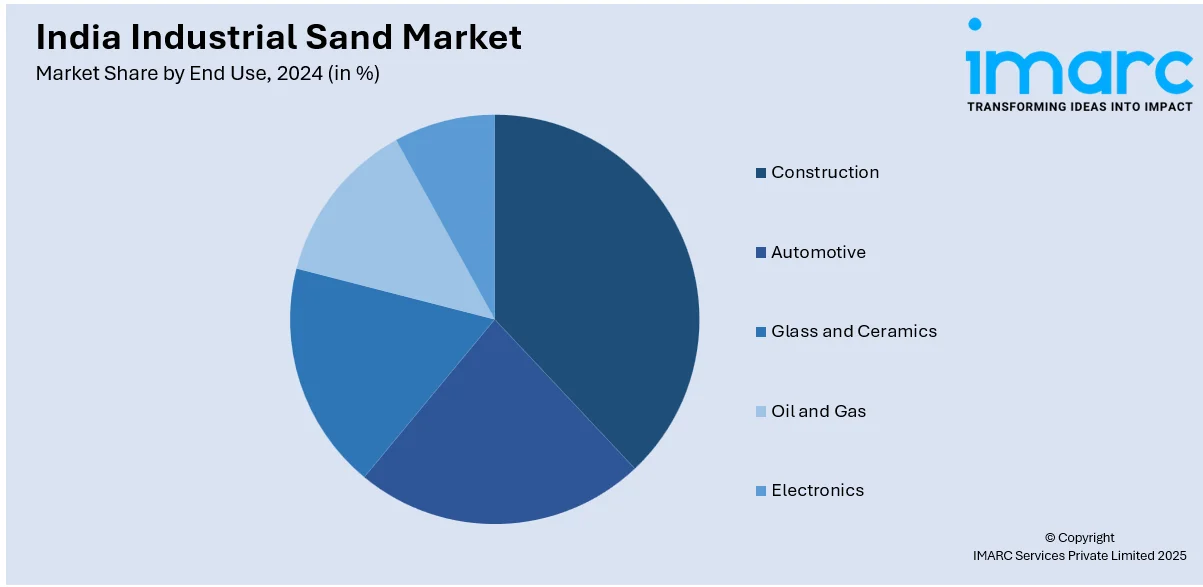

End Use Insights:

- Construction

- Automotive

- Glass and Ceramics

- Oil and Gas

- Electronics

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes construction, automotive, glass and ceramics, oil and gas, and electronics.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Industrial Sand Market News:

- On August 2, 2024, the Coimbatore District Small Industries Association (CODISSIA) made a request to the Tamil Nadu government to allow the region's foundries to resume receiving supply of silica sand from Andhra Pradesh. The competitiveness and sustainability of regional industries have been impacted by the higher procurement prices brought on by the discontinuation of these supplies. Restoring this supply chain is essential to preserving operational effectiveness and bolstering the financial sustainability of Coimbatore's small-scale enterprises, CODISSIA underlined.

India Industrial Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Glass Manufacturing, Foundry Sands, Construction, Oil and Gas Filtration, Chemical Production |

| Product Types Covered | Round Grain, Angular Grain, Coarse Sand, Fine Sand |

| Grades Covered | Industrial Grade, Specialty Grade, High Purity Grade |

| End Uses Covered | Construction, Automotive, Glass and Ceramics, Oil and Gas, Electronics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India industrial sand market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India industrial sand market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India industrial sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial sand market in India was valued at USD 0.56 Billion in 2024.

The India industrial sand market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 0.85 Billion by 2033.

Developing construction and infrastructure activities, expanding glass and ceramics demand, growth in the automobile sector, expansion of oil and gas applications, innovations in sand processing technology, and sustainability initiatives that encourage sustainable sand extraction are stimulating the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)