India Infant Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

India Infant Healthcare Products Market Overview:

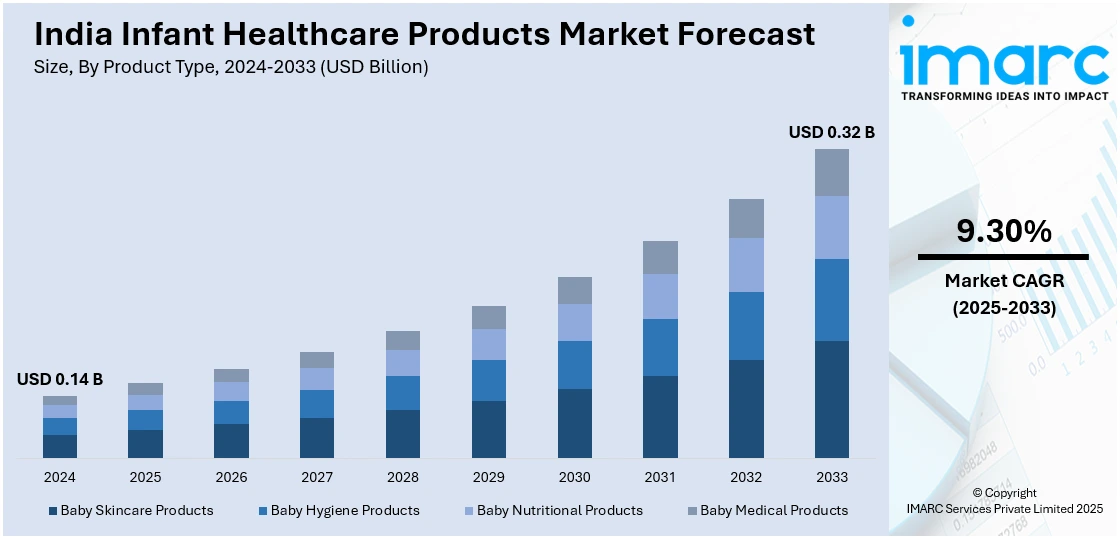

The India infant healthcare products market size reached USD 0.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.32 Billion by 2033, exhibiting a growth rate (CAGR) of 9.30% during 2025-2033. The market is influenced by rising awareness of baby hygiene and health, growth in disposable income, urbanization, and increasing e-commerce penetration, with parents focusing on quality, safety, and convenience of products for babies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.14 Billion |

| Market Forecast in 2033 | USD 0.32 Billion |

| Market Growth Rate 2025-2033 | 9.30% |

India Infant Healthcare Products Market Trends:

Rising Demand for Organic and Natural Products

Indian parents are increasingly preferring organic and natural infant care products as concerns regarding the ill effects of synthetic chemicals have grown. Products, such as natural baby lotions, shampoos, and diaper creams containing natural extracts are becoming more popular. For instance, in June 2023, Adorica Care introduced its line of natural baby care products, such as hair oil, lotion, shampoo, and massage oil, in India for infant skincare requirements. Furthermore, the increased awareness about the advantages of chemical-free products has prompted companies to innovate through plant-based and hypoallergenic products. Moreover, the need for green and bio-degradable packing has increased due to the ever-growing environmental sensitivity of consumers. Ayurvedic and herbal formulations, based on India's heritage of traditional medical practices, too have gained solid ground in infant healthcare. Stress on safety, ingredient transparency and certifications such as organic and cruelty-free labels augment the demand as well. With increasing numbers of parents opting for toxin-free and eco-friendly choices, the segment keeps growing, impacting buying decisions in urban as well as rural markets.

To get more information of this market, Request Sample

Technological Integration in Infant Healthcare

Technology innovations are transforming India's infant healthcare market, increasing both product quality and healthcare services. Intelligent baby monitors, temperature-sensitive clothing, and smart healthcare products give parents constant feedback about the health of their baby. Wearable technologies monitor vital signs, sleep activity, and motion, providing early signs of emerging health problems. Telehealth services have also increased significantly, with online consultations from pediatricians and lactation specialists. AI-based apps give customized advice on nutrition, milestones of growth, and developmental exercises. Electronic healthcare records are also gaining popularity with easy access to medical history and immunization timelines. E-commerce websites also make it easy to access a vast array of infant healthcare products. The convergence of smart technologies raises the confidence level of parents, especially working parents, ensuring babies get ongoing and proactive care.

Increased Focus on Preventive Healthcare

Infant preventive healthcare has become more in focus with parents valuing early-stage health care. Immunizations, nutrition supplements, and fortified foods are highly advertised for treating widespread infant health issues. Probiotic and vitamin-and-mineral-fortified nutritional products are becoming more popular for aiding immune health and cognitive function. For example, in October 2024, Nestlé India launched a no-added-sugar Cerelac baby food range, matching increasing consumer demand for healthier infant nutrition products in the Indian market. Furthermore, DHA-enriched, ARA-enriched, prebiotic-enriched infant formula has become popular as a complement to breastfeeding. Active oral care products such as fluoride-free toothpaste and silicone finger brushes help maintain oral health from an early age. The increasing knowledge regarding neonatal screening and early diagnostic tests also ensured timely diagnosis and management of congenital diseases. The importance of preventive care is further stressed through regular pediatric check-ups, developmental evaluations, and vaccinations. This trend towards preemptive care continues to propel innovation and diversification of products in the Indian infant healthcare market.

India Infant Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Product Type Insights:

- Baby Skincare Products

- Lotions

- Oils

- Creams

- Baby Hygiene Products

- Diapers

- Wipes

- Sanitizers

- Baby Nutritional Products

- Infant Formula

- Vitamins

- Supplements

- Baby Medical Products

- Thermometers

- Nasal Aspirators

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby skincare products (lotions, oils, and creams), baby hygiene products (diapers, wipes, and sanitizers), baby nutritional products (infant formula, vitamins, and supplements), and baby medical products (thermometers, and nasal aspirators).

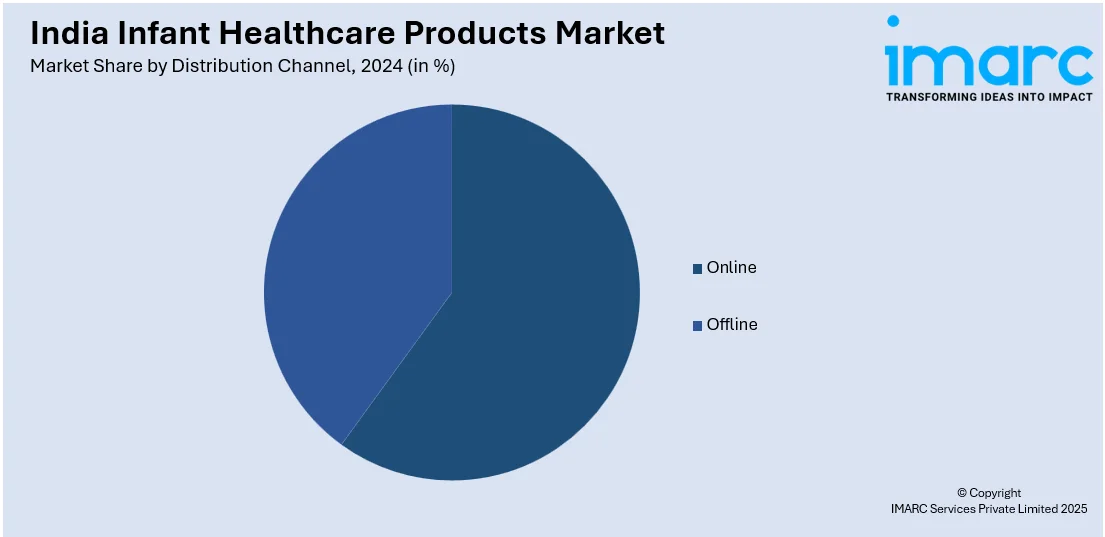

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Age Group Insights:

- 0–6 Months

- 6–12 Months

- 1–3 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0–6 months, 6–12 months, and 1–3 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Infant Healthcare Products Market News:

- In December 2024, R for Rabbit launched Feather Diapers in India bringing with it smart diapers that come equipped with advance wetness detection, super-soft material, and total comfort. A modern parenting product, these diapers are designed to offer a hassle-free experience to both parents and babies, highlighting the brand's focus on smart, easy baby care solutions.

- In November 2023, TERRA launches certified organic biodegradable baby wipes in India, formulated with pure New Zealand waters. In Manuka Honey, Kiwifruit, and Pure Water varieties, they are safe for skin, face, and mouth. SGS, FSC, and Dermatest certified, TERRA promises eco-friendly, chemical-free baby and skin care.

India Infant Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0–6 Months, 6–12 Months, 1–3 Years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India infant healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the India infant healthcare products market on the basis of product type?

- What is the breakup of the India infant healthcare products market on the basis of distribution channel?

- What is the breakup of the India infant healthcare products market on the basis of age group?

- What is the breakup of the India infant healthcare products market on the basis of region?

- What are the various stages in the value chain of the India infant healthcare products market?

- What are the key driving factors and challenges in the India infant healthcare products?

- What is the structure of the India infant healthcare products market and who are the key players?

- What is the degree of competition in the India infant healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India infant healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India infant healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India infant healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)