India Instant Noodles Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

India Instant Noodles Market Summary:

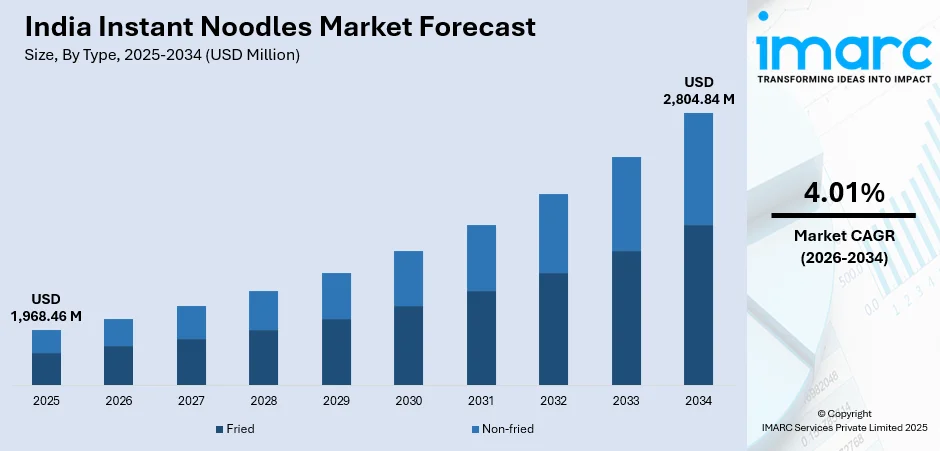

The India instant noodles market size was valued at USD 1,968.46 Million in 2025 and is projected to reach USD 2,804.84 Million by 2034, growing at a compound annual growth rate of 4.01% from 2026-2034.

Rapid urbanization and changing consumer lifestyles that value convenience without sacrificing flavor are driving the Indian instant noodle market. The need for quick meal solutions has increased due to the growth of nuclear families and working professionals in metropolitan and tier-two cities. Expanding modern retail infrastructure and rising disposable incomes have improved customer reach and market accessibility. Product innovation in India's instant noodle market share, including a diversity of taste profiles and healthier formulas, continues to draw in new customer segments looking for variety and nutritional value.

Key Takeaways and Insights:

-

By Type: Fried dominates the market with a share of 70% in 2025, owing to its superior texture, enhanced flavor profiles, and longer shelf life that consumers prefer. The deep-frying process creates a distinctive crunchiness and rich aroma while enabling faster rehydration during preparation, making it the preferred choice.

-

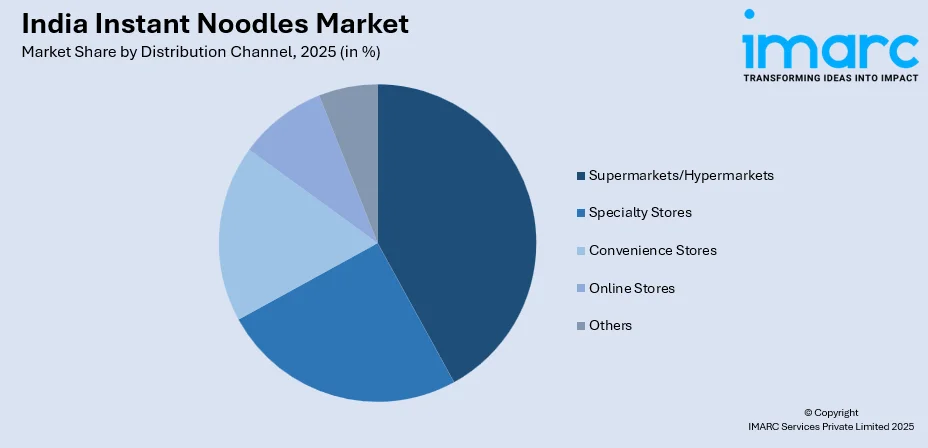

By Distribution Channel: Supermarkets/Hypermarkets lead the market with a share of 42% in 2025. This dominance is driven by customer-friendly shopping environments, extensive product assortments from multiple brands, and strategic promotional activities that attract convenience-seeking urban consumers.

-

By Region: North India is the largest region with 29% share in 2025, driven by high population density across major metropolitan centers, strong consumer preference for spicy masala flavors, and well-established distribution networks across both urban and semi-urban areas.

-

Key Players: Key players drive the India instant noodles market by continuously expanding product portfolios, introducing innovative flavors, and strengthening nationwide distribution. Their investments in marketing, health-focused variants, and partnerships with retailers boost awareness.

To get more information on this market Request Sample

The India instant noodles market continues to demonstrate resilience and adaptability amid evolving consumer preferences and competitive dynamics. Market participants are increasingly focusing on product diversification, introducing Korean-inspired flavors, millet-based formulations, and reduced-sodium variants to capture health-conscious demographics. According to the World Instant Noodles Association, India ranked third globally in instant noodle consumption with approximately 8,678 Million servings in 2023, reflecting a substantial year-on-year increase of over fourteen percent. This consumption trajectory underscores the deep-rooted acceptance of instant noodles as a convenient meal solution across diverse income segments and geographic regions. The market landscape is further shaped by expanding quick commerce platforms and digital retail channels that enhance product accessibility and consumer convenience, particularly in urban and semi-urban markets where time-constrained consumers seek rapid meal preparation options.

India Instant Noodles Market Trends:

Korean Flavor Revolution Reshaping Consumer Preferences

The growing influence of Korean pop culture, including K-dramas and K-pop, has catalyzed unprecedented demand for authentic Korean-style instant noodles across India. People are increasingly looking for spicy ramen options that mimic real Korean flavors, especially millennials and Generation Z. Major domestic manufacturers have responded by launching dedicated Korean flavor variants to capitalize on this cultural affinity. For instance, in October 2024, VRB Consumer Products Pvt. Ltd. announced its expansion in the cup noodles segment with the launch of WokTok by Veeba. The brand focused on catering to Indian taste preferences and offered five delicious and distinctive flavors, which include Chowmein, Masala, Manchurian, Kung Pao, and Spicy Korean.

Health-Conscious Product Innovation and Reformulation

Manufacturers are actively developing healthier instant noodle formulations incorporating whole grains, millets, oats, and reduced sodium content to address growing consumer health awareness. In September 2023, Slurrp Farm, an India brand founded by two mothers, came up with healthy instant noodles for children, which are made with millets. These noodles do not contain preservatives, and they are air dried. Furthermore, the emergence of non-fried variants, fortified options, and products utilizing traditional Ayurvedic ingredients reflects the industry's commitment to nutritional enhancement. Companies are eliminating artificial preservatives and promoting clean-label products that appeal to wellness-focused consumers. This reformulation trend enables manufacturers to attract previously hesitant consumer segments while maintaining the convenience proposition.

Quick Commerce and Digital Retail Transformation

The dynamics of instant noodle distribution in urban India have completely changed due to the explosive growth of quick commerce platforms that provide delivery in a matter of minutes. As digital-first customers embrace online grocery shopping for convenience and variety, e-commerce platforms are growing at an accelerated rate. On these platforms, multi-pack bundles and subscription models have become popular due to their better shipping economics and value propositions. Manufacturers may now target previously underserved customer niches thanks to this digital shift, which is also changing route-to-market methods.

Market Outlook 2026-2034:

The India instant noodles market is poised for sustained expansion throughout the forecast period, driven by continued urbanization, rising disposable incomes, and evolving dietary preferences favoring convenient meal solutions. Product innovation across flavor profiles, packaging formats, and nutritional enhancements will remain central to competitive differentiation strategies. The market generated a revenue of USD 1,968.46 Million in 2025 and is projected to reach a revenue of USD 2,804.84 Million by 2034, growing at a compound annual growth rate of 4.01% from 2026-2034. Expansion of modern retail infrastructure and digital commerce channels will enhance product accessibility across tier-two and tier-three cities, unlocking substantial growth potential in previously underserved markets.

India Instant Noodles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Fried | 70% |

| Distribution Channel | Supermarkets/Hypermarkets | 42% |

| Region | North India | 29% |

Type Insights:

- Fried

- Non-fried

Fried dominates with a market share of 70% of the total India instant noodles market in 2025.

Due to unique textural features and improved flavor profiles that appeal to Indian consumers, the fried instant noodles market continues to dominate. The porous noodle structure produced by the deep-frying production technique at regulated temperatures allows for quick rehydration during preparation, producing reliable cooking outcomes in a matter of minutes. Fried variations are financially feasible for wide distribution networks thanks to this processing technique, which prolongs product shelf life while maintaining taste integrity. Demand for fried noodles is sustained across all demographic groups because consumers are familiar with their distinctive crunch and scent.

Cost-effective manufacturing economics enable competitive retail pricing for price-conscious consumer segments, which benefits fried noodles. In order to minimize oil absorption while preserving the desired textural qualities that consumers anticipate, major producers have perfected frying processes. The segment's adaptability allows for a wide range of regional taste modifications, from modern Korean-inspired formulations to classic masala variations. For satisfying ongoing consumer demand in India's urban and rural markets, industry players are continuing to invest in the expansion of production capacity for the production of fried noodles.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets/Hypermarkets lead with a share of 42% of the total India instant noodles market in 2025.

Supermarkets/hypermarkets maintain distribution leadership through customer-friendly shopping environments that accommodate one-stop purchasing across extensive product categories. These modern retail formats offer consumers access to comprehensive instant noodle assortments from multiple brands under single rooftops, enabling convenient comparison and selection. Strategic promotional activities including discounts, loyalty programs, and bundled offerings drive foot traffic and purchase conversion. The organized retail sector continues expanding its footprint across urban India, with the food and grocery retail market valued at approximately seven hundred nineteen billion dollars in recent estimates, underscoring substantial growth potential for instant noodle distribution through these channels.

Supermarket/hypermarket operators leverage dedicated shelf space and strategic product placement to enhance instant noodle visibility and impulse purchasing behavior. These retail formats facilitate product sampling initiatives and promotional campaigns that manufacturers deploy to introduce new variants and build brand awareness. The expansion of organized retail chains into tier-two and tier-three cities is progressively extending modern trade coverage beyond traditional metropolitan strongholds. Premium and imported instant noodle variants find natural positioning within these retail environments where consumers seek variety and quality assurance alongside trusted shopping experiences that traditional kirana stores cannot replicate.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India instant noodles market in 2025.

North India commands regional leadership through substantial population concentration across major metropolitan centers including Delhi, Uttar Pradesh, Punjab, and Haryana that collectively drive consumption volumes. Consumer preferences in this region favor robust spicy masala flavor profiles and paneer-based variants that align with regional culinary traditions. Well-established distribution networks encompassing traditional kirana stores alongside expanding modern retail infrastructure ensure comprehensive product accessibility across urban and rural markets. The region benefits from strong manufacturer presence with production facilities strategically located to serve northern consumer markets efficiently.

The northern region demonstrates elevated consumption frequency driven by student populations, working professionals, and time-constrained households seeking convenient meal solutions. Rising disposable incomes across tier-two cities including Lucknow, Jaipur, and Chandigarh are expanding the addressable consumer base beyond traditional metropolitan strongholds. Quick commerce platforms have achieved significant penetration in northern metropolitan markets, enhancing product accessibility and purchase convenience for digitally-connected consumers. Manufacturers continue prioritizing distribution expansion and localized marketing initiatives to capitalize on the region's substantial growth potential.

Market Dynamics:

Growth Drivers:

Why is the India Instant Noodles Market Growing?

Accelerating Urbanization and Lifestyle Transformation

India's urban transformation continues reshaping consumption patterns as metropolitan expansion accelerates migration from rural areas to cities offering employment opportunities and improved living standards. The country's urban population continues growing steadily, with this proportion projected to increase substantially through the coming decade as industrialization and service sector expansion attract workforce migration. Urban dwellers demonstrate pronounced preferences for convenient ready-to-eat meal solutions that minimize preparation time while delivering satisfying taste experiences. The demanding schedules characteristic of urban professional life create consistent demand for quick meal options that instant noodles effectively address. Rising participation of women in the formal workforce has further intensified household reliance on convenient food products that reduce domestic cooking burdens. Metropolitan households increasingly incorporate instant noodles into regular meal rotation patterns rather than treating them solely as occasional convenience items. The emergence of nuclear family structures replacing traditional joint family arrangements has amplified demand for individually portioned convenient meals suited to smaller household sizes.

Expanding Modern Retail Infrastructure and Distribution Networks

The proliferation of supermarkets, hypermarkets, and organized retail formats across Indian cities has significantly enhanced instant noodle accessibility and consumer exposure to diverse product offerings. India's food and grocery retail market was valued at approximately seven hundred nineteen billion dollars in recent estimates, reflecting the substantial scale and growth trajectory of organized grocery distribution. Modern retail environments provide manufacturers with strategic platforms for product launches, promotional campaigns, and brand building activities that drive consumer awareness and trial. The expansion of organized retail into tier-two and tier-three cities is progressively extending market reach beyond traditional metropolitan strongholds. Quick commerce platforms offering rapid delivery have emerged as transformative distribution channels, particularly appealing to urban consumers prioritizing convenience. These digital retail innovations complement traditional distribution networks, creating comprehensive market coverage that maximizes product accessibility.

Product Innovation and Flavor Diversification Strategies

Manufacturers are demonstrating sustained commitment to product innovation through introduction of diverse flavor variants, healthier formulations, and premium offerings that address evolving consumer preferences. The emergence of Korean-inspired flavor profiles has created an entirely new premium segment attracting younger consumers influenced by Korean popular culture and entertainment. Health-focused innovations incorporating millets, whole grains, reduced sodium content, and fortification with essential nutrients are expanding the addressable consumer base beyond traditional instant noodle consumers. Regional flavor adaptations catering to local taste preferences across different Indian states enable manufacturers to strengthen market penetration in diverse geographic markets. Packaging innovations including single-serve portions, cup formats, and multi-pack bundles provide consumers with convenient options suited to various consumption occasions. These innovation investments enable manufacturers to maintain competitive differentiation while addressing the diverse requirements of heterogeneous consumer segments.

Market Restraints:

What Challenges the India Instant Noodles Market is Facing?

Health and Nutrition Perception Concerns

Consumer awareness regarding nutritional implications of processed foods has intensified scrutiny of instant noodle ingredients, particularly concerning elevated sodium levels and artificial additives. Health experts continue raising concerns about long-term consumption patterns potentially contributing to lifestyle diseases. This growing health consciousness compels manufacturers to invest substantially in reformulation initiatives addressing nutritional concerns while maintaining taste appeal.

Stringent Regulatory Compliance Requirements

The Food Safety and Standards Authority of India has implemented rigorous quality standards governing instant noodle manufacturing, packaging, and labeling requirements. Compliance with evolving regulatory frameworks necessitates ongoing investments in quality control systems and testing infrastructure. Manufacturers face administrative burdens associated with maintaining regulatory adherence across multiple product variants and manufacturing facilities.

Intense Competitive Pressure and Market Fragmentation

The instant noodles market features numerous domestic and international competitors engaged in aggressive pricing and promotional activities that compress profit margins. New market entrants including regional brands and imported products intensify competitive dynamics, particularly in premium segments. Established players must continuously invest in marketing expenditure and distribution expansion to defend market positions against emerging competitors.

Competitive Landscape:

The India instant noodles market exhibits a consolidated competitive structure dominated by established multinational and domestic players commanding substantial combined market share. Leading participants leverage extensive distribution networks, strong brand equity, and continuous product innovation to maintain competitive positioning. Companies are increasingly investing in manufacturing capacity expansion, health-focused product development, and digital marketing initiatives to capture evolving consumer preferences. Strategic acquisitions and partnerships are reshaping competitive dynamics as market participants seek to strengthen portfolio breadth and distribution capabilities. Private label offerings from organized retailers are emerging as competitive alternatives, compelling branded manufacturers to reinforce value propositions and consumer loyalty programs.

Recent Developments:

-

In October 2025, Nestlé India commissioned a new Maggi noodles production line at its Sanand factory in Gujarat with an investment of approximately INR 85 Crore. The expansion adds around 20,600 tons of annual production capacity, increasing total facility output.

India Instant Noodles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fried, Non-fried |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India instant noodles market size was valued at USD 1,968.46 Million in 2025.

The India instant noodles market is expected to grow at a compound annual growth rate of 4.01% from 2026-2034 to reach USD 2,804.84 Million by 2034.

Fried dominated the market with a share of 70%, driven by superior texture characteristics, enhanced flavor profiles, and consumer preference for the distinctive crunchiness and rapid rehydration properties.

Key factors driving the India instant noodles market include accelerating urbanization, rising working population, expanding modern retail infrastructure, product innovation, and growing quick commerce penetration.

Major challenges include health and nutrition perception concerns, stringent regulatory compliance requirements, intense competitive pressure from domestic and international players, and evolving consumer preferences toward healthier alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)