India Instrument Transformers Market Size, Share, Trends and Forecast by Type, Voltage, Enclosure Type, Cooling Method, Application, End User, and Region, 2026-2034

India Instrument Transformers Market Overview:

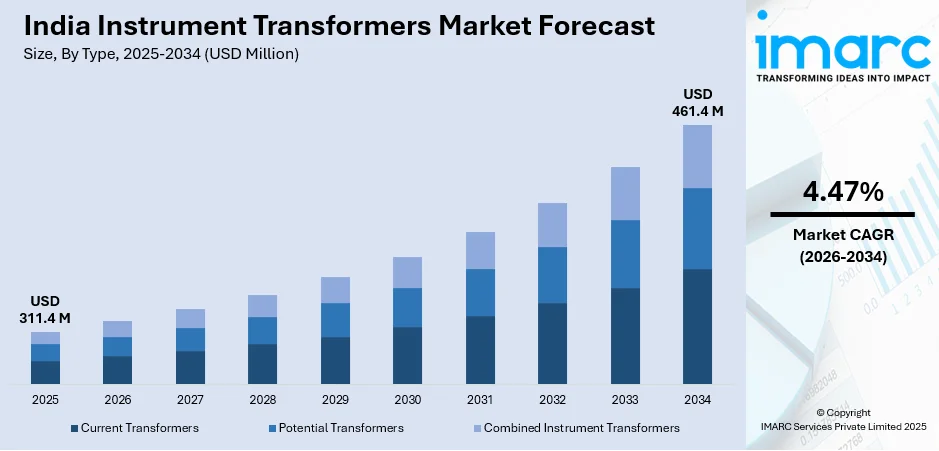

The India instrument transformers market size reached USD 311.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 461.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. The market is growing as a result of rising power infrastructure developments, expanding electrification demand, and expanding transformer manufacturing investments. Moreover, improvements in voltage regulation, smart grid integration, and local production capacity are impelling market growth, thereby improving grid reliability, and lowering dependence on large substations.

Key Takeaways:

- The instrument transformers market in India reached USD 311.4 million in 2025.

- By 2034, the market value is anticipated to reach USD 461.4 million, with a CAGR of nearly 4.47% from 2026-2034.

- Major growth drivers include increasing investments in power transmission and distribution infrastructure, growing demand for reliable electricity supply, rapid industrialization, and the rising integration of renewable energy sources across India’s power grid.

- Segmentation Highlights:

- Type: Current Transformers, Potential Transformers, Combined Instrument Transformers.

- Voltage: Distribution Voltage, Sub-Transmission Voltage, High Voltage Transmission, Extra High Voltage Transmission, Ultra-High Voltage Transmission.

- Enclosure Type: Indoor, Outdoor.

- Cooling Method: Dry-Type, Oil Immersion.

- Application: Transformer and Circuit Breaker Bushing, Switchgear Assemblies, Relaying, Metering, and Protection.

- End User: Power Utilities, Power Generation, Railways and Metros, Industries and OEMs.

- Regional Insights: North, South, East, and West India are analyzed, with the report highlighting growth drivers and opportunities in each region.

To get more information on this market, Request Sample

India Instrument Transformers Market Trends:

Advancements in Power Distribution InfrastructureIndia's power industry is witnessing a revolution with a growing emphasis on efficient and consistent energy delivery. In addition, the demand for advanced instrument transformers is driven by the need for a stable power supply, particularly in rural and unserved areas. Along with this, the thrust provided by the government to drive electrification and upgrade infrastructure has further boosted the trend. As power consumption rises, the need to incorporate state-of-the-art transformer solutions has become imperative to regulate voltage and transmission efficiently. For example, in September 2024, Nissin Electric launched India's first micro substation with a Power Voltage Transformer (PVT) under a demonstration project with Tata Power Delhi Distribution Limited. This innovation is designed to offer stable power in regions that do not have an adequate grid system, minimizing dependence on big substations. Furthermore, this technology enhances grid efficiency and loss minimization by facilitating direct voltage conversion from high-voltage transmission lines. The use of micro substations is likely to increase power accessibility while lowering infrastructure expenses. As power distribution and utility companies embrace similar technologies, the market for instrument transformers for such uses is expected to further flourish. Besides this, growth in transmission and distribution networks, backed by smart grid programs, will also drive the instrument transformers market in India.

Growing Investments in Transformer Manufacturing

Large investments in manufacturing and technology enhancements are supporting the Indian market for instrument transformers. Increased demand for effective voltage control solutions across industrial, commercial, and utility applications has motivated local and foreign companies to increase their manufacturing capacities. Apart from that, growing localization initiatives and incentives for local manufacturing are also contributing significantly towards consolidating the market. In October 2024, Standex International acquired Narayan Powertech Pvt. Ltd., expanded its presence in India’s instrument transformers market. This acquisition enhances domestic manufacturing capabilities, particularly in low to medium voltage transformers. Standex is focused on addressing the growing demand for instrument transformers in energy infrastructure projects, industrial uses, and smart grids, with Narayan Powertech's experience leveraged. These investments are not just enhancing production capabilities but also bringing technological innovation. Furthermore, the expansion of the local manufacturing setup minimizes the dependence on imports and enhances the global supply chain position of India. Also, strategic acquisitions and collaborations in the transformer industry are anticipated to bring forth new product launches and enhance cost-effectiveness. Through ongoing investments in research, development, and expansion of capacity, the Indian instrument transformers market is set to record steady growth.

India Instrument Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, voltage, enclosure type, cooling method, application, and end user.

Type Insights:

- Current Transformers

- Potential Transformers

- Combined Instrument Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes current transformers, potential transformers, and combined instrument transformers.

Voltage Insights:

- Distribution Voltage

- Sub-Transmission Voltage

- High Voltage Transmission

- Extra High Voltage Transmission

- Ultra-High Voltage Transmission

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes distribution voltage, sub-transmission voltage, high voltage transmission, extra high voltage transmission, and ultra-high voltage transmission.

Enclosure Type Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the enclosure type have also been provided in the report. This includes indoor and outdoor.

Cooling Method Insights:

- Dry-Type

- Oil Immersion

A detailed breakup and analysis of the market based on the cooling method have also been provided in the report. This includes dry-type and oil immersion.

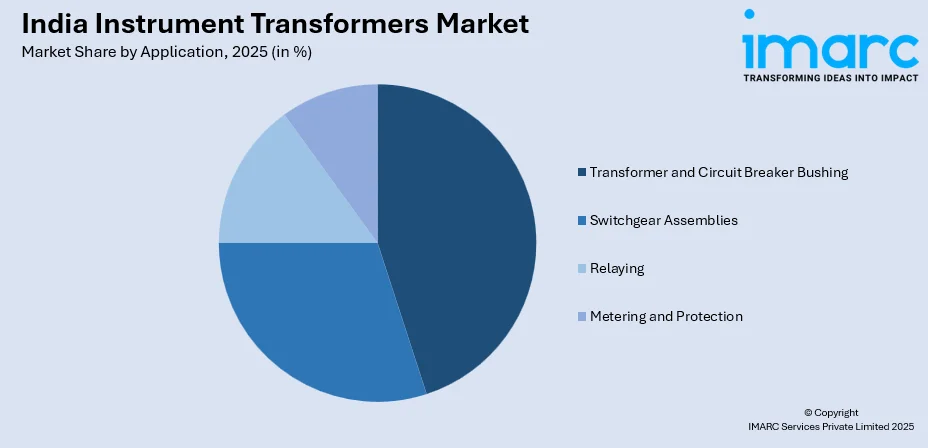

Application Insights:

- Transformer and Circuit Breaker Bushing

- Switchgear Assemblies

- Relaying

- Metering and Protection

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes Transformer and Circuit Breaker Bushing, Switchgear Assemblies, Relaying, Metering and Protection.

End User Insights:

- Power Utilities

- Power Generation

- Railways and Metros

- Industries and OEMs

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes power utilities, power generation, railways and metros, and industries and OEMs.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Instrument Transformers Market News:

- February 2025: Transformers & Rectifiers (India) Ltd (TARIL) introduced 245kV high-voltage bushings under its backward integration strategy. Manufactured at its Changodar plant, this advancement enhances transformer efficiency, strengthens domestic manufacturing, reduces import reliance, and improves supply chain resilience in India’s instrument transformers industry.

- February 2025: Hitachi Energy expanded its transformer facilities in Mysore and Halol, increasing production capacity for insulation pressboards and transformer bushings. This investment strengthens domestic manufacturing, reduces import dependency, enhances supply chain efficiency, and supports India's self-reliance in the instrument transformers segment.

India Instrument Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Current Transformers, Potential Transformers, Combined Instrument Transformers |

| Voltages Covered | Distribution Voltage, Sub-Transmission Voltage, High Voltage Transmission, Extra High Voltage Transmission, Ultra-High Voltage Transmission |

| Enclosure Types Covered | Indoor, Outdoor |

| Cooling Methods Covered | Dry-Type, Oil Immersion |

| Applications Covered | Transformer and Circuit Breaker Bushing, Switchgear Assemblies, Relaying, Metering and Protection |

| End Users Covered | Power Utilities, Power Generation, Railways and Metros, Industries and OEMs |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India instrument transformers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India instrument transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India instrument transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The instrument transformers market in India was valued at USD 311.4 Million in 2025.

The India instrument transformers market is projected to exhibit a (CAGR) of 4.47% during 2026-2034, reaching a value of USD 461.4 Million by 2034.

Key drivers are power infrastructure growth, boosting demand for efficient transmission systems, and government emphasis on electrification. Rising investments in renewable energy projects and smart grids also drive demand. Instrument transformers play a critical role in measurement and protection in substations and industrial networks and facilitate the modernization of India's power distribution network.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)