India Insulated Wire and Cable Market Size, Share, Trends and Forecast by Type, Rating, Product Installation, End User, and Region, 2025-2033

India Insulated Wire and Cable Market Overview:

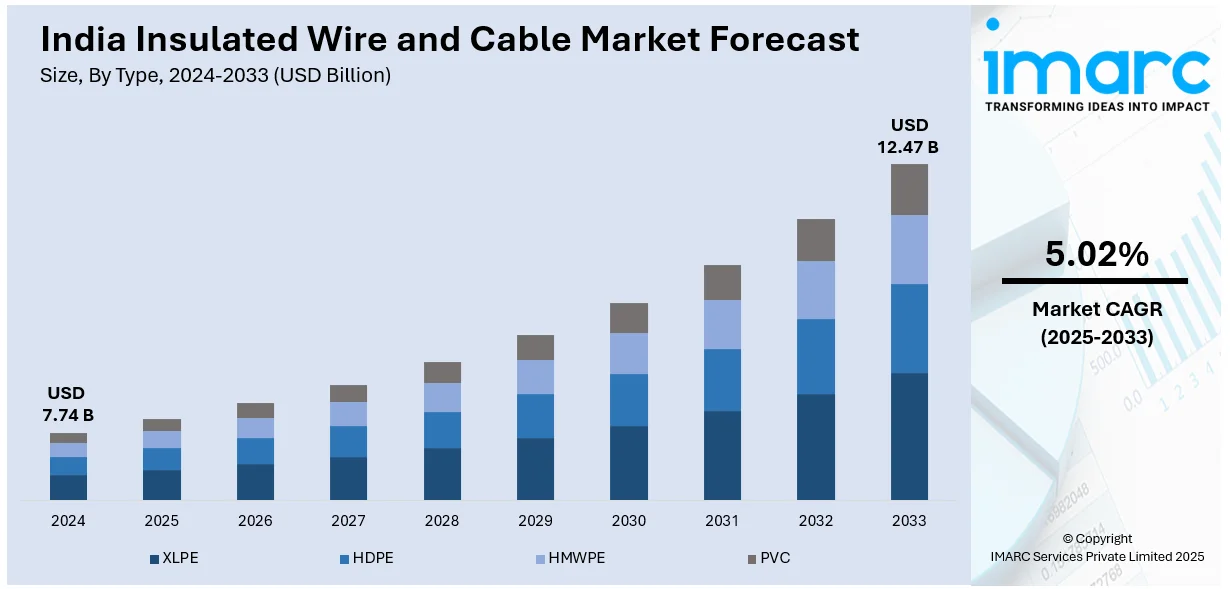

The India insulated wire and cable market size reached USD 7.74 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.47 Billion by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. The India insulated wire and cable market is growing due to expanding power transmission networks, stricter fire safety regulations, and rising demand for energy-efficient solutions. Government initiatives, regulatory compliance, and advancements in insulation technology are driving adoption across industries, ensuring reliability, safety, and sustainability in electrical systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.74 Billion |

| Market Forecast in 2033 | USD 12.47 Billion |

| Market Growth Rate 2025-2033 | 5.02% |

India Insulated Wire and Cable Market Trends:

Expansion of Power Transmission and Distribution Networks

The rise of power transmission and distribution (T&D) infrastructure is driving the demand for insulated wire and cable in India. For instance, in 2025, KEC International announced securing ₹1,445 crore in orders for Transmission & Distribution (T&D) projects in India. These include the construction of ± 800 kV HVDC and 400 kV transmission lines awarded by Power Grid Corporation of India Limited (PGCIL). Government initiatives aimed at modernizing the electrical grid and incorporating renewable energy sources are encouraging the installation of high-performance cables for effective power transmission. The transition to ultra-high voltage (UHV) and extra-high voltage (EHV) transmission systems generates a demand for superior insulation materials capable of enduring significant electrical loads and extreme environmental conditions. Improving outdated T&D infrastructure, especially in rural and semi-urban regions, is further supporting the growth of the market. Increasing electrification initiatives, such as international power links and local transmission paths, are driving investments in sturdy, low-loss insulated cables.

To get more information of this market, Request Sample

Rising Demand for Fire-Resistant and Safety-Compliant Cables

Strict safety regulations and growing awareness about fire risks are boosting the demand for halogen-free and fire-resistant insulated wire and cable in India. Residential, commercial, and industrial structures need low-smoke, flame-resistant wiring options to reduce fire hazards and guarantee the safety of occupants. Adhering to revised building codes and electrical safety regulations is encouraging manufacturers to create cables with enhanced insulation materials that avoid short circuits and electrical malfunctions. As authorities implement stringent fire safety regulations, real estate developers and infrastructure planners are focusing on high-performance insulated cables that improve overall electrical system reliability and decrease potential risks. In 2024, R R Kabel launched the Firex LS0H-EBXL house wire, featuring Electron Beam Cross Linked (EBXL) technology for enhanced safety and durability. This halogen-free, non-toxic wire could withstand temperatures up to 900°C, offered 103% higher current capacity, and provided superior flame retardancy. It complied with global safety standards and ideal for use in public and commercial buildings, meeting recent CEA regulations.

Growing Focus on Energy-Efficient and Sustainable Solutions

The shift towards energy-efficient and sustainable electrical options is catalyzing the demand for insulated wire and cable in India. The growing focus on minimizing energy losses and enhancing system efficiency is leading to the use of low-resistance cables that feature better insulation characteristics. Regulatory measures encouraging energy efficiency and strict safety regulations are encouraging manufacturers to create cables featuring flame-retardant, halogen-free, and eco-friendly insulation materials. The increasing demand for recyclable and lead-free insulation is transforming material choices and manufacturing methods within the industry. additionally, innovations in cable design, such as self-repairing insulation and nano-composite materials, are improving performance and lowering maintenance expenses. Emphasizing sustainable infrastructure growth is securing ongoing investment in innovative insulated wire and cable solutions across multiple industries. In 2024, Finolex Cables introduced the FinoGreen Eco-Safe single-core HFFR insulated industrial cables, emphasizing safety and sustainability. These cables featured recyclable materials, low smoke emission, and were halogen-free, making them ideal for fire safety in high-risk areas. The product highlighted Finolex's commitment to eco-friendly innovations and safer electrical installations.

India Insulated Wire and Cable Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, rating, product installation, and end user.

Type Insights:

- XLPE

- HDPE

- HMWPE

- PVC

The report has provided a detailed breakup and analysis of the market based on the type. This includes XLPE, HDPE, HMWPE, and PVC.

Rating Insights:

- Low Voltage

- Medium Voltage

- High Voltage

- Ultra-High Voltage

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes low voltage, medium voltage, high voltage, and ultra-high voltage.

Product Installation Insights:

- Overhead

- Underground

The report has provided a detailed breakup and analysis of the market based on the product installation. This includes overhead and underground.

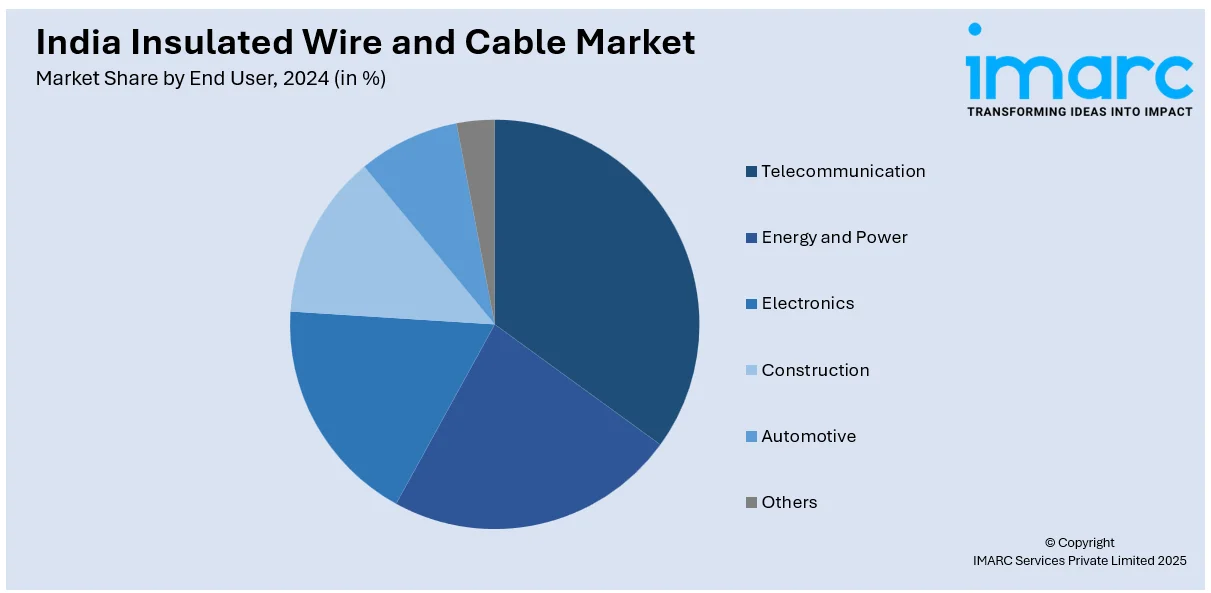

End User Insights:

- Telecommunication

- Energy and Power

- Electronics

- Construction

- Automotive

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes telecommunication, energy and power, electronics, construction, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insulated Wire and Cable Market News:

- In March 2025, Finolex Cables launched FinoUltra, a new wire range utilizing Electron Beam (E-Beam) technology for enhanced safety, durability, and performance. These wires offer 75% higher current capacity, minimal smoke emission during fires, and resistance to pests, UV, and chemicals. FinoUltra is designed for demanding environments, such as malls and airports, and complies with global sustainability standards.

- In January 2025, V-Marc India Limited announced its expansion into Kerala, launching advanced wire and cable products like Flexi-TUF eB-HFFR Wires and eB+ Power Cables. These products, developed with eBeam technology, offer eco-friendly insulation, higher current capacity, and long service life.

India Insulated Wire and Cable Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | XLPE, HDPE, HMWPE, PVC |

| Ratings Covered | Low Voltage, Medium Voltage, High Voltage, Ultra-High Voltage |

| Product Installations Covered | Overhead, Underground |

| End Users Covered | Telecommunication, Energy and Power, Electronics, Construction, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insulated wire and cable market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insulated wire and cable market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insulated wire and cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India insulated wire and cable market was valued at USD 7.74 Billion in 2024.

The India insulated wire and cable market is projected to exhibit a CAGR of 5.02% during 2025-2033, reaching a value of USD 12.47 Billion by 2033.

The India insulated wire and cable market is driven by urbanization, infrastructure development, and rural electrification initiatives. Expansion in power generation, renewable energy projects, and smart grid deployment increases demand. Growth in construction, automotive, and telecommunications sectors further support the market, alongside rising safety standards and modernization of electrical systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)