India Insulation Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Insulation Materials Market Overview:

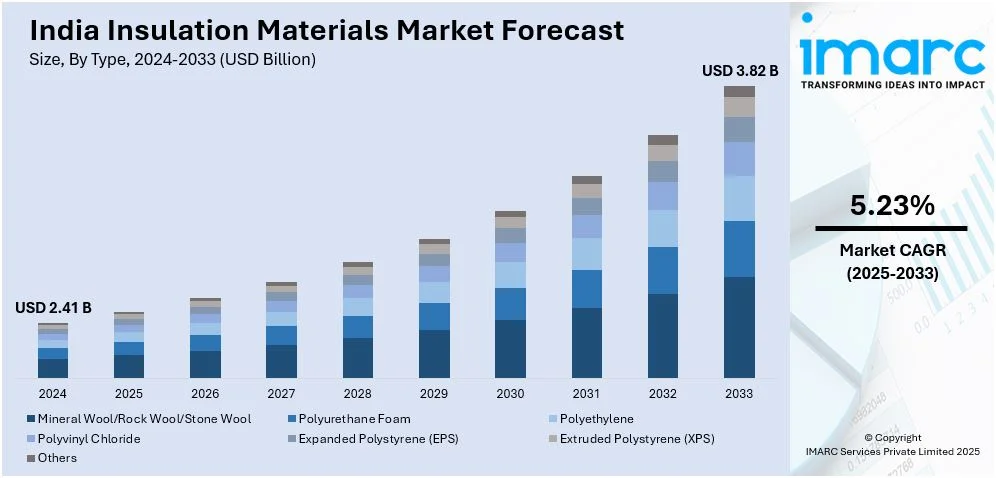

The India insulation materials market size reached USD 2.41 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.82 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The rising construction activity, government energy efficiency regulations, increased demand for sustainable buildings, industrial expansion, and growing adoption of HVAC systems are the factors propelling the growth of the market. Advancements in materials like aerogels and fiberglass, coupled with infrastructure projects, further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.41 Billion |

| Market Forecast in 2033 | USD 3.82 Billion |

| Market Growth Rate 2025-2033 | 5.23% |

India Insulation Materials Market Trends:

Rising Demand for Energy-Efficient Insulation in Warehousing

The push for sustainable and energy-efficient solutions is reshaping the insulation industry, particularly in warehousing and logistics. With increasing focus on reducing energy consumption, advanced insulation materials are being developed to optimize temperature control and minimize heat loss. Companies are introducing solutions that enhance operational efficiency while aligning with sustainability goals. Events and exhibitions are serving as key platforms for industry players to showcase innovations, emphasizing the importance of improved thermal management. Businesses are prioritizing high-performance insulation to meet regulatory requirements, lower carbon footprints, and achieve long-term cost savings. This shift highlights a growing emphasis on integrating eco-friendly materials in storage and logistics infrastructure, reflecting the broader move toward energy-conscious industrial development. For example, Neo Thermal Insulation, a leader in insulation solutions, participated in the India Warehousing Show at Pragati Maidan, New Delhi, from June 14 to 16, 2023. At Booth G30 in Hall 12A, the company showcased advanced products aimed at enhancing energy efficiency and sustainability in warehousing and logistics.

To get more information of this market, Request Sample

Advancements in Insulation for Rail Infrastructure

The focus on energy efficiency and passenger comfort in rail transportation is driving the development of specialized insulation materials. With increasing investment in modern rail systems, advanced thermal solutions are being integrated to optimize temperature regulation and noise reduction in high-speed coaches. Locally manufactured materials are gaining prominence, reducing dependence on imports while supporting domestic industries. Innovations in insulation are not only improving passenger experience but also enhancing energy conservation by minimizing heat loss. Governments and rail operators are prioritizing materials that align with sustainable infrastructure goals, ensuring long-term efficiency. The shift toward high-performance insulation in transportation reflects a broader emphasis on self-reliance, technological advancements, and the adoption of materials designed for next-generation mobility solutions. For instance, in October 2023, ALP Aeroflex introduced a new insulation material designed specifically for high-speed rail coaches in India. This domestically produced solution aims to enhance energy efficiency and passenger comfort, aligning with the country's push for advanced rail infrastructure. The launch signifies a step forward in local manufacturing capabilities, supporting India's vision for modernized transportation systems.

India Insulation Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Mineral Wool/Rock Wool/Stone Wool

- Polyurethane Foam

- Polyethylene

- Polyvinyl Chloride

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mineral wool/rock wool/stone wool, polyurethane foam, polyethylene, polyvinyl chloride, expanded polystyrene (EPS), extruded polystyrene (XPS), and others.

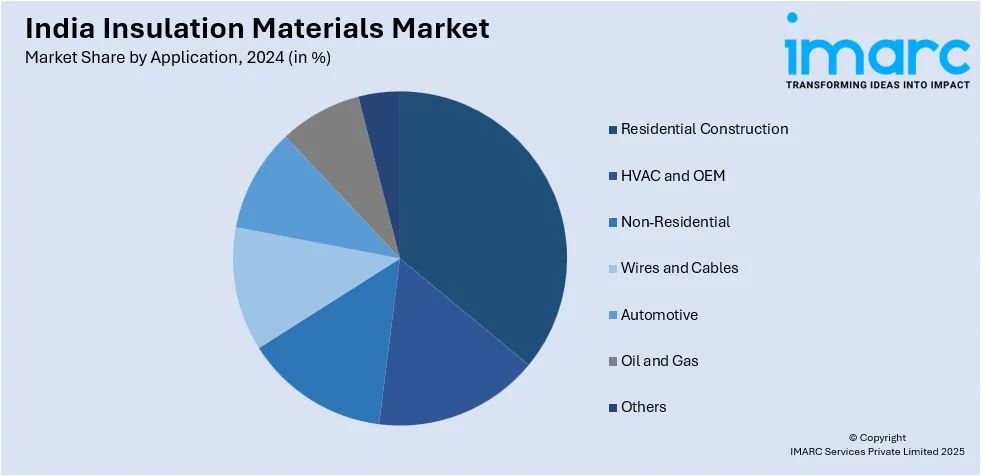

Application Insights:

- Residential Construction

- HVAC and OEM

- Non-Residential

- Wires and Cables

- Automotive

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential construction, HVAC and OEM, non-residential, wires and cables, automotive, oil and gas, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insulation Materials Market News:

- In January 2025, Indobell Insulations Limited, a specialized insulation products manufacturer, launched an IPO on the BSE SME platform to raise INR 1,014.30 Lakhs by issuing 22,05,000 equity shares at INR 46 each. The funds would enhance production capacity, support working capital, and serve general corporate purposes.

- In June 2024, Nuvoco Vistas Corp. Ltd., India's fifth-largest cement group, introduced Ecodure Thermal Insulated Concrete. This innovative material incorporates specialized aggregates with lower thermal conductivity, reducing indoor temperatures by up to 3°C. It also decreases buildings' energy use intensity by 5% and cooling loads by 6%, offering a sustainable solution to rising temperatures and energy consumption.

India Insulation Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Wool/Rock Wool/Stone Wool, Polyurethane Foam, Polyethylene, Polyvinyl Chloride, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others |

| Applications Covered | Residential Construction, HVAC and OEM, Non-Residential, Wires and Cables, Automotive, Oil and Gas, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insulation materials market performed so far and how will it perform in the coming years?

- What is the breakup of the India insulation materials market on the basis of type?

- What is the breakup of the India insulation materials market on the basis of application?

- What are the various stages in the value chain of the India insulation materials market?

- What are the key driving factors and challenges in the India insulation materials market?

- What is the structure of the India insulation materials market and who are the key players?

- What is the degree of competition in the India insulation materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insulation materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insulation materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insulation materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)