India Insulin Pumps Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Insulin Pumps Market:

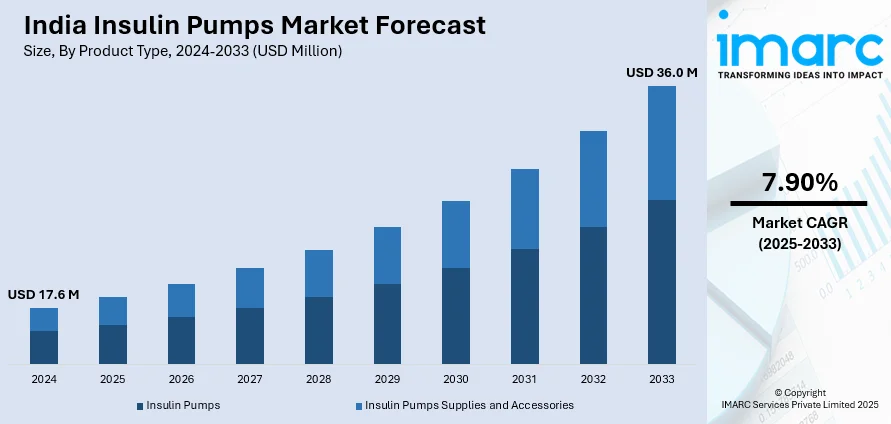

The India insulin pumps market size reached USD 17.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 36.0 Million by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The growing demand for effective diabetes management solutions, along with the collaborations between manufacturers and local distributors, are among the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.6 Million |

|

Market Forecast in 2033

|

USD 36.0 Million |

| Market Growth Rate 2025-2033 | 7.90% |

India Insulin Pumps Market Analysis:

- Major Market Drivers: The increasing prevalence of diabetes in the country, owing to the changing lifestyles and surging obesity rates, is stimulating the market. Moreover, the launch of policies by government bodies to promote healthcare awareness and accessibility is also acting as a significant growth-inducing factor.

- Key Market Trends: The growing number of telemedicine services is one of the emerging trends bolstering the market. Besides this, the inflating emphasis of key players on patient education and support programs is further positively influencing the market in the country.

- Challenges and Opportunities: One of the primary challenges hampering the market is the limited accessibility of these medical devices, which can be overcome by implementing government subsidies and increasing insurance coverage.

India Insulin Pumps Market Trends:

Rising Prevalence of Diabetes

The growing cases of diabetes across the country are propelling the market. In 2021, about 74 million individuals across the country were diagnosed with diabetes, and this figure is anticipated to increase to more than 124 million by 2045. Factors, such as sedentary lifestyles, unhealthy dietary habits, urbanization, obesity, etc., are contributing to this chronic disease. According to an article published by the National Library of Medicine, obese individuals with a predominant increase in upper body fat (abdominal subcutaneous and intra-abdominal fat), intrahepatic triglyceride content, intramyocellular lipid content, and pancreatic fat are more likely to develop type 2 diabetes than those with a lower body fat phenotype. As a result, the escalating demand for advanced diabetes management solutions that can provide better glycemic control and improve quality of life for patients is one of the India insulin pumps market's recent opportunities. As per the Diabetes Control and Complications Trial, insulin pump technology is improving significantly, as it replicates physiologic insulin production more accurately and assists patients in achieving tight glycemic control while decreasing the risk of hypoglycemia. Besides this, the inflating healthcare spending on diabetes prevention, management, and treatment will continue to bolster the market in the coming years. For instance, in November 2023, the All India Institute of Medical Sciences (AIIMS) initiated an innovative project held on World Diabetes Day to distribute free insulin for patients who have diabetes. AIIMS opened its two counters at Amrit pharmacy to support this.

To get more information on this market, Request Sample

Technological Advancements

Technological innovations have led to the development of more advanced insulin delivery systems with features, such as programmable basal rates, bolus calculators, customizable delivery profiles, etc. These advancements allow for more precise and personalized insulin dosing, leading to better glycemic control for patients, which is elevating the India insulin pumps market's recent price. For instance, in February 2023, Abbott signed an agreement to acquire Bigfoot Biomedical, which creates advanced insulin control systems called Bigfoot Unity for people with diabetes. The smart insulin control solution includes connected insulin pen caps that employ integrated continuous glucose monitoring (iCGM) data and healthcare provider instructions. Moreover, technological advancements have enabled the introduction of closed-loop insulin delivery systems, also known as artificial pancreas systems. These systems automatically adjust insulin delivery based on CGM readings, mimicking the function of a healthy pancreas. Closed-loop systems offer greater convenience and improved glycemic control for patients, reducing the burden of diabetes management. For instance, in March 2022, Medtronic India launched the MiniMed 780G system in India. The system is a next-generation closed-loop insulin pump system for the treatment of diabetes. In addition, insulin pump manufacturers are increasingly incorporating smartphone technologies into their products, thereby allowing patients to control their pumps and monitor their diabetes data via dedicated mobile apps. For instance, in October 2022, researchers from the Robert Bosch Centre for Cyber-Physical Systems at the Indian Institute of Science, in collaboration with physicians at MS Ramaiah Medical College, developed a real-time blood sugar monitoring and control system. The system includes three components, namely a sensor, an insulin pump, and an Android app. These factors are further adding to the India insulin pumps market revenue.

Government Policies

The launch of favorable initiatives by government bodies aimed at improving healthcare access is strengthening the market. Additionally, they are providing subsidies to help in reducing the financial burden on patients, thereby making insulin pump therapy more affordable and accessible, particularly for those from low-income backgrounds. For instance, as part of the National Health Mission (NHM), the Department of Health & Family Welfare and the Government of India offer the States and Unions financial and technical support through the National Programme for Prevention and Control of Diabetes, Cancer, Cardiovascular Diseases, and Stroke (NPCDCS). Financial support is also given to States and UTs under the NHM Free Drugs Service Initiative in order to offer free critical medications, including insulin, to the underprivileged and destitute. This is escalating the India insulin pumps market demand. Additionally, insulin and other high-quality generic medications are made accessible to everyone at reasonable costs via the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP), which is run in conjunction with the State Governments. These factors are expected to positively impact the India insulin pumps market outlook over the forecasted period.

India Insulin Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India insulin pumps market report, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Breakup by Product Type:

- Insulin Pumps

- Tethered Pumps

- Disposable/Patch Insulin Pumps

- Insulin Pumps Supplies and Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes insulin pumps (tethered pumps and disposable/patch insulin pumps) and insulin pumps supplies and accessories (infusion set insertion devices and insulin reservoirs/cartridges).

Tethered insulin pumps are traditional pumps that consist of a small device connected to the body via tubing, delivering insulin from a reservoir to the body through an infusion set. In contrast, disposable or patch pumps are newer technologies that do not require tubing and are worn directly on the body like an adhesive patch. They are usually worn for a certain duration and then replaced. Besides this, infusion set insertion devices assist in ensuring correct placement and reducing discomfort. Moreover, insulin reservoirs/cartridges are often available separately from the pump devices. According to the insulin pumps market overview, they are gaining traction, as these cartridges allow users to replace them without restoring the entire pump.

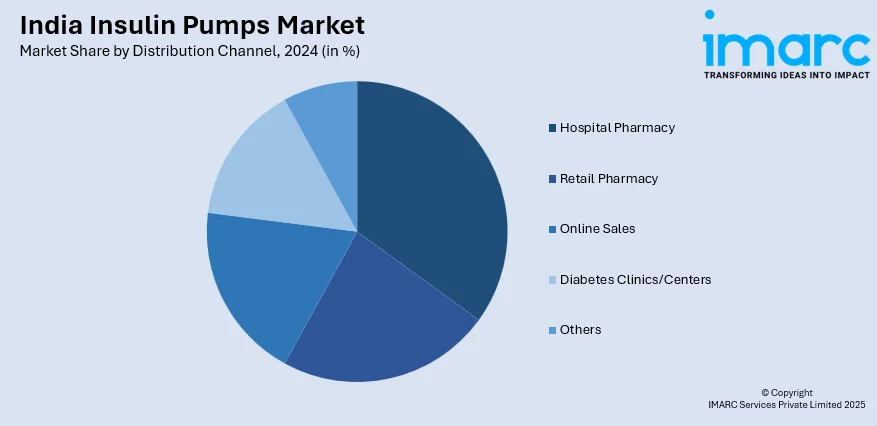

Breakup by Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Sales

- Diabetes Clinics/Centers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, online sales, diabetes clinics/centers, and others.

Hospitals often serve as primary points of contact for individuals with diabetes, especially those requiring intensive management or specialized care. Demand in hospital settings may also be driven by healthcare professionals recommending insulin pump therapy for patients who require close monitoring and precise insulin delivery. In contrast, retail pharmacies cater to a broader segment of the population, including individuals managing diabetes in the community. They are increasing the India insulin pumps market share, owing to their affordability, availability of insurance coverage, and preferences for specific pump brands. Moreover, online sales platforms offer convenience and accessibility to a wide range of healthcare products, including insulin pumps and related supplies. Apart from this, diabetes clinics and centers are specialized facilities focused on diabetes management, education, and support.

Breakup by Region:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

According to the South India insulin pumps market statistics, advanced healthcare infrastructures are propelling the market across the region. Demand for insulin pumps in South India may be relatively higher due to the rising awareness among individuals about diabetes management, access to healthcare facilities, and a relatively higher prevalence of diabetes as compared to other parts of India. At the same time, the demand for insulin pumps in North India is escalating, owing to the large population. Furthermore, the market in West and Central India is experiencing growth driven by the elevating efforts of healthcare authorities to improve distribution networks and patient education.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major India insulin pumps market companies have been provided.

India Insulin Pumps Market Recent Developments:

- May 2024: Sanofi India Limited launched its new diabetes drug, Soliqua, in India.

- January 2024: Medtronic, one of the medical technology providers in India, won the CE mark for its MiniMed 780G automated insulin pump systems with the Simplera Sync sensor.

- November 2023: USV Pvt Ltd and Biogenomics collaborated to introduce INSUQUICK, India’s first biosimilar Insulin Aspart, which aids in improving access for individuals with diabetes.

India Insulin Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/Centers, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insulin pumps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India insulin pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insulin pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insulin pumps market in India was valued at USD 17.6 Million in 2024.

The India insulin pumps market is projected to exhibit a CAGR of 7.90% during 2025-2033, reaching a value of USD 36.0 Million by 2033.

The India insulin pumps market is driven by the rising incidence of diabetes, particularly among younger populations, and increasing awareness about advanced diabetes management. Growing healthcare access, supportive government initiatives, and a shift toward convenient, continuous insulin delivery methods further boost adoption, especially in urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)