India Insurance Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

Market Overview:

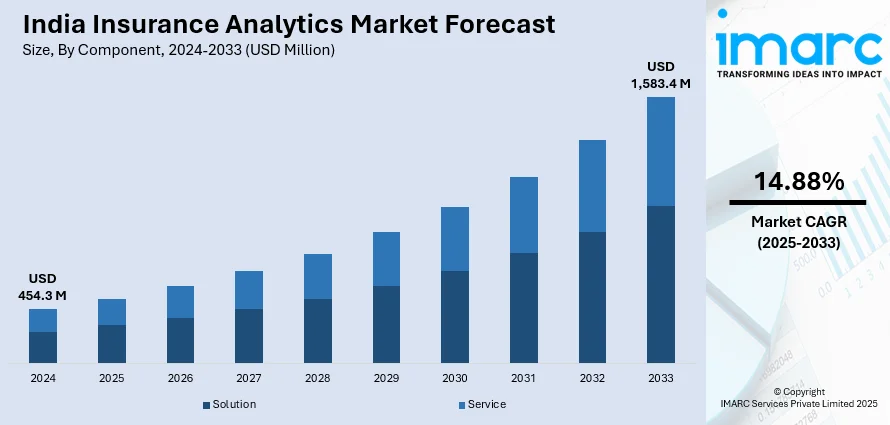

India insurance analytics market size reached USD 454.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,583.4 Million by 2033, exhibiting a growth rate (CAGR) of 14.88% during 2025-2033. The widespread adoption of advanced analytics solutions to manage risk and ensure compliance efficiently, along with the implementation of stringent regulations by government bodies to ensure consumer protection, is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 454.3 Million |

| Market Forecast in 2033 | USD 1,583.4 Million |

| Market Growth Rate (2025-2033) | 14.88% |

Insurance analytics involves employing data analysis tools and statistical models to make informed decisions within the insurance sector. This methodology enables insurance companies to gain valuable insights into different facets of their operations, including customer behavior, risk assessment, and claims management. Through the examination of extensive datasets, insurers can discern patterns and trends that may elude detection using conventional methods. This capability empowers them to deliver more tailored services, establish precise premium rates, and expedite more dependable claims decisions. The overarching objective is to enhance efficiency, curtail costs, and elevate customer satisfaction. In the competitive landscape of the insurance industry, the adoption of insurance analytics becomes a strategic advantage, allowing companies to base decisions on comprehensive data analysis and thereby gaining a competitive edge.

To get more information on this market, Request Sample

India Insurance Analytics Market Trends:

The insurance analytics market in India is witnessing significant growth as insurance companies increasingly recognize the transformative power of data analysis in refining decision-making processes. In India's evolving insurance landscape, companies are leveraging analytics to glean insights from large datasets, uncovering patterns and trends that might escape notice through traditional methods. Additionally, this analytical approach allows insurers to offer more personalized services, set precise premiums, and expedite claims processing with enhanced accuracy. One of the key advantages of insurance analytics is its potential to enhance operational efficiency and reduce costs. Besides this, by harnessing the power of data-driven insights, insurance companies in India can streamline their processes, optimize resource allocation, and make strategic decisions that positively impact their bottom line. Moreover, in a competitive market, insurance analytics serves as a crucial differentiator. Companies that embrace analytics gain a strategic edge by making well-informed, data-driven decisions. This not only allows them to stay ahead of market trends but also positions them to meet the evolving needs and expectations of customers. As the digital transformation journey unfolds in India's insurance sector, the market is expected to continue its growth trajectory in the coming years.

India Insurance Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

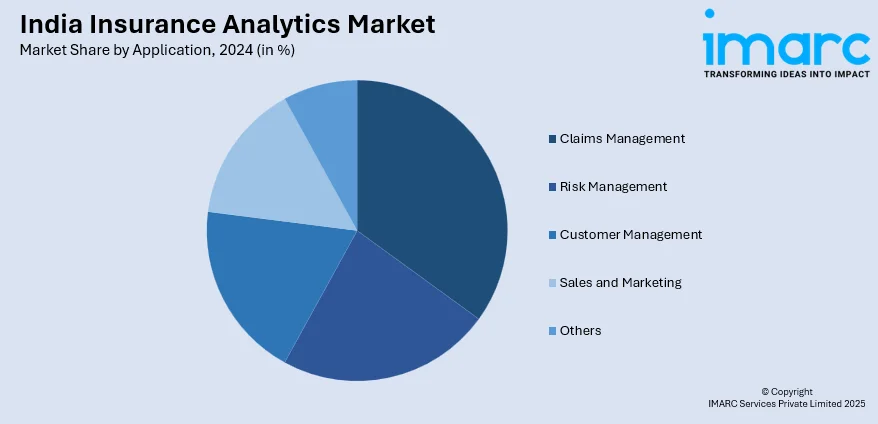

Application Insights:

- Claims Management

- Risk Management

- Customer Management

- Sales and Marketing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes claims management, risk management, customer management, sales and marketing, and others.

End User Insights:

- Insurance Companies

- Government Agencies

- Third-party Administrators, Brokers and Consultancies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes insurance companies, government agencies, and third-party administrators, brokers and consultancies.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insurance Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Claims Management, Risk Management, Customer Management, Sales and Marketing, Others |

| End Users Covered | Insurance Companies, Government Agencies, Third-party Administrators, Brokers and Consultancies |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India insurance analytics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India insurance analytics market?

- What is the breakup of the India insurance analytics market on the basis of component?

- What is the breakup of the India insurance analytics market on the basis of deployment mode?

- What is the breakup of the India insurance analytics market on the basis of enterprise size?

- What is the breakup of the India insurance analytics market on the basis of application?

- What is the breakup of the India insurance analytics market on the basis of end user?

- What are the various stages in the value chain of the India insurance analytics market?

- What are the key driving factors and challenges in the India insurance analytics?

- What is the structure of the India insurance analytics market and who are the key players?

- What is the degree of competition in the India insurance analytics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India insurance analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India insurance analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India insurance analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)