India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034

India Insurance Market Summary:

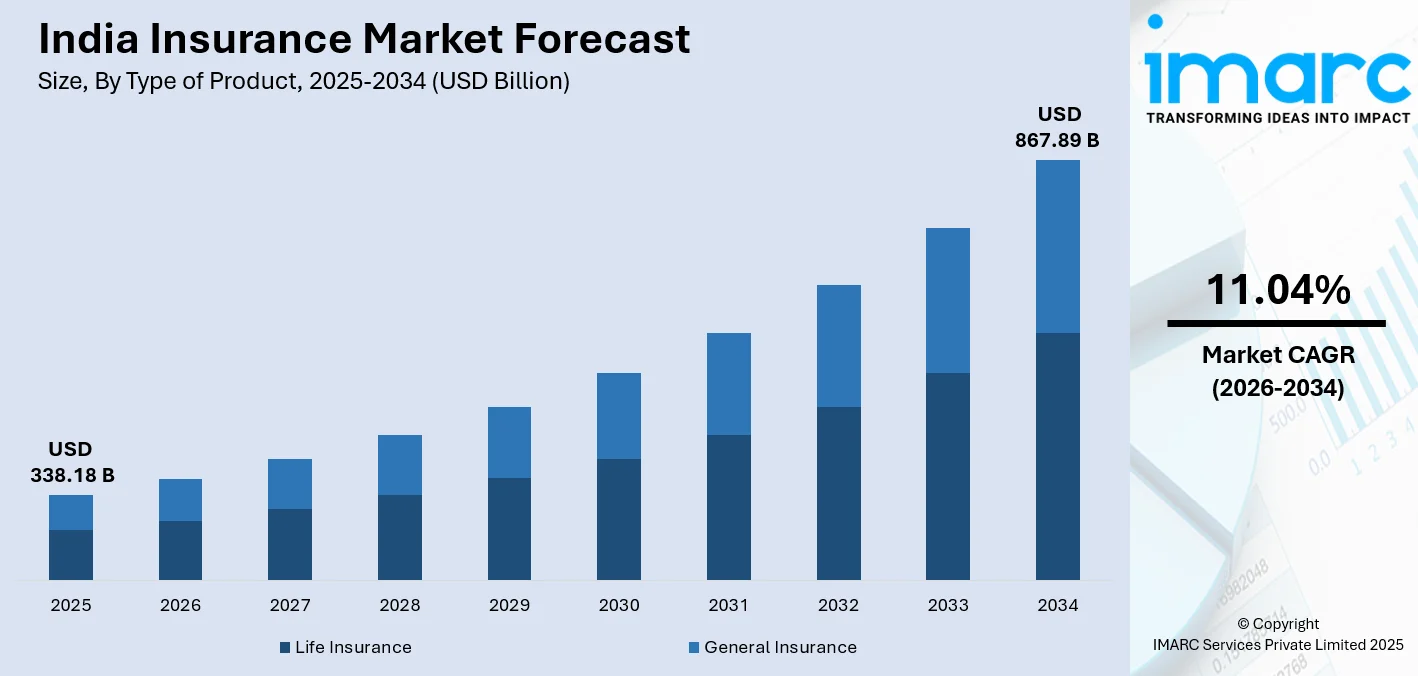

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at a compound annual growth rate of 11.04% from 2026-2034.

The India insurance market is expanding strongly due to an increasing awareness level regarding financial literacy among the growing middle class and the need for risk management. Favorable demographics with a young generation looking for long-term savings solutions are other factors that help the industry. Government policies for financial inclusion and enhancements in market accessibility are further fueling the adoption of financial security solutions.

Key Takeaways and Insights:

- By Type of Product: Life insurance dominates the market with a share of 62% in 2025, driven by growing awareness about financial security, rising demand for retirement planning solutions, and increasing preference for investment-linked protection products among the expanding middle-class population.

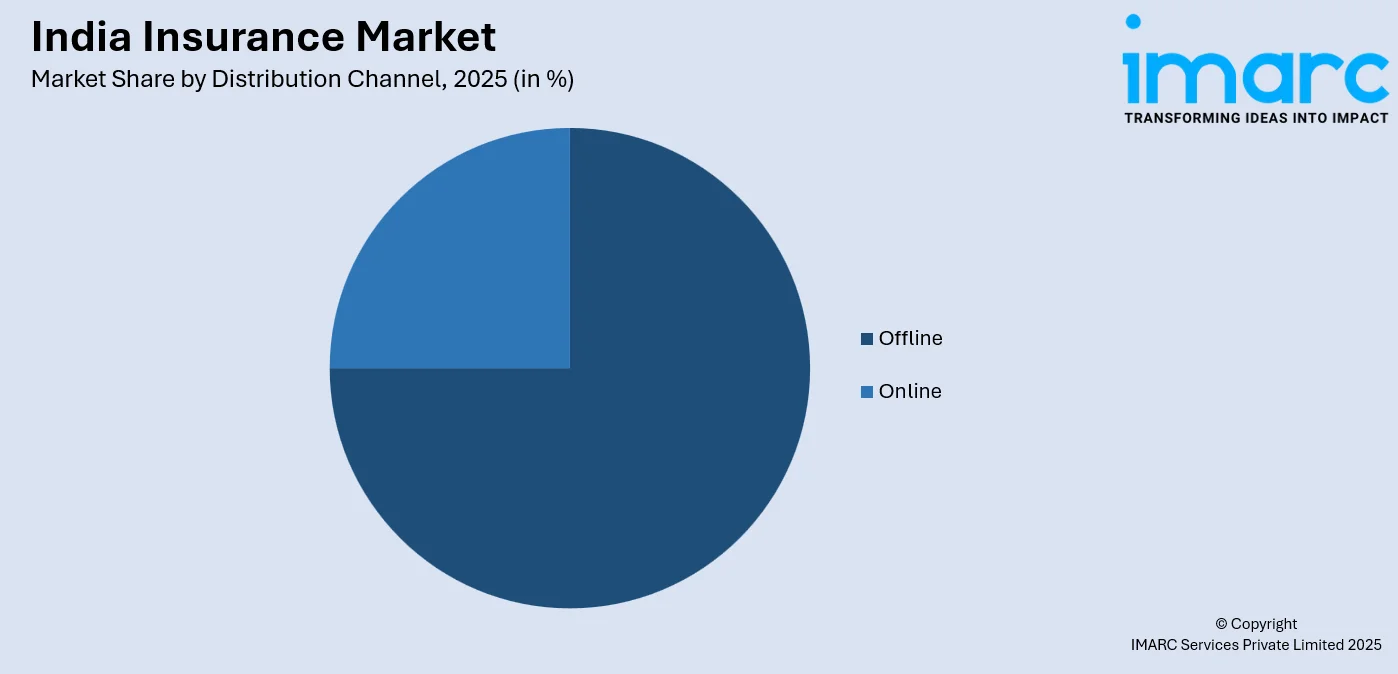

- By Distribution Channel: Offline leads the market with a share of 75% in 2025, owing to the established network of agents and brokers, trust-based personal relationships, and the preference for face-to-face consultations when purchasing complex financial products requiring detailed explanations.

- By End User: Individual represents the largest segment with a market share of 69% in 2025, attributed to increasing disposable incomes, heightened awareness about personal financial planning, and growing demand for family protection and wealth accumulation products among working professionals.

- By Region: North India dominates the market with a share of 30% in 2025, supported by higher population density, concentrated economic activity in metropolitan areas, established distribution infrastructure, and greater insurance awareness levels in states like Delhi, Uttar Pradesh, and Punjab.

- Key Players: The India insurance market exhibits a moderately competitive landscape characterized by the coexistence of established public sector undertakings and dynamic private players. Market participants are focusing on product innovation, digital transformation, and distribution network expansion to enhance market penetration and customer engagement.

To get more information on this market Request Sample

The India insurance market is experiencing transformative growth fueled by structural reforms, technological advancements, and evolving consumer preferences. For instance, in December 2025 the Lok Sabha passed the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, raising the foreign direct investment (FDI) limit in the insurance sector to 100% and strengthening policyholder protections and regulatory clarity, a move expected to attract global capital and enhance competition. Rising healthcare costs and increasing awareness about medical emergencies are driving demand for health insurance products, while the growing emphasis on retirement planning is boosting life insurance adoption. The regulatory environment continues to evolve favorably, with initiatives such as increased foreign direct investment limits and simplified product approval processes encouraging market expansion. Digital platforms and insurtech innovations are revolutionizing distribution channels, enabling insurers to reach previously underserved rural and semi-urban markets.

India Insurance Market Trends:

Digital Transformation and Insurtech Integration

The insurance industry is undergoing rapid digital transformation with the integration of artificial intelligence, machine learning, and advanced analytics across operations. For example, a 2025 report found that generative AI and AI tools are driving over 30% productivity gains in India’s insurance sector, with AI resolving up to 70 % of simple claims in real time and significantly reducing costs and turnaround times, underscoring how core processes are being reinvented through technology. Insurers are leveraging digital platforms for policy issuance, claims processing, and customer engagement, significantly improving operational efficiency and customer experience.

Rise of Personalized and Usage-Based Insurance Products

Insurers are increasingly offering customized products tailored to individual risk profiles and lifestyle requirements. In 2024, Zuno General Insurance launched its “Pay How You Drive” (PHYD) motor insurance feature using mobile telematics, allowing policyholders to save up to 30% on premiums based on driving behavior, one of India’s first widely marketed usage‑based insurance products that exemplifies this shift toward personalization. Usage-based insurance models leveraging telematics and IoT devices are gaining traction, particularly in motor insurance, allowing policyholders to pay premiums based on actual usage patterns.

Expansion of Inclusive Insurance and Financial Protection

The market is witnessing growing momentum toward inclusive insurance initiatives addressing previously underserved segments. In December 2025, the Life Insurance Corporation of India (LIC) announced a strategic partnership with Sahaj Insurance Services to expand insurance coverage in rural and semi‑urban India, aiming to boost accessibility for underserved populations and bridge the urban‑rural insurance gap, reflecting a concrete industry push toward financial inclusion. Products designed for women, senior citizens, small businesses, and first-time insurance buyers are gaining traction, supporting broader financial inclusion objectives.

Market Outlook 2026-2034:

The overall scenario for the insurance industry in India continues to be very favorable and driven by a number of growth-accommodating factors such as demographic dividends, growing prosperity in a country with a large and growing young population, and awareness about risk. The insurance industry can look forward to foreign investment and expertise due to changes in policies that will now permit foreign ownership. Technology adoption will continue to hasten. The market generated a revenue of USD 338.18 Billion in 2025 and is projected to reach a revenue of USD 867.89 Billion by 2034, growing at a compound annual growth rate of 11.04% from 2026-2034.

India Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Product | Life Insurance | 62% |

| Distribution Channel | Offline | 75% |

| End User | Individual | 69% |

| Region | North India | 30% |

Type of Product Insights:

- Life Insurance

- General Insurance

- Health Insurance

- Motor Insurance

- Home Insurance

- Liability Insurance

- Others

The life insurance dominates with a market share of 62% of the total India insurance market in 2025.

Life insurance maintains its dominant position in the India insurance market, driven by the cultural emphasis on family financial security and the growing recognition of life coverage as an essential financial planning tool. For example, in December 2025 India’s life insurance industry posted its strongest monthly growth in nearly two years, with new business premiums rising about 40% year‑on‑year in December, reflecting renewed demand for life cover across segments and resilience in the face of recent headwinds. The segment benefits from increasing demand for term plans, endowment policies, and unit-linked insurance plans that offer dual benefits of protection and investment.

The life insurance segment is further strengthened by favorable tax incentives encouraging long-term savings and the expanding distribution network reaching previously underserved markets. Insurers are introducing innovative products addressing specific life stage requirements, retirement planning needs, and wealth accumulation goals. Digital platforms are simplifying policy comparison and purchase processes, while regulatory initiatives promoting transparency and customer protection are enhancing consumer confidence in life insurance products.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline leads with a share of 75% of the total India insurance market in 2025.

Offline distribution channels continue to dominate the India insurance market, reflecting the importance of personal relationships and trust in financial product purchases. The extensive network of individual agents, corporate agents, and brokers provides personalized advisory services essential for explaining complex insurance products and addressing customer queries. Face-to-face interactions enable better needs assessment and customized product recommendations, particularly for high-value policies requiring detailed discussions.

The offline segment benefits from established relationships between agents and customers, enabling effective cross-selling and policy renewal management. Bancassurance partnerships leverage the trusted customer relationships of banking institutions to distribute insurance products effectively. Despite growing digital adoption, offline channels remain crucial for reaching rural and semi-urban markets where digital infrastructure is still developing and personal touch remains a significant factor in purchase decisions.

End User Insights:

- Corporate

- Individual

The individual dominates with a market share of 69% of the total India insurance market in 2025.

Individual insurance demand is primarily driven by growing financial awareness among the working population and increasing recognition of insurance as a critical component of personal financial planning. For example, data from 2025 shows that term insurance purchases by self‑employed professionals surged by around 58% in FY25, with Millennials and Gen Z making up most of this increase, highlighting deeper engagement with insurance among younger, financially aware individuals. Rising disposable incomes and aspirational lifestyles are enabling individuals to invest in comprehensive protection products covering life, health, and asset risks.

The individual segment is witnessing diversification in product preferences, with consumers seeking customized solutions addressing specific requirements such as critical illness coverage, retirement planning, and children education planning. Digital platforms are empowering individuals with product comparison tools and simplified purchase processes, reducing dependency on intermediaries for standard products. Government initiatives promoting affordable insurance coverage for economically weaker sections are further expanding the individual insurance customer base across income segments.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India insurance market in 2025.

North India maintains its leading position in the insurance market, supported by the concentration of economic activity in the National Capital Region and surrounding industrial hubs. The region benefits from higher insurance awareness levels, established distribution infrastructure, and the presence of major corporate headquarters driving group insurance demand. States like Delhi, Uttar Pradesh, Haryana, and Punjab contribute significantly to premium collections across life and general insurance segments.

The region witnesses strong demand for both individual and corporate insurance products, driven by the large working population and diverse industrial base. Urban centers demonstrate higher penetration of health and motor insurance products, while rural areas are increasingly adopting crop and life insurance through government-sponsored schemes. The competitive presence of insurers and intermediaries ensures product availability and service accessibility across the region.

Market Dynamics:

Growth Drivers:

Why is the India Insurance Market Growing?

Rising Middle-Class Population and Increasing Disposable Incomes

The expanding middle-class population represents a significant growth driver for the India insurance market, as increasing disposable incomes enable greater allocation toward financial protection and wealth accumulation products. According to reports, rising incomes and the expanding middle class are expected to be key forces driving the insurance industry’s growth in FY 2024‑25, with heightened demand for health and life insurance products as people increasingly prioritise financial security. Economic growth and urbanization are creating new consumer segments with aspirational lifestyles seeking comprehensive risk coverage. The demographic dividend characterized by a young working population provides a substantial customer base for long-term insurance products. Rising education levels and financial literacy are enhancing awareness about insurance benefits, driving voluntary adoption beyond traditional agent-push models. The shift from joint family structures to nuclear families is increasing individual responsibility for financial security, further stimulating insurance demand.

Favorable Regulatory Reforms and Government Initiatives

Progressive regulatory reforms are significantly contributing to insurance market expansion by creating an enabling environment for industry growth and innovation. The liberalization of foreign direct investment limits is attracting global expertise, advanced technologies, and substantial capital infusion into the sector. In parallel, initiatives such as the Insurance Regulatory and Development Authority of India’s (IRDAI) “Insurance for All by 2047” vision and the associated “use and file” framework are streamlining regulatory approvals and encouraging product customization across segments. Simplified product approval processes and reduced compliance burden are enabling insurers to launch innovative products addressing evolving consumer needs. Government-sponsored insurance schemes promoting affordable coverage for economically weaker sections are expanding market reach to previously uninsured populations.

Digital Transformation and Technological Innovation

Digital transformation is revolutionizing the insurance industry by enhancing accessibility, improving operational efficiency, and enabling personalized customer experiences. In India, private funding in the insurtech sector is set to surpass $1 billion amid the ongoing digital transformation push, underscoring strong investor confidence in tech‑led insurance solutions and digital business models, a clear signal of how deeply technology is reshaping the market. The proliferation of smartphones and internet connectivity is facilitating digital policy purchases, claims submissions, and customer service interactions. Artificial intelligence and machine learning applications are streamlining underwriting processes, enabling faster policy issuance and more accurate risk assessment. Insurtech innovations are introducing new distribution models, embedded insurance solutions, and usage-based products that align premium payments with actual risk exposure.

Market Restraints:

What Challenges the India Insurance Market is Facing?

Low Insurance Penetration in Rural Areas

Despite overall market growth, insurance penetration remains significantly low in rural and semi-urban areas due to limited awareness, inadequate distribution infrastructure, and affordability constraints. The absence of customized products addressing rural-specific risks and income patterns restricts adoption among agricultural and informal sector workers. Additionally, inconsistent income streams and lack of financial literacy further impede voluntary insurance purchases in these regions.

Complex Product Structures and Trust Deficit

The perceived complexity of insurance products and historical issues related to claims settlement practices have created trust deficits among potential customers. Many consumers find policy terms and conditions difficult to understand, leading to apprehension about product value and claims experience, particularly among first-time buyers. Lengthy documentation requirements and opaque pricing structures further discourage prospective policyholders from making informed purchasing decisions.

Rising Claims Costs and Healthcare Inflation

Escalating healthcare costs and claims inflation pose significant challenges for insurers in maintaining profitability while offering affordable premium rates. The increasing frequency and severity of claims, particularly in health insurance, require careful pricing strategies and cost management initiatives to ensure sustainable growth. Medical advancements and expensive treatment protocols continue exerting upward pressure on claim payouts, impacting overall sector margins.

Competitive Landscape:

The India insurance market features a diverse competitive landscape comprising established public sector entities, dynamic private insurers, and emerging insurtech players. The market structure reflects varying degrees of consolidation across life and general insurance segments, with public sector entities maintaining significant market presence alongside growing private participation. Competition is intensifying as players invest in digital capabilities, product innovation, and distribution network expansion to capture market share. Strategic partnerships between traditional insurers and technology companies are reshaping competitive dynamics, while regulatory support for new entrants is fostering market diversification. Industry consolidation through mergers and acquisitions is creating larger entities with enhanced financial strength and operational capabilities.

Recent Developments:

- In November 2025, Manulife Financial and Mahindra & Mahindra agreed to set up a 50:50 life insurance joint venture in India, aiming to combine Mahindra’s strong rural/semi‑urban distribution with Manulife’s global insurance expertise to tap the fast‑growing market. Subject to regulatory approval, the partnership plans major investments to drive long‑term savings and protection products.

India Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Products Covered |

|

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Corporate, Individual |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India insurance market size was valued at USD 338.18 Billion in 2025.

The India insurance market is expected to grow at a compound annual growth rate of 11.04% from 2026-2034 to reach USD 867.89 Billion by 2034.

Life insurance dominated the market with a 62% share, driven by growing awareness about financial security, rising demand for retirement planning solutions, and tax benefits encouraging long-term savings products.

Key factors driving the India insurance market include rising middle-class population with increasing disposable incomes, favorable regulatory reforms including liberalized FDI limits, digital transformation enhancing accessibility, and government initiatives promoting financial inclusion.

Major challenges include low insurance penetration in rural and semi-urban areas, complex product structures creating trust deficits, rising claims costs due to healthcare inflation, limited awareness among potential customers, and distribution infrastructure gaps in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)