India Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

India Insurtech Market Overview:

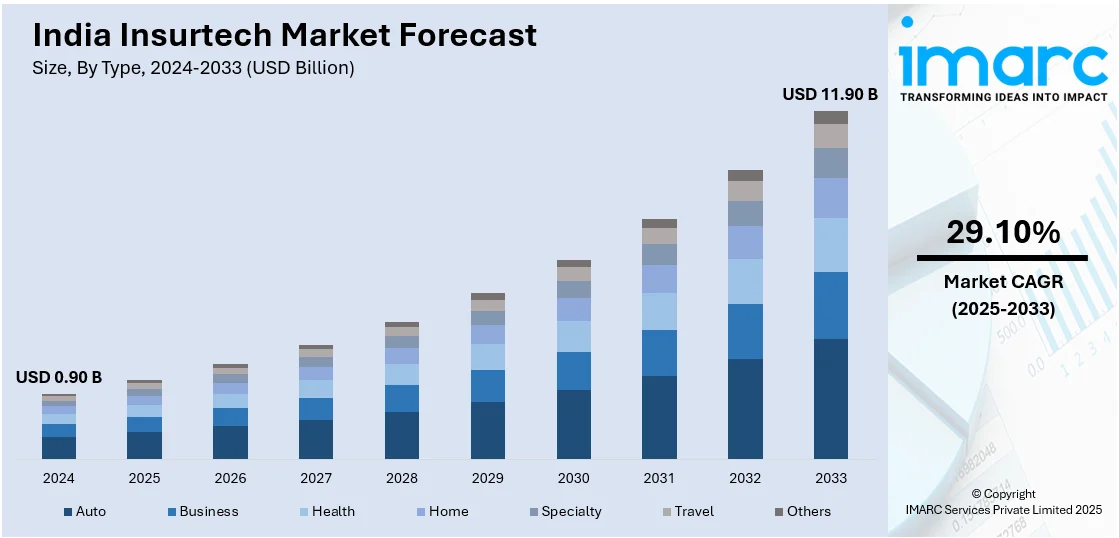

The India Insurtech market size reached USD 0.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.90 Billion by 2033, exhibiting a growth rate (CAGR) of 29.10% during 2025-2033. The market is driven by rising digital adoption, increasing insurance penetration, expanding regulatory support, artificial intelligence (AI)-driven underwriting, growing demand for personalized policies, expanding mobile and internet usage, and strategic partnerships between insurers and tech firms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.90 Billion |

| Market Forecast in 2033 | USD 11.90 Billion |

| Market Growth Rate (2025-2033) | 29.10% |

India Insurtech Market Trends:

Growing Adoption of AI and Big Data for Personalized Insurance

The India Insurtech market is rapidly leveraging artificial intelligence (AI) and big data to enhance underwriting, fraud detection, and policy customization. In line with this, machine learning (ML) algorithms are being utilized by insurers to precisely calculate risk profiles and create hyper-personalized policies that adapt to the exact customer requirements. Moreover, chatbots and virtual assistants with AI capabilities are enhancing customer interactions, simplifying the claims-handling process, and diminishing turnaround time. Besides this, with growing digital transactions, predictive analytics ensures the detection of fraudulent claims, reducing financial losses. According to reports, AI-powered predictive models analyze extensive data sources to forecast trends and identify potential risks, enhancing early fraud detection capabilities. Furthermore, wearable devices and telematics are facilitating usage-based insurance models, especially in health and motor insurance. As a result, the trend towards AI-driven personalization is increasing customer engagement and promoting increased policy uptake. Additionally, established insurers are incorporating advanced analytics to stay competitive, as more Insurtech startups are innovating using AI-enabled solutions. The regulatory thrust towards digital transformation and data-driven decision-making is also speeding up the uptake of AI in India's insurance sector, which is boosting the India Insurtech market share.

To get more information of this market, Request Sample

Expansion of Embedded Insurance and Digital Distribution

The India Insurtech market outlook is transforming because of embedded insurance which merges coverage directly with consumer transactions. The combination of insurance products with e-commerce platforms along with fin-tech solutions and ride-hailing services creates new accessibility for coverage. For example, in March 2024, IRDAI introduced a framework to expand insurance distribution by embedding coverage into consumer platforms like e-commerce and ride-hailing, enhancing accessibility and driving market growth. Concurrently, the integration of insurance products into consumer transactions happens because of digital payment expansion and increasing smartphone adoption alongside consumer needs for simple insurance services. Besides this, customers can purchase insurance seamlessly during transactions, such as travel platforms offering trip protection at booking and consumer electronics retailers providing device insurance directly at checkout. The insurance technology industry also teams up with non-standard distribution networks to deliver coverage solutions to customers who lack traditional insurance services especially those in rural areas. Furthermore, digital policy acceptance has been accelerated by regulatory backing for digital norms which have simplified Know Your Customer (KYC) requirements. Apart from this, digital ecosystems are transforming the importance of embedded insurance because the solution presents an opportunity to boost India's insurance penetration by delivering affordable needed coverage through daily transactions without additional policy buying requirements. As a result, this trend is further driving the India Insurtech market growth.

India Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

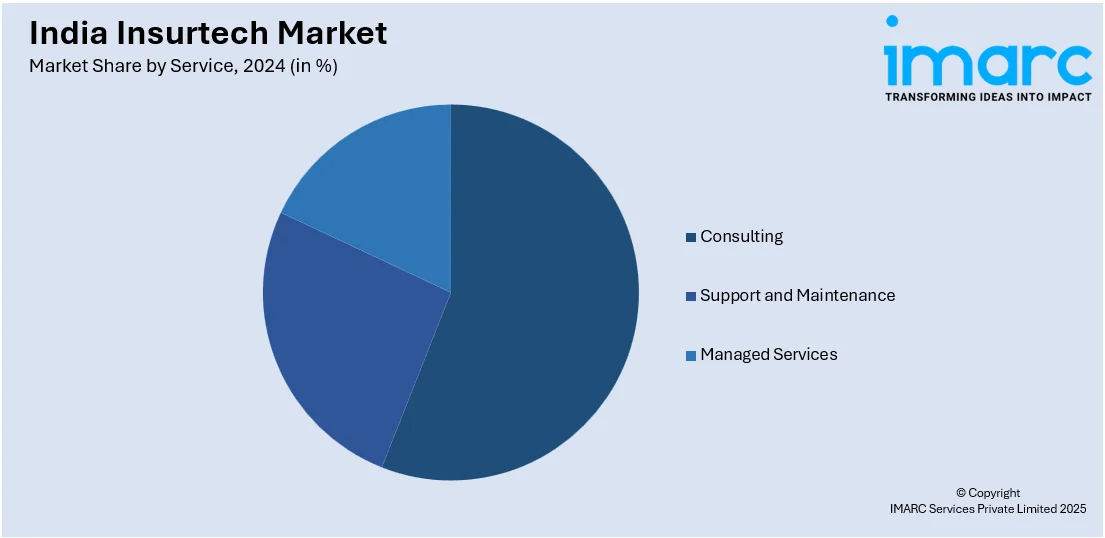

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes block chain, cloud computing, IoT, machine learning, Robo advisory, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Insurtech Market News:

- In March 2025, Bajaj Finserv announced plans to acquire Allianz's 26% stake in their joint ventures for approximately $2.8 billion. This acquisition signifies Bajaj's commitment to consolidating its position in the Indian insurance market and allows for greater strategic control over its insurance subsidiaries.

- In September 2024, Infosys partnered with LIC to develop a NextGen Digital Platform aimed at enhancing omnichannel engagement and providing hyper-personalized experiences for customers, agents, and employees. This initiative leverages AI and cloud technologies to modernize LIC's operations, thereby improving efficiency and customer satisfaction.

India Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insurtech market in India was valued at USD 0.90 Billion in 2024.

The India insurtech market is projected to exhibit a CAGR of 29.10% during 2025-2033, reaching a value of USD 11.90 Billion by 2033.

India’s insurtech growth is fueled by increased digital access, rising demand for simple, paperless policies, and a young, tech-savvy population. Advancements in AI, real-time underwriting, and mobile platforms are improving customer experiences. Regulatory support and collaboration with traditional insurers are also expanding reach, especially in smaller cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)