India Integrated Circuits Market Size, Share, Trends and Forecast by Product Type, Application Type, and Region, 2025-2033

India Integrated Circuits Market Size and Share:

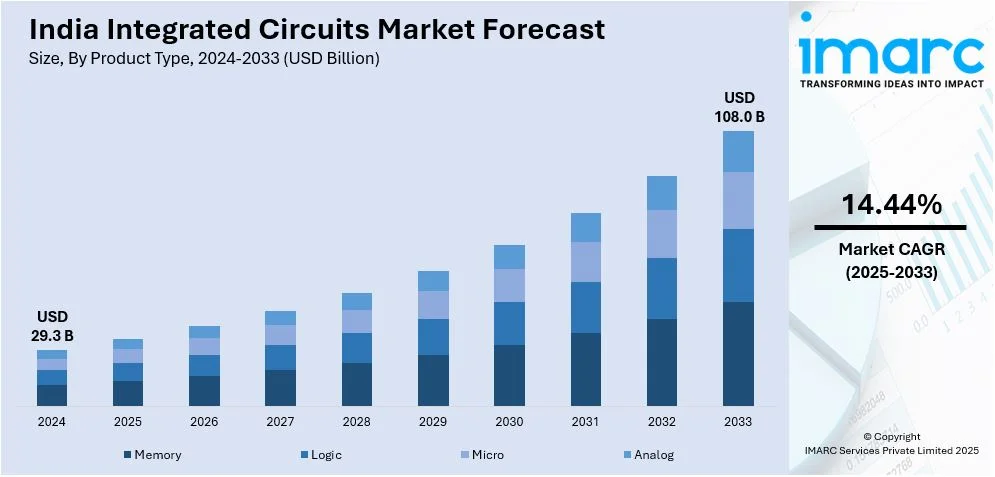

The India integrated circuits market size reached USD 29.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 108.0 Billion by 2033, exhibiting a growth rate (CAGR) of 14.44% during 2025-2033. The market share is growing due to government initiatives, increasing consumer electronics demand, and expanding IoT adoption, driving the need for advanced, efficient, and high-performance semiconductor solutions across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.3 Billion |

| Market Forecast in 2033 | USD 108.0 Billion |

| Market Growth Rate 2025-2033 | 14.44% |

India Integrated Circuits Market Trends:

Rising Consumer Electronics Demand

Increasing smartphone penetration is catalyzing the demand for high-performance integrated circuits, enhancing device processing speed and efficiency. In March 2025, Samsung launched the Galaxy F16 5G in India, featuring a 6.7-inch FHD+ sAMOLED display, 50MP triple-camera setup, and a MediaTek Dimensity 6300 processor, highlighting the growing need for advanced integrated circuits. Laptops, tablets, and smart televisions (TVs) are witnessing higher adoption, requiring integrated circuits for improved graphics, connectivity, and storage. Wearable devices like smartwatches and fitness trackers are integrating specialized integrated circuits for better battery life and functionality. The growing middle-class population is fueling higher spending on consumer electronics, supporting India integrated circuits market growth. Rapid urbanization is increasing smart appliance adoption, necessitating integrated circuits for automation, energy efficiency, and user experience improvements. E-commerce expansion is making consumer electronics more accessible, further accelerating the demand for integrated circuit components. Rising gaming culture is driving the need for graphics-intensive devices, which include advanced integrated circuits. Increasing digital payments and mobile banking adoption are enhancing demand for secure and efficient integrated circuit-based solutions. Moreover, emerging trends like foldable smartphones and augmented reality (AR) devices are creating opportunities for innovative integrated circuit designs.

Growth of Internet of Thing (IoT) and Automation

The India integrated circuits market outlook is being greatly impacted by the expansion of automation and the Internet of Things (IoT). The need for integrated circuits in linked devices is being accelerated by the growing popularity of smart homes, which will improve automation and energy efficiency. Highlighting the growing need for cutting-edge integrated circuits, in 2024, ABB India unveiled ABB-free home, a wireless home automation system that connects with Amazon Alexa, Apple HomeKit, Google Home, and Samsung SmartThings. Advanced integrated circuits are being used into industrial automation to enhance real-time monitoring, predictive maintenance, and robotics. The need for integrated circuits in wearable technology and telemedicine applications is being driven by the growing usage of IoT in healthcare. Growing demand for connected vehicles is fueling the need for automotive integrated circuits in infotainment, safety, and navigation systems. Expanding smart agriculture practices are integrating IoT-based sensors, demanding integrated circuits for real-time monitoring and automation. Businesses are increasingly adopting IoT solutions, necessitating high-performance integrated circuits for cloud computing, artificial intelligence (AI), and data analytics. Besides this, wireless connectivity advancements are improving IoT device performance, driving the need for efficient of integrated circuits.

India Integrated Circuits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and application type.

Product Type Insights:

- Memory

- Logic

- Micro

- Analog

The report has provided a detailed breakup and analysis of the market based on the product type. This includes memory, logic, micro, and analog.

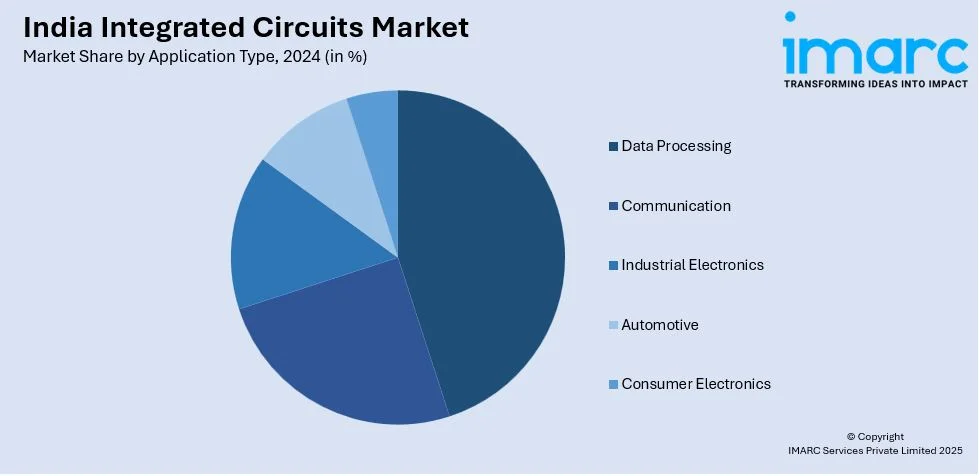

Application Type Insights:

- Data Processing

- Communication

- Industrial Electronics

- Automotive

- Consumer Electronics

A detailed breakup and analysis of the market based on the application type have also been provided in the report. This includes data processing, communication, industrial electronics, automotive, and consumer electronics.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Integrated Circuits Market News:

- In February 2025, the Semicon India programme announced to launch India’s first indigenous semiconductor chip by the end of 2025 to improve local manufacturing and reduce import dependence. Backed by ₹76,000 crore, the initiative strengthens India’s semiconductor ecosystem, attracts global investments, and supports the country’s digital and industrial expansion, reinforcing its position in the global tech industry.

- In August 2024, L&T Semiconductor Technologies partnered with C-DAC to develop Make-in-India Integrated Circuits (ICs) and System-on-Chip (SoC) solutions for automotive, industrial, and energy sectors. This collaboration aimed to enhance domestic semiconductor manufacturing, reduce import reliance, and strengthen India’s position in the global IC market, supporting the Atmanirbhar Bharat initiative.

India Integrated Circuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Memory, Logic, Micro, Analog |

| Applications Covered | Data Processing, Communication, Industrial Electronics, Automotive, Consumer Electronics |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India integrated circuits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India integrated circuits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India integrated circuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The integrated circuits market in India was valued at USD 29.3 Billion in 2024.

The India integrated circuits market is projected to exhibit a (CAGR) of 14.44% during 2025-2033, reaching a value of USD 108.0 Billion by 2033.

Major growth drivers for India's integrated circuits market are the 'Make in India' initiative of the government, increasing use of consumer electronics, and spread of IoT and smart devices. Increasing automotive electronics consumption, 5G rollout, and overseas investments in semiconductor fabrication and design are also driving the sector's development in industrial, consumer, and communications applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)