India Interior Design Market Size, Share, Trends and Forecast by Decoration Type, End User, and Region, 2026-2034

India Interior Design Market Summary:

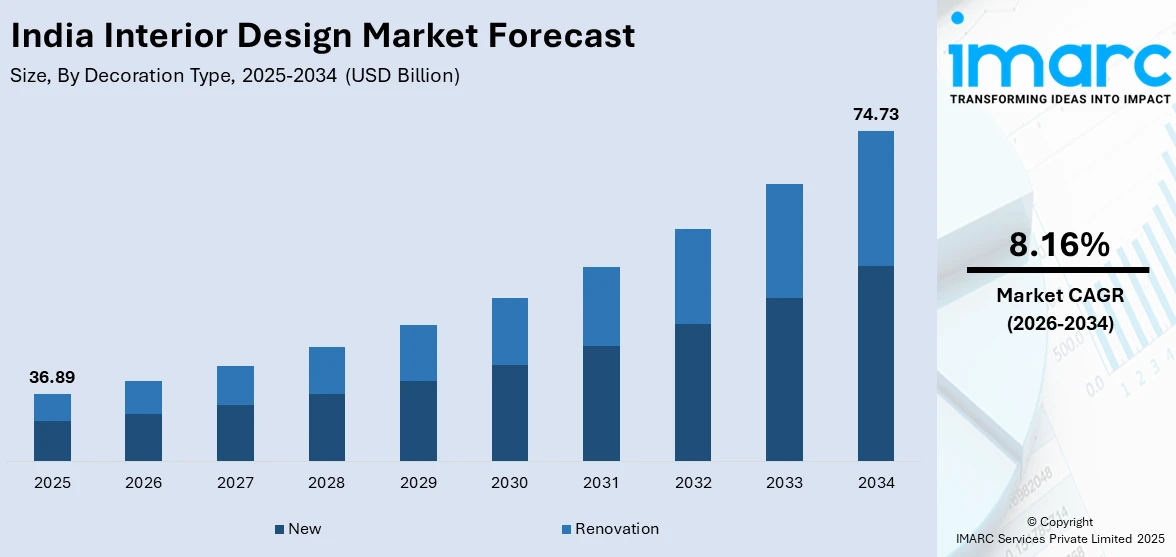

The India interior design market size was valued at USD 36.89 Billion in 2025 and is projected to reach USD 74.73 Billion by 2034, exhibiting a compound annual growth rate of 8.16% from 2026-2034.

India’s interior design market is witnessing strong momentum as urban expansion, higher household spending power, and shifting lifestyle aspirations reshape demand for well-designed spaces. Consumers increasingly seek customized, visually refined interiors that reflect personal taste and functionality. Growth in residential, commercial, and mixed-use real estate developments is creating sustained opportunities for interior design firms. Additionally, government-led infrastructure projects and the growing adoption of smart home solutions are reinforcing the need for professional design expertise, supporting market expansion across metropolitan and emerging urban centers nationwide.

Key Takeaways and Insights:

- By Decoration Type: New dominated the market with a share of 56% in 2025, driven by robust new housing construction, expanding commercial developments, and increasing consumer preference for contemporary design solutions in newly built properties across urban and suburban areas.

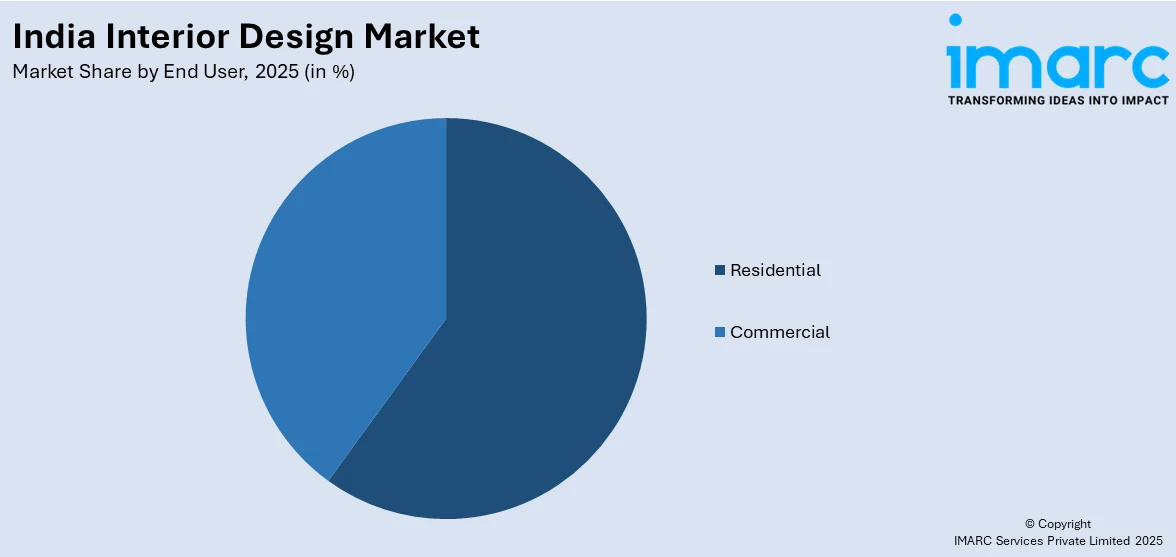

- By End User: Residential leads the market with a share of 60% in 2025, attributed to growing demand from homeowners seeking personalized living spaces, rising nuclear family formations, and increasing investments in home improvement and renovation projects.

- By Region: North India represents the largest segment with a market share of 29% in 2025, supported by significant urban development in major cities like Delhi, Chandigarh, and Jaipur, along with diverse cultural heritage inspiring fusion design aesthetics.

- Key Players: The India interior design market exhibits a competitive landscape with major organized players including tech-enabled platforms and established furniture brands competing alongside regional designers. Companies are leveraging digital visualization tools, omnichannel experiences, and end-to-end execution models to capture market share.

The Indian interior design industry is undergoing a transformative phase characterized by the convergence of traditional craftsmanship and modern technological innovation. Organized platforms are expanding their footprints across tier-2 and tier-3 cities, bringing professional design services to previously underserved markets. The integration of augmented reality and virtual reality tools has revolutionized the design consultation process, enabling immersive client experiences. For instance, in October 2025, Livspace reported 23% year-on-year revenue growth in FY25 to USD 170.7 million and announced plans to expand its store footprint from 150+ stores in 90 cities to over 200 stores in 100+ cities by March 2026. Sustainability has emerged as a key differentiator, with eco-friendly materials and energy-efficient solutions gaining prominence among environmentally conscious consumers.

India Interior Design Market Trends:

Integration of Smart Home Technologies and Automation

The adoption of smart home technologies is reshaping interior design preferences across India, with consumers increasingly demanding seamless integration of automated lighting, climate control, and security systems into their living spaces. Interior designers are now required to conceptualize layouts that accommodate IoT-enabled devices while maintaining aesthetic appeal. The India smart home devices market size reached USD 6.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.46 Billion by 2033, exhibiting a growth rate (CAGR) of 24.30% during 2025-2033, indicating strong demand for tech-integrated interior solutions.

Rising Demand for Sustainable and Eco-Friendly Design Solutions

Environmental consciousness is driving a significant shift toward sustainable interior design practices, with consumers increasingly opting for eco-friendly materials such as natural wood, recycled components, and low-VOC paints. Biophilic design elements incorporating indoor plants and natural textures are gaining momentum in both residential and commercial spaces. For instance, in March 2024, PARE Innovations launched INNOV2+ wall and ceiling panels, emphasizing sustainability features like lightweight construction and fire retardancy, reflecting the growing market demand for green interior solutions.

Growth of Personalized and Customized Interior Solutions

Consumer preferences are shifting toward bespoke furniture, tailored layouts, and customized décor elements that reflect individual tastes and cultural backgrounds. The demand for modular and multifunctional furniture is increasing as urban dwellers seek space-optimizing solutions for compact living environments. Tech-enabled platforms are leveraging data-driven insights to deliver personalized design recommendations, with companies offering 3D visualization tools that allow clients to experience their customized spaces before implementation, significantly enhancing customer engagement and satisfaction.

Market Outlook 2026-2034:

The India interior design market is poised for sustained growth over the forecast period, supported by expanding urbanization, rising real estate investments, and increasing consumer spending on home improvement. The formalization of the industry through organized players and digital platforms will continue to enhance service quality and accessibility. Government initiatives, including the PM Awas Yojana and Smart Cities Mission, are expected to generate substantial demand for interior design services in affordable housing and urban infrastructure projects. The market generated a revenue of USD 36.89 Billion in 2025 and is projected to reach a revenue of USD 74.73 Billion by 2034, growing at a compound annual growth rate of 8.16% from 2026-2034.

India Interior Design Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Decoration Type |

New |

56% |

|

End User |

Residential |

60% |

|

Region |

North India |

29% |

Decoration Type Insights:

- New

- Renovation

New dominates with a market share of 56% of the total India interior design market in 2025.

The new decoration segment maintains its leadership position driven by the continuous expansion of residential and commercial construction across major Indian cities. The surge in new housing projects, particularly in metropolitan regions and emerging tier-2 cities, has created substantial demand for fresh interior design solutions. Real estate developers are increasingly partnering with interior design firms to offer move-in-ready homes with pre-designed interiors, enhancing property appeal to prospective buyers.

Consumer demand for contemporary and modern design styles in newly developed spaces continues to drive growth across interior design segments. New projects increasingly blend global design influences with local cultural aesthetics, creating distinctive and functional interiors. Rapid expansion of commercial real estate in major urban centers is further supporting demand, as startups and established enterprises seek thoughtfully designed office environments that enhance productivity and brand identity. This shift toward visually appealing, well-planned workspaces is reinforcing the need for professional commercial interior design services across India.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 60% of the total India interior design market in 2025.

The residential segment maintains its dominant position, fueled by rising homeownership rates among millennials, increasing dual-income households, and growing consumer willingness to invest in professional interior design services. The shift toward nuclear family structures has intensified demand for optimized living spaces that maximize functionality within compact urban apartments. Home renovation activities have surged as homeowners seek to modernize existing properties with contemporary designs and smart home features.

Government-led initiatives are significantly supporting the expansion of India’s interior design market by accelerating urban development and large-scale housing projects. Programs focused on smart urban planning and sustainable city development are increasing the demand for innovative, functional, and modern interior solutions. Affordable housing schemes and urban renewal efforts are creating sustained requirements for interior finishing and space optimization services. At the same time, rising public investment in transportation hubs and government facilities is encouraging greater collaboration with professional design firms, fostering architectural creativity and improved interior aesthetics across public and civic infrastructure.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents the largest share with 29% of the total India interior design market in 2025.

North India maintains its market leadership supported by significant urban development, diverse cultural heritage, and substantial economic activity in major cities, including Delhi, Chandigarh, and Jaipur. The region benefits from a fusion of classical and contemporary design styles, with consumers seeking interiors that reflect both traditional Rajasthani craftsmanship and modern global aesthetics. The concentration of affluent consumers and luxury housing projects continues to drive demand for premium interior design services.

The National Capital region has emerged as a hub for innovative interior design, with numerous experience centers and design studios catering to discerning clientele. For instance, in October 2024, Hippo Homes opened its fifth home improvement and interior design store in Gurugram, enhancing its presence in Delhi-NCR and supporting strategic expansion plans. East and Northeast India are projected to expand at the fastest growth rate as improved connectivity, expanding retail formats, and platform-led execution combine to formalize spending on those previously favored unorganized contractors.

Market Dynamics:

Growth Drivers:

Why is the India Interior Design Market Growing?

Rapid Urbanization and Expanding Real Estate Development

India's accelerating urbanization continues to be a primary catalyst for interior design market growth, as increasing migration to metropolitan areas intensifies demand for modern, functional living and working spaces. According to the World Bank, India's urban population is projected to reach 600 million by 2036, accounting for approximately 40% of the total population and contributing around 70% to the country's GDP. The India real estate market size was valued at USD 532.61 Billion in 2025 and is projected to reach USD 1,264.00 Billion by 2034, growing at a compound annual growth rate of 10.08% from 2026-2034, creating substantial opportunities for interior design services. In the Union Budget 2024-25, the government announced PM Awas Yojana Urban 2.0 to address housing needs for one crore urban families with a Rs. 10 lakh crore investment, directly stimulating demand for interior finishing and design services.

Rising Disposable Incomes and Growing Middle-Class Aspirations

The expansion of India's middle class and increasing disposable incomes are enabling greater investment in professional interior design services. Consumers are transitioning from viewing interior design as a luxury to considering it an essential component of modern living. The growing financial independence of millennials and their preference for aesthetically curated spaces that reflect personal values are driving demand for customized design solutions. Dual-income households with greater purchasing power are increasingly willing to allocate significant budgets toward home improvement and personalization. The luxury housing segment has witnessed particularly strong growth, with sales surging 37.8% year-on-year in the first nine months of 2024, indicating robust demand for premium interior design services.

Government Infrastructure Initiatives and Policy Support

Government-led initiatives are significantly supporting the expansion of India’s interior design market by accelerating urban development and large-scale housing projects. Programs focused on smart urban planning and sustainable city development are increasing the demand for innovative, functional, and modern interior solutions. Affordable housing schemes and urban renewal efforts are creating sustained requirements for interior finishing and space optimization services. At the same time, rising public investment in transportation hubs and government facilities is encouraging greater collaboration with professional design firms, fostering architectural creativity and improved interior aesthetics across public and civic infrastructure.

Market Restraints:

What Challenges the India Interior Design Market is Facing?

Rising Raw Material Costs and Supply Chain Constraints

The increasing prices of basic materials such as wood, steel, and textiles are posing a big challenge to the service providers and consumers of interior design. The cost of construction material and labor has been significantly high in recent years, and this has been pulling down the profit margin of design firms and escalating the project costs as well. These cost pressures especially affect middle-tier companies not able to purchase in large scale, forcing many to enter joint-development partnerships with their suppliers to keep down costs.

Shortage of Skilled Labor and Professional Training Gaps

The interior design sector experiences a significant lack of experienced workers and qualified specialists to address the increasing number of orders in the market. This would cause delays in projects, and there is a possibility of poor work quality since the available manpower is not able to cope with the growing demands. The number of interior designers who have formal qualifications is a very small percentage, and this affects the standardization of services as well as the development of the profession in the industry.

Market Fragmentation and Unorganized Sector Dominance

The high number of unorganized players in the Indian interior design market poses challenges in the standardization of quality of product or services, uniformity in pricing, and protection to the customer. Such disaggregation complicates service comparison and quality evaluation of consumers, restricting the visibility of the market and professional growth prospects. Price-sensitive customers in some segments still favour unorganised contractors with lower prices, limiting the expansion of the organised ones.

Competitive Landscape:

The India interior design market exhibits a dynamic competitive landscape characterized by the presence of tech-enabled platforms, established furniture brands, and regional design firms competing across price segments. Key players have introduced innovations embracing technology, sustainability, and personalization to differentiate their offerings. Augmented Reality and Virtual Reality tools have revolutionized the design process, enabling immersive client experiences before implementation. Companies are leveraging digital visualization, standardized execution models, and omnichannel strategies to capture market share in both metro and non-metro markets. Strategic partnerships, franchise expansion, and vertical integration through supply chain control have emerged as key competitive strategies to enhance margins and service quality.

India Interior Design Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Decoration Types Covered | New, Renovation |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India interior design market size was valued at USD 36.89 Billion in 2025.

The India interior design market is expected to grow at a compound annual growth rate of 8.16% from 2026-2034 to reach USD 74.73 Billion by 2034.

New dominated the market with a 56% share in 2025, driven by the continuous expansion of residential and commercial construction, increasing consumer preference for contemporary designs, and real estate developers offering pre-designed interiors in new housing projects.

Key factors driving the India interior design market include rapid urbanization and real estate expansion, rising disposable incomes among the growing middle class, government infrastructure initiatives such as PM Awas Yojana and Smart Cities Mission, and increasing adoption of smart home technologies.

Major challenges include rising raw material costs and supply chain constraints, shortage of skilled labor and professional training gaps, market fragmentation due to unorganized sector dominance, price sensitivity among budget-conscious consumers, and limited standardization across service quality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)