India Internet of Things Market Size, Share, Trends and Forecast by Component, Application, Vertical, and Region, 2026-2034

India Internet of Things Market Summary:

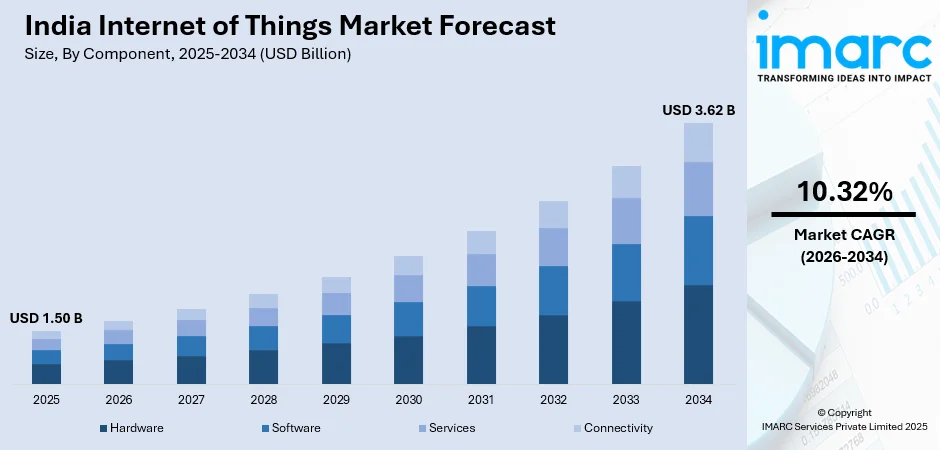

The India Internet of Things market size was valued at USD 1.50 Billion in 2025 and is projected to reach USD 3.62 Billion by 2034, growing at a compound annual growth rate of 10.32% from 2026-2034.

The India Internet of Things market is propelled by rapid digital transformation across manufacturing, healthcare, and urban infrastructure sectors. The proliferation of affordable smartphones and expanding broadband connectivity are creating a robust foundation for widespread IoT implementation. Government initiatives including Digital India and Smart Cities Mission are accelerating technology adoption, while rising demand for real-time analytics and operational efficiency drives enterprise integration of connected solutions, collectively expanding the India Internet of Things market share.

Key Takeaways and Insights:

- By Component: Hardware dominates the market with a share of 40% in 2025, fueled by the widespread deployment of sensors, actuators, and edge devices that facilitate data capture across manufacturing plants, smart city systems, and healthcare applications that rely on reliable connectivity and real-time monitoring.

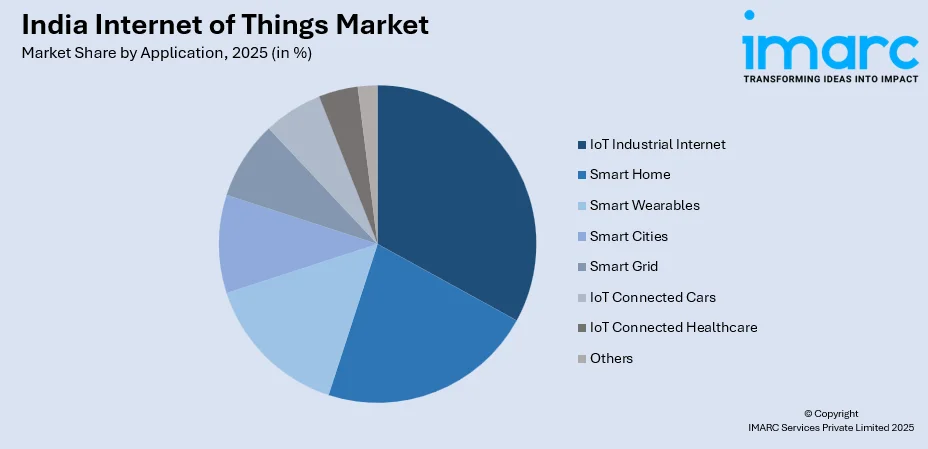

- By Application: IoT Industrial Internet leads the market with a share of 25% in 2025, driven by growing use of predictive maintenance, asset monitoring, and process automation across automotive, electronics, and pharmaceutical manufacturing, as companies seek to enhance operational efficiency, reduce downtime, and optimize production workflows.

- By Vertical: Healthcare represents the largest segment with a market share of 22% in 2025, fueled by the rising adoption of remote patient monitoring, telemedicine integration, and connected medical devices addressing the growing prevalence of chronic diseases and rural healthcare accessibility needs.

- By Region: North India dominates the market with a share of 31% in 2025, supported by advanced healthcare facilities, higher awareness of digital health technologies, and government investments in healthcare infrastructure across Delhi and Uttar Pradesh.

- Key Players: The India IoT market exhibits moderate competitive intensity, with multinational technology corporations competing alongside domestic IT service providers. Major players are focusing on strategic partnerships with telecom operators and cloud service providers to deliver comprehensive IoT solutions across manufacturing, energy, healthcare, and transportation sectors.

To get more information on this market Request Sample

The India Internet of Things market is experiencing transformative growth as enterprises across diverse sectors recognize the value of connected technologies for enhancing operational efficiency and customer engagement. The convergence of affordable connectivity, cloud computing capabilities, and artificial intelligence is enabling sophisticated IoT deployments that were previously cost-prohibitive. Healthcare institutions are leveraging IoT for continuous patient monitoring and telemedicine services, while manufacturers implement industrial IoT for predictive maintenance and supply chain optimization. For instance, in May 2025, IIT researchers commemorated the activation of India's first commercial RISC-V-based secure IoT chip developed by Mindgrove Technologies, marking a significant milestone in indigenous semiconductor capabilities for IoT applications. The expanding 5G infrastructure and edge computing adoption are further accelerating market growth by enabling low-latency, high-bandwidth IoT applications across smart cities, connected vehicles, and industrial automation use cases.

India Internet of Things Market Trends:

Advancement in Indigenous Semiconductor and IoT Hardware Development

The shift toward self-sufficiency in semiconductor and chip production is reshaping the market, with emphasis on developing affordable, high-quality hardware domestically. Government backing through design-linked incentives and production-linked incentives is fostering innovation in chip design and manufacturing. Companies are creating programmable, secure, and energy-efficient chips designed for IoT applications, facilitating wider use of connected devices in wearables, consumer gadgets, and intelligent infrastructure. For instance, in May 2024, Mindgrove Technologies launched India's first commercial high-performance IoT chip named Secure IoT, which is reportedly thirty percent cheaper than competing international chips, marking a milestone in establishing indigenous capabilities.

Integration of Artificial Intelligence with IoT Analytics Platforms

The convergence of IoT and artificial intelligence is revolutionizing analytics capabilities across Indian enterprises. AI algorithms analyze vast amounts of data generated by IoT sensors to identify patterns, detect anomalies, and generate actionable insights for maintenance teams and production managers. Predictive analytics algorithms assess risk factors based on real-time data, enabling early intervention and proactive decision-making. For instance, in March 2025, Deloitte launched its Global AI Simulation Centre of Excellence in Bengaluru as part of a three-billion-dollar investment in generative AI, focusing on enhancing decision-making through AI-driven simulations covering sectors including 5G, IoT, and robotics.

Rising Adoption in Preventive and Personalized Healthcare

The increasing prevalence of lifestyle-related illnesses is encouraging healthcare providers and technology companies to implement IoT-driven solutions for early identification and ongoing monitoring. Devices including blood pressure monitors, smart scales, and wearable health trackers are becoming vital for gathering real-time health information integrated with digital health platforms for personalized insights. The need for remote health monitoring is rising in urban and semi-urban regions, driven by convenience, cost-effectiveness, and heightened awareness. For instance, in February 2025, MediBuddy partnered with ELECOM to launch IoT-based health monitoring devices in India, including body composition scales and blood pressure monitors integrating with digital platforms for personalized health insights.

Market Outlook 2026-2034:

The outlook for the India Internet of Things market remains strong, driven by ongoing digital transformation across sectors such as manufacturing, healthcare, agriculture, and smart city infrastructure. The deployment of 5G networks is facilitating faster, more reliable IoT connectivity, while advancements in edge computing are minimizing latency for real-time applications. Increased investment in domestic semiconductor production and IoT hardware development is enhancing market accessibility, supporting innovation, and enabling startups and smaller enterprises to participate more effectively in the rapidly expanding IoT ecosystem across India. The market generated a revenue of USD 1.50 Billion in 2025 and is projected to reach a revenue of USD 3.62 Billion by 2034, growing at a compound annual growth rate of 10.32% from 2026-2034.

India Internet of Things Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Hardware |

40% |

|

Application |

IoT Industrial Internet |

25% |

|

Vertical |

Healthcare |

22% |

|

Region |

North India |

31% |

Component Insights:

- Hardware

- Software

- Services

- Connectivity

Hardware dominates with a market share of 40% of the total India Internet of Things market in 2025.

The hardware segment forms the foundation of the India IoT market, encompassing sensors, actuators, gateways, RFID tags, and edge devices that gather and transmit data across connected ecosystems. With rising demand for smart devices across manufacturing, energy, agriculture, and healthcare sectors, the necessity for robust and scalable hardware solutions continues expanding. Investments in embedded systems and advances in semiconductor technologies are propelling segment growth, supported by government initiatives encouraging domestic hardware manufacturing through production-linked incentive schemes.

Indigenous development efforts are transforming the hardware landscape as Indian companies focus on creating programmable, secure, and energy-efficient chips designed specifically for local IoT applications. For instance, in August 2024, Bar Code India introduced Dristi, an IoT-based RFID reader designed to transform supply chain operations in manufacturing, distribution, transportation, and retail sectors with advanced features including 4G-LTE and Wi-Fi connectivity support. These innovations are reducing dependence on imported components while improving the scalability and availability of IoT solutions for startups and enterprises throughout the country.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Smart Home

- Smart Wearables

- Smart Cities

- Smart Grid

- IoT Industrial Internet

- IoT Connected Cars

- IoT Connected Healthcare

- Others

IoT industrial internet leads with a share of 25% of the total India Internet of Things market in 2025.

Industrial IoT represents a crucial segment as manufacturers leverage connected technologies for predictive maintenance, asset tracking, process automation, and quality assurance across automotive, electronics, and pharmaceutical industries. The growing emphasis on Industry 4.0 adoption is driving demand for IoT solutions that enhance productivity and reduce operational downtime. Government policies including the Production Linked Incentive scheme across fourteen strategic manufacturing sectors are creating favorable conditions for industrial IoT deployment by providing financial incentives for smart factory investments.

The business case for predictive maintenance through industrial IoT is compelling as manufacturers transition from reactive maintenance approaches to condition-based interventions preventing unexpected equipment failures. Factories implementing automation and IoT solutions have reported productivity increases of fifteen to thirty percent by streamlining processes and reducing unplanned downtime. For instance, in August 2024, Neilsoft introduced Industry 4.0 solutions in India to accelerate digital transformation in manufacturing, offering Digital Factory and IIoT-enabled automation solutions at shopfloor, factory, and enterprise levels.

Vertical Insights:

- Healthcare

- Energy

- Public and Services

- Transportation

- Retail

- Individuals

- Others

Healthcare exhibits a clear dominance with a 22% share of the total India Internet of Things market in 2025.

The healthcare sector is witnessing significant IoT adoption, with medical providers using connected technologies for remote patient monitoring, intelligent diagnostics, and streamlined data management. IoT devices facilitate data-driven health tracking and more efficient clinical workflows, helping address the rising burden of chronic diseases and improving access to healthcare in rural and semi-urban areas. By enabling remote monitoring and virtual consultations, these technologies enhance patient care, increase operational efficiency, and support broader healthcare accessibility across diverse communities.

The rising adoption of wearable health devices including blood pressure monitors, glucose monitors, and fitness trackers is creating continuous feedback loops between patients and healthcare providers. These technologies enable early detection of health anomalies and reduce emergency hospital visits by supporting proactive chronic disease management. For instance, in December 2024, the MeitY-NASSCOM Centre of Excellence for AI and IoT collaborated with startups, corporates, and healthcare providers to develop solutions for improving diagnostics, reducing healthcare costs, and addressing the rural-urban divide in medical access across India.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India represents the largest share with 31% of the total India Internet of Things market in 2025.

North India dominates the market owing to the presence of advanced healthcare facilities and higher awareness of digital health technologies among consumers and enterprises. States including Delhi and Uttar Pradesh are leading IoT adoption, driven by government initiatives and investments in healthcare and smart city infrastructure. The region benefits from strong connectivity infrastructure and a growing concentration of technology-focused enterprises implementing IoT solutions across manufacturing, logistics, and consumer services sectors.

Government support for smart city development and digital governance initiatives is accelerating IoT deployment across northern states. The expansion of 5G networks and improved broadband connectivity are enabling more sophisticated IoT applications in urban and semi-urban areas. For instance, in 2025, India announced the launch of the IoT and AI-based Depot Darpan platform to digitally monitor over two thousand food grain depots using smart sensors and real-time data, demonstrating the government's commitment to leveraging connected technologies for infrastructure management.

Market Dynamics:

Growth Drivers:

Why is the India Internet of Things Market Growing?

Government-Led Digital Transformation and Smart City Initiatives

The Indian government has launched comprehensive initiatives including Digital India, Smart Cities Mission, and Make in India, to promote IoT adoption and smart infrastructure development across the country. These programs focus on digital connectivity, infrastructure development, and creating an enabling environment for technology adoption and innovation. The Smart Cities Mission has expanded its scope to target modernizing thousands of cities with focus areas including Internet of Things, Integrated Command and Control Centres, smart cameras for security and surveillance, smart meters, drones, and mobile applications for telemedicine. As of August 2025, the Production Linked Incentive scheme has generated investments worth Rs. 02 lakh crore rupees across fourteen sectors, creating several jobs and resulting in substantial production and sales growth. These policy initiatives are creating favorable conditions for IoT deployment across automotive, electronics, pharmaceuticals, and other manufacturing sectors.

Proliferation of Connected Devices and Affordable Internet Connectivity

Rapid growth in smartphone adoption, expanding broadband networks, and accessible data plans is creating a strong base for broad IoT deployment across India. Internet users in the country are expected to surpass nine hundred million by 2025, driven by increasing usage of regional languages in online content and expanding digital literacy. The increasing number of connected users, coupled with a rising middle class, is fueling the acceptance of connected consumer devices including smart televisions, wearables, and home automation systems. Telecom companies are rapidly expanding high-speed coverage while the deployment of 5G networks is improving support for low-latency, high-bandwidth IoT applications. In rural areas, initiatives such as BharatNet are facilitating IoT applications in agriculture, telemedicine, and supply chain management, broadening market accessibility beyond urban centers.

Rising Demand for Operational Efficiency and Real-Time Analytics

Enterprises across manufacturing, healthcare, logistics, and retail sectors are implementing connected technologies to oversee equipment performance, optimize resource management, and improve operational efficiency. The business case for IoT deployment is compelling as organizations recognize the value of data-driven decision-making for competitive advantage. Businesses are increasingly investing in IoT platforms integrated with artificial intelligence and machine learning capabilities that analyze vast datasets to identify patterns, predict maintenance requirements, and automate operational decisions. The integration of cloud computing with IoT ecosystems provides scalable storage and processing capabilities for the substantial data volumes generated by connected devices. Early adopters implementing AI-powered predictive models integrated with IoT sensors have reported significant reductions in unplanned downtime, demonstrating the tangible benefits driving market adoption across industries.

Market Restraints:

What Challenges the India Internet of Things Market is Facing?

Cybersecurity Vulnerabilities and Data Privacy Concerns

The proliferation of IoT devices in Indian enterprises is expanding attack surfaces for cybercriminals who exploit device vulnerabilities, weak authentication, and outdated firmware to infiltrate networks. The lack of unified security standards for IoT devices leads to inconsistent security practices, with manufacturers deploying devices without adequate safeguards. Data privacy concerns compound these challenges as IoT devices collect substantial personal information requiring secure storage and regulatory compliance, creating complex challenges for organizations seeking to balance data utilization with privacy protection.

Interoperability Challenges and Standardization Gaps

The IoT ecosystem remains highly fragmented due to the wide variety of devices, operating systems, and communication protocols from different manufacturers and vendors. Ensuring seamless communication among diverse IoT systems is complex as proprietary solutions flood the market, hindering integration and interoperability. Legacy devices often lack built-in connectivity features, creating integration complexities when organizations attempt to modernize existing infrastructure with IoT capabilities, increasing the total cost of ownership and deployment timelines.

Shortage of Skilled IoT Professionals

India faces a significant shortage of professionals with specialized expertise in IoT technology development and deployment. The rapid pace of IoT advancement requires a workforce well-versed in hardware programming, data analytics, cybersecurity, and machine learning integration. Many graduates from traditional educational programs lack the practical experience needed for real-world IoT applications, creating talent gaps that lead to project delays, increased development costs, and limited innovation capacity across enterprises.

Competitive Landscape:

The India Internet of Things market exhibits moderate competitive intensity with multinational technology corporations competing alongside domestic IT service providers and emerging startups. Major companies are concentrating on broadening product portfolios through ongoing innovation, incorporating advanced technologies including artificial intelligence, machine learning, and edge computing, into IoT solutions. Strategic partnerships and collaborations with telecom operators, cloud service providers, and sector-specific enterprises are enabling comprehensive IoT solution delivery across manufacturing, energy, healthcare, and transportation verticals. Companies are investing in research operations to improve device interoperability, security, and data analysis capabilities while focusing on scalable platforms designed for industry-specific requirements. The market is experiencing increased activity from both established players expanding their presence and innovative startups developing niche solutions for local challenges across agriculture, healthcare, and smart city applications.

Recent Developments:

- February 2025: Probus Smart Things, an IoT communications startup based in New Delhi, secured USD 5 Million in its Series A1 funding round, spearheaded by Unicorn India Ventures and assisted by US-based and Indian family offices, bringing total funding to USD 8 million to scale operations.

- February 2025: Altium LLC established a partnership with Amazon Web Services India Private Limited to provide a comprehensive curriculum equipping graduates for in-demand positions in IoT applications, cloud computing, and electronics.

- September 2024: ABB India launched ABB-free@home, a smart home automation solution with improved interoperability designed to enhance security, comfort, and energy efficiency in residential homes, enabling integration of EV chargers, third-party devices, and white goods appliances.

India Internet of Things Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| Applications Covered | Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, Others |

| Verticals Covered | Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India Internet of Things market size was valued at USD 1.50 Billion in 2025.

The India Internet of Things market is expected to grow at a compound annual growth rate of 10.32% from 2026-2034 to reach USD 3.62 Billion by 2034.

Hardware represents the largest component share at 40% in 2025, driven by the proliferation of sensors, actuators, gateways, and edge devices enabling data collection across manufacturing, smart city infrastructure, and healthcare applications.

Key factors driving the India Internet of Things market include government-led digital transformation initiatives, proliferation of affordable smartphones and internet connectivity, rising demand for operational efficiency and real-time analytics across manufacturing and healthcare sectors.

Major challenges include cybersecurity vulnerabilities and data privacy concerns, interoperability issues among diverse IoT devices and platforms, shortage of skilled professionals with specialized IoT expertise, and high initial deployment costs for small and medium enterprises.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)