India Intraocular Lens Market Size, Share, Trends and Forecast by Product, Material, End Use, and Region, 2025-2033

India Intraocular Lens Market Overview:

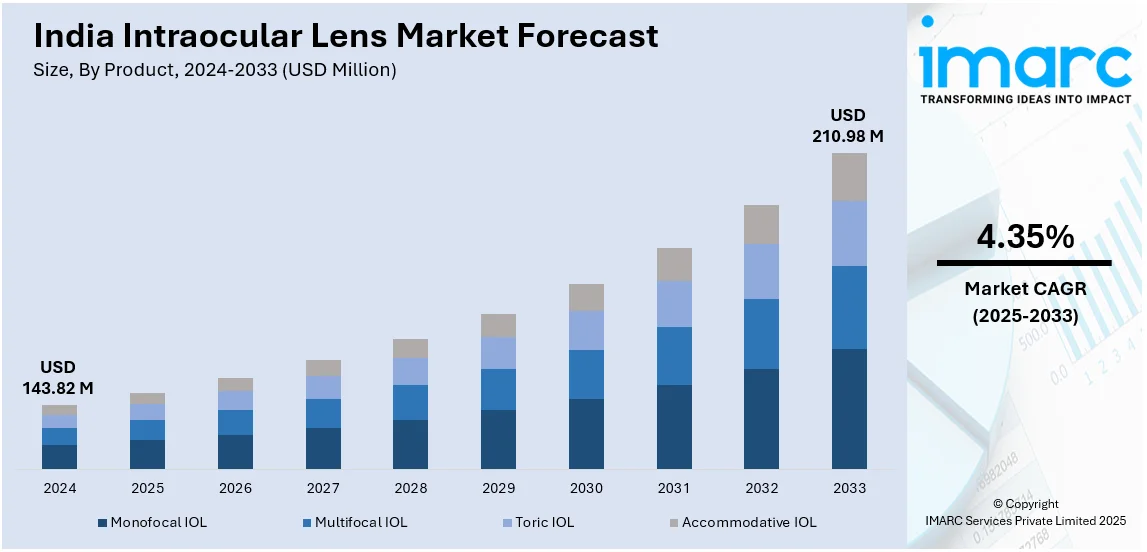

The India intraocular lens market size reached USD 143.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 210.98 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. Rising cataract prevalence, increasing geriatric population, growing adoption of premium intraocular lenses, advancements in surgical techniques, government initiatives for affordable eye care, expanding medical tourism, and rising awareness about vision correction are some of the major factors positively impacting the India intraocular lens market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 143.82 Million |

| Market Forecast in 2033 | USD 210.98 Million |

| Market Growth Rate (2025-2033) | 4.35% |

India Intraocular Lens Market Trends:

Increasing Adoption of Premium Intraocular Lenses (IOLs)

The shift from traditional mono-focal lenses to multifocal, toric, and extended depth of focus (EDOF) lenses due to enhanced visual outcomes is propelling the India intraocular market growth. These advanced IOLs provide better vision correction for presbyopia and astigmatism, reducing dependency on eyeglasses after cataract surgery. Individuals who want superior vision correction are prepared to spend more for premium choices. Technological advancements in IOLs, such as blue-light filtering, enhanced contrast sensitivity, and aspheric optics, further contribute to this trend. Increased awareness and rising disposable incomes enable greater accessibility to these solutions, especially in urban areas. Private hospitals, specialty eye clinics, and medical professionals are actively promoting premium IOLs. For instance, on March 3, 2025, the Department of Ophthalmology at Father Muller Medical College (FMMC) in Mangaluru hosted a Continuing Medical Education (CME) series titled 'Premium IOLs & Beyond'. The half-day event convened distinguished ophthalmologists and experts to discuss advancements in intraocular lenses (IOLs) and their impact on vision enhancement. The program featured insightful sessions on topics such as trifocal IOLs, extended depth of focus (EDoF) lenses, and toric IOL preferences, culminating in an interactive panel discussion addressing challenges and real-world applications in ophthalmic practice. Additionally, medical tourism plays a role in expanding the premium IOL segment, with international patients seeking high-quality, cost-effective cataract procedures in India.

To get more information of this market, Request Sample

Government Initiatives and Public-Private Partnerships

The Indian government is actively working to improve access to cataract treatment and intraocular lens procedures through initiatives which are positively influencing the India intraocular market outlook. Free or subsidized cataract surgeries are provided to economically weaker sections, thereby increasing the volume of intraocular lens implantations in public hospitals. The Ayushman Bharat scheme also covers cataract surgeries, further increasing demand for IOLs. According to a research report published in March 2024, out of 15,274 eye procedures, 3,458 patients (22.6%) used the PM-JAY program. Additionally, 2,713 patients (78.5%) utilized Ayushman scheme benefits specifically for cataract surgery. Moreover, state governments collaborate with non-governmental organizations (NGOs) and private hospitals to enhance ophthalmic care, particularly in rural and semi-urban regions where cataract-related blindness remains a major concern. Non-profit organizations and charitable trusts conduct large-scale eye camps, distributing free intraocular lenses and conducting cataract surgeries at minimal costs. These initiatives contribute to the growing penetration of intraocular lenses across different socio-economic segments. Additionally, the Indian government has streamlined regulatory approvals for medical devices, encouraging domestic IOL manufacturing and reducing dependency on imports, making lenses more affordable and accessible across various regions.

India Intraocular Lens Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, material, and end use.

Product Insights:

- Monofocal IOL

- Multifocal IOL

- Toric IOL

- Accommodative IOL

The report has provided a detailed breakup and analysis of the market based on the product. This includes monofocal IOL, multifocal IOL, toric IOL, and accommodative IOL.

Material Insights:

- Polymethylmethacrylate (PMMA)

- Silicone

- Hydrophobic Acrylic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes polymethylmethacrylate (PMMA), silicone, and hydrophobic acrylic.

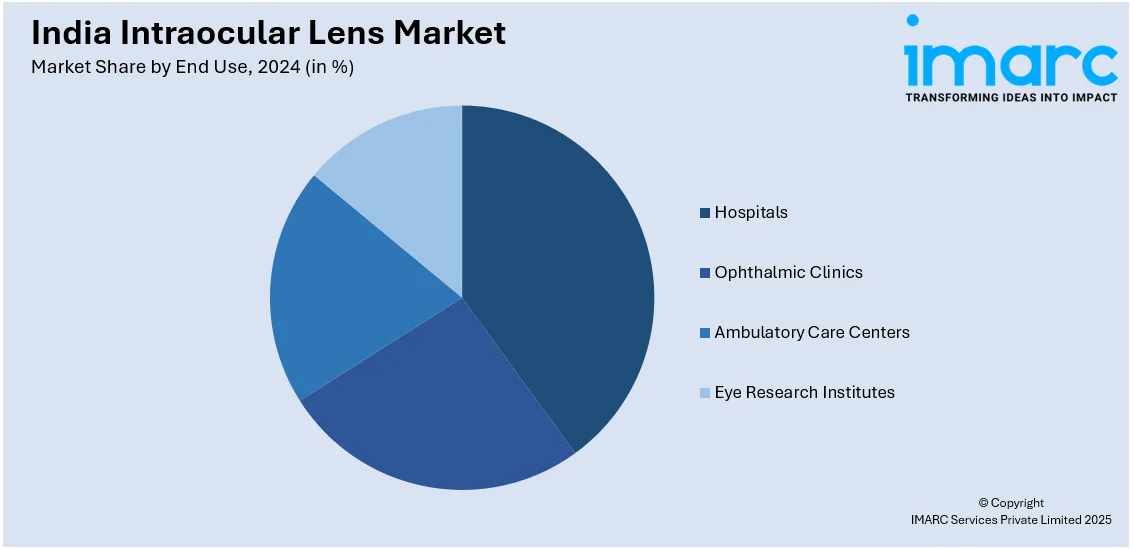

End Use Insights:

- Hospitals

- Ophthalmic Clinics

- Ambulatory Care Centers

- Eye Research Institutes

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, ophthalmic clinics, ambulatory care centers, and eye research institutes.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Intraocular Lens Market News:

- On March 12, 2024, advanced presbyopia correction technologies were introduced in India with the Clareon® Family of intraocular lenses (IOLs) by Alcon. The Clarion platform includes the PanOptix® Trifocal IOL, which offers patients 20/20 vision at various distances and has more than 2.2 million implants worldwide. The Vivity® IOL is designed to extend vision with mono-focal-like quality and a low incidence of visual disturbances. These innovations aim to provide Indian patients with exceptional, long-lasting visual clarity.

- On February 13, 2025, Johnson & Johnson launched the TECNIS PureSeeTM intraocular lens (IOL) to treat presbyopia in India. Similar to a monofocal IOL, this next-generation lens's solely refractive construction provides continuous, excellent vision with the best contrast and low-light performance in its class. The goal of the TECNIS PureSeeTM IOL is to provide Indian patients and surgeons a high-end choice that combines improved vision with less visual complaints.

India Intraocular Lens Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Monofocal IOL, Multifocal IOL, Toric IOL, Accommodative IOL |

| Materials Covered | Polymethylmethacrylate (PMMA), Silicone, Hydrophobic Acrylic |

| End Uses Covered | Hospitals, Ophthalmic Clinics, Ambulatory Care Centers, Eye Research Institutes |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India intraocular lens market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India intraocular lens market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India intraocular lens industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The intraocular lens market in India was valued at USD 143.82 Million in 2024.

The India intraocular lens market is projected to exhibit a (CAGR) of 4.35% during 2025-2033, reaching a value of USD 210.98 Million by 2033.

The market is fueled by the growing prevalence of cataract, an increasing geriatric population, and amplified availability of eye care services. The ease in affordability of ophthalmic procedures and government health programs enable increased uptake. Advancements in technology, including toric and multifocal lenses, as well as enhanced awareness of eye care, play a key role in the growth pattern of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)