India Investment Casting Market Size, Share, Trends and Forecast by Process Type, Material, Application, and Region, 2025-2033

India Investment Casting Market Size and Share:

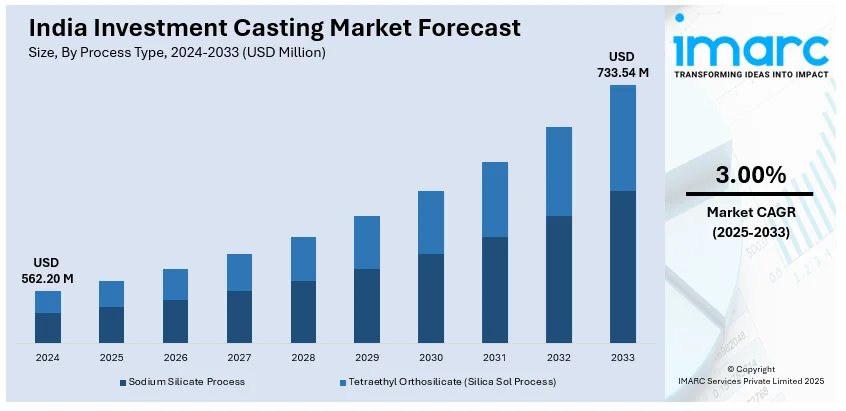

The India investment casting market size reached USD 562.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 733.54 Million by 2033, exhibiting a growth rate (CAGR) of 3.00% during 2025-2033. The market is driven by increasing demand from aerospace, defense, and automotive sectors, particularly for lightweight, high-precision components. Government initiatives such as "Make in India" and the push for electric vehicles (EVs) further enhance the India investment casting market share. Technological advancements and the need for sustainable manufacturing practices also contribute to the market's expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 562.20 Million |

| Market Forecast in 2033 | USD 733.54 Million |

| Market Growth Rate (2025-2033) | 3.00% |

India Investment Casting Market Trends:

Increasing Adoption of Investment Casting in Aerospace and Defense

The increasing adoption in the aerospace and defense sectors is majorly driving the India investment casting market growth. Investment casting, known for its precision and ability to produce complex components, is becoming a preferred manufacturing method for critical parts in aircraft, missiles, and defense equipment. The Indian government’s focus on enhancing domestic aerospace manufacturing under initiatives such as "Make in India" has further fueled this trend. On 5th April 2024, GE Aerospace announced plans to invest USD 30 Million to upgrade and expand its manufacturing facility in Pune, India. The investment will increase production capabilities. Such a development strengthens India's aerospace manufacturing sector and aligns with the growing investment casting industry in the country. The facility has hired more than 5,000 professionals since its inception in 2015, highlighting its substantial role in India becoming a growing global aerospace hub. Additionally, the rising demand for lightweight and high-strength components in modern aircraft aligns perfectly with the capabilities of investment casting. As global aerospace companies look to India for cost-effective manufacturing solutions, local foundries are investing in advanced technologies to meet international quality standards. This trend is expected to drive the market’s growth, positioning India as a key player in the global investment casting industry.

To get more information of this market, Request Sample

Growing Demand from Automotive and Electric Vehicle (EV) Sectors

The automotive industry, including the rapidly expanding electric vehicle (EV) segment, is creating a positive India investment casting market outlook. India is leading the electric vehicle revolution in Emerging Asia, creating a USD 1.3 Trillion investment opportunity by 2030 as electric two- and three-wheelers proliferate. In the year 2023, India emerged as a world leader in electric three-wheeler sales with 580,000 units and 60 percent market share and also totaled 880,000 e-scooter sales for second place globally. The rise of electric vehicles is driving the need for precision components and is thus complementing India's flourishing investment casting market and its manufacturing industry. Investment casting is increasingly used to manufacture engine components, transmission parts, and other critical automotive elements that require high precision and durability. With the Indian government pushing for EV adoption to reduce carbon emissions, the demand for lightweight and efficient components is on the rise. Investment casting offers the advantage of producing intricate designs with minimal material waste, making it ideal for EV manufacturers. Furthermore, the shift toward sustainable manufacturing practices is encouraging automakers to adopt investment casting for its eco-friendly benefits. As the automotive and EV sectors continue to grow, the investment casting market in India is poised for substantial expansion, supported by technological advancements and increasing investments in the industry.

India Investment Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on process type, material, and application.

Process Type Insights:

- Sodium Silicate Process

- Tetraethyl Orthosilicate (Silica Sol Process)

The report has provided a detailed breakup and analysis of the market based on the process type. This includes sodium silicate process and tetraethyl orthosilicate (silica sol process).

Material Insights:

- Superalloys

- Steel

- Aluminum

- Titanium

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes superalloys, steel, aluminum, titanium, and others.

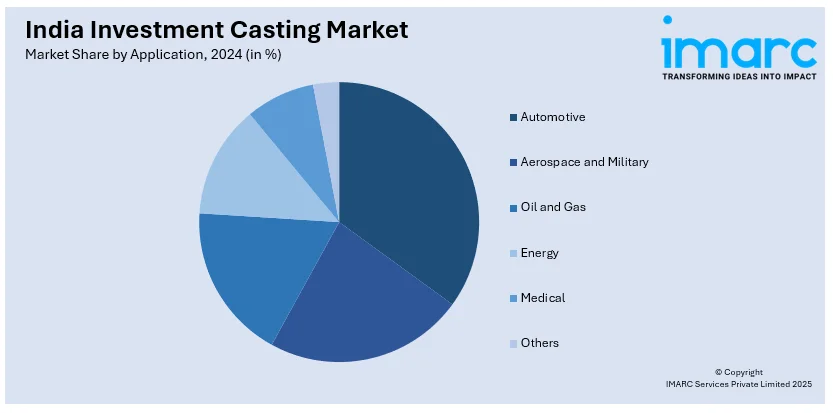

Application Insights:

- Automotive

- Aerospace and Military

- Oil and Gas

- Energy

- Medical

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, aerospace and military, oil and gas, energy, medical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Investment Casting Market News:

- December 21, 2024: Jaya Hind Industries installed India's biggest high-pressure die-casting machine with a capacity of 4,400 tons at its plant in Urse, Pune. This upgrade greatly increases the output of aluminum parts for electric and commercial vehicles. This investment further strengthens India′ position in advanced die-casting and precision manufacturing and is supplied by Buhler-Switzerland. This initiative addresses the growing need for high-strength lightweight components in the investment casting and automotive sectors.

- December 11, 2024: Bharat Forge's JS Auto Cast Foundry has announced a ₹67.5 Crore (approximately USD 8.23 Million) investment to expand its operations in Tamil Nadu, which the company says will increase its casting capacity by more than 60 percent, as its annual capacity will be 1,16,000 tonnes. The initiative includes the setting up of new induction furnaces and sand-handling systems to meet the rising demand for high-quality investment castings in the domestic and overseas markets. This expansion will create 400 jobs, strengthen India’s positioning in precision casting, and contribute to industrial growth.

India Investment Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Process Types Covered | Sodium Silicate Process, Tetraethyl Orthosilicate (Silica Sol Process) |

| Material Covered | Superalloys, Steel, Aluminum, Titanium, Others |

| Applications Covered | Automotive, Aerospace and Military, Oil and Gas, Energy, Medical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India investment casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India investment casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India investment casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The investment casting market in India was valued at USD 562.20 Million in 2024.

The India investment casting market is projected to exhibit a CAGR of 3.00% during 2025-2033, reaching a value of USD 733.54 Million by 2033.

The India investment casting market is driven by growing demand in industries like aerospace, automotive, and energy. Factors include the need for high-precision, complex components, advancements in casting technologies, and increasing industrial applications. The market is also supported by rising demand for lightweight, durable materials and the shift toward automation and cost-efficient production methods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)