India Iodine Market Size, Share, Trends and Forecast by Source, Form, Application, and Region, 2025-2033

India Iodine Market Overview:

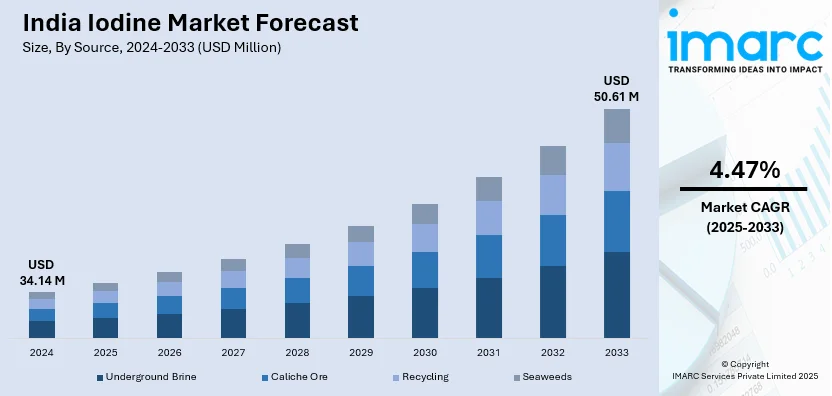

The India iodine market size reached USD 34.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 50.61 Million by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. The market is propelled by increasing health awareness leading to higher demand in pharmaceuticals, expanding applications in agriculture and food processing, and government initiatives promoting domestic production to reduce import dependence.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.14 Million |

| Market Forecast in 2033 | USD 50.61 Million |

| Market Growth Rate (2025-2033) | 4.47% |

India Iodine Market Trends:

Rising Demand in Medical and Pharmaceutical Applications

Iodine has significance in the medical and pharmaceutical industries for its involvement in thyroid hormone synthesis as well as its antibacterial characteristics. The rising frequency of thyroid problems, as well as the growth of India's pharmaceutical sector, are driving up demand for iodine. The National Family Health Survey (NFHS) V (2019-2021) found a 2.9% prevalence of thyroid disorders, up from 2.2% in NFHS IV. This growth has raised public awareness of iodine's significance in avoiding thyroid-related diseases, resulting in increasing use of iodine supplements and iodized salt. Moreover, India's pharmaceutical sector for the fiscal year 2023-24 is estimated to be worth USD 50 billion, with domestic sales accounting for USD 23.5 billion and exports contributing USD 26.5 billion. The country ranks as the third-largest producer globally in terms of volume and holds the 14th position based on production value. Iodine is integral in manufacturing various medical products, including antiseptics, disinfectants, and contrast agents for imaging. The industry's expansion has consequently escalated the demand for iodine.

To get more information of this market, Request Sample

Expanding Use in Animal Husbandry and Agriculture

The agricultural sector's growth, particularly in animal husbandry, has led to a surge in iodine demand for animal nutrition and crop protection. The Indian animal feed market size reached INR 1,110.0 billion in 2024. IMARC Group expects the market to reach INR 2,025.1 billion by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033. Iodine is an important element in animal diets, supporting metabolic activities and disease prevention. The growing chicken and aqua feed industries have substantially influenced the rising usage of iodine supplements. Furthermore, India's dairy sector, which is the world's largest, requires high-quality animal feed fortified with iodine to maintain optimal milk output and animal health. The emphasis on increasing animal production has accelerated the use of iodine in feed formulations. Beyond animal feeding, iodine is used in agriculture activities for its antibacterial qualities, which help to safeguard crops. Its use in soil fumigants and fertilizers aids in disease control, thereby enhancing crop output and quality.

India Iodine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on source, form, and application.

Source Insights:

- Underground Brine

- Caliche Ore

- Recycling

- Seaweeds

The report has provided a detailed breakup and analysis of the market based on the source. This includes underground brine, caliche ore, recycling, and seaweeds.

Form Insights:

- Inorganic Salts and Complexes

- Organic Compounds

- Elementals and Isotopes

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes inorganic salts and complexes, organic compounds, and elementals and isotopes.

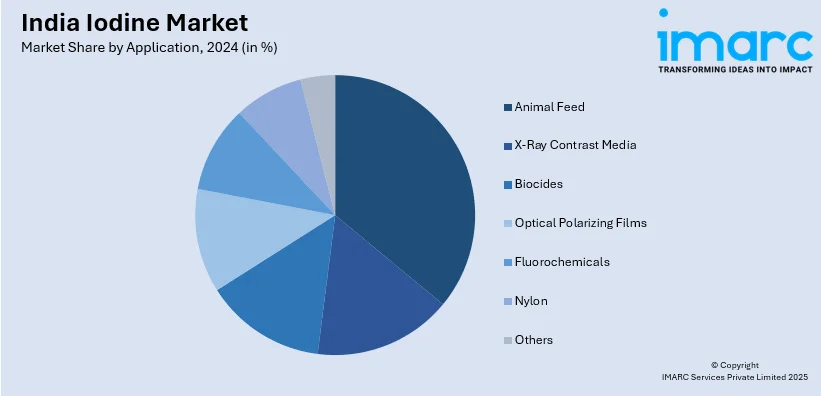

Application Insights:

- Animal Feed

- X-Ray Contrast Media

- Biocides

- Optical Polarizing Films

- Fluorochemicals

- Nylon

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes animal feed, X-ray contrast media, biocides, optical polarizing films, fluorochemicals, nylon, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Iodine Market News:

- October 2024: ITC Ltd, in collaboration with the Institute of Global Development, launched the Aashirvaad Smart India Program to fight iodine deficiency disorders (IDD). This initiative seeks to educate 5 lakh people on the health benefits of iodized salt.

- March 2024: The American Oncology Institute at Imphal's Babina Specialty Hospital introduced iodine therapy for thyroid cancer. This treatment uses radioactive iodine to effectively target and eliminate cancerous cells.

India Iodine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Underground Brine, Caliche Ore, Recycling, Seaweeds |

| Forms Covered | Inorganic Salts and Complexes, Organic Compounds, Elementals and Isotopes |

| Applications Covered | Animal Feed, X-Ray Contrast Media, Biocides, Optical Polarizing Films, Fluorochemicals, Nylon, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India iodine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India iodine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India iodine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The iodine market in India was valued at USD 34.14 Million in 2024.

The India iodine market is projected to exhibit a CAGR of 4.47% during 2025-2033, reaching a value of USD 50.61 Million by 2033.

The growth of the India iodine market is driven by demand from pharmaceuticals, iodized salt production, animal feed additives, and industrial uses like chemicals and dyes. In addition to this, rising health awareness, government salt iodization programs, and expansion of medical and nutrition sectors keep increasing consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)