India IoT in Manufacturing Market Size, Share, Trends and Forecast by Software, Connectivity, Services, Application, End User, and Region, 2026-2034

India IoT in Manufacturing Market Summary:

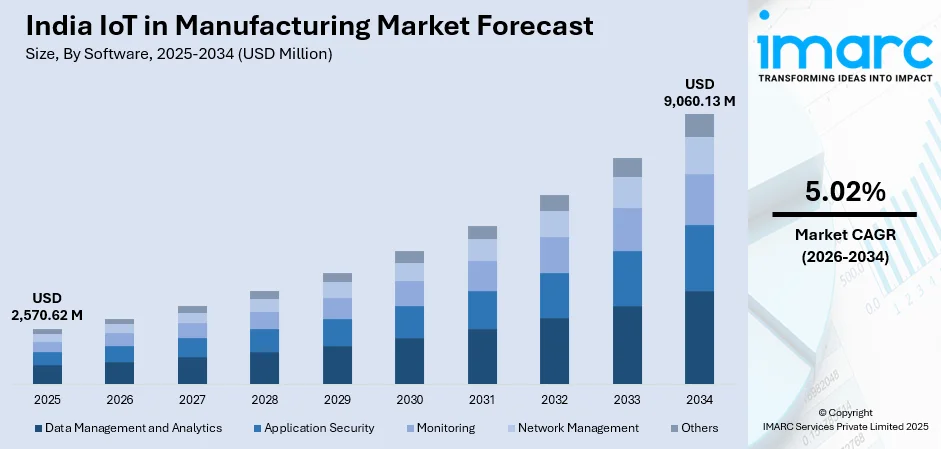

The India IoT in manufacturing market size was valued at USD 2,570.62 Million in 2025 and is projected to reach USD 9,060.13 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034.

The market is driven by rising government initiatives promoting smart manufacturing, increasing adoption of automation technologies across industrial facilities, and growing emphasis on operational efficiency optimization. Expanding digital infrastructure and widespread cloud computing implementation are accelerating market expansion. Additionally, the growing need for real-time production monitoring and predictive analytics capabilities is propelling demand across diverse sectors, contributing to the India IoT in manufacturing market share.

Key Takeaways and Insights:

- By Software: Data management and analytics dominates the market with a share of 28% in 2025, driven by growing emphasis on extracting actionable insights from vast industrial data streams.

- By Connectivity: Cellular network leads the market with a share of 35% in 2025, owing to widespread telecommunications infrastructure expansion enabling reliable machine-to-machine communication and superior data transmission capabilities supporting real-time industrial operations.

- By Services: Professional represents the largest segment with a market share of 30% in 2025, driven by increasing demand for specialized consulting expertise in implementing complex industrial IoT architectures and integration support services.

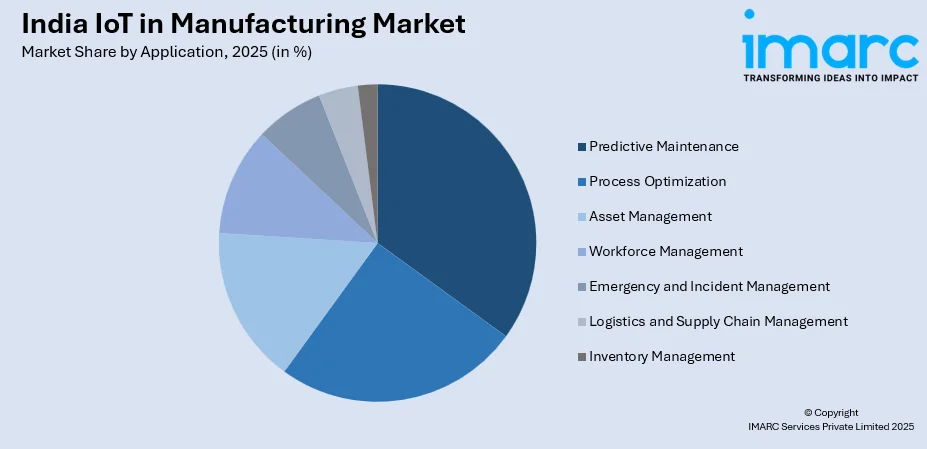

- By Application: Predictive maintenance dominates the market with a share of 22% in 2025, owing to manufacturers prioritizing equipment reliability enhancement and growing focus on reducing unplanned operational disruptions across production environments.

- By End User: Automotive represents the largest segment with a market share of 26% in 2025, driven by the sector's pioneering adoption of smart factory concepts and extensive implementation of connected assembly systems.

- By Region: North India leads the market with a share of 28.5% in 2025, driven by concentration of major industrial corridors, established manufacturing infrastructure, and presence of significant automotive production hubs.

- Key Players: The India IoT in manufacturing market exhibits a fragmented competitive landscape, with global technology corporations competing alongside domestic solution providers across various industry verticals. Market participants are focusing on strategic partnerships, technology integrations, and expanding service portfolios to strengthen their market positioning.

To get more information on this market Request Sample

The India IoT in manufacturing market is experiencing robust expansion driven by multiple converging factors reshaping the industrial landscape. Government initiatives including the Production linked incentive (PLI) scheme and make in India campaign are creating favorable conditions for smart manufacturing adoption across diverse sectors. According to sources, the Government of India had approved 806 applications under the Production Linked Incentive (PLI) schemes across 14 sectors including electronics, telecom, and automotive, supporting the modernisation and connected factory push in manufacturing. Moreover, the expanding telecommunications infrastructure, particularly nationwide deployment of advanced connectivity networks, is establishing essential foundations for large-scale industrial IoT implementations. Rising labor costs and growing competition from global markets are compelling manufacturers to embrace automation and digital transformation strategies. Additionally, increasing availability of affordable sensors, cloud computing platforms, and advanced analytics tools is making IoT deployments more accessible and economically viable for enterprises of varying scales throughout the manufacturing ecosystem.

India IoT in Manufacturing Market Trends:

Digital Twin Technology Integration

Manufacturing enterprises across India are increasingly adopting digital twin technology to create virtual replicas of physical production systems and equipment. This sophisticated approach enables manufacturers to simulate operational scenarios, test process modifications, and optimize performance parameters without disrupting actual production activities. As per sources, MG Motor India reported that deploying digital twin solutions improved throughput by about 15% in its paint shop and enabled “what-if” operational simulations to optimise energy use and reduce emissions at its manufacturing facility. Furthermore, digital twins facilitate comprehensive lifecycle management by providing real-time visibility into equipment behaviour, enabling proactive identification of potential issues before they impact operations.

Edge Computing Deployment for Real-Time Processing

Indian manufacturers are progressively implementing edge computing architectures to process industrial data closer to its source rather than transmitting everything to centralized cloud platforms. This distributed computing approach dramatically reduces latency in critical manufacturing operations, enabling split-second automated responses to production anomalies and quality deviations. In October 2024, Qualcomm announced partnerships with Indian OEMs and ODMs to accelerate deployment of edge AI and edge computing solutions tailored for industrial IoT use cases, bringing real-time analytics and low latency processing closer to factory floors. Moreover, edge computing supports enhanced operational continuity by maintaining essential processing capabilities even during network connectivity disruptions.

Artificial Intelligence-Powered Quality Assurance

Machine learning (ML) and artificial intelligence (AI) technologies are transforming quality control processes across Indian manufacturing facilities through advanced visual inspection systems and pattern recognition capabilities. These intelligent systems continuously analyze production outputs, identifying defects and deviations with superior accuracy compared to traditional manual inspection methods. As per sources, in June 2025, AI-based vision systems deployed by Indian manufacturers inspected up to 10,000 parts per minute with over 99% accuracy, strengthening real-time defect detection on production lines. Furthermore, AI-powered quality assurance enables manufacturers to implement zero-defect manufacturing strategies by detecting anomalies at early production stages, preventing defective products from progressing through subsequent operations. The technology supports continuous improvement initiatives by correlating quality outcomes with process parameters, enabling systematic optimization of manufacturing conditions to enhance overall product quality and consistency.

Market Outlook 2026-2034:

The India IoT in manufacturing market is positioned for sustained revenue growth throughout the forecast period, supported by accelerating digital transformation initiatives across industrial sectors. Manufacturing enterprises are increasingly recognizing the strategic importance of connected technologies in achieving operational excellence and maintaining competitive positioning in global markets. The expanding ecosystem of domestic solution providers and growing technology partnerships is enhancing market accessibility for enterprises across all scales. Government incentive programs continue supporting capital investments in smart manufacturing infrastructure, while improving digital literacy and workforce capabilities are facilitating broader adoption. The market generated a revenue of USD 2,570.62 Million in 2025 and is projected to reach a revenue of USD 9,060.13 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034

India IoT in Manufacturing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Software |

Data Management and Analytics |

28% |

|

Connectivity |

Cellular Network |

35% |

|

Services |

Professional |

30% |

|

Application |

Predictive Maintenance |

22% |

|

End User |

Automotive |

26% |

|

Region |

North India |

28.5% |

Software Insights:

- Application Security

- Data Management and Analytics

- Monitoring

- Network Management

- Others

Data management and analytics dominates with a market share of 28% of the total India IoT in manufacturing market in 2025.

Data management and analytics lead the software category, reflecting manufacturers’ focus on extracting actionable insights from industrial data. These platforms enable collection, storage, processing, and visualization of operational information. In February 2025, Tata Consultancy Services (TCS) partnered with Salesforce to provide Indian manufacturers real-time insights and predictive analytics across production and supply chains. Moreover, enterprises increasingly deploy analytics solutions to detect inefficiencies, optimize resource allocation, and support evidence-based decision-making, driving widespread adoption and enhancing operational visibility across manufacturing operations nationwide.

Advanced data management platforms are enabling manufacturers to establish unified data architectures integrating information from disparate production systems, quality control equipment, and supply chain networks. These solutions support sophisticated analytical capabilities including trend analysis, anomaly detection, and performance benchmarking across manufacturing operations. The segment continues expanding as manufacturers recognize data as a strategic asset, investing in platforms that transform raw operational information into competitive advantages through enhanced visibility and optimization.

Connectivity Insights:

- Satellite Network

- Cellular Network

- RFID

- NFC

- Wi-Fi

- Others

Cellular network leads with a share of 35% of the total India IoT in manufacturing market in 2025.

The cellular network dominates the connectivity category, driven by India’s expanding telecommunications infrastructure. It enables reliable, high-bandwidth communication for real-time monitoring, remote equipment management, and mobile workforce coordination. In March 2025, Vodafone Idea launched 5G services in Mumbai using Nokia equipment, implementing AI-powered Self-Organizing Network technology and unlimited data plans, with phased 5G rollout planned across India. With superior coverage flexibility over fixed networks, cellular connectivity facilitates IoT deployments across geographically dispersed facilities and diverse outdoor operations, supporting enhanced operational efficiency and seamless industrial automation nationwide.

Ongoing expansion of advanced cellular networks is significantly enhancing the value proposition for industrial IoT applications requiring low-latency communication and high data throughput capabilities. Manufacturers are also leveraging cellular connectivity to implement sophisticated machine-to-machine communication systems, enabling autonomous coordination between production equipment and automated material handling systems. The segment benefits from continuous infrastructure investments by telecommunications providers, ensuring progressive coverage expansion and capability enhancements supporting increasingly demanding industrial connectivity requirements.

Services Insights:

- Professional

- System Integration and Deployment

- Managed

- Others

Professional exhibits a clear dominance with a 30% share of the total India IoT in manufacturing market in 2025.

Professional lead the category, providing consulting, system integration, implementation, and training to help manufacturers navigate complex IoT deployments, ensuring effective adoption, optimized operations, and measurable value across industrial environments. These service providers bridge the critical gap between technology capabilities and operational requirements, ensuring IoT deployments deliver anticipated business outcomes and measurable value across diverse manufacturing sectors and industrial verticals. In October 2025, HashStudioz Technologies strengthened its IoT and digital transformation services by acquiring a majority stake in Maxify Digital to broaden consulting and implementation support for enterprise IoT solutions.

Manufacturing enterprises increasingly recognize the substantial value of engaging specialized expertise for their complex digital transformation initiatives, particularly given the significant technical complexity of integrating modern IoT platforms with existing legacy production systems and equipment. Professional services providers offer critical capabilities in solution architecture design, vendor evaluation, project management, and change management supporting successful technology adoption across organizations. The segment continues growing rapidly as manufacturers seek experienced partners capable of navigating the evolving technology landscape while minimizing implementation risks effectively.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Process Optimization

- Predictive Maintenance

- Asset Management

- Workforce Management

- Emergency and Incident Management

- Logistics and Supply Chain Management

- Inventory Management

Predictive maintenance leads with a market share of 22% of the total India IoT in manufacturing market in 2025.

Predictive maintenance dominates the application category, driven by manufacturers’ focus on maximizing equipment availability and minimizing unplanned disruptions. Leveraging sensor data, machine learning, and historical performance, it anticipates failures for proactive interventions and optimized asset utilization. In August 2025, Siemens deployed Armv9-based AI-powered sensors in Indian factories, enabling real-time anomaly detection, automatic machine adjustments, and extended equipment lifespan. This approach reduces maintenance costs, extends equipment life, and minimizes production losses from unexpected breakdowns, delivering substantial operational efficiency across manufacturing facilities.

Manufacturing facilities across India are increasingly implementing predictive maintenance programs as foundational elements of their comprehensive digital transformation strategies and initiatives. The application enables condition-based maintenance approaches replacing traditional time-based schedules, ensuring maintenance activities occur precisely when needed rather than according to arbitrary intervals. Organizations implementing predictive maintenance report substantial improvements in overall equipment effectiveness, with reduced downtime, lower maintenance expenditures, and enhanced operational predictability supporting superior production planning and strategic resource allocation decisions effectively.

End User Insights:

- Automotive

- Food and Agriculture Equipment

- Industrial Equipment

- Electronics and Communication Equipment

- Chemicals and Materials Equipment

- Others

Automotive exhibits a clear dominance with a 26% share of the total India IoT in manufacturing market in 2025.

The automotive leads the end-user category, driven by early adoption of advanced manufacturing technologies and automation systems. IoT solutions enhance quality control, production efficiency, and supply chain coordination in complex, high-volume operations. In 2025, Maruti Suzuki began production at its Kharkhoda plant with a 250,000 units vehicle annual capacity, supporting smart manufacturing and IoT initiatives. Stringent quality standards and competitive pressures further incentivize connected technology adoption, enabling superior operational performance across Indian automotive manufacturing facilities and driving broader digital transformation in the sector.

Automotive facilities across India have emerged as showcases for sophisticated IoT implementations, with connected systems spanning assembly operations, quality inspection, logistics management, and facility infrastructure. The sector's experience with automation and digital technologies positions automotive manufacturers as early adopters of emerging IoT capabilities, influencing adoption patterns across adjacent industries. Continued expansion of automotive production capacity in India, supported by government incentive programs and favorable policies, ensures sustained IoT investment momentum throughout the forecast period.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 28.5% of the total India IoT in manufacturing market in 2025.

The North India commands the largest market share, driven by strong concentration of well-established industrial corridors and major manufacturing hubs actively supporting technology adoption initiatives. The region hosts significant automotive production clusters, electronics manufacturing facilities, and diverse industrial enterprises creating substantial demand for comprehensive IoT solutions and services. Well-developed transportation networks, robust power infrastructure, and advanced telecommunications connectivity provide essential foundations supporting large-scale industrial IoT deployments across multiple manufacturing verticals throughout this prominent region.

The region benefits from strategic proximity to major metropolitan centers providing access to skilled technology workforce, solution providers, and supporting ecosystem participants facilitating widespread IoT adoption effectively. Government initiatives promoting industrial development in northern states continue attracting significant manufacturing investments, steadily expanding the addressable market for IoT solutions. Educational institutions and technical training programs concentrated in the region support workforce development needs, ensuring availability of qualified personnel capable of implementing and managing connected manufacturing technologies.

Market Dynamics:

Growth Drivers:

Why is the India IoT in Manufacturing Market Growing?

Accelerating Government Support for Smart Manufacturing Initiatives

Government programs are creating substantial momentum for IoT adoption across India's manufacturing sector through financial incentives, policy frameworks, and strategic infrastructure investments. The Production Linked Incentive scheme spanning multiple strategic sectors provides direct financial support encouraging manufacturers to invest in advanced technologies including industrial IoT platforms. As per sources, the government launched four SAMARTH Centres to advance smart manufacturing adoption, showcasing IoT and Industry 4.0 implementations across key industrial clusters. Furthermore, make in India initiatives emphasize manufacturing competitiveness enhancement through technology adoption, creating favorable regulatory environments for digital transformation investments. Government agencies are establishing centers of excellence and demonstration projects showcasing smart manufacturing capabilities, building awareness and confidence among potential adopters nationwide.

Rising Demand for Operational Efficiency and Cost Optimization

Intensifying global competition and margin pressures are compelling Indian manufacturers to pursue aggressive operational efficiency improvements achievable through IoT-enabled optimization strategies. Connected manufacturing systems provide unprecedented visibility into production processes, enabling identification and elimination of inefficiencies previously invisible to management teams. According to sources, a Pune SME implemented IoT sensors on CNC machines, increasing uptime by 15 % and saving ₹5 Lakh in downtime, demonstrating tangible efficiency gains through automation and AI. Furthermore, real-time monitoring capabilities enable rapid response to operational anomalies, minimizing waste and preventing quality deviations from escalating into significant problems. IoT platforms support systematic continuous improvement programs by providing objective performance data enabling evidence-based decision-making. The compelling return on investment demonstrated by early adopters is accelerating adoption decisions.

Expanding Availability of Affordable IoT Technologies and Solutions

Declining costs for sensors, connectivity, computing, and software platforms are dramatically improving the accessibility of industrial IoT solutions for manufacturers across all scales. Component miniaturization and manufacturing scale economies have reduced hardware costs while enhancing capabilities, enabling cost-effective deployment of comprehensive sensor networks across production environments. According to reports, in January 2026, India approved 22 Electronics Component Manufacturing Scheme (ECMS) projects worth ₹418.63 Billion, boosting domestic production of IoT-relevant components and reducing import dependence. Moreover, cloud computing platforms provide enterprise-grade data management and analytics capabilities without requiring substantial capital investments in on-premises infrastructure. Growing ecosystem of domestic solution providers offers locally relevant IoT platforms and services at price points accessible to small and medium enterprises effectively.

Market Restraints:

What Challenges the India IoT in Manufacturing Market is Facing?

High Initial Implementation Costs and Investment Requirements

Despite declining component costs, comprehensive industrial IoT implementations require substantial capital investments creating barriers for many manufacturers. System integration complexity, customization requirements, and infrastructure upgrades significantly increase total implementation costs. Small and medium enterprises often lack financial resources necessary for full-scale deployments, while extended payback periods create investment approval difficulties.

Shortage of Skilled Workforce for IoT Implementation and Management

Successful industrial IoT adoption requires personnel possessing specialized competencies spanning operational technology, information technology, data analytics, and domain expertise. Current educational programs inadequately address interdisciplinary skill requirements for connected manufacturing environments. Rural and smaller manufacturing centers face particular difficulties attracting and retaining skilled workforce necessary for implementation.

Cybersecurity Vulnerabilities and Data Protection Concerns

Expanding connectivity across manufacturing environments creates new attack surfaces potentially exposing critical production systems to cyber threats. Legacy industrial equipment often lacks security capabilities necessary for safe network connectivity. Manufacturers express legitimate concerns about protecting proprietary production data and intellectual property when adopting cloud-based IoT platforms and connected solutions.

Competitive Landscape:

The India IoT in manufacturing market competitive landscape is characterized by diverse participation spanning global technology corporations, specialized industrial automation providers, telecommunications operators, and emerging domestic solution providers. Market participants compete across multiple dimensions including technology capabilities, industry-specific expertise, implementation experience, service quality, and pricing. Strategic partnerships between technology providers and domain experts are becoming increasingly common, enabling comprehensive solution offerings addressing complex manufacturer requirements. The market demonstrates ongoing consolidation through acquisitions as established players seek to expand capabilities and market reach. Domestic solution providers are gaining market share by offering locally relevant platforms, responsive support services, and competitive pricing aligned with Indian manufacturing requirements.

Recent Developments:

- In September 2025, Vi Business, in collaboration with Amazon Web Services and the Centre for Development of Telematics (C‑DOT), launched an IoT Innovation Lab in Mumbai. The lab aims to support enterprises, start-ups, and device makers in designing, testing, and scaling industry-grade IoT solutions, including smart manufacturing and edge AI applications.

India IoT in Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Softwares Covered | Application Security, Data Management and Analytics, Monitoring, Network Management, Others |

| Connectivities Covered | Satellite Network, Cellular Network, RFID, NFC, Wi-Fi, Others |

| Services Covered | Professional, System Integration and Deployment, Managed, Others |

| Applications Covered | Process Optimization, Predictive Maintenance, Asset Management, Workforce Management, Emergency and Incident Management, Logistics and Supply Chain Management, Inventory Management |

| End Users Covered | Automotive, Food and Agriculture Equipment, Industrial Equipment, Electronics and Communication Equipment, Chemicals and Materials Equipment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India IoT in manufacturing market size was valued at USD 2,570.62 Million in 2025.

The India IoT in manufacturing market is expected to grow at a compound annual growth rate of 5.02% from 2026-2034 to reach USD 9,060.13 Million by 2034.

Data management and analytics held the largest market share, driven by manufacturers' growing emphasis on extracting actionable intelligence from industrial data streams and supporting evidence-based decision-making processes across diverse manufacturing environments.

Key factors driving the India IoT in manufacturing market include accelerating government initiatives, rising operational efficiency demand, expanding digital infrastructure, increasing affordable IoT technology accessibility, and growing predictive analytics emphasis.

Major challenges include high initial implementation costs creating barriers for smaller manufacturers, shortage of skilled workforce possessing interdisciplinary competencies, cybersecurity vulnerabilities and data protection concerns, integration complexity with legacy production systems, and interoperability challenges across heterogeneous technology environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)