India IoT in Middleware Market Size, Share, Trends and Forecast by Platform, Application, Infrastructure Service, Organization Size, and Region, 2025-2033

India IoT in Middleware Market Overview:

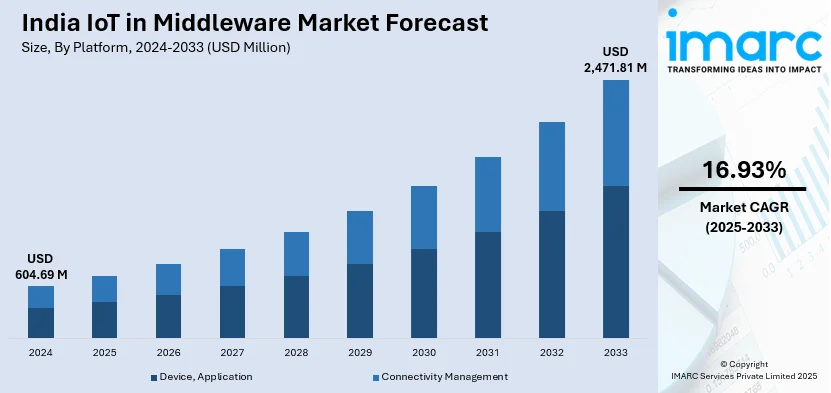

The India IoT in middleware market size reached USD 604.69 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,471.81 Million by 2033, exhibiting a growth rate (CAGR) of 16.93% during 2025-2033. The market is driven by the rapid adoption of IoT devices across industries, expansion of the manufacturing sector, government initiatives like Digital India and Smart Cities, substantial digital transformation efforts, and escalating demand for seamless interoperability, real-time data analytics, and secure IoT infrastructure in businesses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 604.69 Million |

| Market Forecast in 2033 | USD 2,471.81 Million |

| Market Growth Rate 2025-2033 | 16.93% |

India IoT in Middleware Market Trends:

Surge in Adoption of IoT Devices

India is a substantially growing market for IoT adoption across various domains such as Healthcare, Agriculture, Smart Cities, and Manufacturing. The need for automation, data-driven decision-making, and improved operational efficiency is driving growth. India's IoT market size is anticipated to reach USD 3.6 Billion by 2033, growing at a CAGR of more than 10.2% as per a report by the IMARC Group. As more companies incorporate IoT devices into their operations, it becomes difficult to manage a large network of sensors, smart devices, and connected systems. This is where IoT middleware comes in, serving as an intermediary between various IoT applications, hardware, and networks. Middleware solutions provide smooth data exchange, device interoperability, and secure communication. As industries are very dependent on IoT for real-time tracking and predictive analysis, the need for effective middleware solutions is increasing, thus impelling the India IoT in Middleware market a great deal.

To get more information of this market, Request Sample

Expansion of the Manufacturing Sector

India's manufacturing industry is seeing a dramatic change with Industry 4.0 technology adoption, such as IoT, artificial intelligence, and automation. The Make in India program has also given a push to the growth of the industry, making the nation a global manufacturing center. As per the India Brand Equity Foundation (IBEF), the manufacturing sector is to grow to 25% of India's GDP by 2025 from its current level of 17%. IoT is transforming manufacturing through real-time monitoring of equipment, predictive maintenance, and optimizing production. But as factories automate thousands of IoT devices, it becomes essential to manage these interconnected systems efficiently. IoT middleware solutions assist manufacturers in streamlining operations by facilitating seamless device communication, data integration, and cloud connectivity. As the focus on smart factories and automation continues to rise, demand for middleware platforms is increasing, positioning it as a key driver of India's industrial IoT growth and propelling advancement in the IoT in middleware market.

India IoT in Middleware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on platform, application, infrastructure service, and organization size.

Platform Insights:

- Device, Application

- Connectivity Management

The report has provided a detailed breakup and analysis of the market based on the platform. This includes device, application and connectivity management.

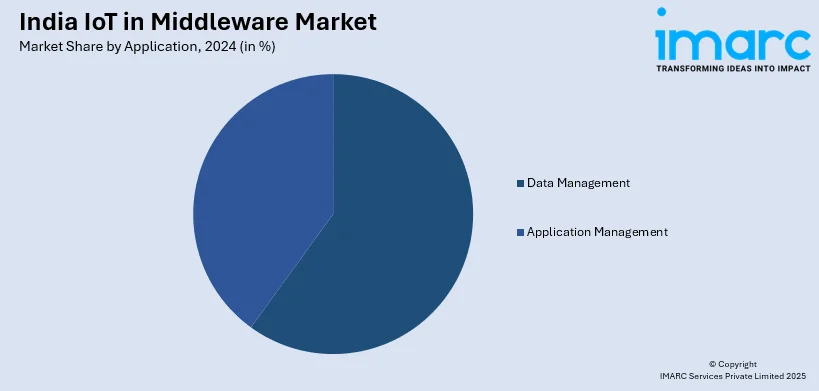

Application Insights:

- Data Management

- Application Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data management and application management.

Infrastructure Service Insights:

- Manufacturing

- Government

- Defense

- Automotive

- Transportation

A detailed breakup and analysis of the market based on the infrastructure service have also been provided in the report. This includes manufacturing, government, defense, automotive, and transportation.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IoT in Middleware Market News:

- January 2025: TP-Link partnered with Optiemus Electronics to manufacture networking and smart home products in India, aligning with the "Make in India" initiative. This collaboration is set to produce up to 6 million devices annually, including key telecom and IoT products like GPON (ONT), home Wi-Fi routers, enterprise routers, cameras, modems, and other networking equipment. By bolstering local supply chains and reducing dependency on imports, this initiative enhances the domestic IoT ecosystem, thereby driving India's IoT middleware market.

- October 2024: Airtel Business partnered with Kia India to power its connected car platform, Kia Connect 2.0, using a robust IoT solution for real-time vehicle management, security, and AI-driven features. This collaboration enhances IoT integration in the automotive sector, increasing the complexity of managing connected devices. As more automakers adopt IoT, the demand for middleware solutions to streamline data integration and device communication grows, driving India's IoT in middleware market.

India IoT in Middleware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Device, Application, Connectivity Management |

| Applications Covered | Data Management, Application Management |

| Infrastructure Services Covered | Manufacturing, Government, Defense, Automotive, Transportation |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IoT in middleware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IoT in middleware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IoT in middleware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IoT in middleware market in India was valued at USD 604.69 Million in 2024.

The India IoT in middleware market is projected to exhibit a CAGR of 16.93% during 2025-2033, reaching a value of USD 2,471.81 Million by 2033.

The market is driven by the increasing interconnectivity of devices, need for efficient data management, and the complexity of integrating diverse IoT systems. Middleware enables smooth communication between hardware and software layers, facilitating scalability and flexibility. Businesses are adopting these solutions to support automation, streamline operations, and enhance responsiveness in connected environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)