India Irrigation Systems Market Size, Share, Trends and Forecast by Type of Irrigation System, Crop Type, Application, and Region, 2025-2033

India Irrigation Systems Market Overview:

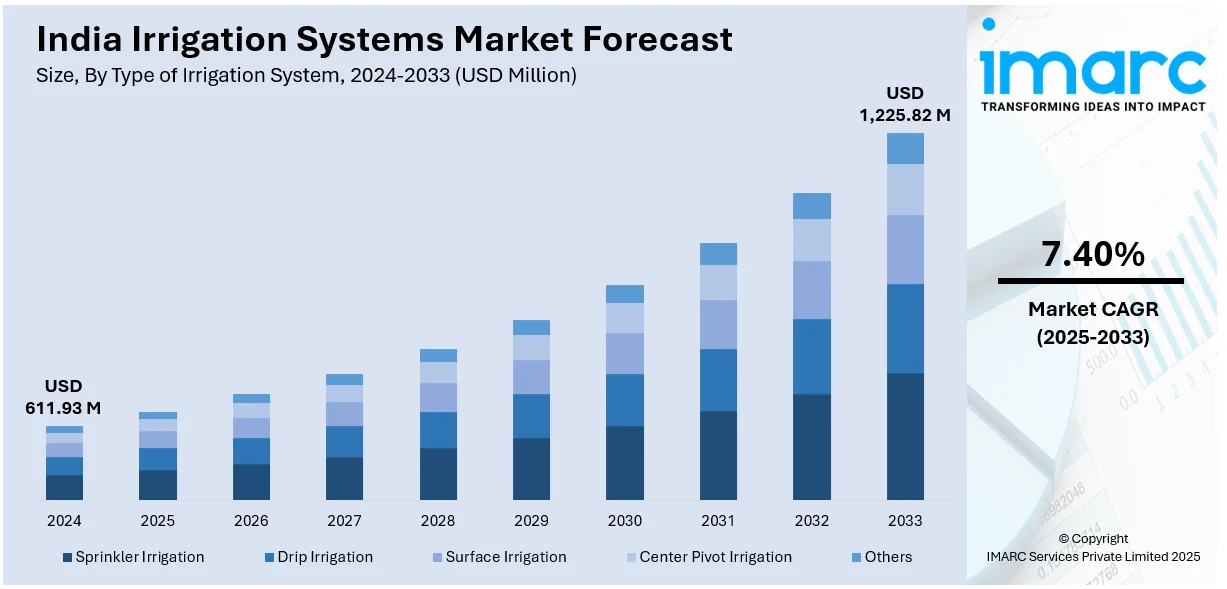

The India irrigation systems market size reached USD 611.93 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,225.82 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is witnessing significant growth, driven by the increasing adoption of drip irrigation systems and technological integration with smart irrigation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 611.93 Million |

| Market Forecast in 2033 | USD 1,225.82 Million |

| Market Growth Rate 2025-2033 | 7.40% |

India Irrigation Systems Market Trends:

Increasing Adoption of Drip Irrigation Systems

One of the most prominent trends in the India irrigation systems market is the increasing adoption of drip irrigation technology. As agricultural productivity and water conservation become paramount, drip irrigation is emerging as an effective solution for efficient water usage. For instance, in March 2025, Mahindra EPC Irrigation secured a Rs 13.12 crore order for micro-irrigation systems under a community project covering 2,625 hectares, to be completed within twelve months. The company specializes in irrigation solutions. Drip irrigation comes with direct water supply into the roots of plants, thereby minimizing wastage and maintaining uniform distribution. This method is mainly important in water-scarce areas in India, so the traditional method of irrigation, flood irrigation, will lose a lot of water due to evaporation and runoff savings of evapotranspiration. The adoption of drip irrigation has gained momentum due to the push of the government towards sustainable practices in agriculture and various subsidies and support schemes offered to farmers. Growing interest in precision agriculture, where irrigation is synchronized with real-time data and weather forecasts, has further fueled the market for these systems. Moreover, increased crop yield, lower labor costs, and improved efficiency in water use make drip irrigation a worthy investment for farmers. This trend is likely to be continued as more farmers will come to know the potential benefit of this system in both economic and environmental terms in the long run; thus, drip irrigation can be perceived as a major component of the advanced modernization of irrigation infrastructure in India.

To get more information of this market, Request Sample

Technological Integration with Smart Irrigation Solutions

Another key trend in the Indian irrigation systems market is the integration of advanced technologies, particularly smart irrigation solutions. With the rising pressures of climate change, erratic weather patterns, and a growing demand for water conservation, the need for intelligent, data-driven irrigation systems is becoming more urgent. Smart irrigation systems, which include sensors, weather stations, automated controllers, and real-time monitoring platforms, enable farmers to optimize irrigation schedules based on weather forecasts, soil moisture levels, and crop water requirements. For instance, in March 2025, the Tamil Nadu government announced a Rs 722.55 crore plan to upgrade irrigation systems in 35 districts, focusing on reducing water wastage and improving supply by repairing 149 dilapidated systems. This technology minimizes water wastage, increases efficiency, and enhances crop productivity. Furthermore, the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into irrigation systems offers farmers the ability to manage their irrigation processes remotely through mobile applications or web-based platforms. As awareness about these technologies increases and the cost of implementation decreases, the demand for smart irrigation systems is expected to rise. The government and private sector are increasingly investing in the research and development of such solutions, which will drive innovation and accelerate the widespread adoption of smart irrigation technologies in India. This trend aligns with India’s broader agricultural modernization agenda, focused on optimizing resources and improving sustainability.

India Irrigation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type of irrigation system, crop type, and application.

Type of Irrigation System Insights:

- Sprinkler Irrigation

- Drip Irrigation

- Surface Irrigation

- Center Pivot Irrigation

- Others

The report has provided a detailed breakup and analysis of the market based on the type of irrigation system. This includes sprinkler irrigation, drip irrigation, surface irrigation, center pivot irrigation, and others.

Crop Type Insights:

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Cash Crops

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals and grains, fruits and vegetables, oilseeds and pulses, and cash crops.

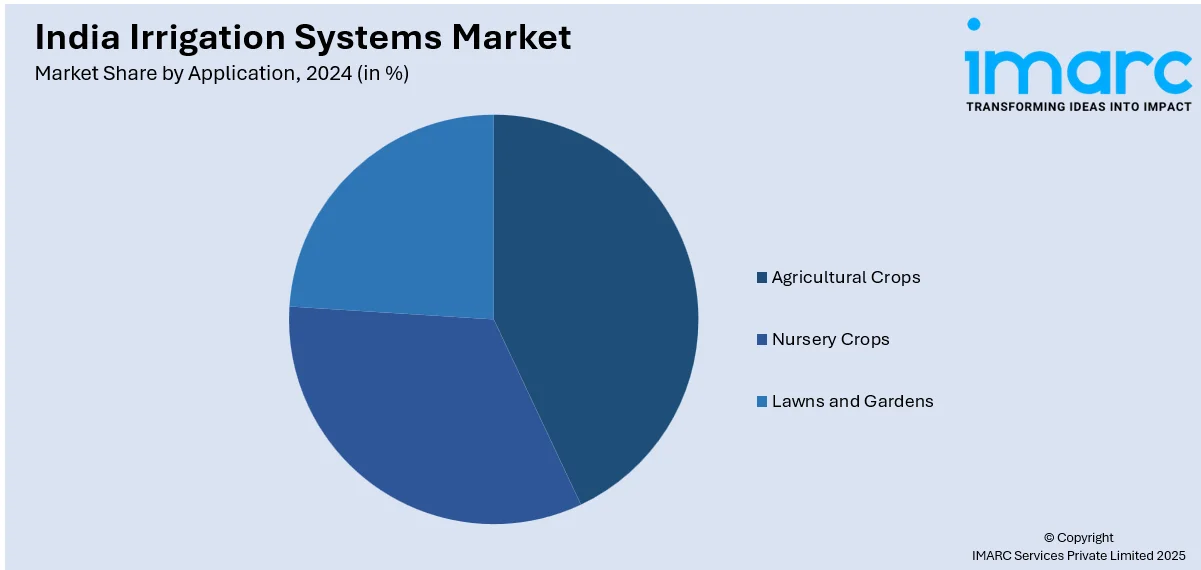

Application Insights:

- Agricultural Crops

- Nursery Crops

- Lawns and Gardens

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes agricultural crops, nursery crops, and lawns and gardens.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Irrigation Systems Market News:

- In March 2025, Irrigation Minister N. Uttam Kumar Reddy and Revenue Minister Ponguleti Srinivas Reddy inaugurated the water release system at Devadula Pumping Station in Warangal, marking a milestone in Phase-3 of the Lift Irrigation Scheme. One pump released 600 cubic feet of water, with two more pumps expected in 15 days.

India Irrigation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Irrigation Systems Covered | Sprinkler Irrigation, Drip Irrigation, Surface Irrigation, Center Pivot Irrigation, Others |

| Crop Types Covered | Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Cash Crops |

| Applications Covered | Agricultural Crops, Nursery Crops, Lawns and Gardens |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India irrigation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India irrigation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India irrigation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India irrigation systems market was valued at USD 611.93 Million in 2024.

The India irrigation systems market is projected to exhibit a CAGR of 7.40% during 2025-2033, reaching a value of USD 1,225.82 Million by 2033.

India irrigation systems market is driven by increasing water scarcity, government support through subsidies, and the need for efficient agricultural practices. Rising adoption of micro-irrigation, growing awareness among farmers, and expansion of high-value crops also escalate product demand. Technological advancements and precision farming further enhance market growth across regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)