India Isobutyl Benzene Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Isobutyl Benzene Market Overview:

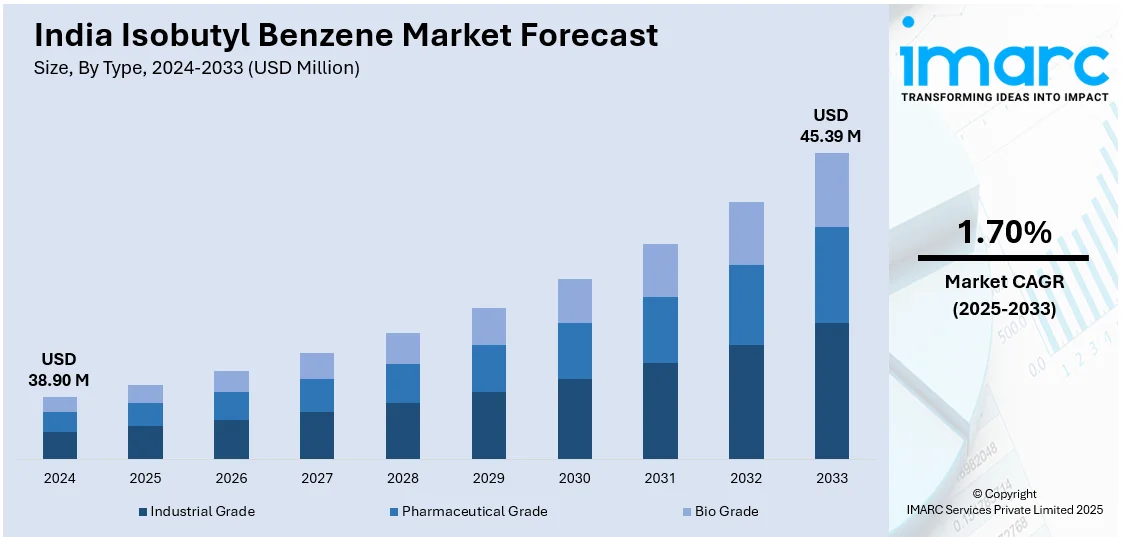

The India isobutyl benzene market size reached USD 38.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 45.39 Million by 2033, exhibiting a growth rate (CAGR) of 1.70% during 2025-2033. The market is witnessing significant growth, driven by the increasing demand for paraxylene and PET production and emphasis on sustainable production and green chemistry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.90 Million |

| Market Forecast in 2033 | USD 45.39 Million |

| Market Growth Rate 2025-2033 | 1.70% |

India Isobutyl Benzene Market Trends:

Increasing Demand for Paraxylene and PET Production

One of the key trends driving the isobutyl benzene market is the growing demand for paraxylene (PX), a critical intermediate in the production of polyethylene terephthalate (PET). For instance, in January 2025, Polyplex Corporation will invest $65 million to build a new 52,400 MTPA BOPET film plant in India, expanding its 90,000 MTPA capacity to meet growing industrial and packaging demand. Isobutyl benzene plays an essential role in the production of paraxylene, which is primarily used in the manufacture of PET, a versatile material widely used in packaging, textiles, and beverage containers. As global consumption of PET continues to increase, particularly in the packaging and textile industries, the demand for isobutyl benzene is poised to rise correspondingly. This growth is particularly evident in developing regions, where rising disposable incomes, increased urbanization, and greater consumer demand for packaged goods and clothing are contributing to higher PET consumption. Additionally, the shift towards sustainable packaging, such as recyclable PET bottles and containers, further enhances the demand for isobutyl benzene as a precursor for producing high-quality paraxylene. As industries continue to focus on enhancing the production capacity and efficiency of PET, the isobutyl benzene market will continue to benefit from this expanding demand for paraxylene, reinforcing its critical role in the global chemicals supply chain.

To get more information of this market, Request Sample

Emphasis on Sustainable Production and Green Chemistry

A growing trend within the isobutyl benzene market is the increased emphasis on sustainable production methods and the adoption of green chemistry practices. As environmental concerns and sustainability become central priorities for industries worldwide, companies in the chemicals sector are exploring ways to reduce their carbon footprints and enhance the environmental performance of their production processes. For instance, Hindustan Unilever (HUL) aims to cut scope 3 energy and industrial emissions by 42% by 2030, accelerating efforts to reduce its carbon footprint and promote sustainability. In response to this, the isobutyl benzene industry is witnessing investments in more energy-efficient technologies, cleaner manufacturing processes, and the use of renewable feedstocks. This shift is driven by stricter environmental regulations as well as rising consumer and corporate pressure for sustainable and eco-friendly products. Innovations such as improved catalytic processes and the development of bio-based isobutyl benzene are expected to contribute significantly to this trend, providing environmentally friendly alternatives to traditional production methods. Furthermore, companies are focusing on reducing waste generation and optimizing resource utilization during the manufacturing process to minimize their ecological impact. As these green technologies continue to evolve, the isobutyl benzene market will likely see increased demand from environmentally conscious consumers and businesses, positioning sustainability as a key differentiator in the competitive landscape.

India Isobutyl Benzene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Industrial Grade

- Pharmaceutical Grade

- Bio Grade

The report has provided a detailed breakup and analysis of the market based on the type. This includes industrial grade, pharmaceutical grade, and bio grade.

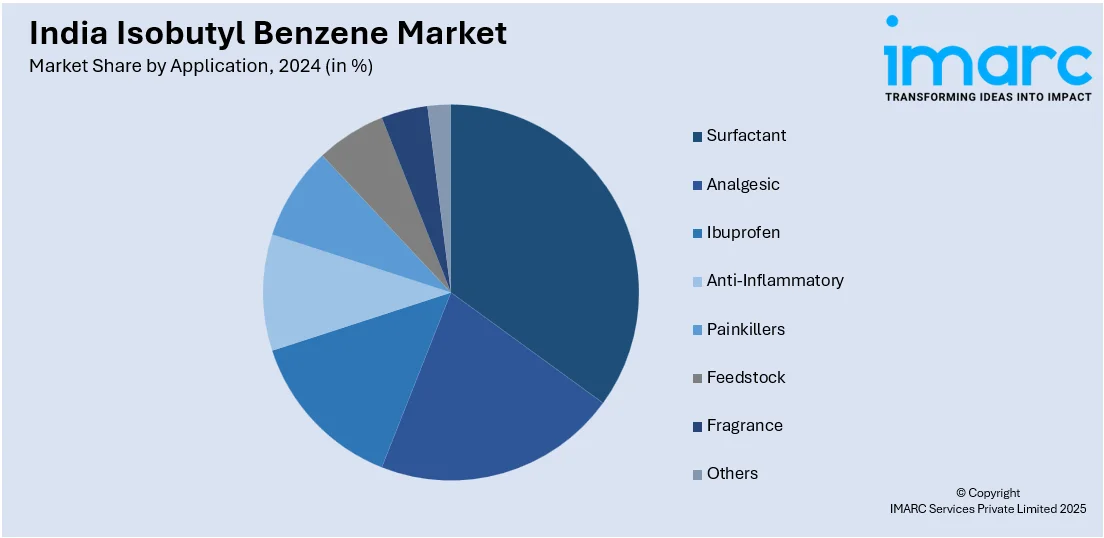

Application Insights:

- Surfactant

- Analgesic

- Ibuprofen

- Anti-Inflammatory

- Painkillers

- Feedstock

- Fragrance

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes surfactant, analgesic, ibuprofen, anti-inflammatory, painkillers, feedstock, fragrance, and others.

End User Insights:

- Personal Care

- Pharmaceutical

- Chemical

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal care, pharmaceutical, chemical, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regionl markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Isobutyl Benzene Market News:

- In August 2023, MRPL Managing Director (Additional Charge) Sanjay Varma announced plans to establish a world-scale Isobutylbenzene (IBB) production facility. IBB, a key ingredient in painkiller manufacturing, will utilize MRPL’s patented technology, enhancing its pharmaceutical sector presence. The project highlights the company's commitment to innovation and market expansion.

India Isobutyl Benzene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Industrial Grade, Pharmaceutical Grade, Bio Grade |

| Applications Covered | Surfactant, Analgesic, Ibuprofen, Anti-Inflammatory, Painkillers, Feedstock, Fragrance, Others |

| End Users Covered | Personal Care, Pharmaceutical, Chemical, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India isobutyl benzene market performed so far and how will it perform in the coming years?

- What is the breakup of the India isobutyl benzene market on the basis of type?

- What is the breakup of the India isobutyl benzene market on the basis of application?

- What is the breakup of the India isobutyl benzene market on the basis of end user?

- What is the breakup of the India isobutyl benzene market on the basis of region?

- What are the various stages in the value chain of the India isobutyl benzene market?

- What are the key driving factors and challenges in the India isobutyl benzene?

- What is the structure of the India isobutyl benzene market and who are the key players?

- What is the degree of competition in the India isobutyl benzene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India isobutyl benzene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India isobutyl benzene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India isobutyl benzene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)