India IT Asset Disposition Market Size, Share, Trends and Forecast by Service, Asset Type, Enterprise Size, Industry Vertical, and Region, 2025-2033

Market Overview:

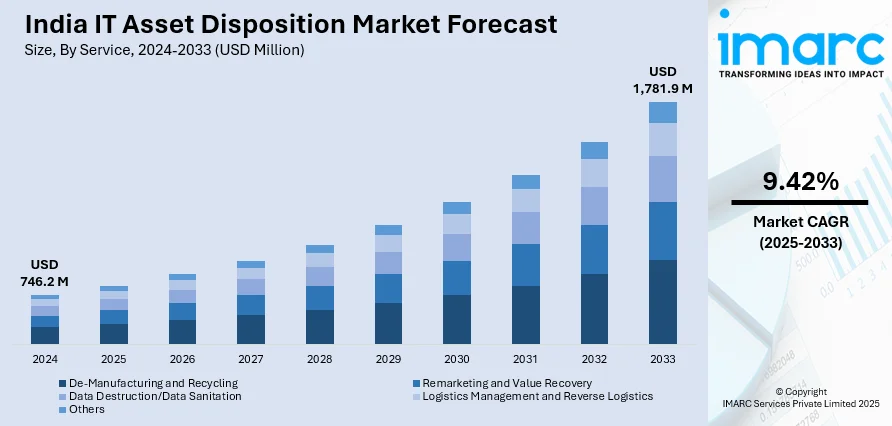

India IT asset disposition market size reached USD 746.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,781.9 Million by 2033, exhibiting a growth rate (CAGR) of 9.42% during 2025-2033. The evolving technological landscape and the increasing awareness among businesses towards the importance of responsible IT asset management are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 746.2 Million |

|

Market Forecast in 2033

|

USD 1,781.9 Million |

| Market Growth Rate 2025-2033 | 9.42% |

IT asset disposition (ITAD) involves overseeing the disposal, resale, and recycling of obsolete or excess information technology (IT) assets in an organizational context. These assets encompass computers, laptops, servers, storage devices, networking equipment, and various electronic devices. The ITAD process emphasizes the secure and conscientious management of these assets, prioritizing data security, adherence to environmental regulations, and the extraction of optimal value from retired IT equipment. Through the implementation of ITAD practices, companies can effectively navigate the end-of-life cycle of their IT assets, mitigating risks and optimizing returns.

To get more information of this market, Request Sample

India IT Asset Disposition Market Trends:

The India IT asset disposition market is experiencing significant growth and transformation as organizations recognize the importance of efficiently managing the end-of-life cycle of their information technology equipment. Additionally, this market has witnessed a surge in demand driven by technological advancements and the increasing adoption of digital solutions. As businesses in India continue to upgrade their IT infrastructure, there is a simultaneous need to responsibly handle obsolete equipment. Besides this, the market across the nation addresses this requirement by offering secure and environmentally compliant solutions for the disposal and recycling of IT assets, including computers, laptops, servers, storage devices, networking equipment, and other electronic devices. Moreover, compliance with environmental regulations is another key aspect, with an emphasis on reducing electronic waste and promoting sustainable practices, thereby acting as another significant growth-inducing factor. The India IT asset disposition market is characterized by the emergence of specialized companies offering comprehensive services, ranging from asset assessment and data sanitization to responsible recycling. Additionally, the market benefits from the growing awareness among Indian enterprises about the financial and environmental advantages of adopting ITAD practices. Furthermore, as the digital transformation journey continues in India, the market is expected to play a crucial role in ensuring the secure, compliant, and sustainable disposal of IT assets.

India IT Asset Disposition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service, asset type, enterprise size, and industry vertical.

Service Insights:

- De-Manufacturing and Recycling

- Remarketing and Value Recovery

- Data Destruction/Data Sanitation

- Logistics Management and Reverse Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes de-manufacturing and recycling, remarketing and value recovery, data destruction/data sanitation, logistics management and reverse logistics, and others.

Asset Type Insights:

- Computers and Laptops

- Servers

- Mobile Devices

- Storage Devices

- Others

A detailed breakup and analysis of the market based on the asset type have also been provided in the report. This includes computers and laptops, servers, mobile devices, storage devices, and others.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

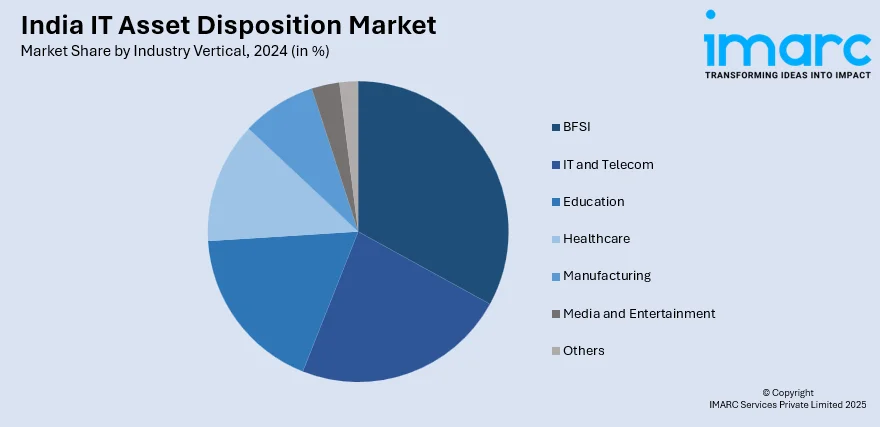

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Education

- Healthcare

- Manufacturing

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecom, education, healthcare, manufacturing, media and entertainment, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IT Asset Disposition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitation, Logistics Management and Reverse Logistics, Others |

| Asset Types Covered | Computers and Laptops, Servers, Mobile Devices, Storage Devices, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Education, Healthcare, Manufacturing, Media and Entertainment, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IT asset disposition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IT asset disposition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IT asset disposition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IT asset disposition market in India was valued at USD 746.2 Million in 2024.

The India IT asset disposition market is projected to exhibit a CAGR of 9.42% during 2025-2033, reaching a value of USD 1,781.9 Million by 2033.

The India IT asset disposition market is driven by increasing awareness about data security, rising e-waste regulations, and the growing need for secure and sustainable disposal of outdated IT equipment. The shift toward circular economy practices and rising enterprise digitization further support demand for certified disposition services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)