India IT Hardware Market Size, Share, Trends and Forecast by Product Type, Enterprise Size, Distribution Channel, End User, and Region, 2026-2034

India IT Hardware Market Summary:

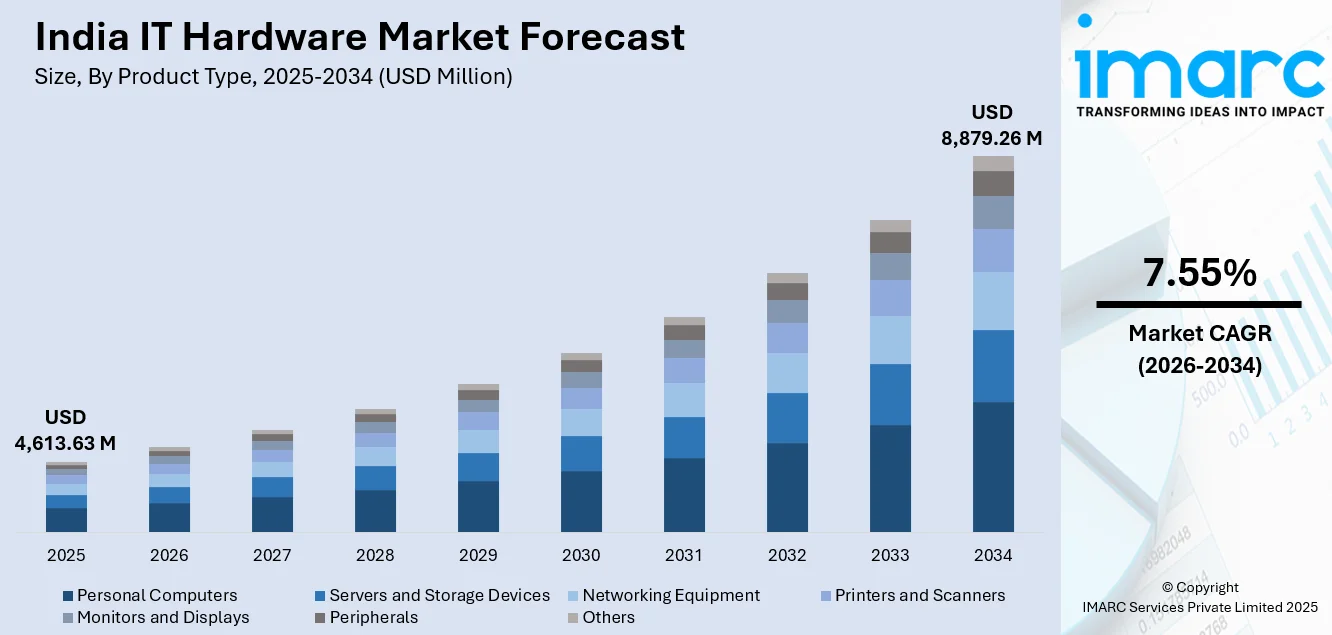

The India IT hardware market size was valued at USD 4,613.63 Million in 2025 and is projected to reach USD 8,879.26 Million by 2034, growing at a compound annual growth rate of 7.55% from 2026-2034. .

The market is driven by government digitalization initiatives encouraging local manufacturing, broad enterprise cloud adoption requiring advanced servers and networking, and AI integration demanding specialized computing hardware. Expanding hybrid work sustains personal computer demand, while public sector modernization, e-governance platforms, smart city projects, telemedicine infrastructure, digital payments, cybersecurity investments, and educational technology upgrades drive consistent hardware procurement. Collectively, these trends strengthen India’s role as a key technology hub within the global IT hardware market.

Key Takeaways and Insights:

- By Product Type: Personal computers dominate the market with a share of 29% in 2025, driven by remote work adoption, growing educational technology needs, and consumer preference for portable computing enabling flexible work and digital learning solutions.

- By Enterprise Size: Small and medium enterprises (SMEs) leads the market with a share of 60% in 2025, owing to rapidly digitizing businesses requiring scalable, cost-effective infrastructure, government digitalization initiatives, and adoption of technology aligned with affordability and growth-focused enterprise strategies.

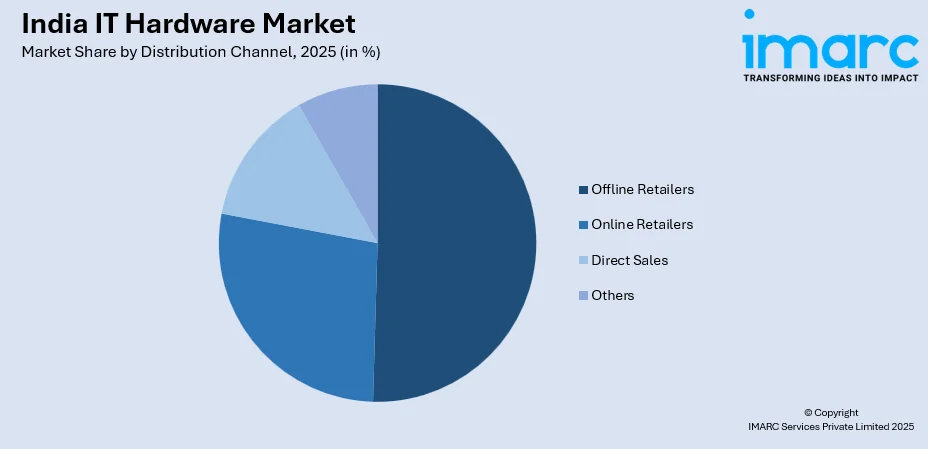

- By Distribution Channel: Offline retailers represent the largest segment with a market share of 41% in 2025, driven by physical networks offering product evaluation, instant fulfillment, trusted after-sales service, and technical support preferred by enterprises and individual consumers alike.

- By End User: Individual consumers dominate the market with a share of 34% in 2025, owing to smartphone connectivity enabling computing adoption, rising disposable incomes, digital literacy programs, and entertainment consumption increasing personal computing equipment demand.

- By Region: North India leads the market with a share of 31% in 2025, driven by government institutions, major educational hubs, corporate headquarters, and proximity to manufacturing facilities enhancing supply chain efficiency and enterprise technology deployment.

- Key Players: The market comprises global technology corporations, emerging domestic manufacturers, and specialized component suppliers competing across diverse products. Key competition focuses on localized manufacturing, resilient supply chains, AI-optimized hardware, and strategic partnerships with hyperscale cloud providers enabling efficient infrastructure deployment.

To get more information on this market Request Sample

India IT hardware market expansion reflects transformative digitalization across governmental, commercial, and personal computing domains. Government production-linked incentive schemes encourage domestic manufacturing capabilities, reducing import dependencies while attracting substantial foreign direct investments into local fabrication facilities. As per sources, in 2024, Lenovo announced local manufacturing of AI servers in India, enabling production of 50,000 enterprise servers annually to support cloud, data center, and artificial intelligence workloads nationwide deployment. Moreover, enterprise digital transformation journeys necessitate infrastructure modernization, cloud migration initiatives demand robust server installations, and artificial intelligence (AI) adoption requires specialized computing architectures with advanced processing capabilities. Hybrid work model permanence sustains personal computer demand as organizations equip distributed workforces with reliable computing tools. Smart city implementations, telemedicine infrastructure development, digital payment ecosystem expansion, and educational technology integration collectively broaden hardware procurement requirements. Public sector e-governance modernization drives systematic technology upgrades across administrative functions. Consumer technology adoption accelerates through rising disposable incomes, increasing internet penetration, streaming entertainment consumption, online education participation, and gaming culture proliferation.

India IT Hardware Market Trends:

Artificial Intelligence Driven Specialized Computing Infrastructure Expansion

Organizations deploy AI applications requiring specialized computing infrastructure vastly exceeding traditional requirements. Machine learning (ML) training demands high-performance graphics processing units, tensor processing units, and application-specific integrated circuits delivering computational throughput beyond conventional processors. In October 2024, in NVIDIA reported that India will achieve nearly tenfold growth in GPU deployments, adding tens of thousands of Hopper GPUs to deliver approximately 180 exaflops of AI computing capacity. Enterprise AI adoption spans predictive analytics, natural language processing, computer vision, autonomous systems, and intelligent automation. Healthcare providers deploy diagnostic systems, financial institutions implement algorithmic trading infrastructure, manufacturers install predictive maintenance platforms, and retailers leverage recommendation engines.

Domestic Manufacturing and Supply Chain Localization

Government incentive programs catalyze substantial manufacturing capacity expansion, attracting multinational corporations establishing local facilities and domestic manufacturers scaling operations. According to reports, 27 companies, including Dell, HP, Foxconn, and Lenovo, received approval under India’s IT hardware PLI scheme, with anticipated investments of ₹3,000 Crore to scale local PC, server, laptop, and tablet manufacturing. Furthermore, electronics manufacturing service providers invest in assembly lines, component suppliers develop local sourcing capabilities, and testing infrastructure ensures quality standards. Contract manufacturers expand workforce hiring, skills programs train technical personnel, and quality certifications enable global participation. Local ecosystems benefit from reduced logistics costs, faster responsiveness, currency advantages, and preferential procurement policies.

Hybrid Infrastructure and Edge Computing Adoption

Organizations transition from centralized data centers toward distributed computing models combining cloud services, on-premises infrastructure, and edge deployments. Hybrid strategies optimize workload placement based on latency requirements, data sovereignty considerations, and cost objectives. As per sources, in July 2025, Tata Communications partnered with Amazon Web Services to deploy a high-capacity, low-latency network connecting major cloud and edge infrastructure across Mumbai, Hyderabad, and Chennai, enhancing distributed computing capabilities nationwide. Furthermore, multi-cloud adoption necessitates hardware supporting diverse platform integrations, container orchestration, and microservices architectures. Edge computing proliferates across manufacturing facilities, retail locations, transportation networks, healthcare facilities, and telecommunications infrastructure.

Market Outlook 2026-2034:

The India IT hardware market demonstrates robust revenue growth trajectories through sustained digitalization momentum, manufacturing localization initiatives, and technology infrastructure modernization. Government production incentives, enterprise cloud migration continuity, AI infrastructure expansion, and cybersecurity investment priorities collectively sustain procurement momentum across all product categories. Domestic manufacturing capacity additions reduce import dependencies while attracting foreign investments. Consumer technology adoption accelerates through rising prosperity, digital literacy improvements, and entertainment consumption patterns. Smart city implementations, digital payment infrastructure, telemedicine platforms, and educational technology deployments broaden addressable markets. The market generated a revenue of USD 4,613.63 Million in 2025 and is projected to reach a revenue of USD 8,879.26 Million by 2034, growing at a compound annual growth rate of 7.55% from 2026-2034.

India IT Hardware Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Personal Computers |

29% |

|

Enterprise Size |

Small and Medium Enterprises (SMEs) |

60% |

|

Distribution Channel |

Offline Retailers |

41% |

|

End User |

Individual Consumers |

34% |

|

Region |

North India |

31% |

Product Type Insights:

- Personal Computers

- Servers and Storage Devices

- Networking Equipment

- Printers and Scanners

- Monitors and Displays

- Peripherals

- Others

Personal computers dominate with a market share of 29% of the total India IT hardware market in 2025.

Personal computers maintain market leadership through diverse application requirements spanning professional productivity, educational learning, entertainment consumption, content creation, and gaming activities. According to reports, HP India partnered with Dixon to commence local laptop and desktop manufacturing, aiming to nearly double production under the ₹17,000-Crore IT hardware PLI scheme. Moreover, desktop computers serve enterprise environments requiring fixed workstation deployments, power users demanding upgradeable configurations, and budget-conscious consumers seeking cost-effective solutions. Laptop computers dominate portable computing demand through hybrid work arrangements, business travel requirements, student mobility needs, and consumer preference for space-efficient solutions. Premium laptop segments grow through professional content creators demanding high-performance specifications and gaming enthusiasts seeking dedicated graphics capabilities.

Workstation computers serve specialized professional applications including computer-aided design, video editing, three-dimensional rendering, and scientific computing requiring exceptional processing capabilities. Gaming computers represent rapidly expanding segments through esports popularity and streaming culture proliferation demanding cutting-edge hardware specifications. Convertible laptops appeal to flexibility-seeking consumers requiring tablet functionality alongside traditional computing capabilities. Chromebook adoption expands through educational sector deployments and cloud-centric computing models. Refurbished computer markets provide cost-effective alternatives supporting price-sensitive segments while mini computers serve space-constrained environments and digital signage applications.

Enterprise Size Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Small and medium enterprises (SMEs) leads with a share of 60% of the total India IT hardware market in 2025.

SMEs lead India IT hardware market, driven by digital transformation, operational efficiency, and competitive positioning. Technology hubs and startups demand robust computing for software development, cloud services, and collaboration. E-commerce firms rely on hardware for inventory, order processing, CRM, and analytics, while manufacturing adopts Industry 4.0 technologies for production monitoring, quality control, and supply chain management. Professional service firms, including accounting and consulting, invest in computing infrastructure to support client deliverables, enhancing productivity and scalability across sectors.

Digital SMEs schemes, government subsidies, and technology adoption incentives accelerate technology acquisition among smaller enterprises previously hesitant toward substantial technology investments. In May 2025, the Indian government received 70 applications for its ₹23,000‑Crore Electronics Component Manufacturing Scheme, with 80% submitted by MSMEs, reflecting strong small-business participation in domestic technology adoption. Cloud computing adoption reduces upfront infrastructure investments while software-as-a-service models minimize licensing costs. Cybersecurity concerns drive hardware investments in firewalls, intrusion detection systems, and secure storage solutions protecting sensitive business data. Remote work infrastructure requirements sustain laptop procurement and collaboration tool adoption necessitates computing resources.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retailers

- Offline Retailers

- Direct Sales

- Others

Offline retailers exhibit a clear dominance with a 41% share of the total India IT hardware market in 2025.

Offline retailers maintain substantial market presence through tangible product experiences, immediate purchase gratification, personalized consultation services, and after-sales support accessibility. Multi-brand retail chains operate extensive store networks across urban centers providing comprehensive product selections, comparative shopping opportunities, and financing options. Authorized brand stores deliver immersive brand experiences, dedicated product demonstrations, and specialist technical consultation attracting quality-conscious consumers. Regional retail chains leverage local market knowledge, established customer relationships, and vernacular language support. Computer specialty stores provide technical expertise, custom configuration services, and specialized product knowledge serving enthusiast communities and professional users. In July 2025, Indian Apple reseller Ample announced plans to grow revenue by 35 percent by expanding its retail presence to around 175 stores across India, strengthening offline availability of computers and accessories.

Offline retailers enhance customer experience by enabling hands-on product inspection, size checks, display and keyboard assessment, and immediate purchase. Knowledgeable sales staff provide guidance, specifications, and recommendations, boosting confidence. Instant availability reduces delivery delays, while physical after-sales support eases warranty, repair, and technical issues. Trade-in programs, exchange offers, and promotions appeal to price-sensitive buyers. Corporate and educational partnerships allow bulk purchases and large-scale deployments, ensuring efficient, reliable, and effective channel operations across the market.

End User Insights:

- Individual Consumers

- Government and Public Sector

- Educational Institutions

- Healthcare Sector

- Retail

- Others

Individual consumers lead with a market share of 34% of the total India IT hardware market in 2025.

Individual consumers represent diverse hardware requirements spanning work-from-home arrangements, educational pursuits, entertainment consumption, content creation, and gaming activities. In 2025, India’s PC market recorded its strongest quarterly performance ever, with shipments reaching 4.9 Million units, highlighting robust consumer demand for laptops and desktops. Furthermore, hybrid work models sustain laptop demand as professionals require reliable computing tools supporting productivity applications, video conferencing platforms, and collaborative software. Online education participation necessitates computing devices for virtual classrooms, assignment completion, and research activities. Entertainment consumption drives hardware acquisition for streaming services, social media engagement, and multimedia content access. Gaming enthusiasts invest in high-performance systems featuring dedicated graphics cards, high-refresh displays, and advanced cooling solutions supporting immersive gaming experiences.

Individual consumers, mainly students and young adults, prioritize affordability, portability, and essential features over high-end specifications. Replacement demand is sustained through upgrade cycles as technology evolves. Home offices drive purchases of peripherals like monitors, keyboards, webcams, and headsets, enhancing productivity and comfort. Growing smart home integration, IoT management, and personal cloud storage expand residential hardware use. Additionally, photographers, hobbyists, and freelancers invest in computing infrastructure to support creative work and income-generating activities across diverse regions.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 31% of the total India IT hardware market in 2025.

North India demonstrates market leadership through concentrated technology industry presence, metropolitan population density, higher income demographics, and extensive educational infrastructure. National capital region hosts numerous multinational technology corporations, domestic IT services providers, government agencies, and research organizations generating substantial enterprise and institutional hardware procurement. Corporate headquarters concentration drives server installations, networking equipment deployments, and workstation acquisitions supporting extensive workforce populations. Technology parks, special economic zones, and business process outsourcing centers sustain continuous infrastructure investments.

North India, with its dense metropolitan hubs, drives significant IT hardware demand. Smart city projects require infrastructure for traffic management, surveillance, and public services, while e-governance initiatives digitize government operations via online portals, records, and biometric systems. State and municipal technology programs create strong institutional demand. Rising disposable incomes, tech awareness, and premium preferences boost consumer markets, while expanding retail networks, shopping malls, and authorized service centers ensure widespread availability, supporting efficient distribution and robust IT hardware adoption across the region.

Market Dynamics:

Growth Drivers:

Why is the India IT Hardware Market Growing?

Government Production-Linked Incentive Schemes

Strategic government intervention through production-linked incentive programs transforms India's IT hardware manufacturing landscape by attracting substantial domestic and foreign investments into local fabrication capabilities. Policy frameworks incentivize electronics manufacturing service providers, contract manufacturers, and original equipment manufacturers establishing state-of-the-art production facilities across strategic industrial corridors. In January 2026, India approved 22 electronics component projects under the ECMS, with ₹41,863 Crore investment from companies including Dixon, Samsung, Foxconn, and Tata Electronics, boosting domestic manufacturing capacity. Moreover, investment commitments translate into manufacturing capacity additions, employment generation, and supply chain ecosystem development. Domestic production reduces import dependencies, enhances supply chain resilience, and shortens delivery timelines while providing cost advantages through reduced logistics expenses. Government procurement preferences favoring domestically manufactured products stimulate demand, infrastructure development subsidies reduce establishment costs, and skills training programs address workforce requirements supporting manufacturing cluster development.

Enterprise Digital Transformation and Cloud Migration

Organizations across sectors pursue comprehensive digital transformation programs modernizing legacy infrastructure, optimizing operational workflows, and enabling data-driven decision-making capabilities. Cloud computing adoption necessitates hybrid infrastructure deployments combining on-premises computing resources with public cloud services addressing data sovereignty requirements, latency-sensitive applications, and regulatory compliance mandates. As per sources, in February 2025, Infosys was recognized as a Leader in the 2024 Gartner Magic Quadrant for Public Cloud IT Transformation Services, underscoring its role in helping enterprises modernize hybrid and cloud infrastructures effectively. Furthermore, server infrastructure investments support private cloud implementations, virtual machine environments, and containerized application deployments. Storage system upgrades accommodate exponential data growth from transactional systems, customer interactions, and analytical workloads. Networking equipment modernization enables high-bandwidth connectivity, software-defined networking architectures, and secure remote access capabilities. Cybersecurity infrastructure investments including firewalls, intrusion prevention systems, and endpoint protection platforms address escalating threat landscapes.

Rising Consumer Technology Adoption and Hybrid Work Demand

The India IT hardware market benefits from accelerating consumer technology adoption and the permanence of hybrid work models. Growing digital literacy, rising disposable incomes, and increased reliance on personal computing devices for work, education, entertainment, and gaming drive PC, laptop, and peripheral demand. In September 2025, India’s Ministry of Electronics & IT announced the deployment of 38,000 GPUs and the establishment of 600 data labs nationwide, strengthening compute infrastructure and supporting technology-driven research. Home offices, online learning, and gaming setups fuel hardware procurement, while peripherals such as monitors, keyboards, webcams, and networking equipment see expanded adoption. Evolving smart home integration, IoT devices, and personal cloud storage further broaden consumer hardware requirements, creating sustained growth across residential and small-business segments.

Market Restraints:

What Challenges the India IT Hardware Market is Facing?

Semiconductor Supply Chain Vulnerabilities

Heavy reliance on semiconductor imports exposes manufacturers to volatile pricing dynamics, supply disruptions, and geopolitical tensions undermining production predictability. Memory chip shortages impact laptop assembly, processor allocation constraints limit desktop manufacturing, and specialized component unavailability delays server production. Currency fluctuations amplify import cost variabilities affecting pricing strategies while lead time extensions complicate inventory management and customer delivery commitments.

Price Sensitivity and Value Perception Challenges

Intense price competition limits manufacturers' pricing flexibility, compresses profit margins, and constrains premium product positioning opportunities. Budget-conscious consumers prioritize affordability over advanced features exhibiting high price elasticity. Imported product availability through informal channels provides lower-priced alternatives undermining authorized distribution channels. Online marketplace price transparency enables constant comparison shopping while promotional discounting creates expectations for reduced pricing.

Technical Skills Shortages and Service Infrastructure Gaps

Limited technical expertise availability constrains enterprise technology adoption rates and complicates deployment processes particularly for smaller organizations lacking dedicated information technology teams. After-sales service infrastructure inadequacies beyond metropolitan areas create customer hesitation regarding hardware investments. Authorized service center network sparsity reduces convenience, increases downtime during failures, and complicates warranty claims while spare parts constraints extend repair durations.

Competitive Landscape:

The competitive environment demonstrates dynamic interactions between established multinational corporations leveraging global research capabilities, extensive distribution networks, comprehensive product portfolios, and strong brand recognition, alongside emerging domestic manufacturers emphasizing cost competitiveness, localized customer service, and regional market knowledge. Competition intensifies through continuous product innovation cycles introducing performance enhancements, energy efficiency improvements, and feature additions addressing evolving customer requirements. Pricing strategies balance premium positioning for advanced specifications against value offerings targeting price-sensitive segments. Distribution channel partnerships, both traditional retail relationships and expanding online marketplace presence, determine market reach effectiveness.

Recent Developments:

- In October 2025, Dixon Technologies completed a joint venture with Inventec, forming Dixon IT Devices Private Limited. Dixon holds 60% stake with ₹20.51 Crore, Inventec holds 40% with ₹13.68 Crore. The JV will manufacture notebook PCs, servers, and desktops, combining Dixon’s domestic manufacturing with Inventec’s global expertise to boost India’s IT hardware sector.

India IT Hardware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Personal Computers, Servers and Storage Devices, Networking Equipment, Printers and Scanners, Monitors and Displays, Peripherals, Others |

| Enterprise Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Distribution Channels Covered | Online Retailers, Offline Retailers, Direct Sales, Others |

| End Uses Covered | Individual Consumers, Government and Public Sector, Educational Institutions, Healthcare Sector, Retail, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India IT hardware market size was valued at USD 4,613.63 Million in 2025.

The India IT hardware market is expected to grow at a compound annual growth rate of 7.55% from 2026-2034 to reach USD 8,879.26 Million by 2034.

Personal computers held the largest market share, due to sustained demand from hybrid work arrangements, educational institution requirements, gaming enthusiasts, content creators, and consumer preference for portable computing solutions supporting diverse productivity, entertainment, and professional applications across residential and commercial environments.

Key factors driving the India IT hardware market include government production-linked incentive schemes promoting domestic manufacturing, enterprise digital transformation initiatives requiring infrastructure modernization, AI adoption demanding specialized computing architectures, and expanding hybrid work models sustaining personal computer demand.

Major challenges include semiconductor supply chain vulnerabilities creating component shortages, heavy import dependencies exposing manufacturers to pricing volatility, intense price competition compressing profit margins, technical skills shortages constraining adoption rates, and after-sales service infrastructure inadequacies particularly beyond metropolitan centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)