India IT Outsourcing Market Size, Share, Trends and Forecast by Service Model, Organization Size, End User, and Region, 2025-2033

India IT Outsourcing Market Overview:

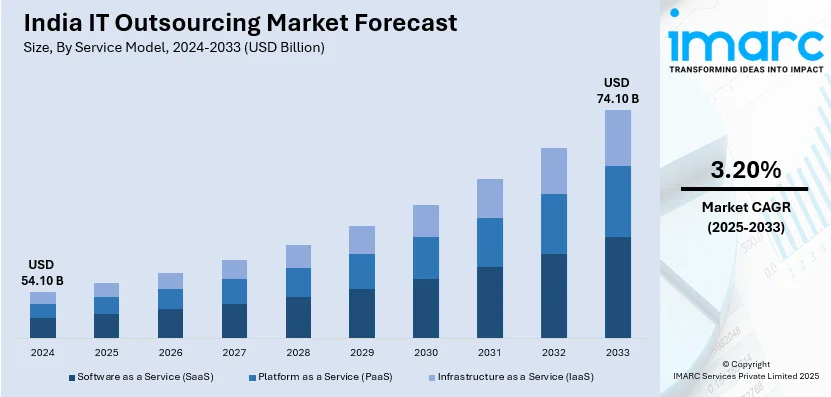

The India IT outsourcing market size reached USD 54.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 74.10 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. India’s IT outsourcing market is expanding with increasing demand for AI-driven security, digital transformation, and automation. Moreover, growth is fueled by rising global investments in cybersecurity, healthcare IT solutions, and cost-efficient technology services, strengthening India’s role as a preferred outsourcing hub for advanced digital solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.10 Billion |

| Market Forecast in 2033 | USD 74.10 Billion |

| Market Growth Rate 2025-2033 | 3.20% |

India IT Outsourcing Market Trends:

Advancing AI-Driven Digital Security

India's IT outsourcing market is seeing significant growth with the rising demand for AI-driven digital security solutions. In addition, businesses worldwide are increasingly relying on outsourced IT services to strengthen cybersecurity, prevent fraud, and enhance digital identity verification. AI-powered security frameworks are becoming essential due to the surge in online transactions, digital banking, and cloud-based operations. As global enterprises seek advanced protection against cyber threats, India's IT outsourcing firms are integrating AI and automation to offer real-time risk assessment and fraud detection services. For example, in December 2024, Firstsource partnered with WebID Group to enhance digital identity verification and platform security. This collaboration boosts India's IT outsourcing capabilities by improving AI-driven Trust & Safety solutions. This development strengthens India's role in providing secure technology solutions for financial services and other industries with better fraud prevention mechanisms. As cyber threats evolve, companies outsourcing IT services to India are looking for end-to-end security solutions powered by AI and machine learning. The ability to provide advanced risk management, identity authentication, and compliance monitoring is positioning India as a key player in the global IT security outsourcing market. Further, the adoption of AI-driven security solutions is expected to continue growing, reinforcing India’s IT outsourcing sector as a hub for cutting-edge digital safety technologies.

To get more information of this market, Request Sample

Expanding Healthcare IT Transformation

The demand for healthcare-focused IT outsourcing is increasing, driven by digital transformation in the global healthcare industry. India’s IT outsourcing sector is playing a key role in providing scalable and cost-effective solutions with hospitals and healthcare providers adopting AI, automation, and cloud-based technologies. Aligned with this, healthcare companies are seeking advanced digital solutions to enhance patient care, optimize operations, and comply with regulatory standards. This has led to a surge in outsourcing IT services related to electronic health records (EHRs), AI-based diagnostics, and automated healthcare workflows. In August 2024, Sonata Software secured a multi-year, multi-million-dollar IT outsourcing deal with a US-based healthcare company. This agreement strengthens India's position in healthcare IT services by expanding digital transformation efforts in the sector. By leveraging AI and automation, Sonata Software aims to improve efficiency, reduce costs, and enhance the quality of healthcare IT solutions. With the increasing use of AI in diagnostics, remote patient monitoring, and predictive analytics, India's IT outsourcing companies are well-positioned to support healthcare organizations globally. The focus on automation and data-driven solutions is driving the demand for specialized IT outsourcing services in the healthcare sector. This trend highlights India's growing expertise in healthcare IT, thereby making it a preferred destination for outsourcing digital healthcare transformation initiatives.

India IT Outsourcing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service model, organization size, and end user.

Service Model Insights:

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

The report has provided a detailed breakup and analysis of the market based on the service model. This includes software as a service (SaaS), platform as a service (PaaS), infrastructure as a service (IaaS).

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

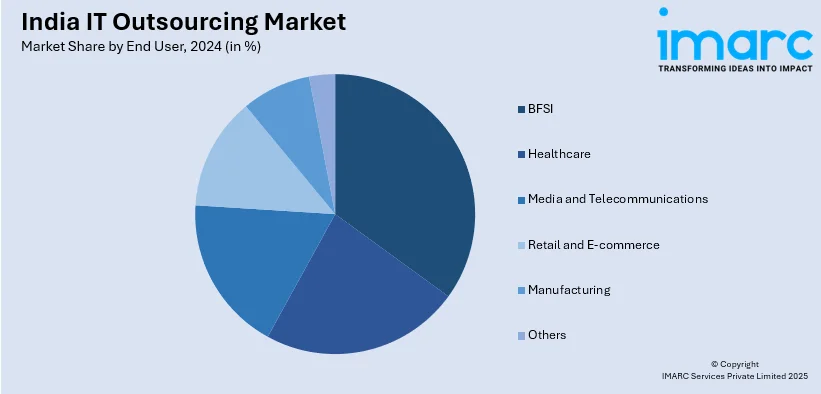

End User Insights:

- BFSI

- Healthcare

- Media and Telecommunications

- Retail and E-commerce

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, healthcare, media and telecommunications, retail and e-commerce, manufacturing, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India IT Outsourcing Market News:

- January 2025: Infosys and Google Cloud launched an AI innovation hub in Bengaluru, enhancing IT outsourcing capabilities. The initiative accelerates AI-driven enterprise solutions across sectors, boosting automation, efficiency, and digital transformation. This strengthens India’s IT outsourcing industry, increasing global competitiveness and driving demand for AI-integrated outsourcing services.

- April 2024: BDO India launched BDO EDGE, a Center of Excellence, to enhance global outsourcing in tax, assurance, accounting, and technology services. This strengthens India's IT outsourcing segment by expanding service capabilities, leveraging skilled talent, and enabling cost-effective, 24/7 operations for global enterprises.

India IT Outsourcing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Models Covered | Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS) |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, Healthcare, Media and Telecommunications, Retail and E-commerce, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India IT outsourcing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India IT outsourcing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India IT outsourcing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IT outsourcing market in India was valued at USD 54.10 Billion in 2024.

The India IT outsourcing market is projected to exhibit a CAGR of 3.20% during 2025-2033, reaching a value of USD 74.10 Billion by 2033.

The India IT outsourcing market is driven by a skilled workforce, cost advantages, and strong digital infrastructure. Supportive government policies, widespread English proficiency, and global demand for software services also contribute. Additionally, advancements in cloud computing and AI technologies enhance India’s outsourcing capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)