India Jointing Compound Market Size, Share, Trends and Forecast by Product, Application, Type, and Region, 2025-2033

India Jointing Compound Market Size and Share:

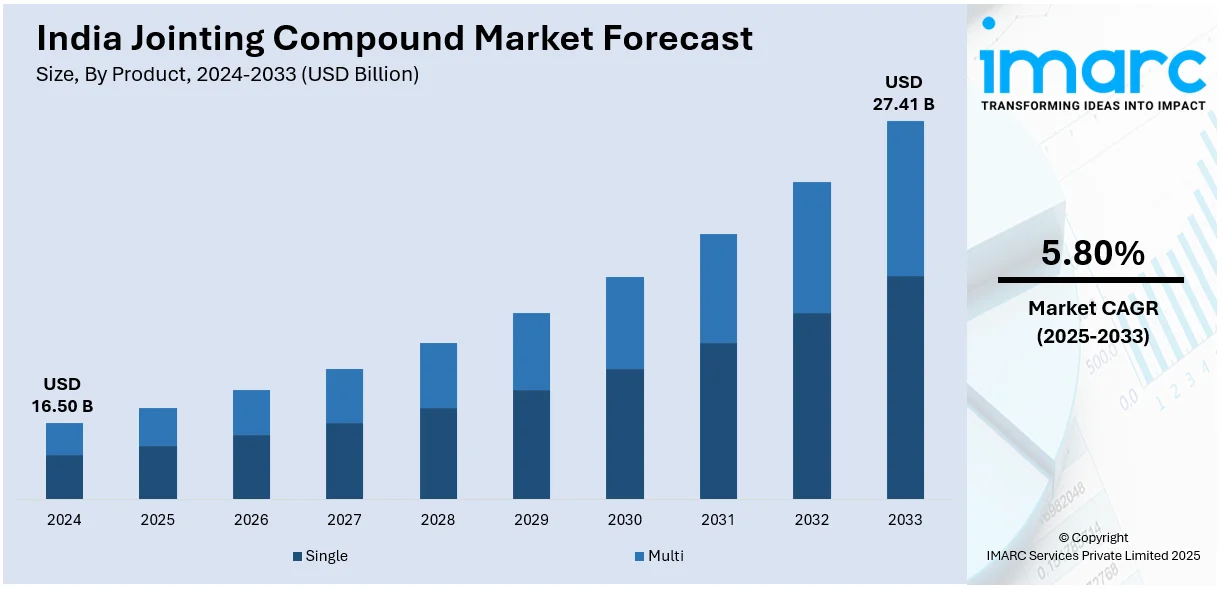

The India jointing compound market size reached USD 16.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.41 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is actively witnessing steady expansion, primarily driven by an increasing number of construction activities, rapid urbanization, and a rising demand for high-quality finishing materials. Growing number of infrastructure projects and significant advancements in formulation technologies further contribute to market expansion, along with the widespread adoption in residential, commercial, and industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.50 Billion |

| Market Forecast in 2033 | USD 27.41 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

India Jointing Compound Market Trends:

Rising Adoption of Eco-Friendly and Sustainable Jointing Compounds

Sustainability is also emerging as a priority area in the India jointing compound market, with more emphasis on environmentally friendly and non-toxic products. Rising environmental awareness, combined with regulatory pressures for the reduction of VOC emissions, is compelling manufacturers to develop green products. Low-VOC water-based jointing compounds are becoming increasingly popular because they reduce health hazards as well as indoor air pollution without compromising on adhesion and durability. Also driving the product demand for green building materials is the increasing uptake of green building certifications, primarily covering LEED and GRIHA (Green Rating for Integrated Habitat Assessment). For instance, as per industry reports, in 2024, India maintained its 3rd position on the annual list of top ten nations for LEED certifications. 370 projects, encompassing 8.5 Million GSM were LEED certified across India. Additionally, manufacturers are integrating recycled materials and bio-based ingredients into their formulations to reduce environmental impact. As the construction industry moves toward sustainable practices, the adoption of environmentally responsible jointing compounds is expected to rise, steering the future of the industry with innovative and greener solutions.

To get more information of this market, Request Sample

Increasing Demand for Lightweight and High-Performance Jointing Compounds

The India jointing compound market is witnessing a growing requirement for high-performance as well as lightweight materials, driven by advancements in construction and infrastructure projects. Builders and contractors increasingly prefer jointing compounds that offer enhanced adhesion, quick drying times, and superior crack resistance. With rapid urbanization and the expansion of commercial and residential spaces, high-quality finishing materials are becoming a priority. For instance, as per industry reports, urban population is anticipated to increase from 31.1% in 2011 t0 35%-37% in 2024, highlighting an accelerating urbanization trend across India. Moreover, the use of polymer-based and ready-to-use jointing compounds is gaining traction due to their ease of application, reduced labor costs, and improved durability. Additionally, manufacturers are focusing on producing environmentally safe and low-VOC (volatile organic compound) formulations to align with stringent environmental norms. The increasing adoption of prefabricated and drywall construction methods is further contributing to the demand for innovative jointing compounds that provide seamless and long-lasting finishes. As the market evolves, companies are investing in R&D to develop multi-functional jointing solutions that enhance both aesthetics and structural integrity.

India Jointing Compound Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, application, and type.

Product Insights:

- Single

- Multi

The report has provided a detailed breakup and analysis of the market based on the product. This includes single and multi.

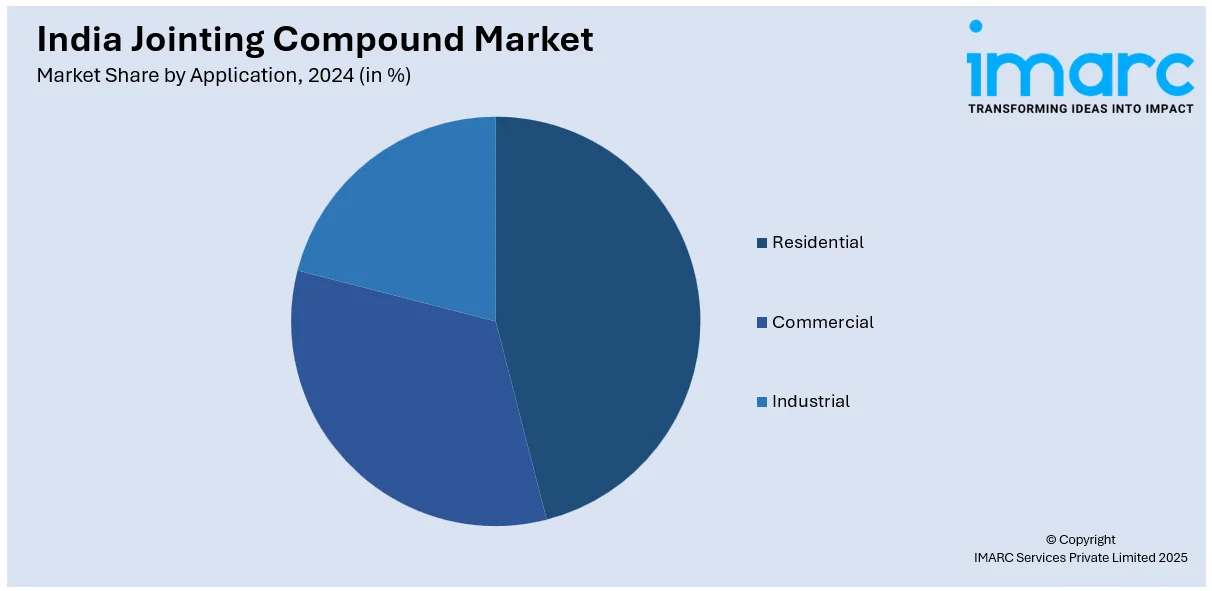

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Type Insights:

- Taping

- Topping

- All Purpose

- LITE Drying

- Setting

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes taping, topping, all purpose, LITE drying, and setting.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Jointing Compound Market News:

- In August 2024, DuPont unveiled two new products for its commercial construction product line. These products include LiquidArmor FJ Flashing and Joint Compound and DuraGard WD Self-Adhered Flashing Tape. Both products are developed to offer water as well as air barrier stability and incorporate flexibly with company's wall assembly.

India Jointing Compound Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Single, Multi |

| Applications Covered | Residential, Commercial, Industrial |

| Types Covered | Taping, Topping, All Purpose, LITE Drying, Setting |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India jointing compound market performed so far and how will it perform in the coming years?

- What is the breakup of the India jointing compound market on the basis of product?

- What is the breakup of the India jointing compound market on the basis of application?

- What is the breakup of the India jointing compound market on the basis of type?

- What is the breakup of the India jointing compound market on the basis of region?

- What are the various stages in the value chain of the India jointing compound market?

- What are the key driving factors and challenges in the India jointing compound market?

- What is the structure of the India jointing compound market and who are the key players?

- What is the degree of competition in the India jointing compound market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India jointing compound market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India jointing compound market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India jointing compound industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)